Special project “E-commerce UA”: how online-stores’ key indicators changed over the year

The Ukrainian Retail Association presents the third annual global analytical review of the Ukrainian e-commerce market and peculiarities of country’s leading online-stores audience.

All retailers, including those working in online-trading, try to get to know their customer as best as possible. And at the same time they try to compare: what is the difference between their client and the competitor’s buyer, and who is interested in purchasing this or that product on the Internet. Collecting and analyzing such information for online-stores is not an example easier than for its offline- colleagues: modern services provide the opportunity to get almost any data.

What was considered

We set the goal to prepare most large-scale analysis of the Ukrainian e-commerce market, to make an approximate portrait of domestic consumers buying goods online. We set also the goal to analyze the performance of leading online-stores in different segments.

And then we set the goal to compare obtained data with results of last year’s research and find out: what trends prevail in Ukrainian e-commerce, what online-players would pay attention to, how consumer behavior, market share and so on have changed over the year.

Similarweb and alexa.com services were used to collect information, supplemented by data from other open sources.

We prepared the detailed analysis of various e-commerce sub-segments in addition to the general report. We have selected department stores (such as Rozetka), in order to avoid the comparing players with disparate indicators, in a separate category, where you can buy almost anything – from jewelry and spinners to snowmobiles, yachts and professional equipment. At the same time, the report does not contain classic marketplaces – olx, prom and others – because it do not sell its own goods, but act as a platform for contact between the buyer and the seller.

As was considered

The period from November 1, 2018 to October 31, 2019 was analyzed, since retailers of different profiles have different “peak” sales periods. The selected time period made it possible to cover all possible fluctuations in demand. The research examined eight segments: department stores, portable electronics and gadgets, home appliances, fashion, sports products, jewelry retail, children’s products, cosmetics and drogerie. Several parameters were taken into account in each of it: users’ age, main input channels, devices used (PCs and laptops or smartphones and tablets), unique calls and failures’ number, prevailing social chains in a particular segment.

Why was considered

This report allows like any analytics online-retailers to find out own strong and weak sides, get acquainted with the customer’s portrait in the segment and compare it with data about own customers. In addition, information about main traffic channels and most effective social chains will help to adjust SEO- and SMM-promotion strategies to increase the brand’ awareness. This information will help to attract new users, to assess the need and prospects for mobile applications’ creation and implementation and the adaptive layout, and also obtain a lot of other useful information.

We hope that our analytical report will be useful for you!

Ukraine

If we consider domestic e-commerce as a whole, then most popular segment of online-stores remains unchanged: universal portals where we can buy everything from toothpicks to gaming computers, or even luxury cars. Over the year that has passed since the last research, it slightly reduced the audience’ reach – from 60.66 to 58.25% UAnet users – but still significantly ahead of all other store categories combined.

At the same time, other segments of Ukrainian online-trading spent the past year in different ways. Greatest successes were achieved by beauty and health products’ online-stores (such as Watsons, EVA and others). Over 12 months, it managed to increase the audience’ reach by almost 50% – from 8.04% to 11.32% Ukrainian citizens who went online.

Similar achievements, albeit on a smaller scale, have been successful for online- sellers of goods for children, sportswear and equipment, as well as jewelers. Indicators of household appliances’ retailers almost unchanged – within the statistical error.

But two categories have noticeably lost in coverage compared to 2018: portable electronics and gadgets stores, as well as Fashion retailers. This is all the more surprising since the Ukrainian e-commerce’ volume is constantly growing, and all key market players are talking about a steadily increasing online-sales share. On the other hand, it is possible that these two directions of e-commerce managed to achieve the highest conversion, and the drop in coverage does not affect sales’ growth.

All diagrams can be enlarged by clicking on the image

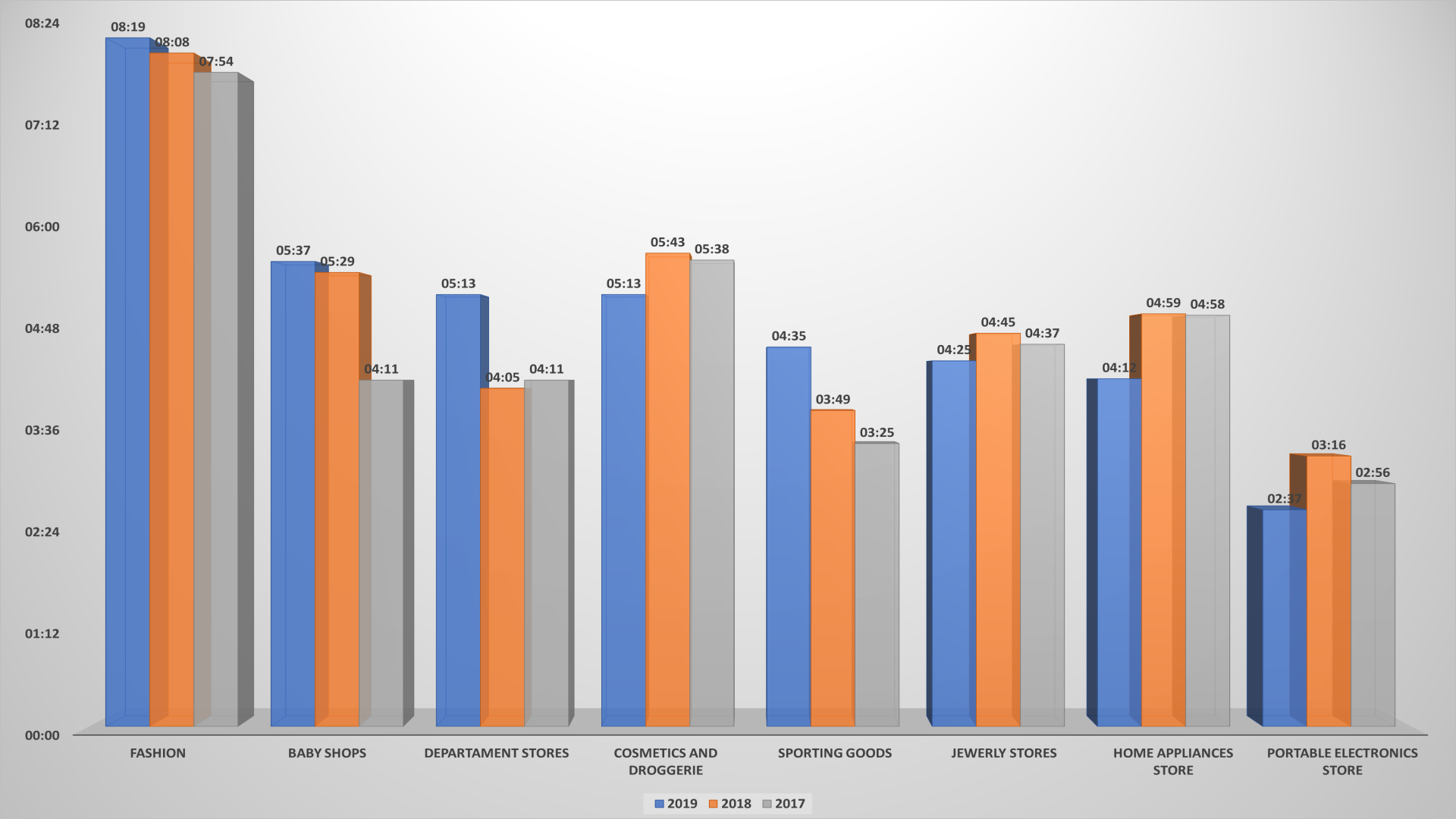

But if “universals” are on the audience reach out of competition, then other sectors are leading by two other key indicators – the time spent on the site and the view’ depth. The longest time users stay on fashion-retailers sites: almost 8 minutes 19 seconds. Children’s products are in second place in duration’ terms, the third and fourth are divided by department stores, as well as cosmetics and drogerie segment.

Moreover, “all on one site”-format stores were able to increase the consumer’s stay on the store’s website the most: by 1 minute and 8 seconds. Indicators are more modest for others – sports’ stores hold the attention of buyers for almost a minute longer than a year earlier. But the time spent on portals of drogerie Internet retailers, equipment and jewelry has even decreased.

Customers are determined by the fastest way, as in the past year, with the portable electronics, gadgets and accessories choice. Most likely, customers already know in advance what they need, and only specify certain technical characteristics and the purchase’ nuances.

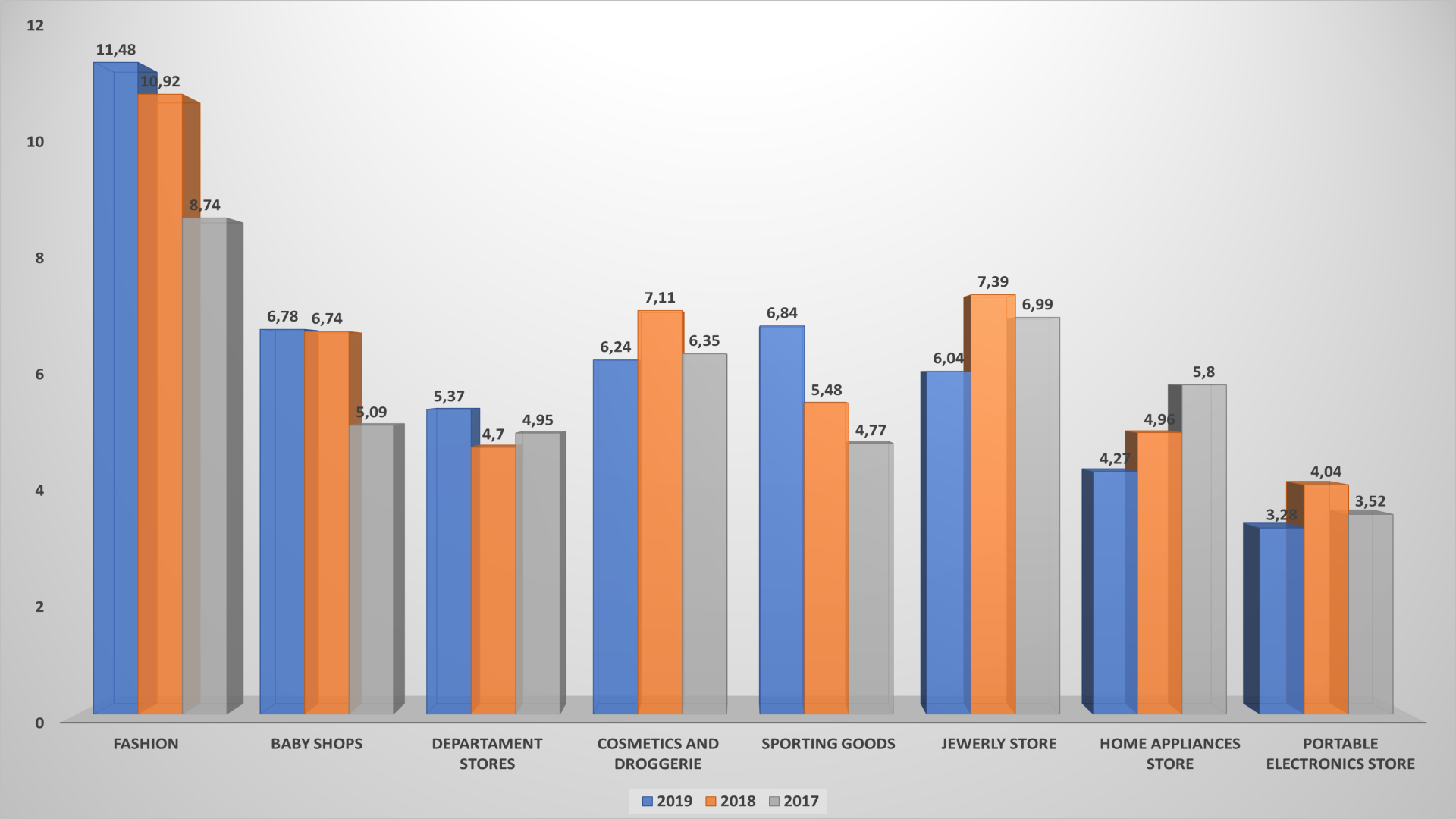

The viewing’ depth corresponds to the time spent on the Fashion-retailers’ website: on average, a user views almost 11.5 pages to select the product he likes. For the third year in a row, this indicator has been steadily growing for sellers of clothes, shoes and accessories.

The second place in the viewing’ depth is occupied by sellers of sporting goods, and the third – goods for children: Ukrainians carefully investigate the presented assortment and carefully choose a purchase for their beloved child. The viewings’ depth has also increased in department stores just because the constant range expansion. The choice of dresses or gifts for a child takes longer than the viewing of gadgets or batteries’ characteristics.

But the clicks’ number from page to page inside the site is reduced for other online-retailers. Moreover, this figure falls for the third year in a row for household appliances’ sellers, that cannot but worry.

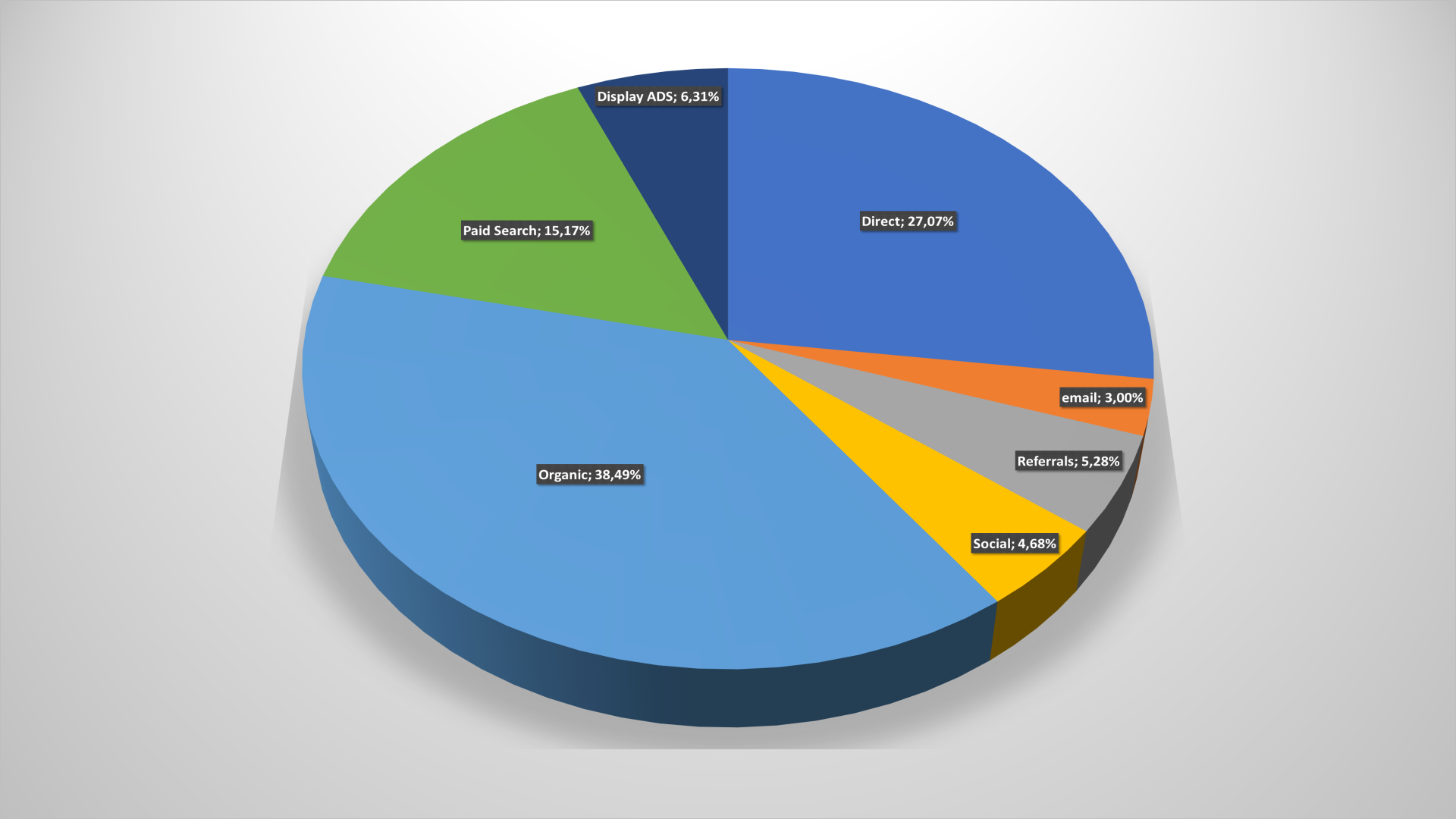

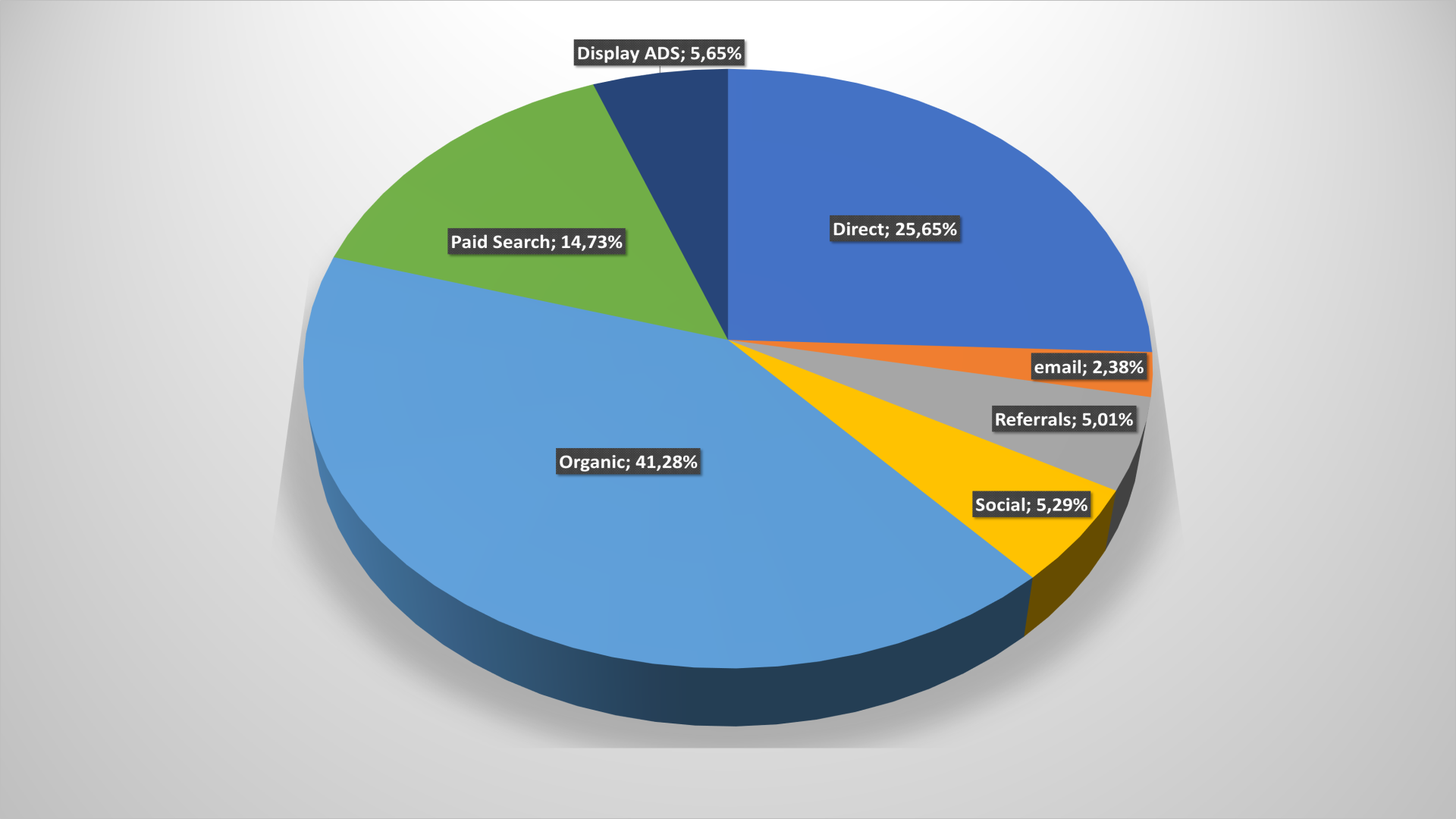

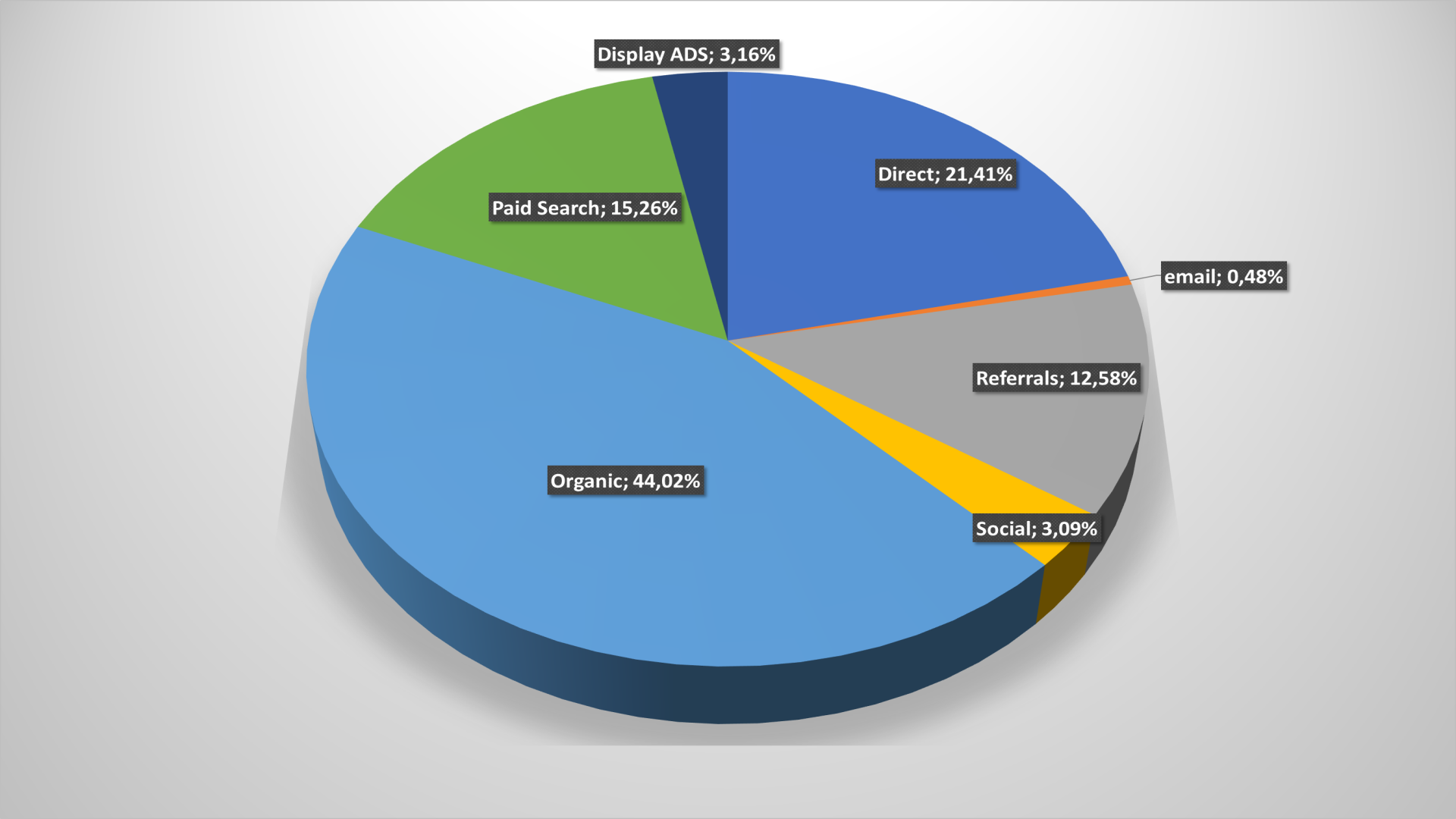

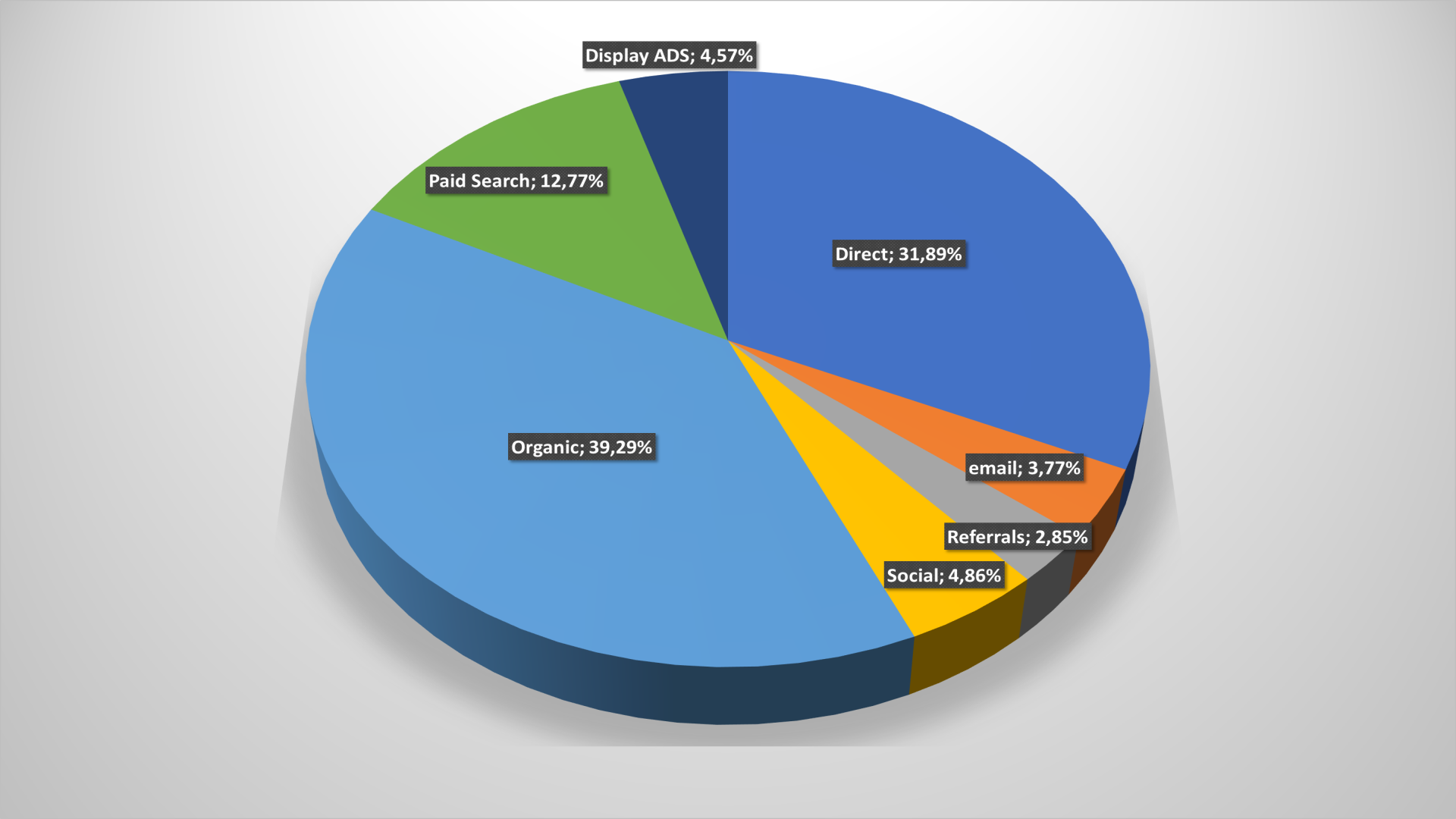

There is the information by entry points, or how users get to retailer sites. There are two main channels: the organic search (on Google and other search engines) and direct visits (direct, when the buyer immediately goes to the store’s portal). The share of the second increased by 2.7% compared to last year, but the share of the first – fell by 1.5%. But the conversions’ share on paid contextual advertising increased by about the same 1.5%. It seems to be small fluctuations, but there is present tendency towards the upcoming “advertising wars for keywords in the Google sample”.

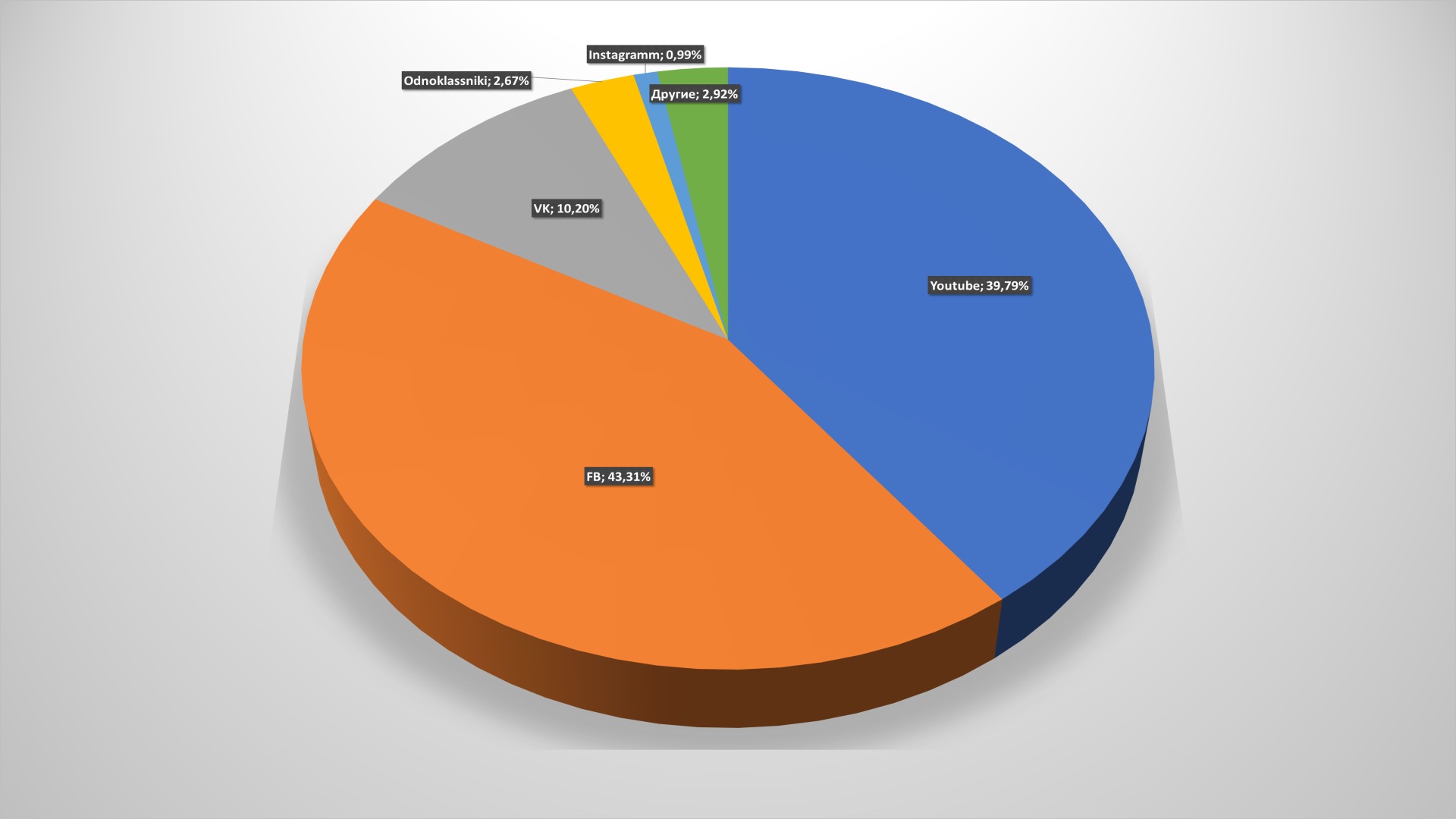

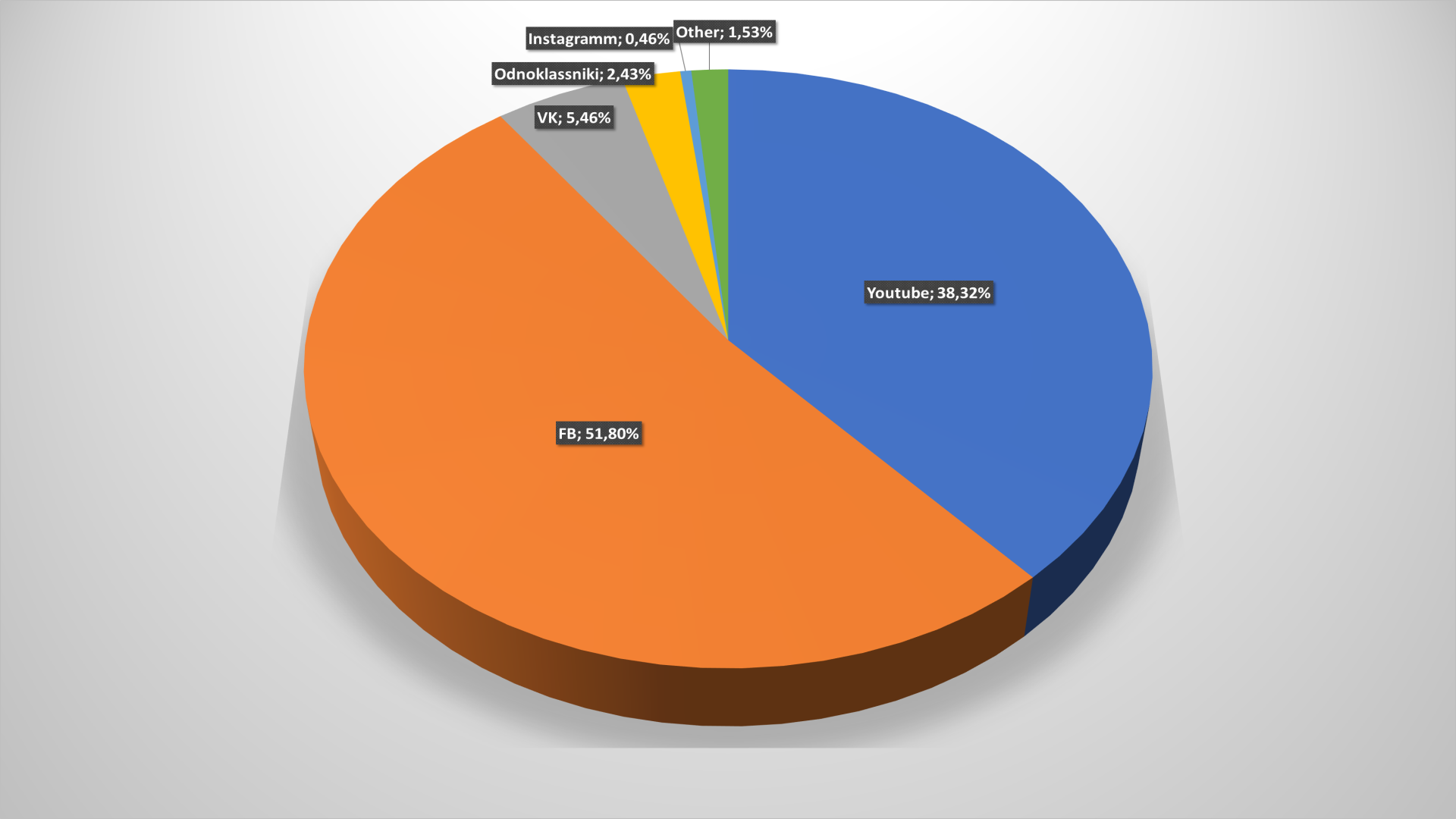

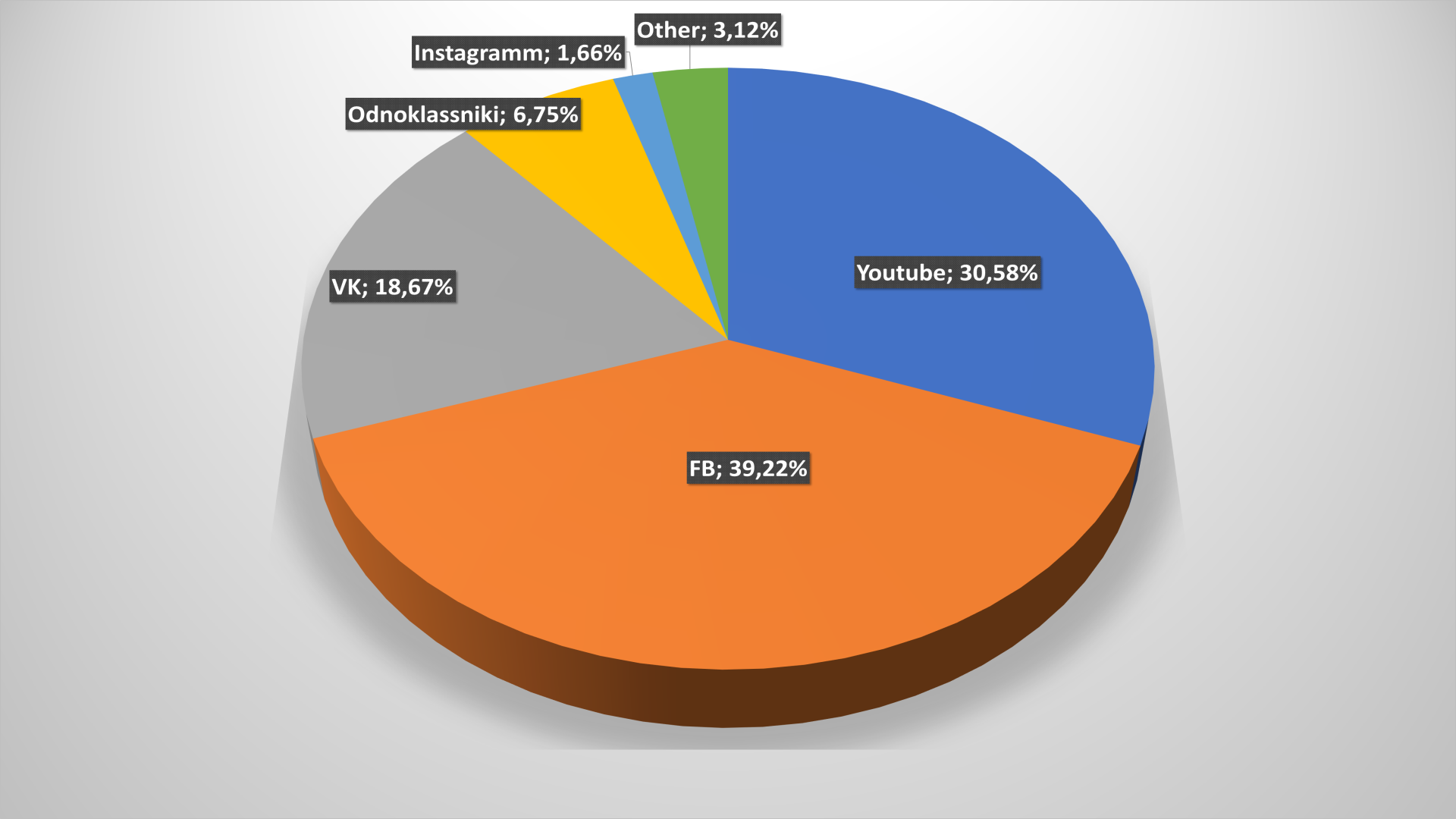

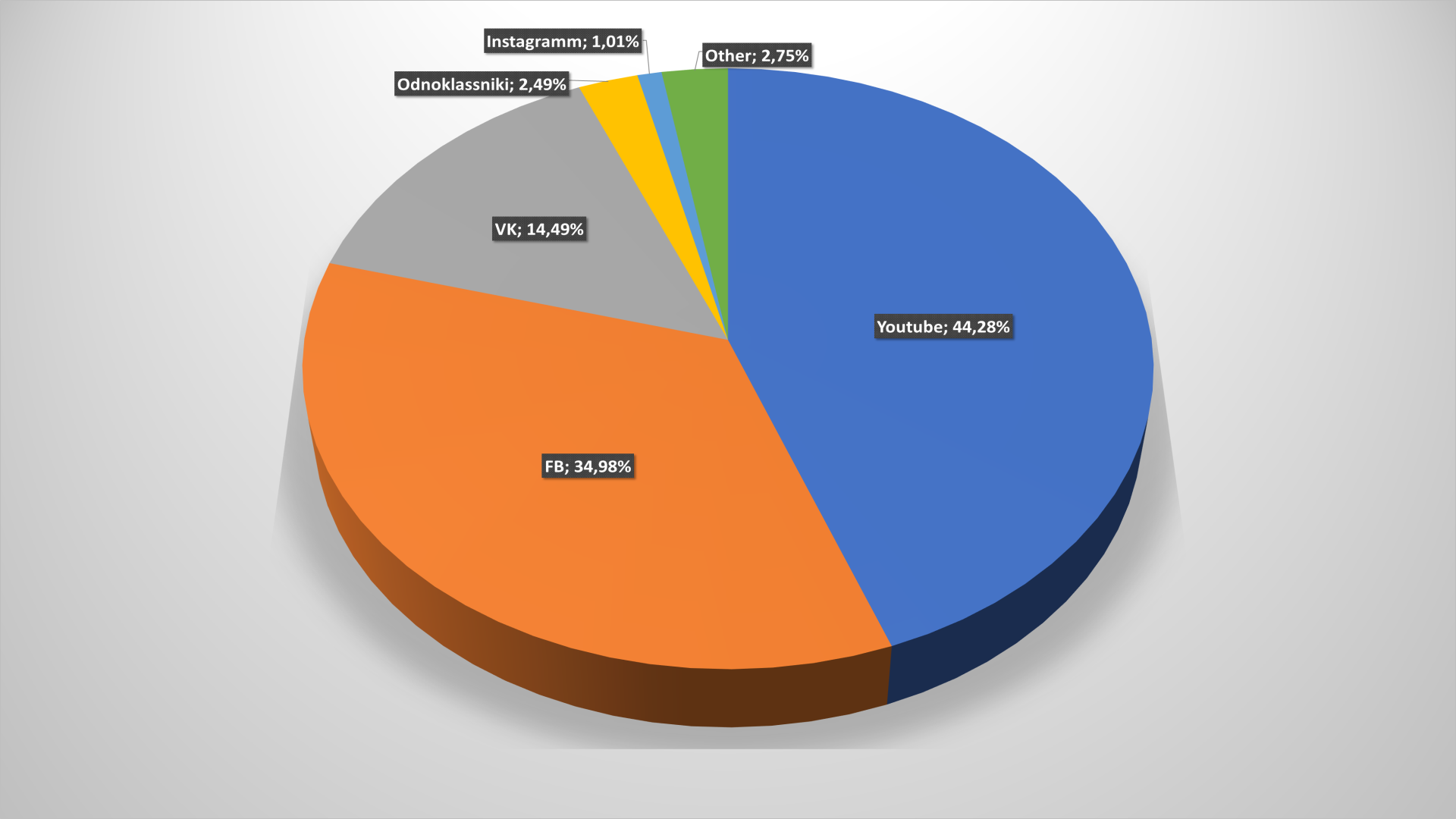

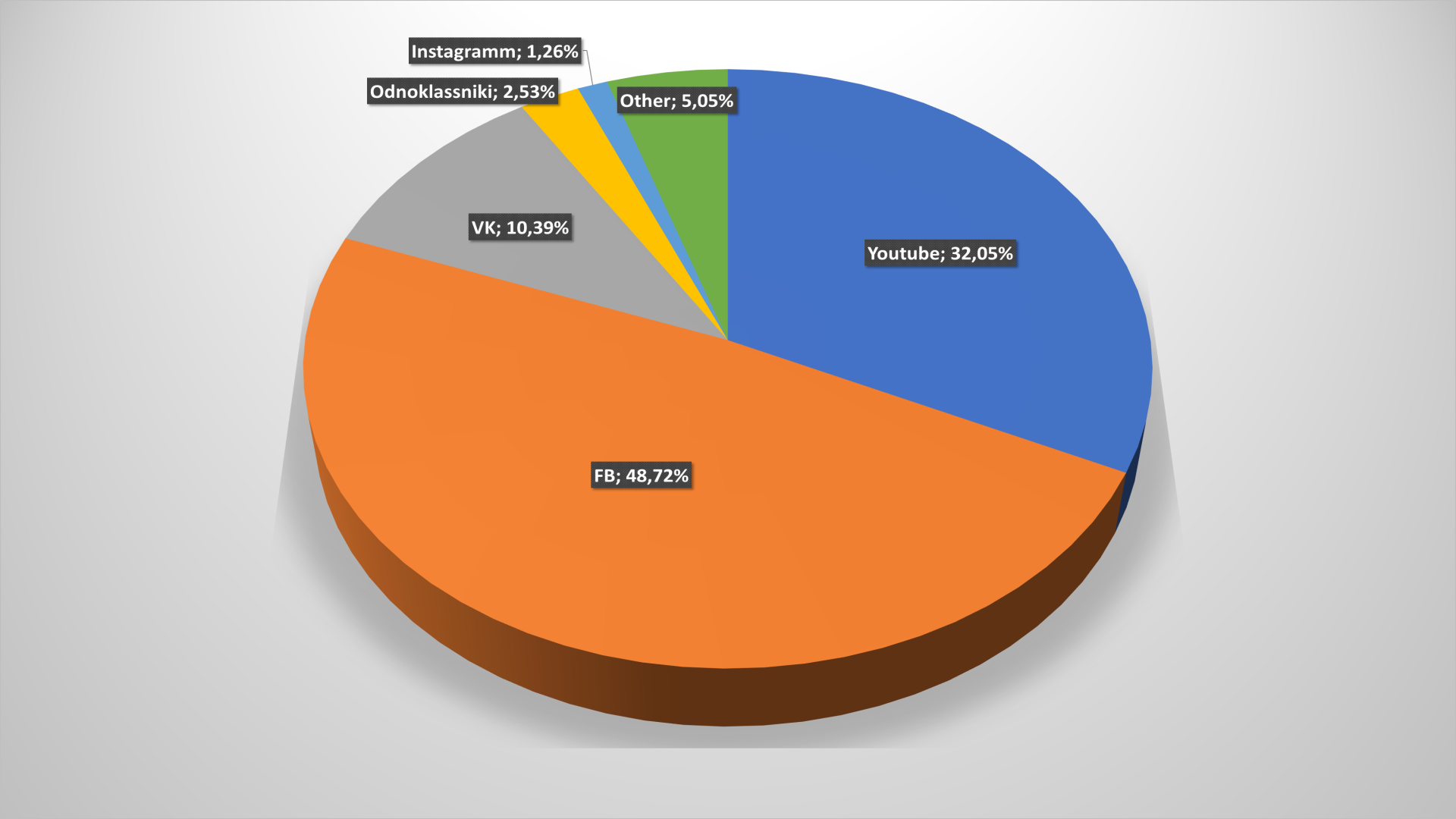

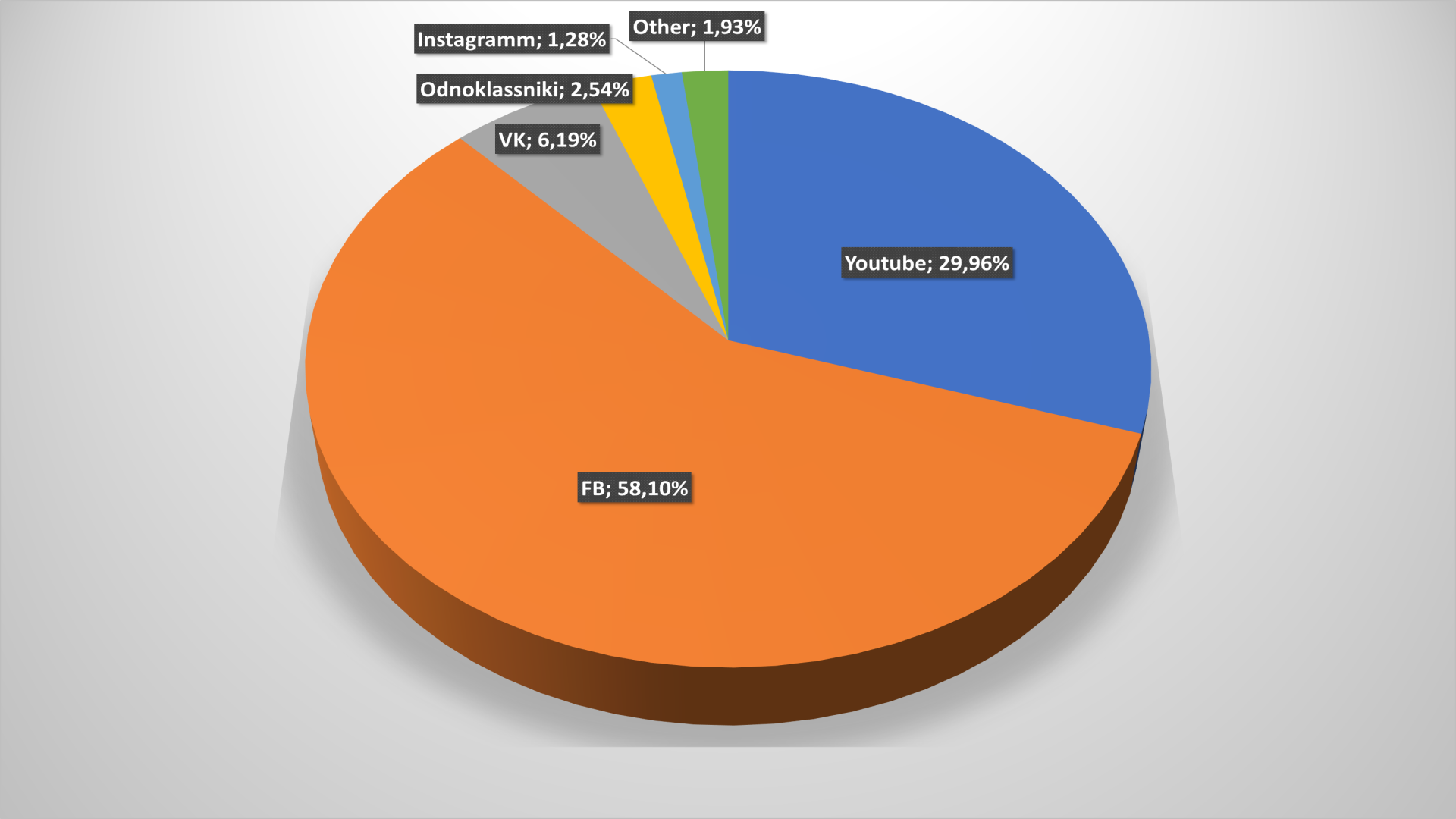

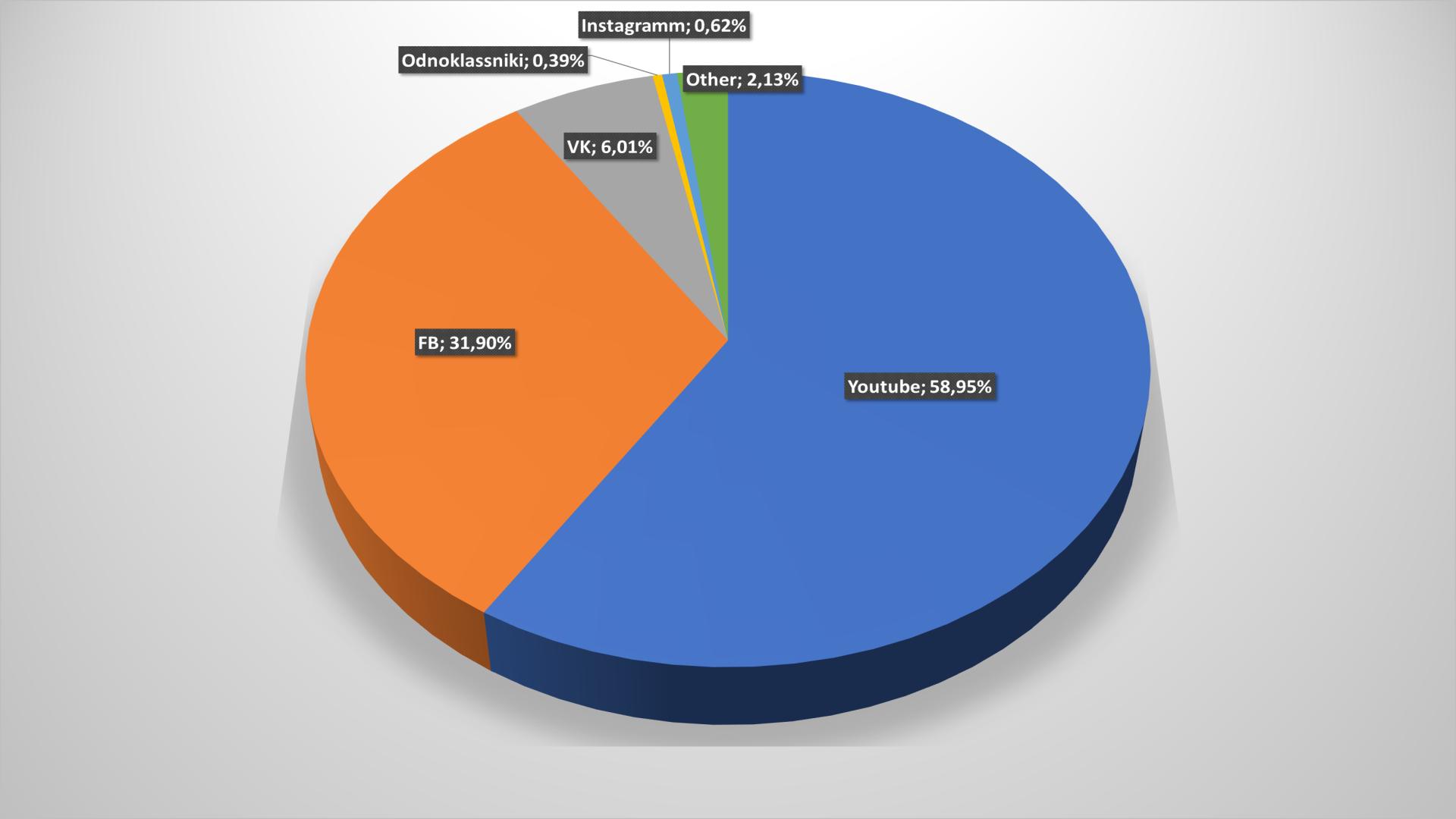

If you analyze traffic from social chains separately, then it provides only 4.68% conversions to the seller’s website. And main providers of traffic remain Facebook – (43.31%) and YouTube (39.79%). And here it’s worth noting the castling of these two channels: a year ago the picture was diametrically opposite: YouTube provided 44.57% transitions from social chains, and Facebook – 38.81%. This is a very interesting tendency and can give headache marketers who really bet on video-content and similar “things”.

However, this can all turn out to be a “storm in a glass of water,” which will cost retailers millions advertising budgets taking into account the nominal role of social chains in generating traffic to online-store sites.

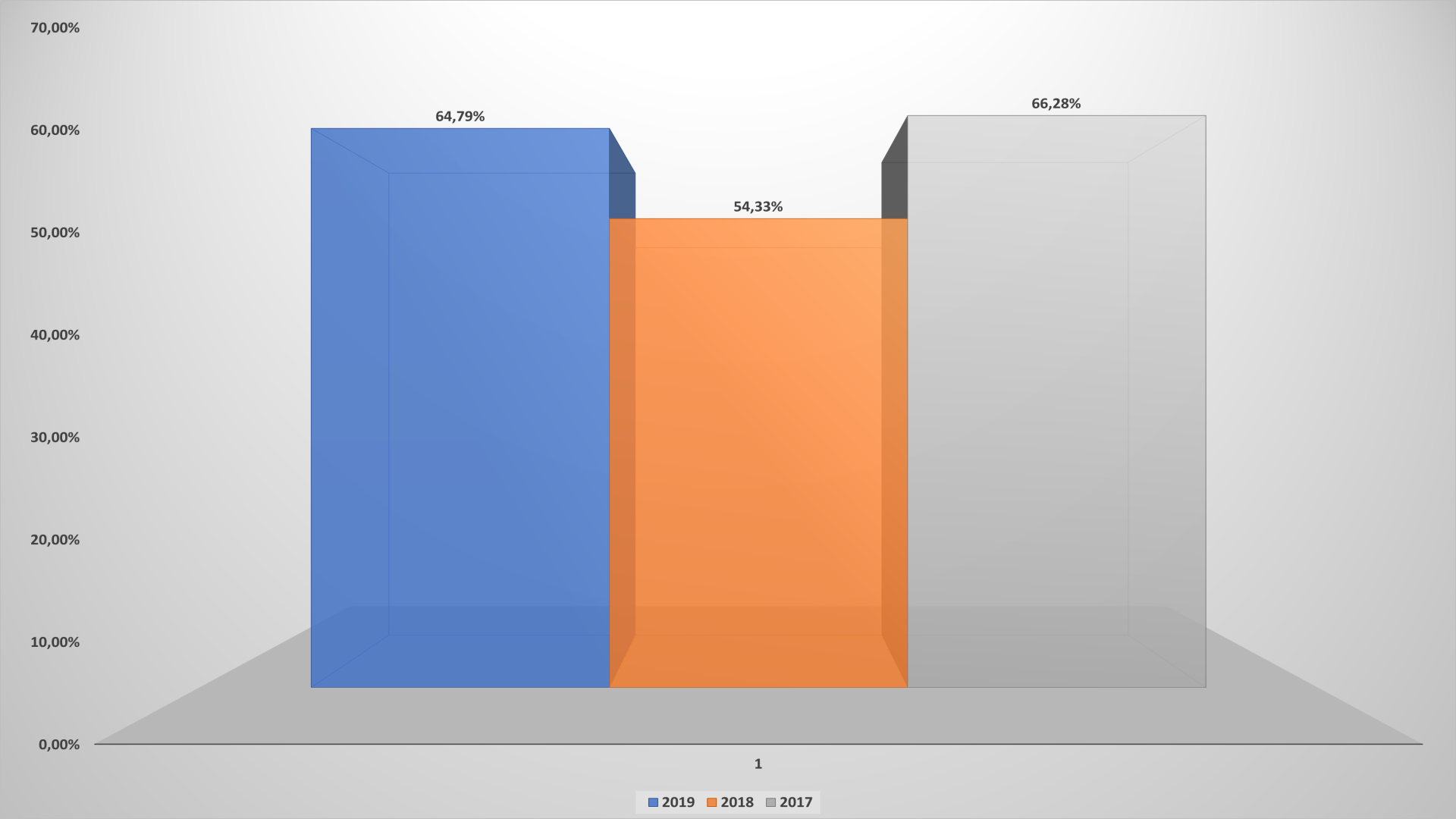

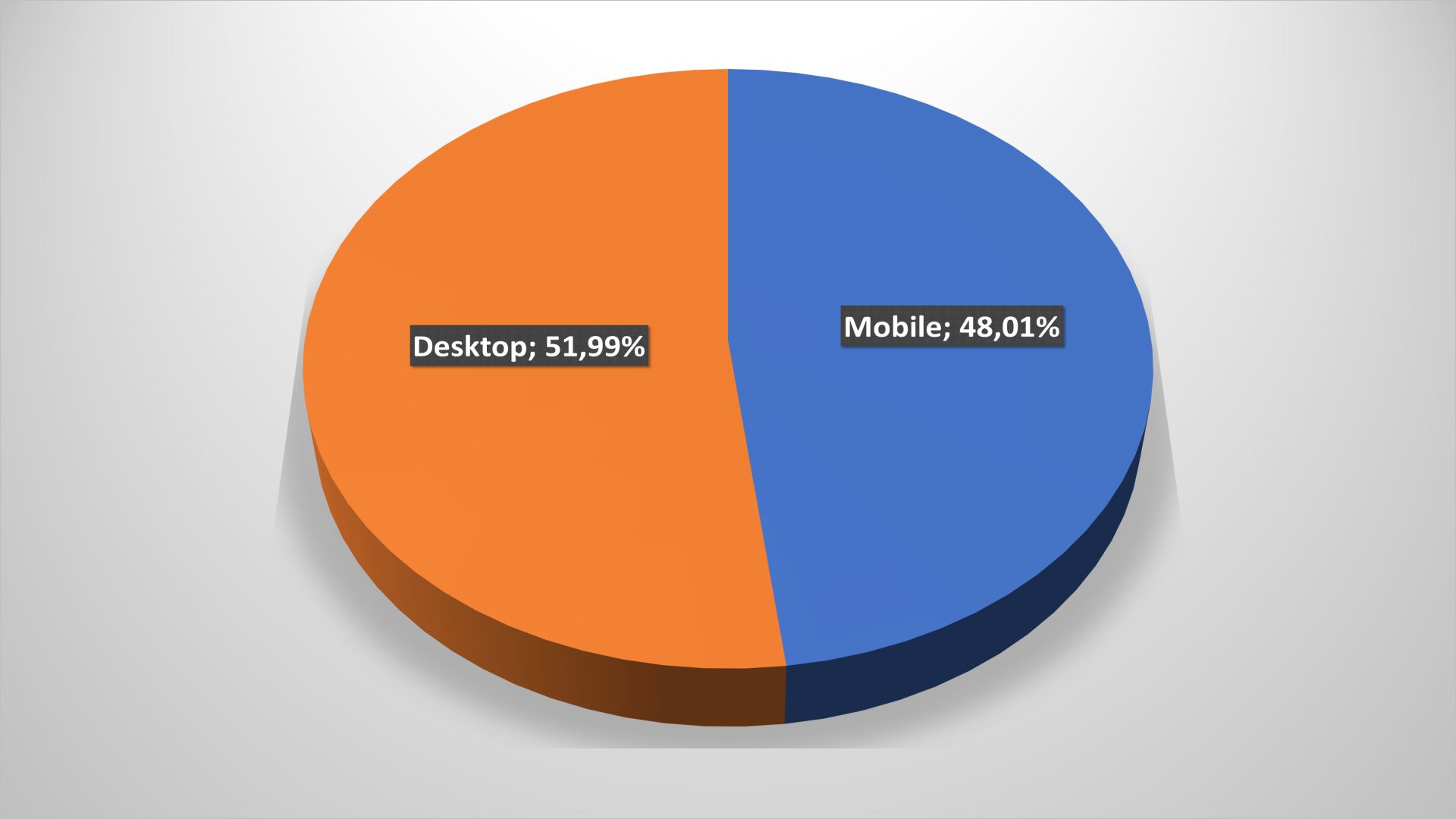

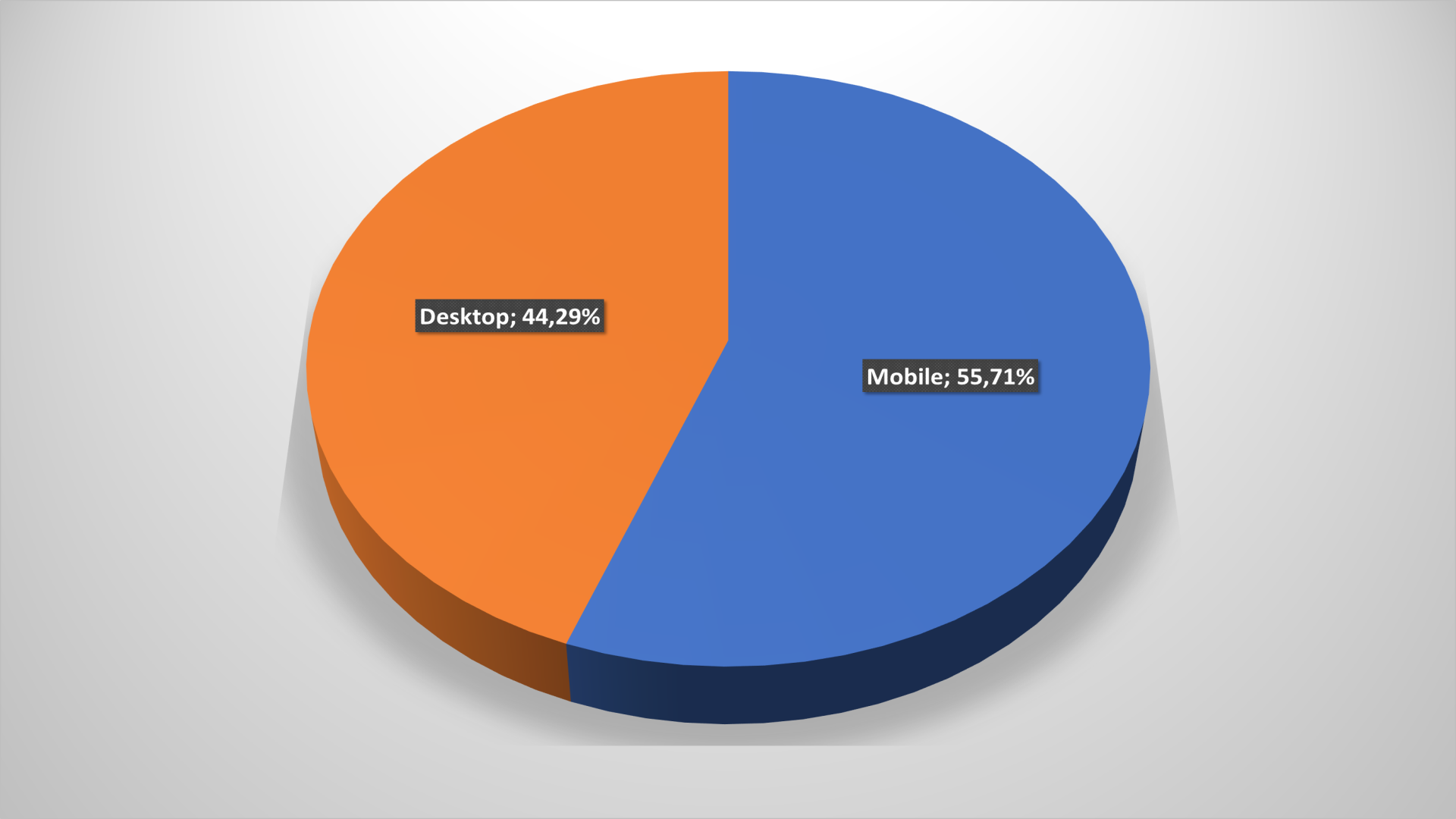

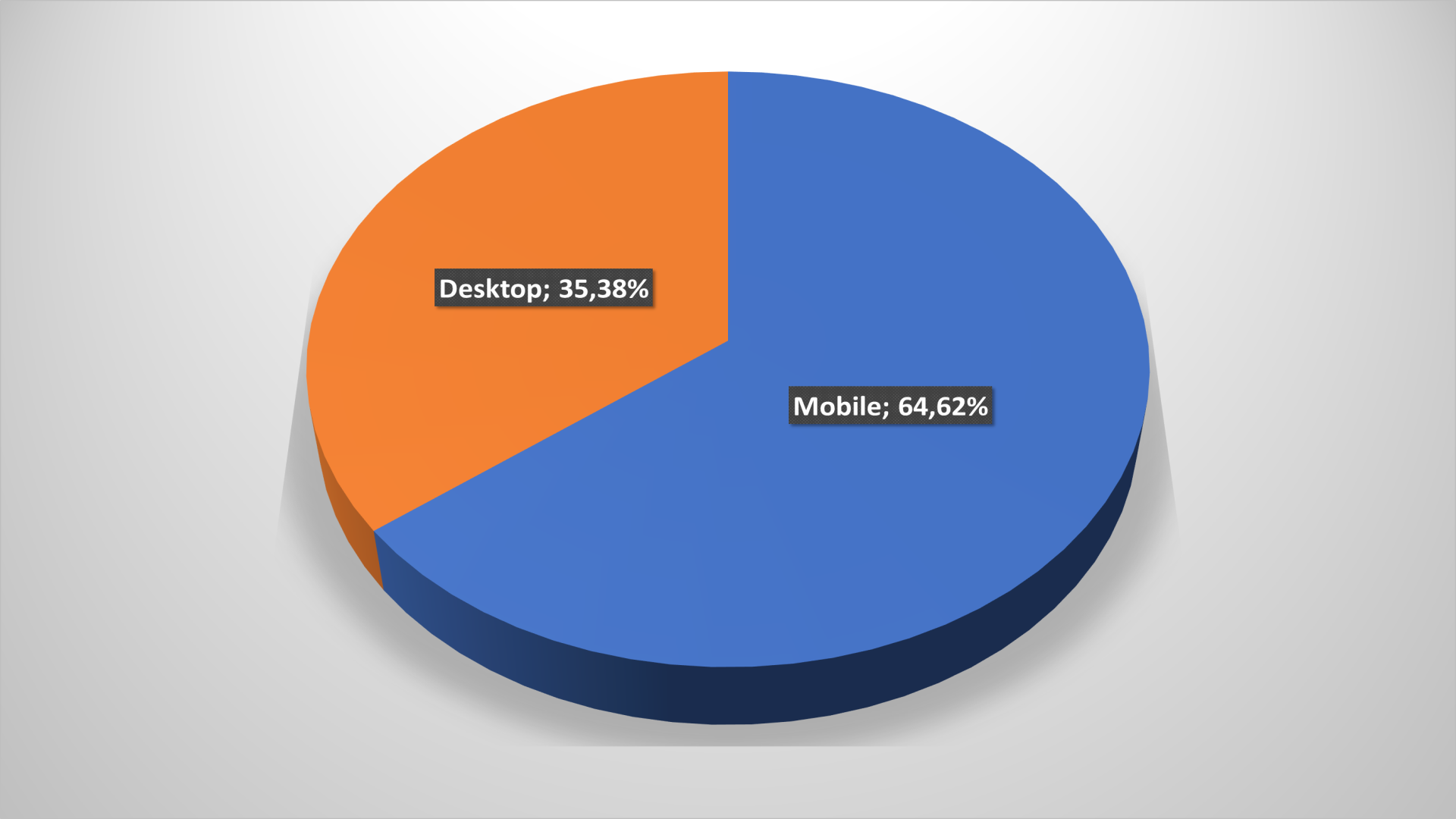

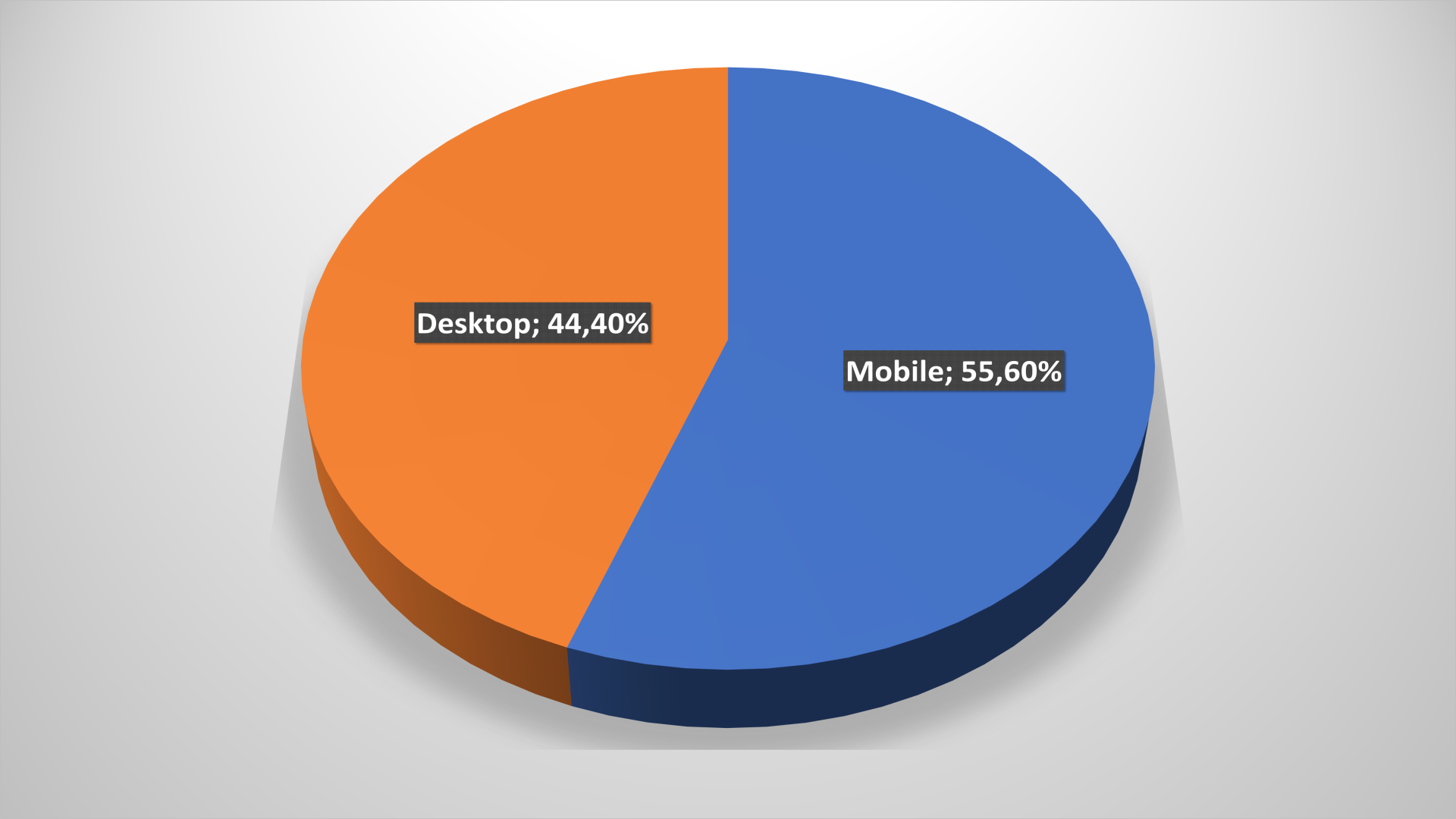

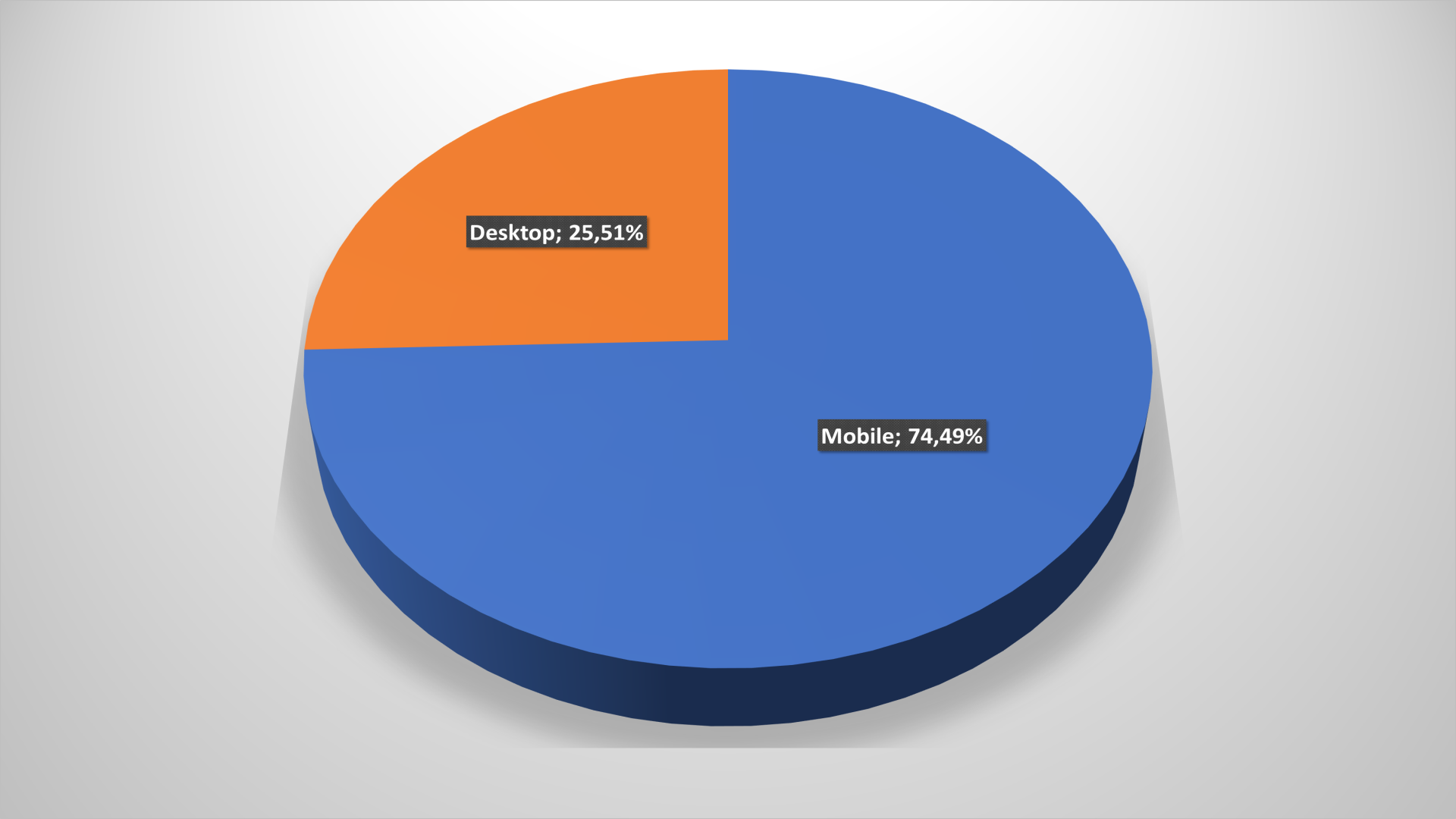

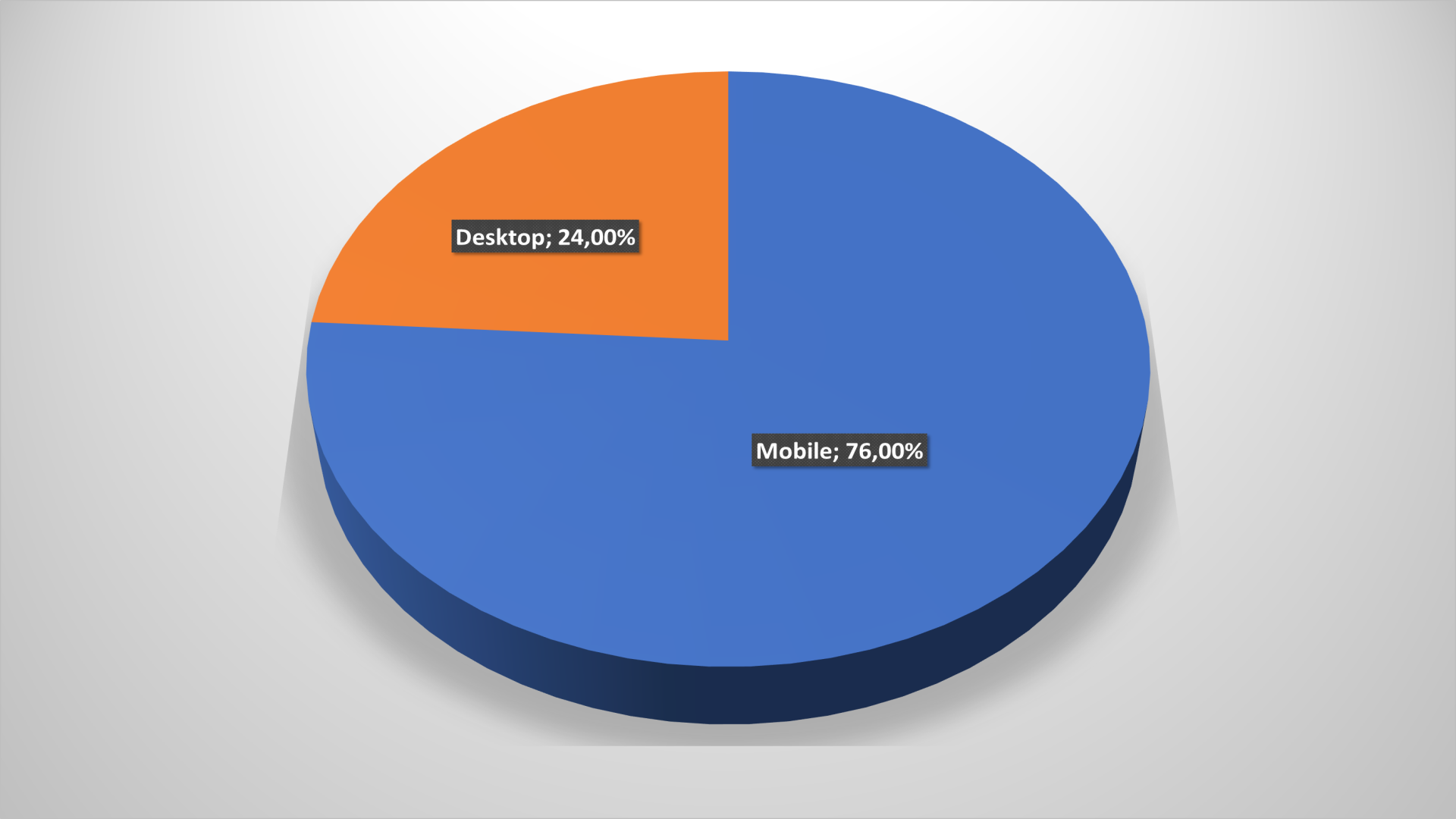

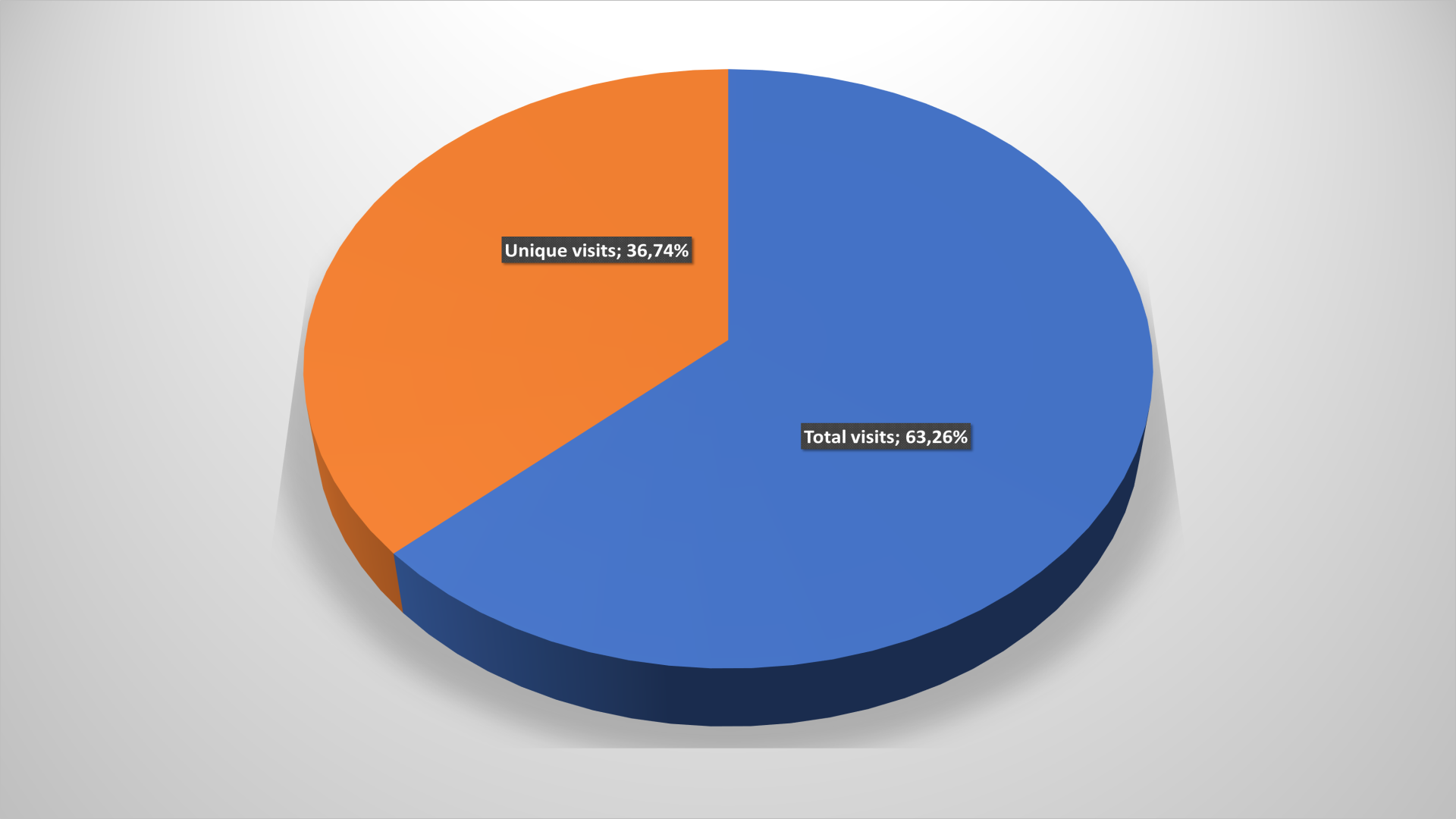

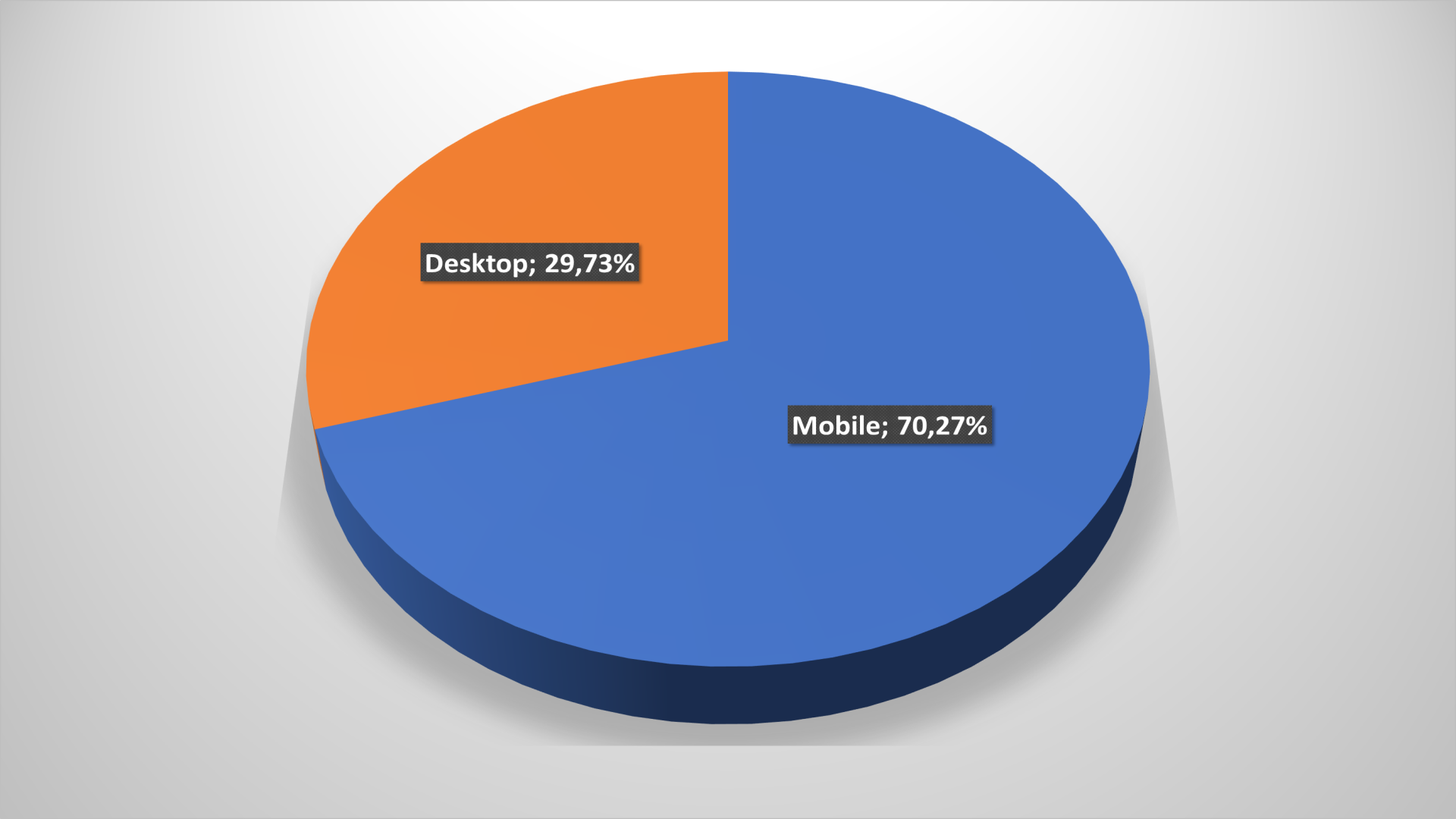

But expert’ forecasts regarding the importance of the m-commerce development are confirmed. The traffic’ share from mobile devices sharply collapsed according to 2018 results immediately at 12% – to 54.33%. But in this year the share almost returned the lost ground: mobile traffic to online-store sites grew by 10% and reached almost 65% all visits to portals.

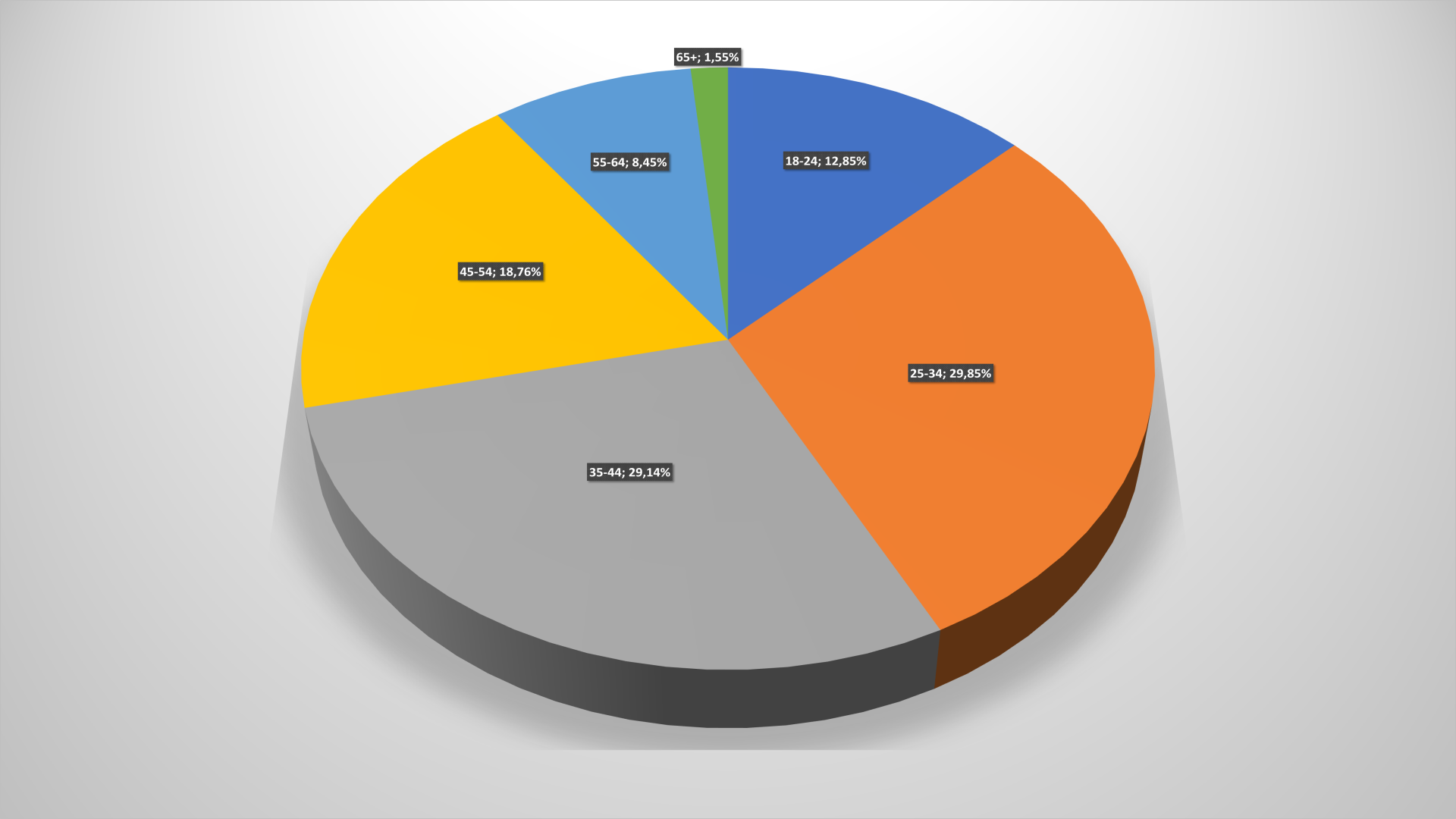

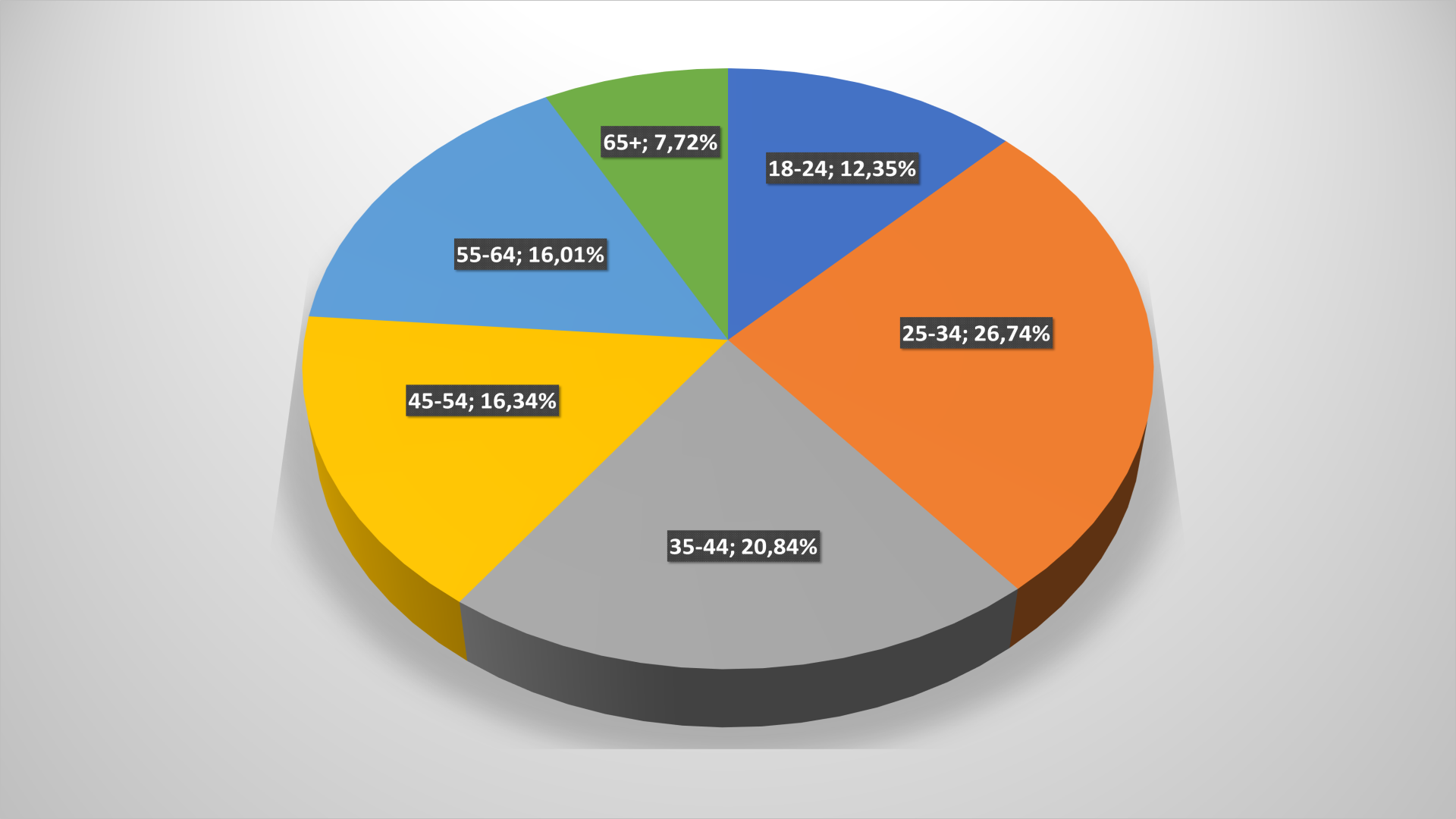

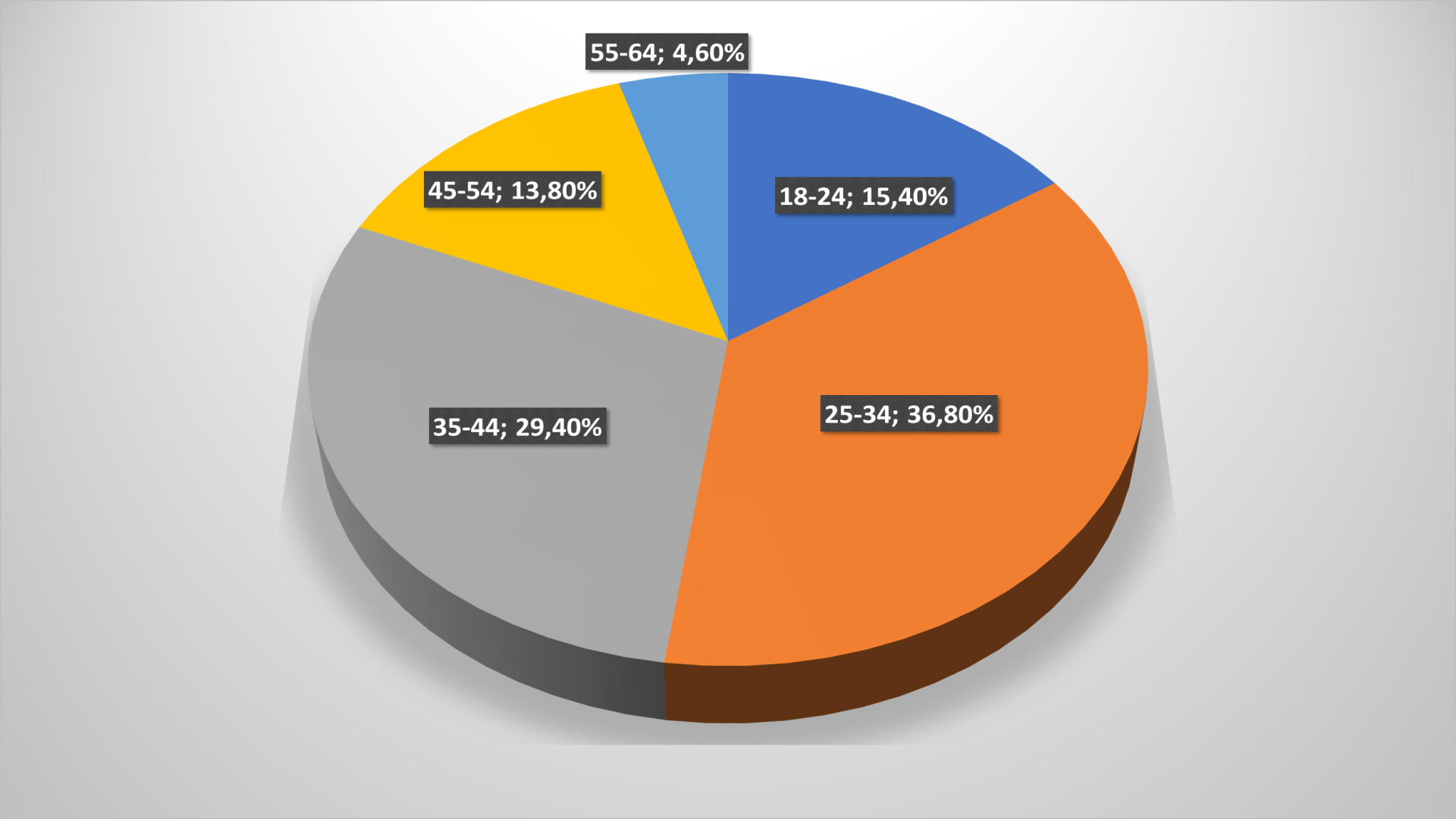

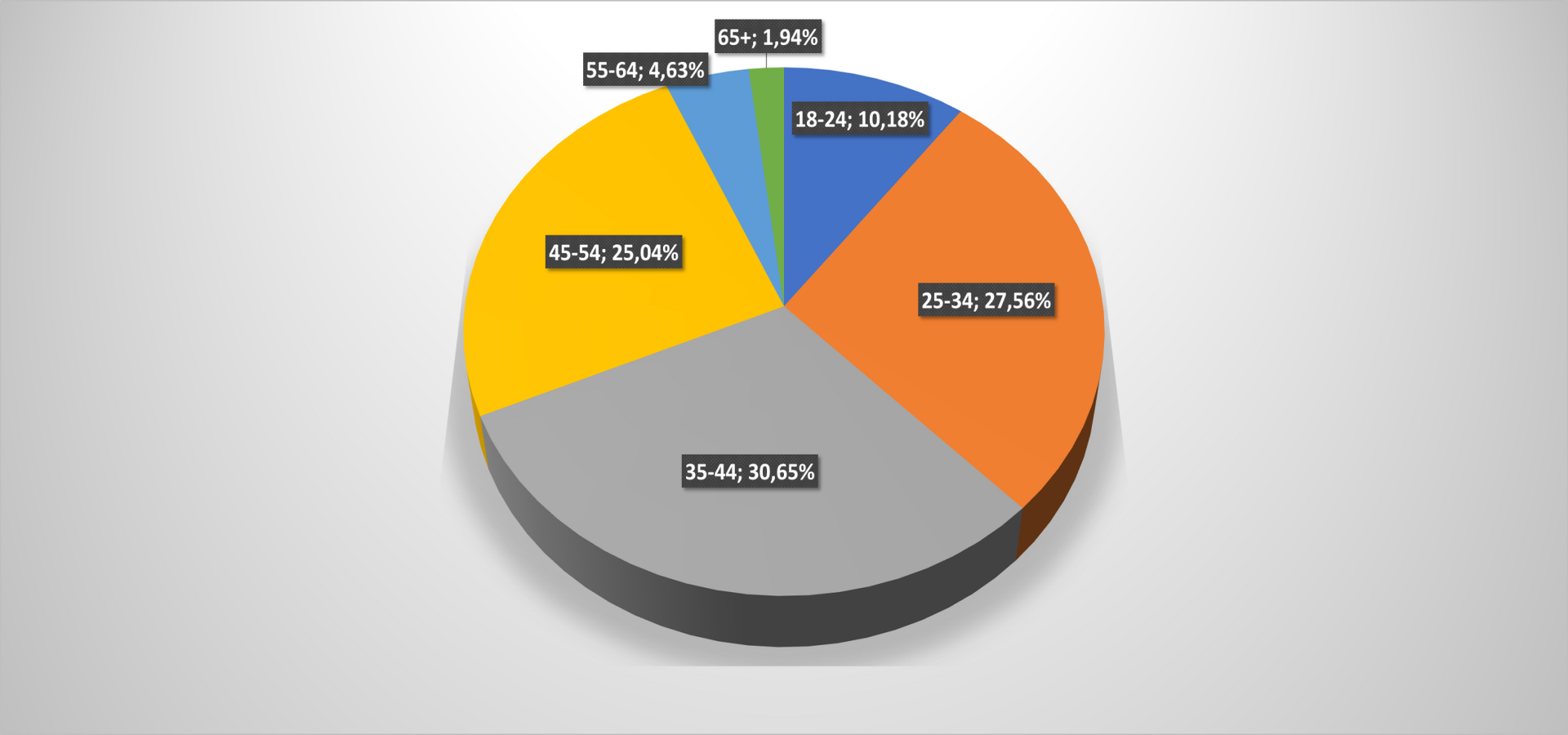

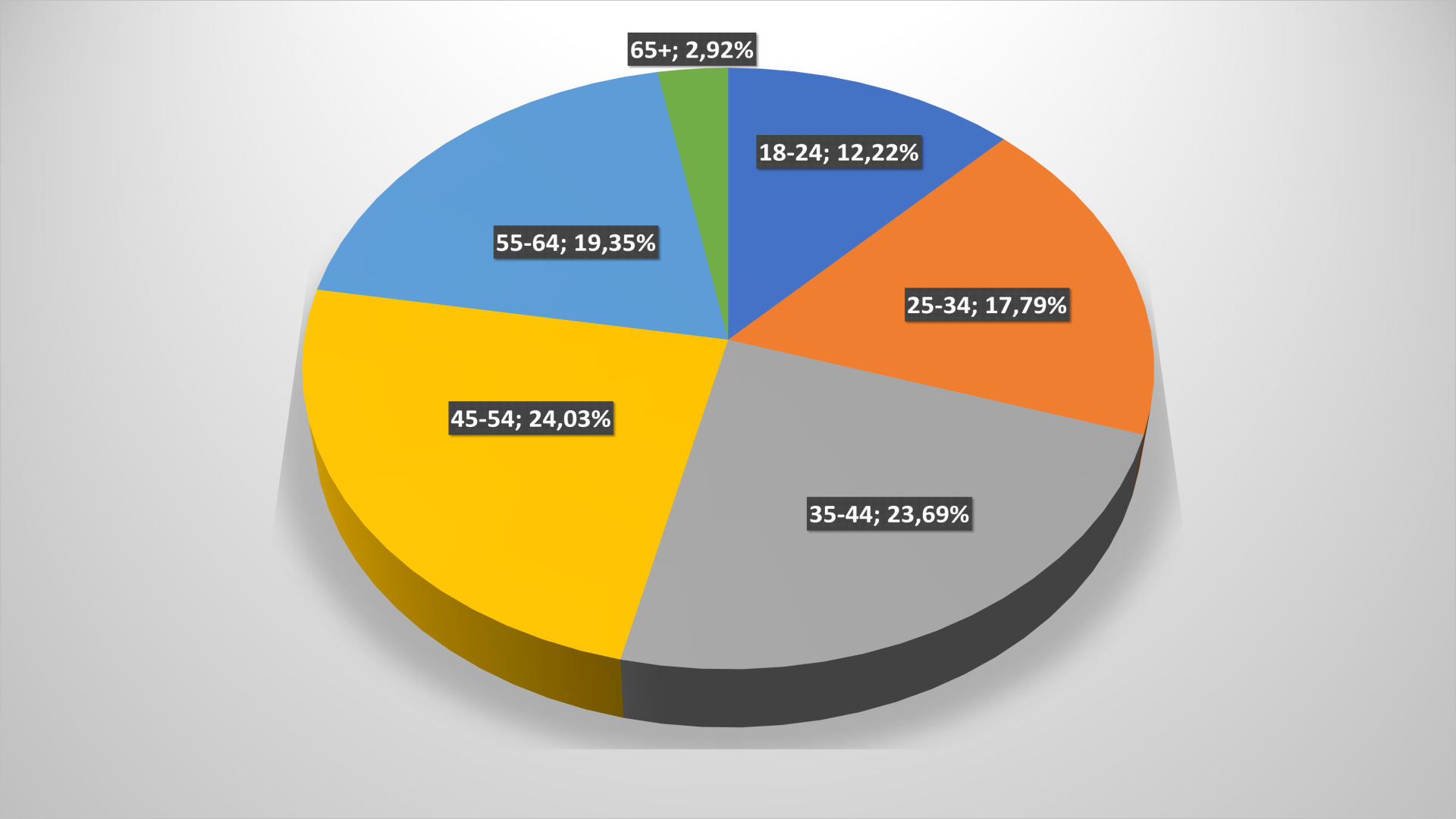

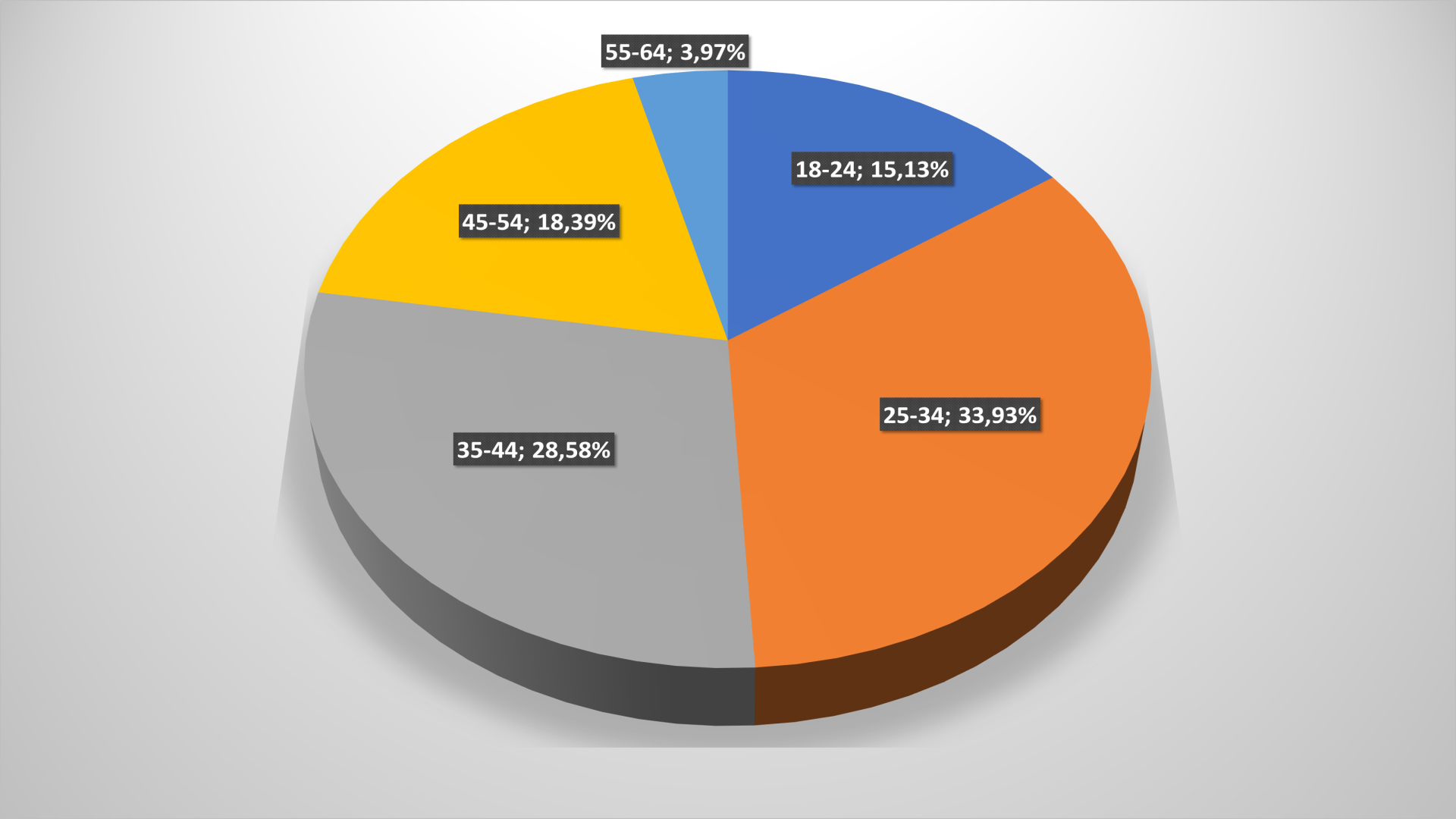

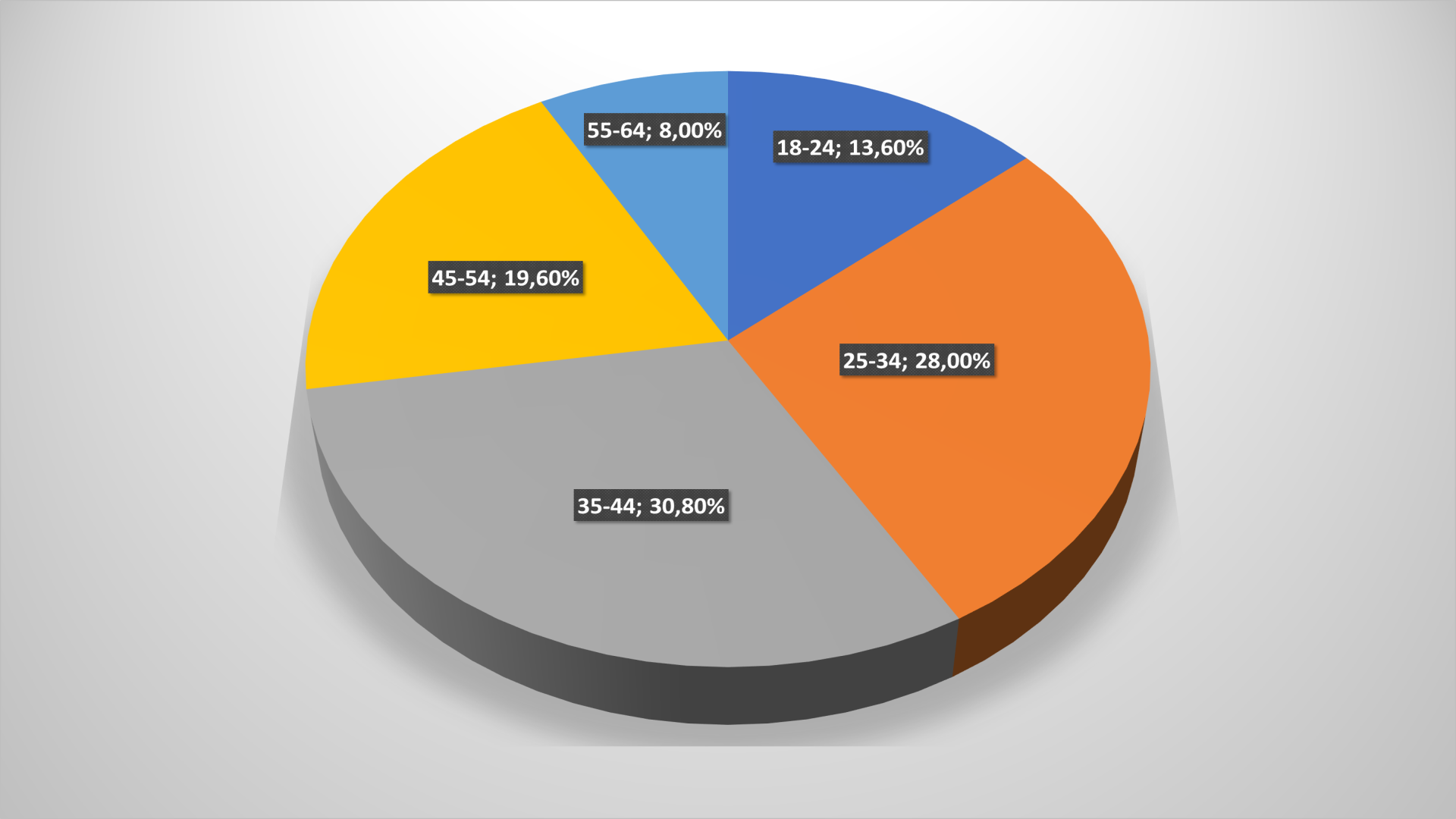

The users general age cut did not bring any surprises. More than 60% online-stores’ customers are people from 25 to 44 years old, another 30% – age categories 18-24 and 45-54. The older generation (over 55) provides to Ukrainian online-retailers exactly 10% (for comparison, in 2018 this user’ category accounted for 17% online-store traffic).

Department stores

If we examine individual segments of domestic e-commerce in more detail, practically “under the microscope”, then we can find many interesting, and partly unexpected trends.

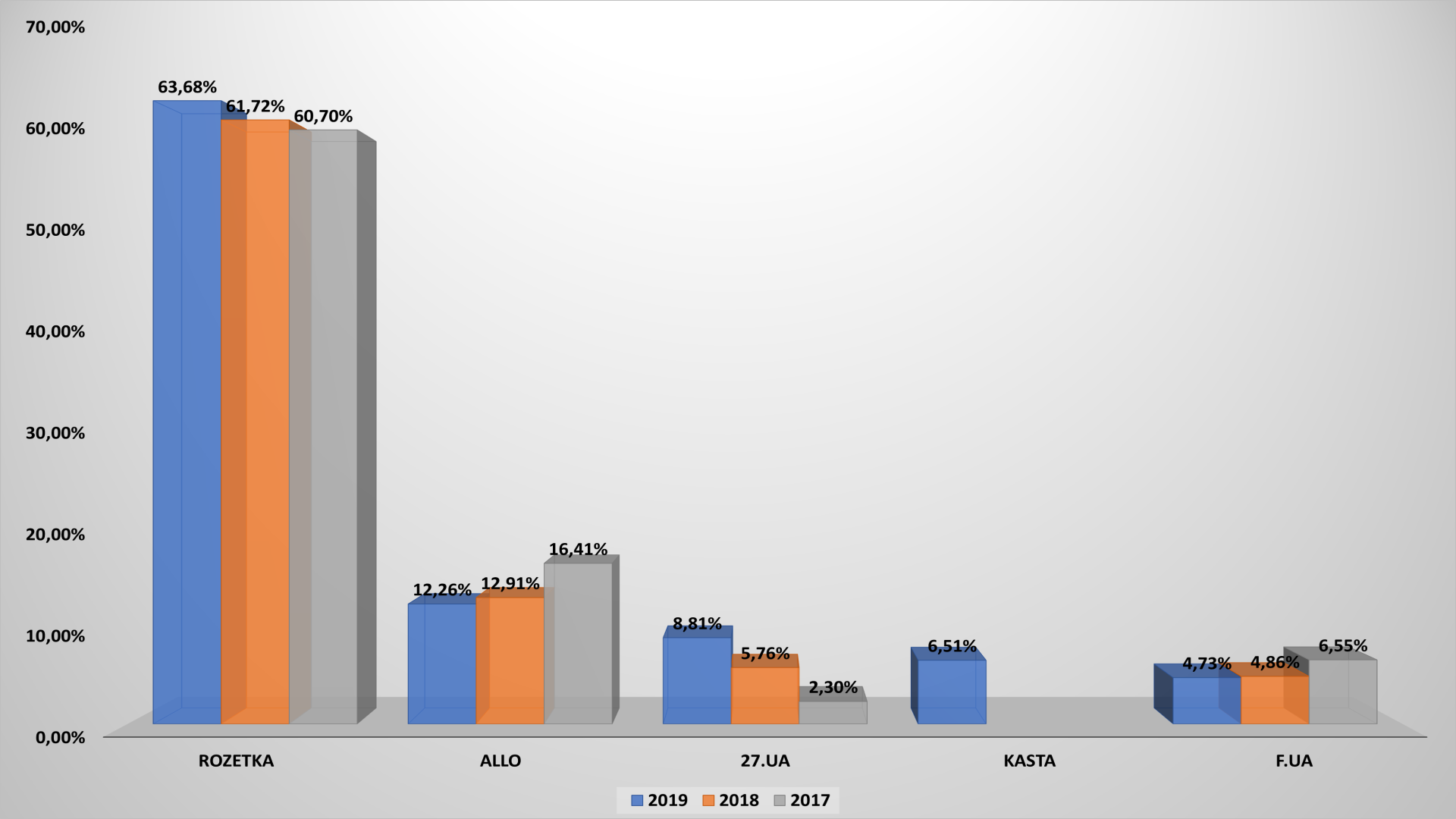

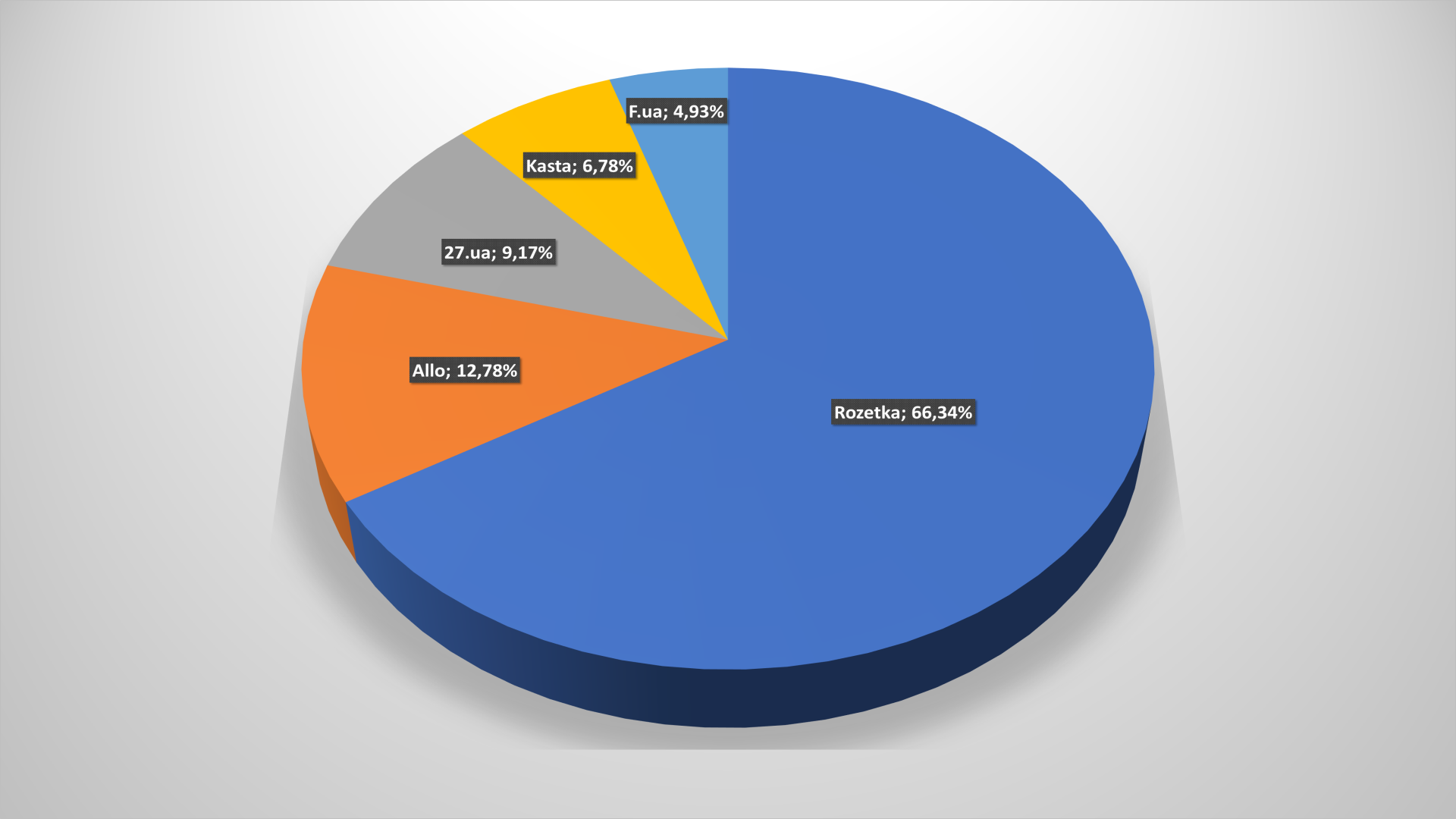

Rozetka.ua is the confident leader among department stores – none of competitors even not came close to the largest Ukrainian marketplace. It would be clarified that the audience’ coverage in the diagram below (as in further cases) is indicated as a percentage of the total segment’ attendance, and not only among mentioned key player.

So, Rozetka controls 63.68% all visitors to universal online-stores. Over the year, the marketplace’ coverage grew by almost two percent. Only the subsidiary project of the Epicenter K–27.ua chain grew faster, having increased this indicator by more than 3% over the year.

It is also worth paying attention to the undoubted success of Kasta.ua, which first entry top-5 universal online-stores (dropped out from the top-5 MOYO). And it is also worth paying attention to the fact that other marketplaces’ share continues to decline slowly.

Vladislav Chechetkin brainchild is also unshakable among top-5 positions in audience coverage’ terms: over 66%.

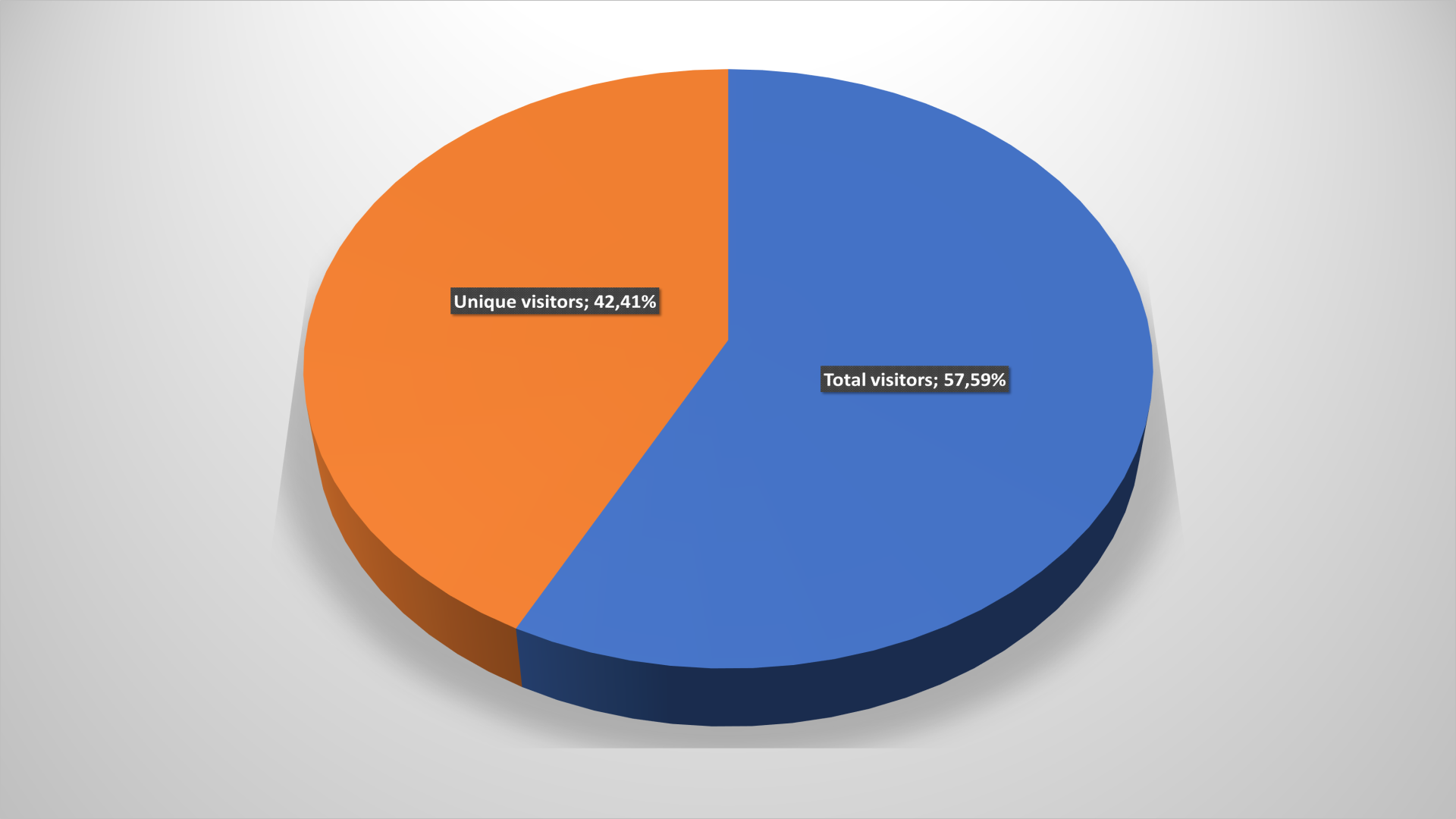

Audience’ loyalty also remains at the consistently high level: more than 57% users visited the leading marketplaces two or more times during the year. This indicator fell slightly compared to 2018, but this can be explained by the general increasing in the Internet-users’ number in Ukraine and the continuing rapid development of the e-commerce segment.

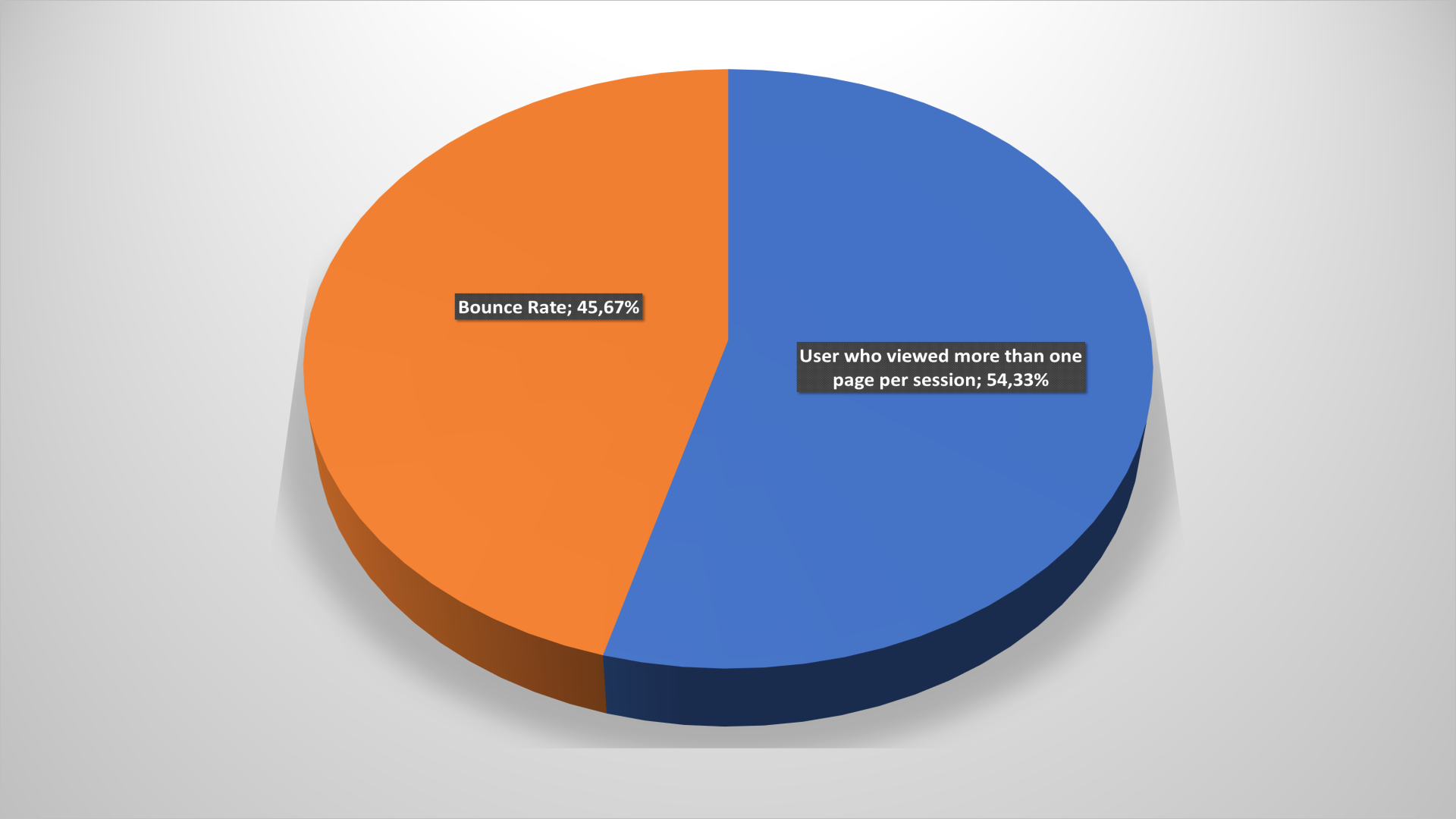

However, more than half of customers leave the site after viewing only one page, which it means – it is guaranteed without a purchase, since at least one transition is necessary to pay for good.

Another curious factor is – channels for attracting customers to universal online-stores sites. Year after year, the organic search’ role has significantly decreased – from 47% traffic to 41%. The conversions’ number for promoted words has increased sharply: from 9.5 to 14.5%, as in the case of the all-Ukrainian e-commerce indicator. Cross-references and desktop applications continue to decline.

What is noteworthy: social chains as an input channel remained almost at the same level. But there was a certain restructuring inside of it. In 2017, YouTube accounted for 62% transition to universal online-shopping sites from social chains, and Facebook – 25%. Last year, the Facebook share increased sharply – immediately to 33%, but the video-service has somewhat lost its position. In 2019, Mark Zuckerberg creation continues to increase performance, almost catching up with YouTube despite all problems and the users’ indignation.

Users approximately equally come from mobile devices and from desktop computers or laptops on marketplace sites.

The online-shoppers’ age for universal online-stores is quite diverse. So the big role of stationary devices can be explained by the fact that every fourth user who “looked” at marketplaces during the year is over 45 years old. It is a fairly solid indicator. At the same time, the proportion of age-related users declined immediately by 7% compared with last year.

Portable equipment, electronics and gadgets

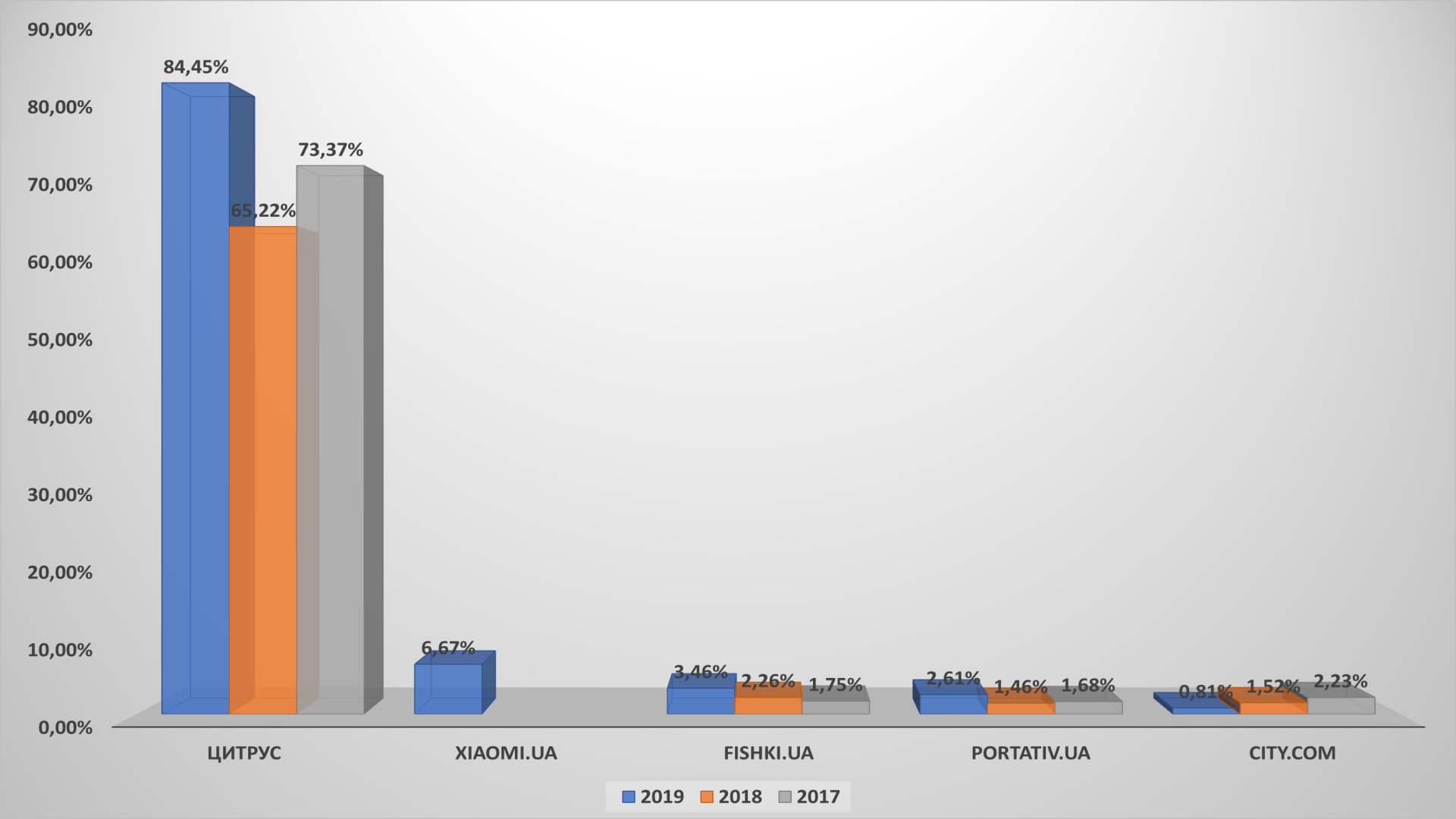

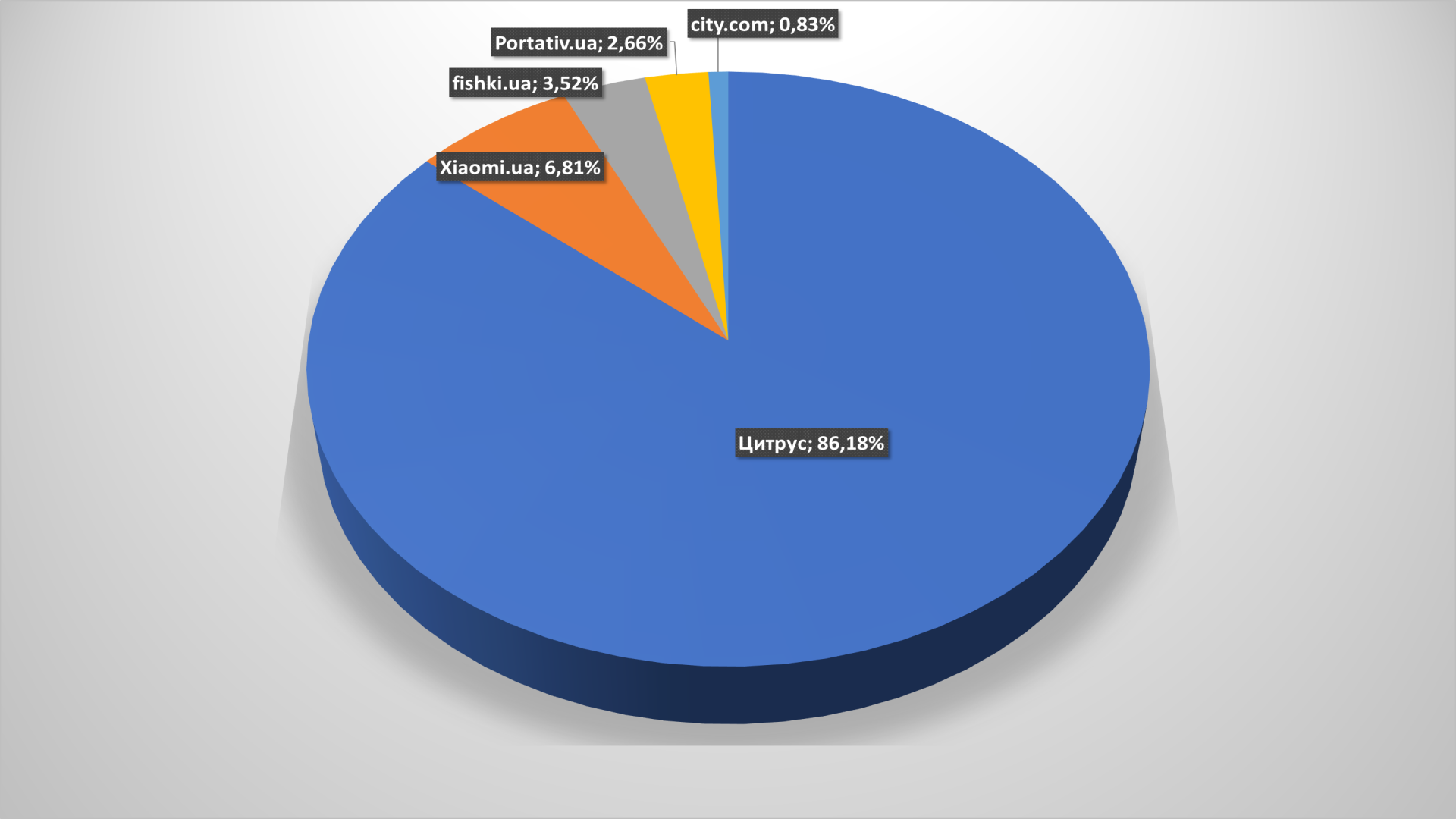

The segment has a pronounced leader as in the case with department stores. It is online-store Citrus.ua in this case. Its overall coverage in the segment broke all records, compared to last year!

It is also worth noting the appearance of top-5 debutant in this category: xiaomi.ua, which immediately rose to second place and supplanted the ZZUK online-store from the rating.

Like a year ago, Citrus has no equal among five largest online-retailers of equipment and gadgets. If it is considered the situation from this angle, then Citrus.ua can be safely called the monopolist in this segment.

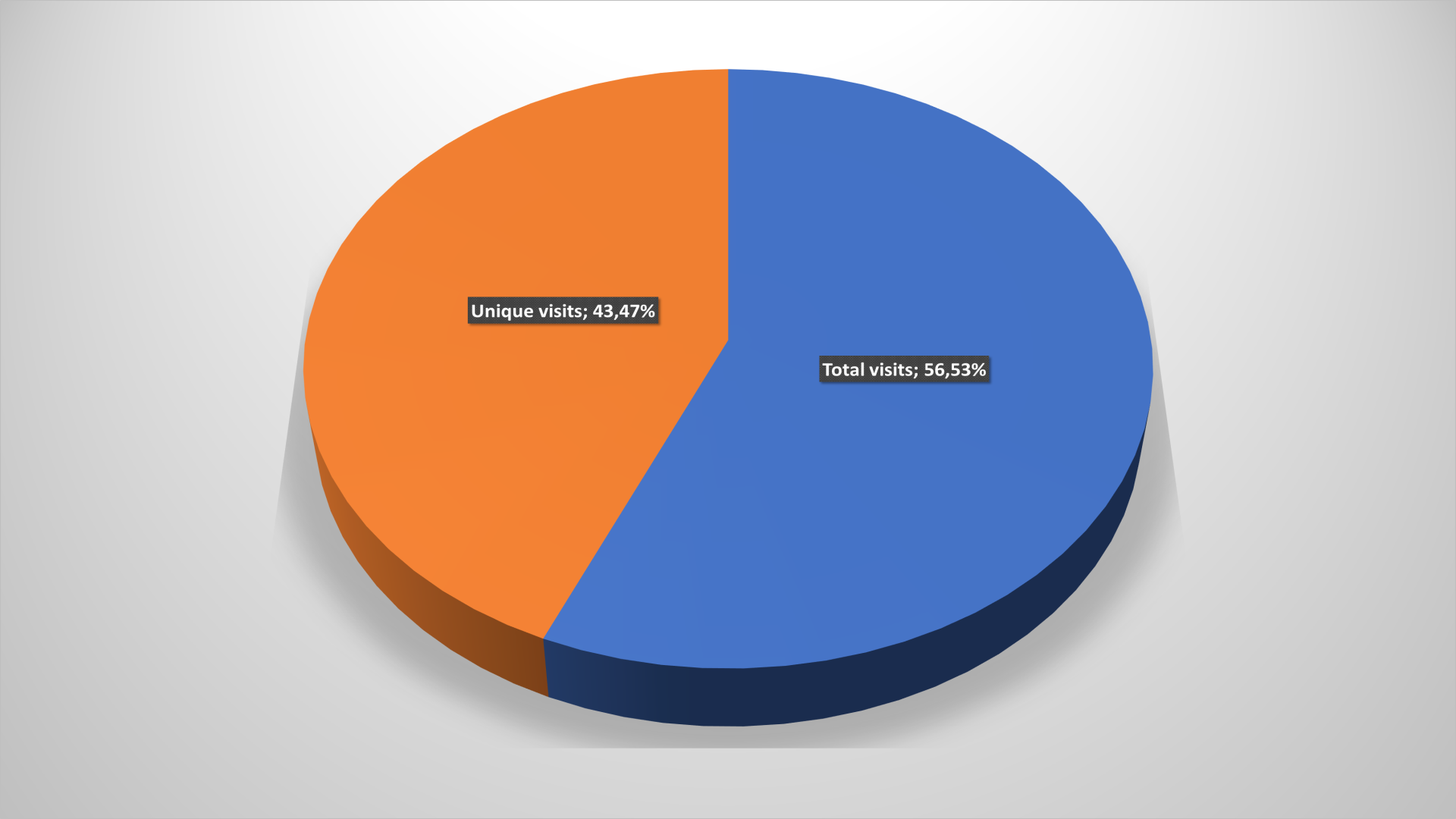

The audience’ loyalty has grown slightly compared to last year within the margin of error during the research. In 2018, 55% users returned to sites of gadgets and accessories online-stores, and in this year – 56.53%.

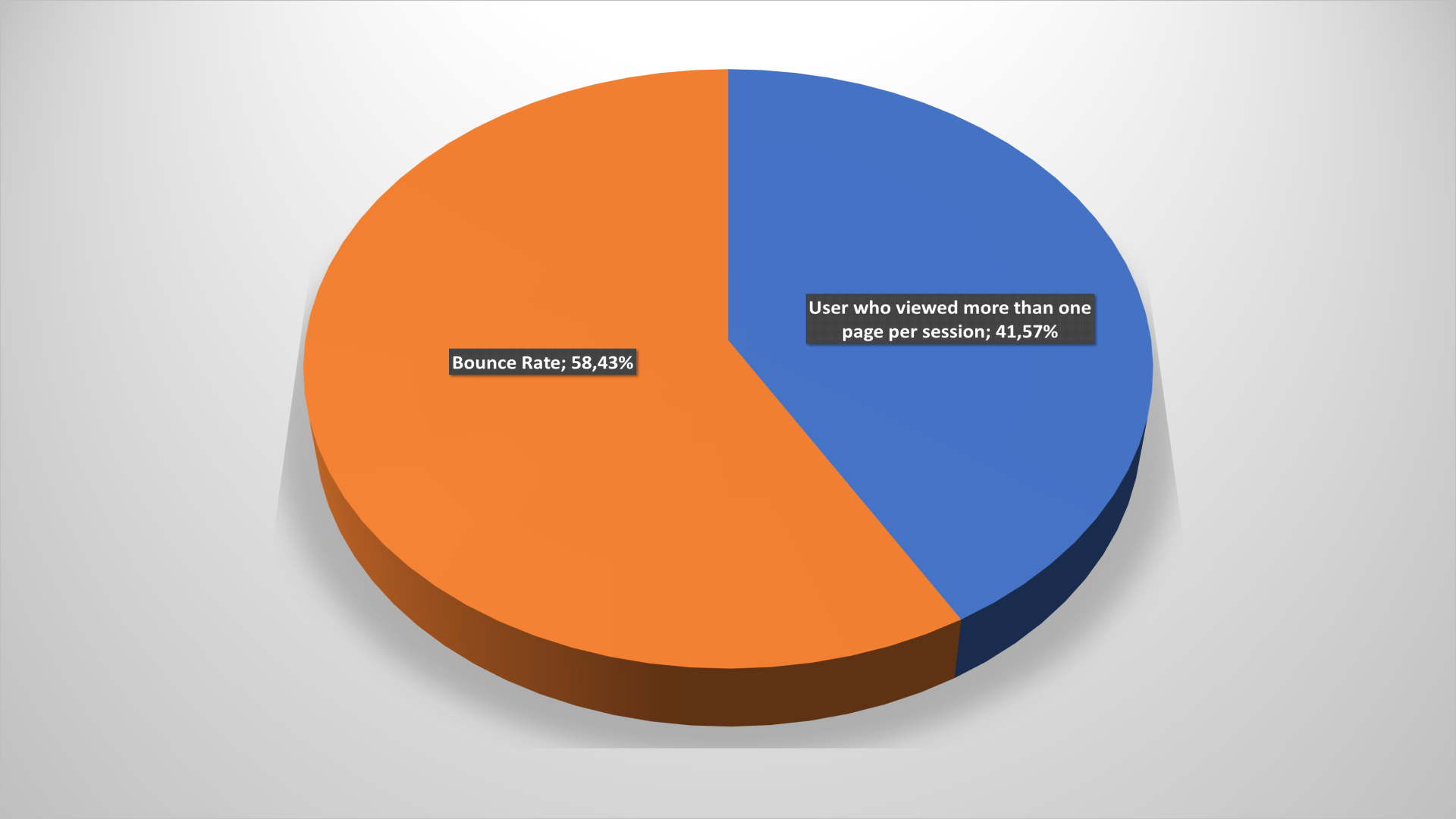

Moreover: the Bounce rate number has noticeably increased. If a year ago only 54% users left electronics and portable equipment’ portals from the login page, now more than 58% customers leave without making a purchase. It is an alarming trend taking into account the decline in the loyal audience.

Sellers of gadgets and related products were able to increase traffic from search engines and the direct visits’ number (due to a corresponding reduction in referrals and social chains). But, as is characteristic of all Ukrainian e-commerce, the paid traffic’ share from search engines showed the greatest growth.

Here retailers clearly continue to bet on YouTube, unlike the previous category – almost 50% traffic from social chains is provided by this channel. But it is traditionally difficult to increase sales with its help. The Facebook share for portable electronics’ sellers has grown, but less than the average for Ukrainian online-commerce.

What is another feature of portable equipment’ online-retailers: here the predominant share of mobile users remains. However, main buyers of such products are young people, so 55.7% visits from mobile devices are more than understandable. Moreover, in 2017 there were 68%, that is, the general tendency for m-commerce to fall also affected this category.

The age cut confirms all of the above: 82% gadgets and accessories’ buyers are users under 45 years old. The older generation does not pursue fashionable novelties.

Home Appliances

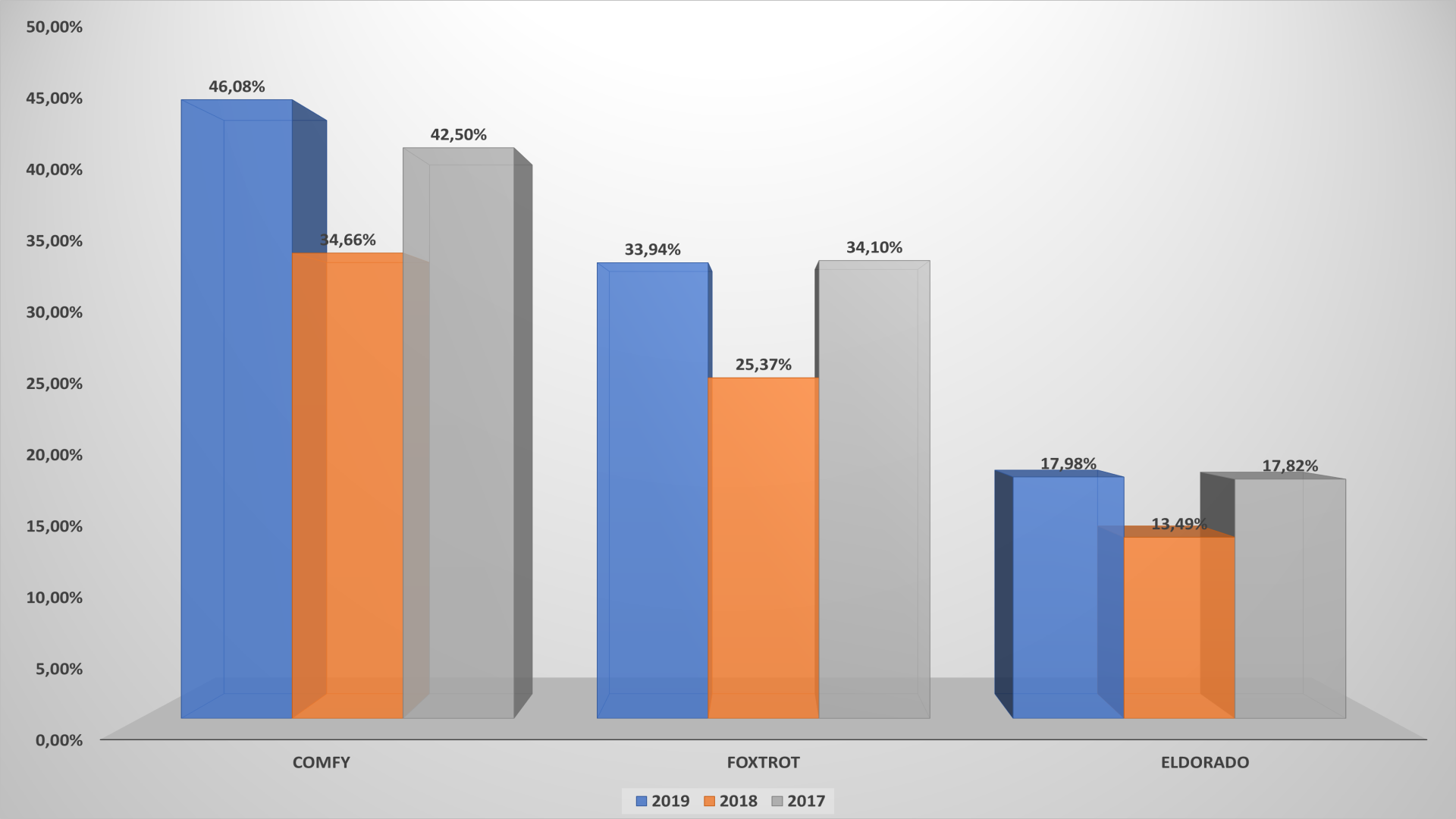

There are only three significant players in this Ukrainian e-commerce segment, since the rest are inferior to it at times. And it is unlikely that in the foreseeable future there will be a company ready to give up to market leaders. In 2019 the “Big Three” easily regained its lost positions after last year’s subsidence, simply destroying even potential competitors.

Moreover, if it is judging by the alignment of forces in the top-3, nothing has changed: the coverage remained absolutely identical to last year.

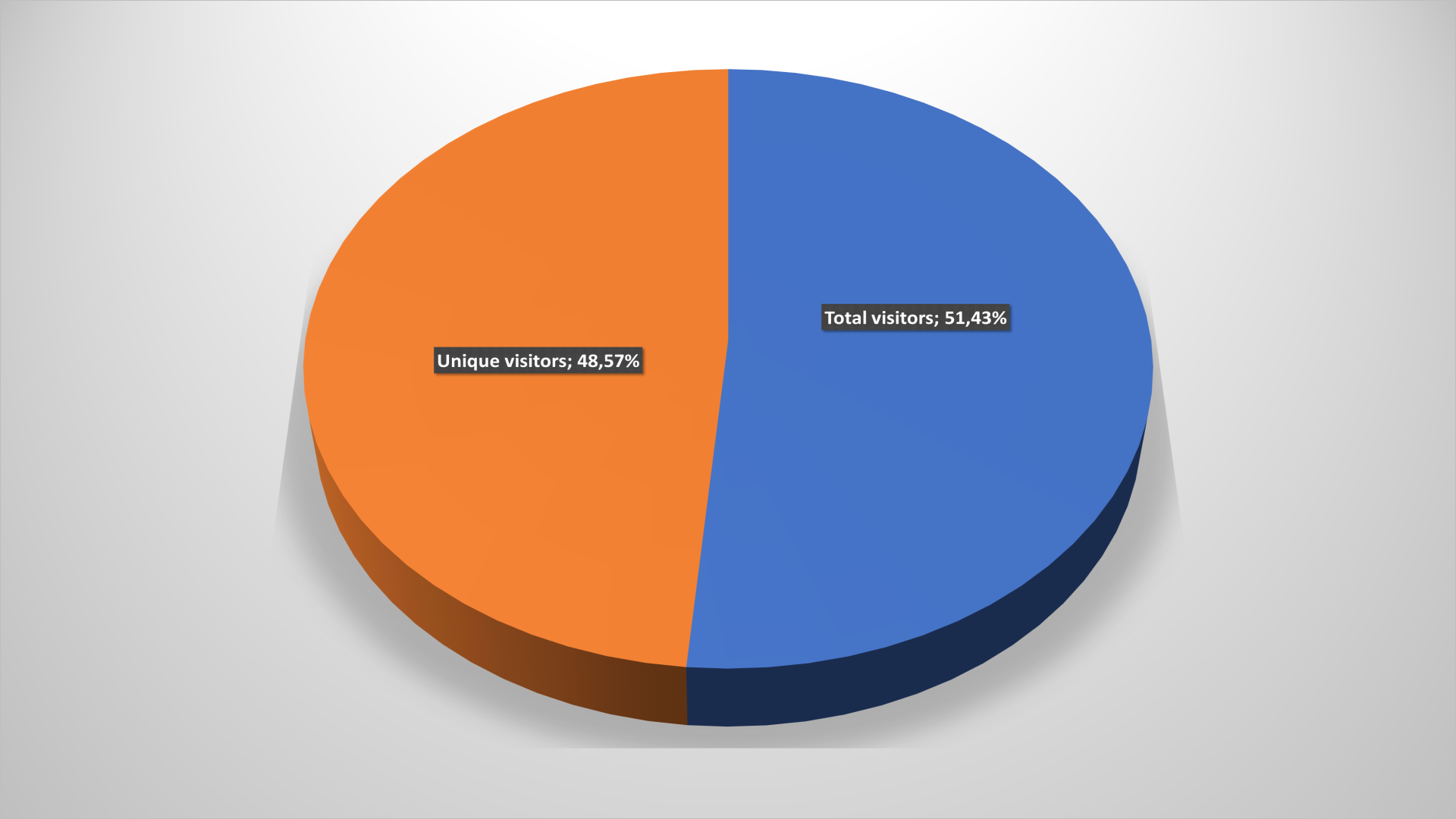

It is also unusual that users who visited the store’s site once a year and those who visited the portal two or more times shared roughly equally – about 50/50. Last year there was a similar situation, with small shifts in the percentage share.

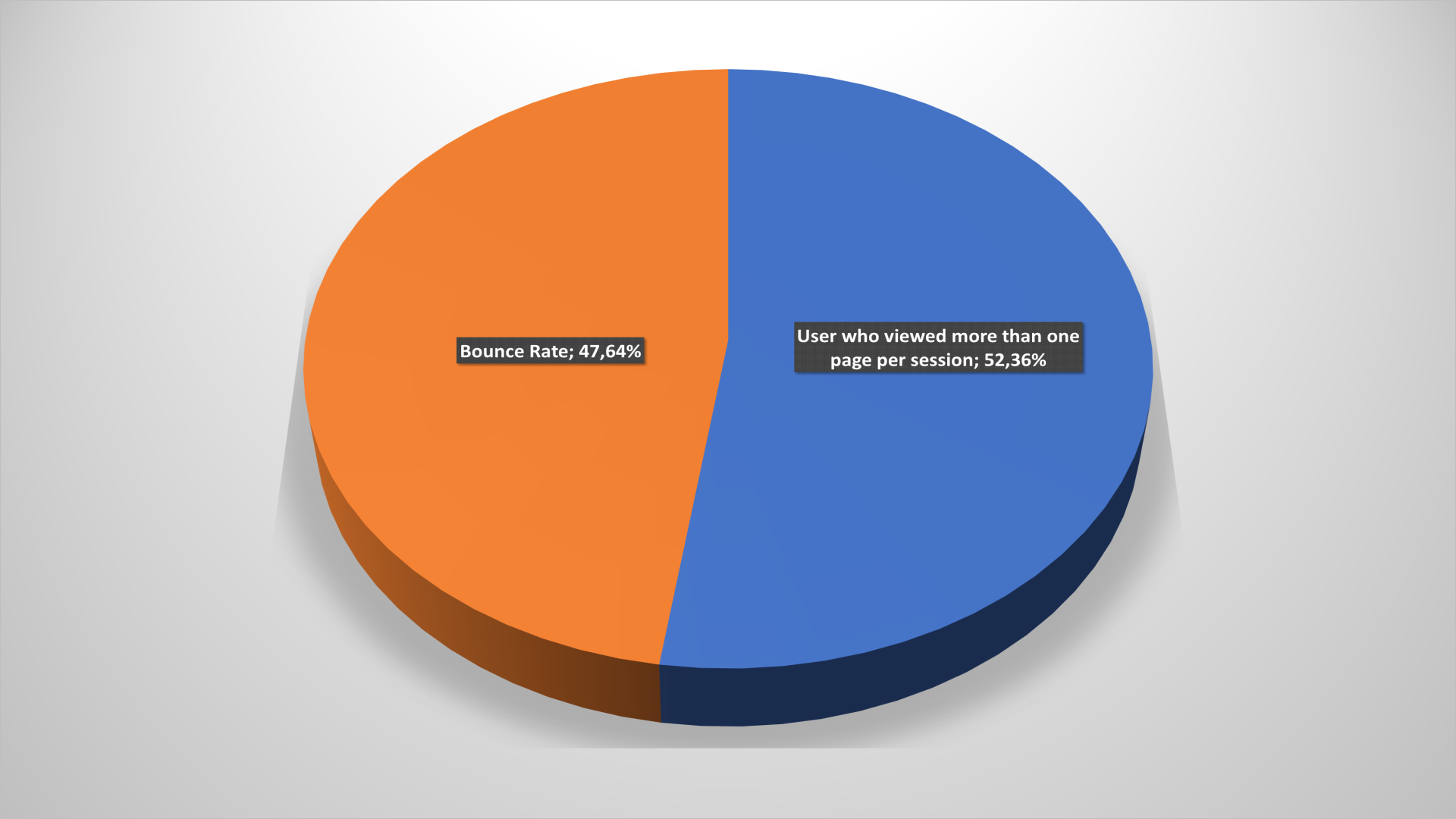

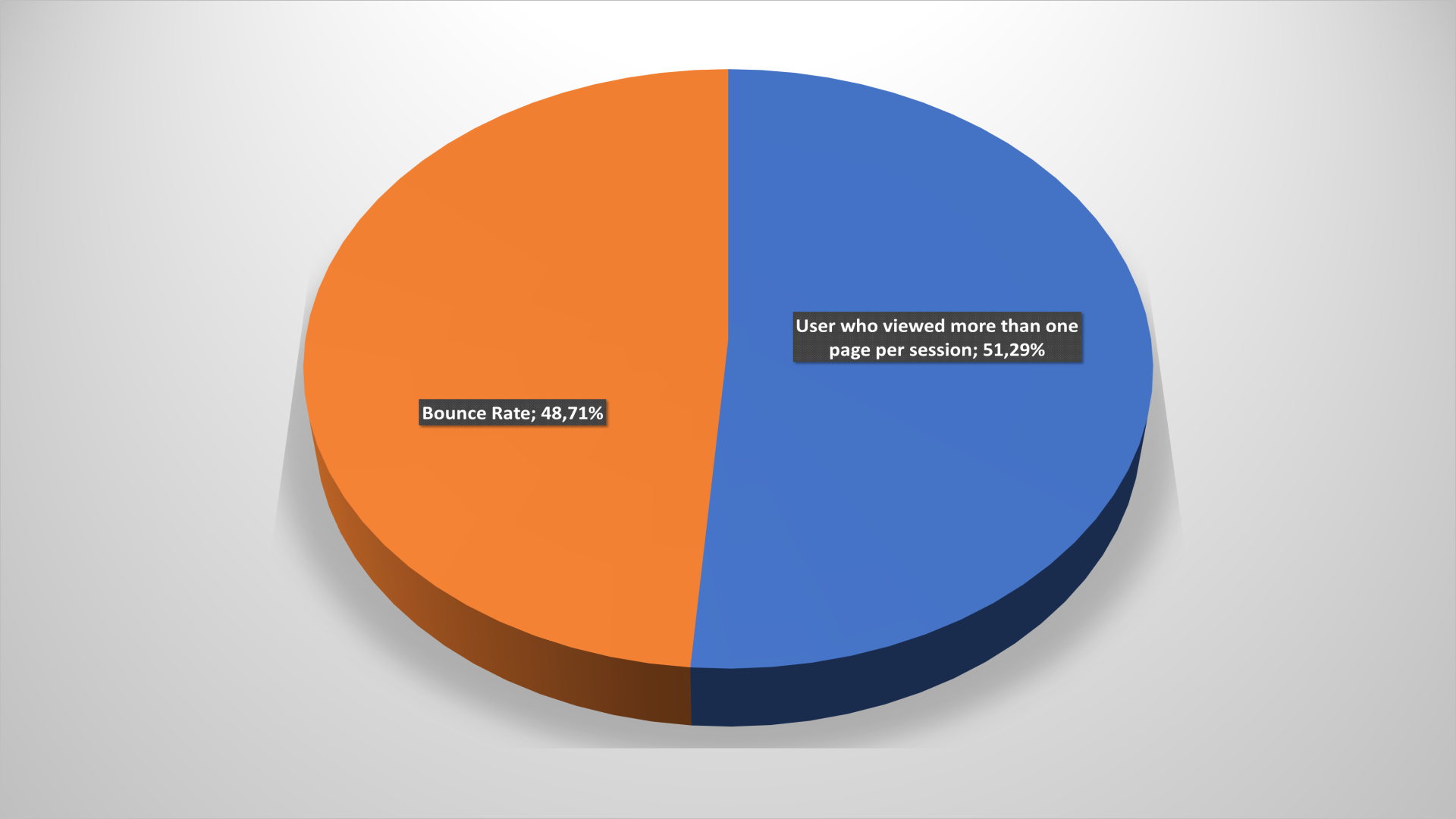

For all that, the Bounce rate number has risen sharply – from 42 to 48.5% at once! If earlier sellers of technology could be sure that six out of ten visitors to the site did not leave, even if they didn’t go to another page, now the situation has noticeably changed. There is reason to think and analyze what is happening.

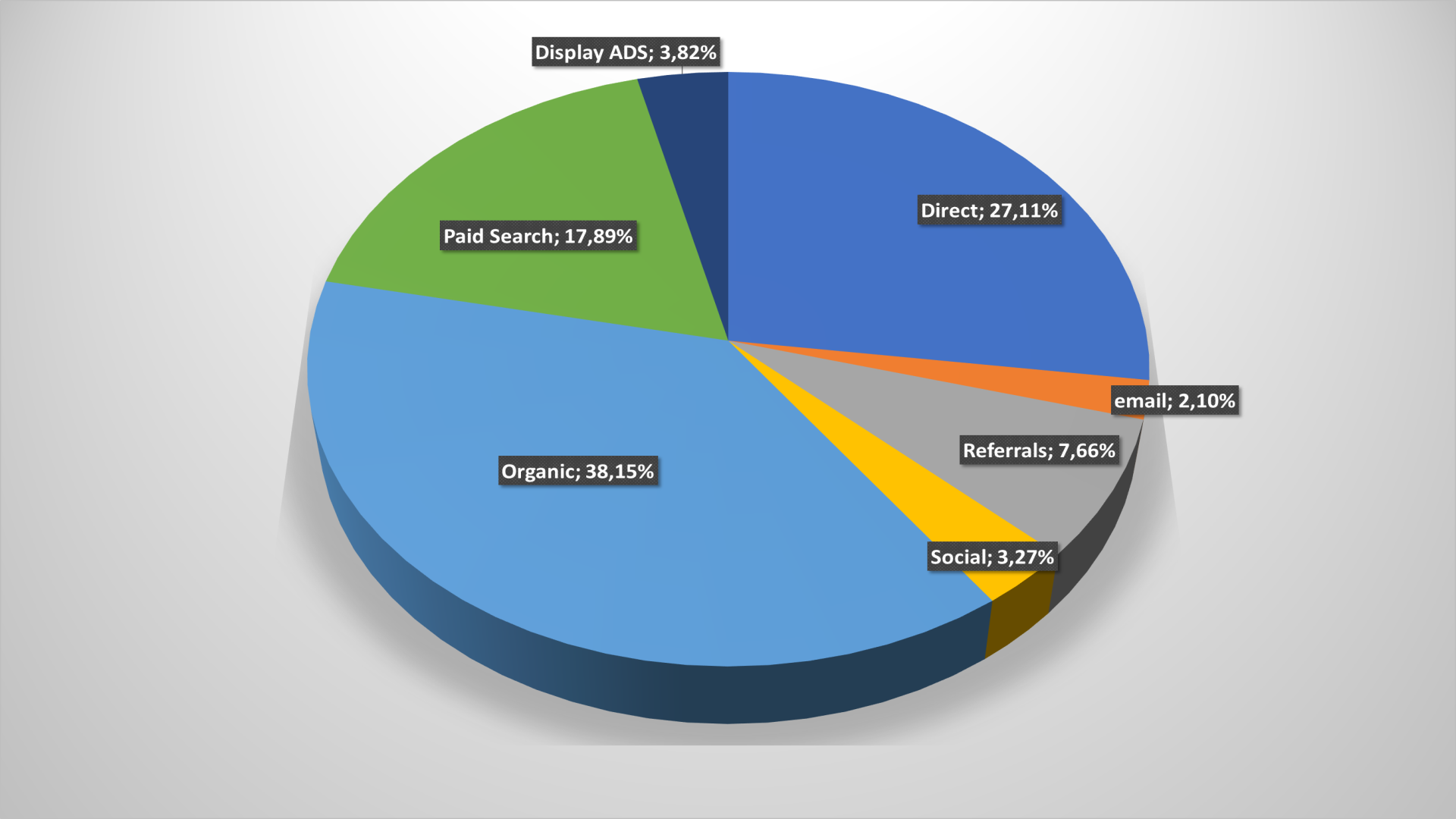

In general, the category of traffic channels does not fundamentally differ from average Ukrainian indicators. There is also a rather significant share of paid advertising search: competition for consumers forces online-stores to invest in such channel to attract users.

Social chains, despite the image importance, actually provide sellers of household appliances and electronics with only 3.27% total traffic. It would seem that this direction can be neglected, but all companies working in this segment pay a lot of attention to SMM-strategies. Facebook contributes, as in most other categories, transitions’ bulk to online-stores’ pages. In second place is YouTube. The rest can be neglected.

Over the year, companies in this category managed to significantly increase mobile traffic, having won back last year’s decline by 13% and even breaking the 2017 record, when m-commerce provided 63% visits to the site. For comparison, last year mobile and “desktop” traffic were approximately at the same level.

Most solvent categories of citizens – between ages from 25 to 55 – prevail, not surprisingly, among online-buyers of household appliances and electronics. The rest make up less than a fifth of customers.

Fashion

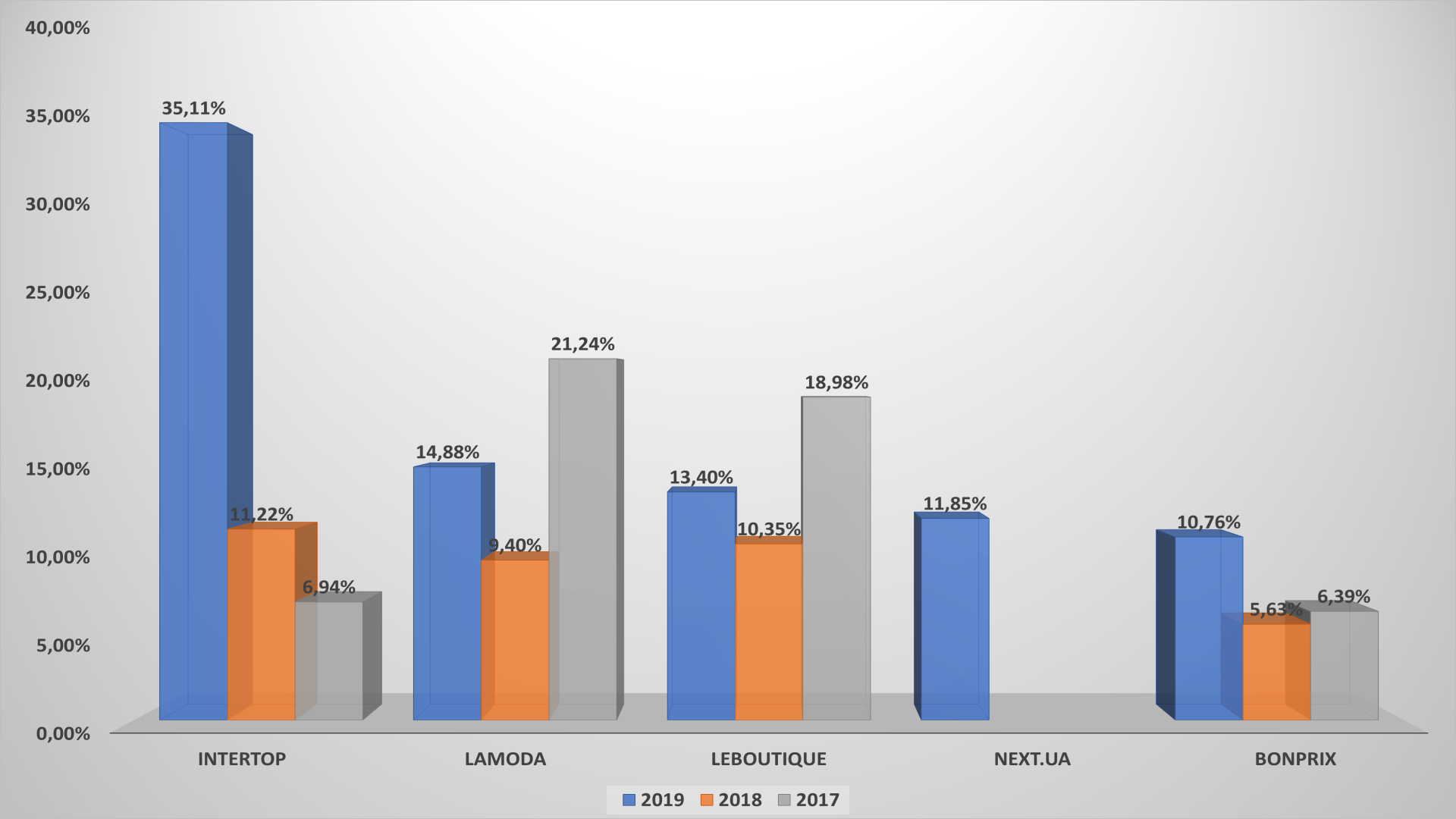

First of all, it must be said that this segment’ leader in previous two year – Kasta.ua – officially announced its work in the marketplace-format and is now represented in the corresponding category “Department stores”. So new player – Next.ua – appeared in top-5 Ukrainian Fashion-operators on the Internet. All subsequent evaluations and comments would be analyzed taking into account this fact.

It is worth noting that only Intertop sells mainly its products among leaders in this direction. The rest are presented with both its own purchases and offers of third-party sellers. But since a significant percentage of goods is made up of its own stocks, it would be wrong to exclude it from the online-stores’ rating and assign it only to marketplaces.

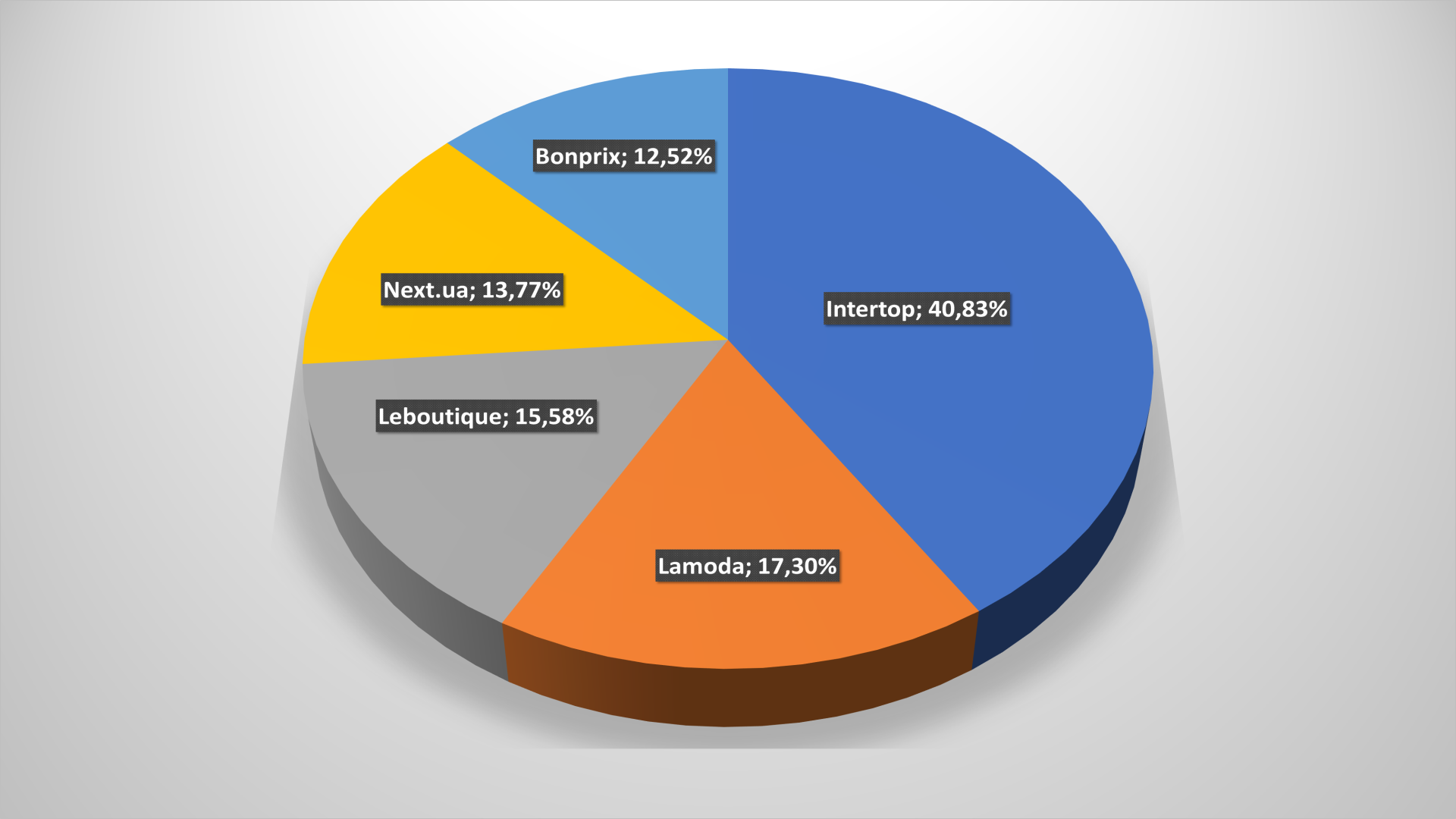

In general, top-5 fashion industry companies represented in the Ukrainian segment of the Internet have increased coverage. The Intertop online-sales share is constantly growing, and its own leader appeared here (almost like Citrus in portable electronics) after Kasta.ua “moved” to another category. It can be assumed that in the future Intertop and company-owned brands will further increase its separation from competitors taking into account the constant attention of the MTI group to the direction electronic commerce’ development.

In particular, now Vladimir Tsoi company already provides coverage for 41% visitors to Ukrainian online-stores offering clothes, shoes, and accessories. If we do not forget that Intertop also headed for the “marketplace”-format development, though so far only in the Fashion-segment, then in the future its leadership will only be strengthened.

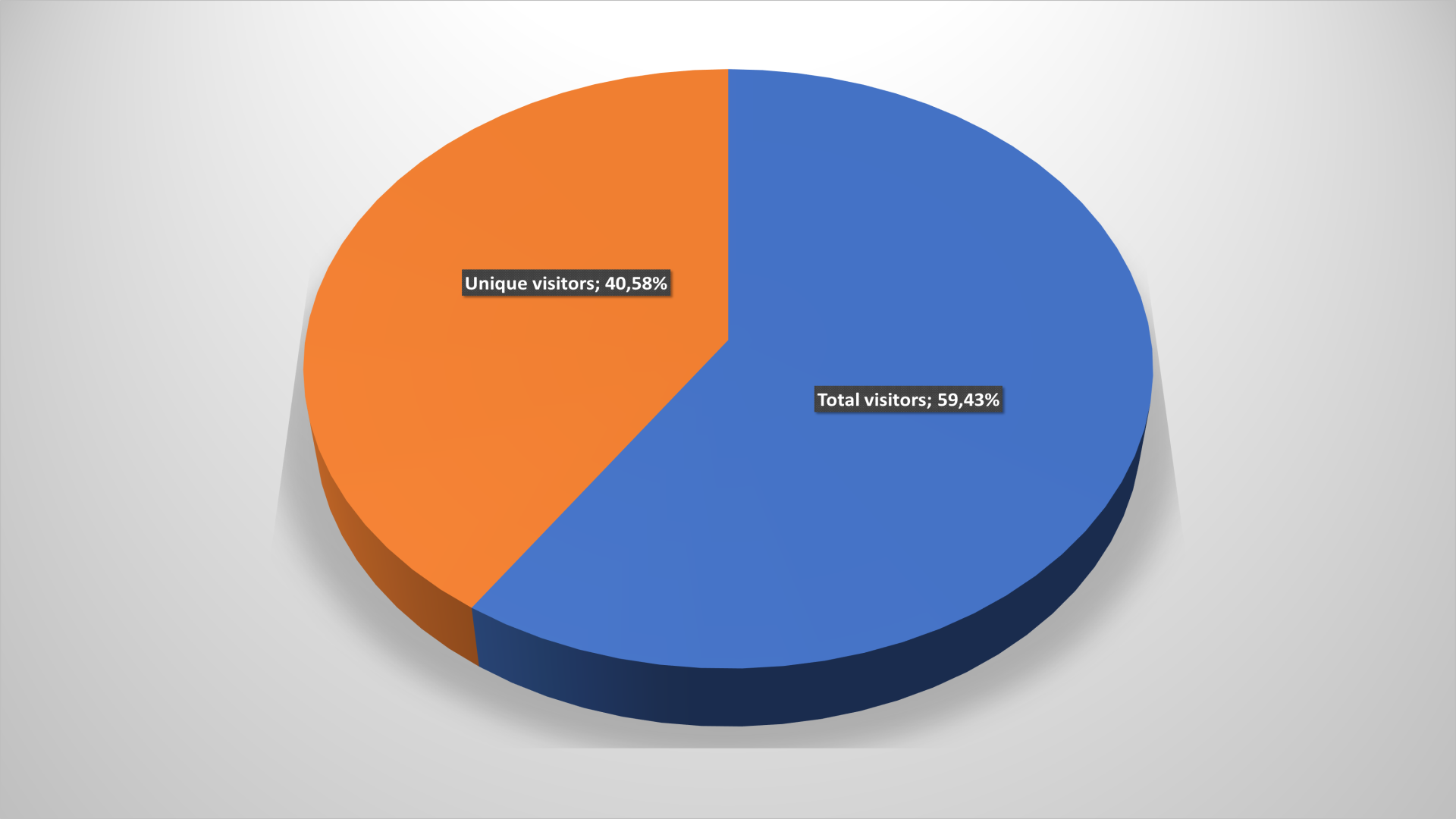

At the same time, visitors to this segment are distinguished by an enviable loyalty to selected brands. Almost two thirds of them visit retailer sites more than once a year. The figure fell slightly compared to last year, but 4% drop does not mean anything. At the same time, the decline has been observed for the second year in a row, and this is not a good trend.

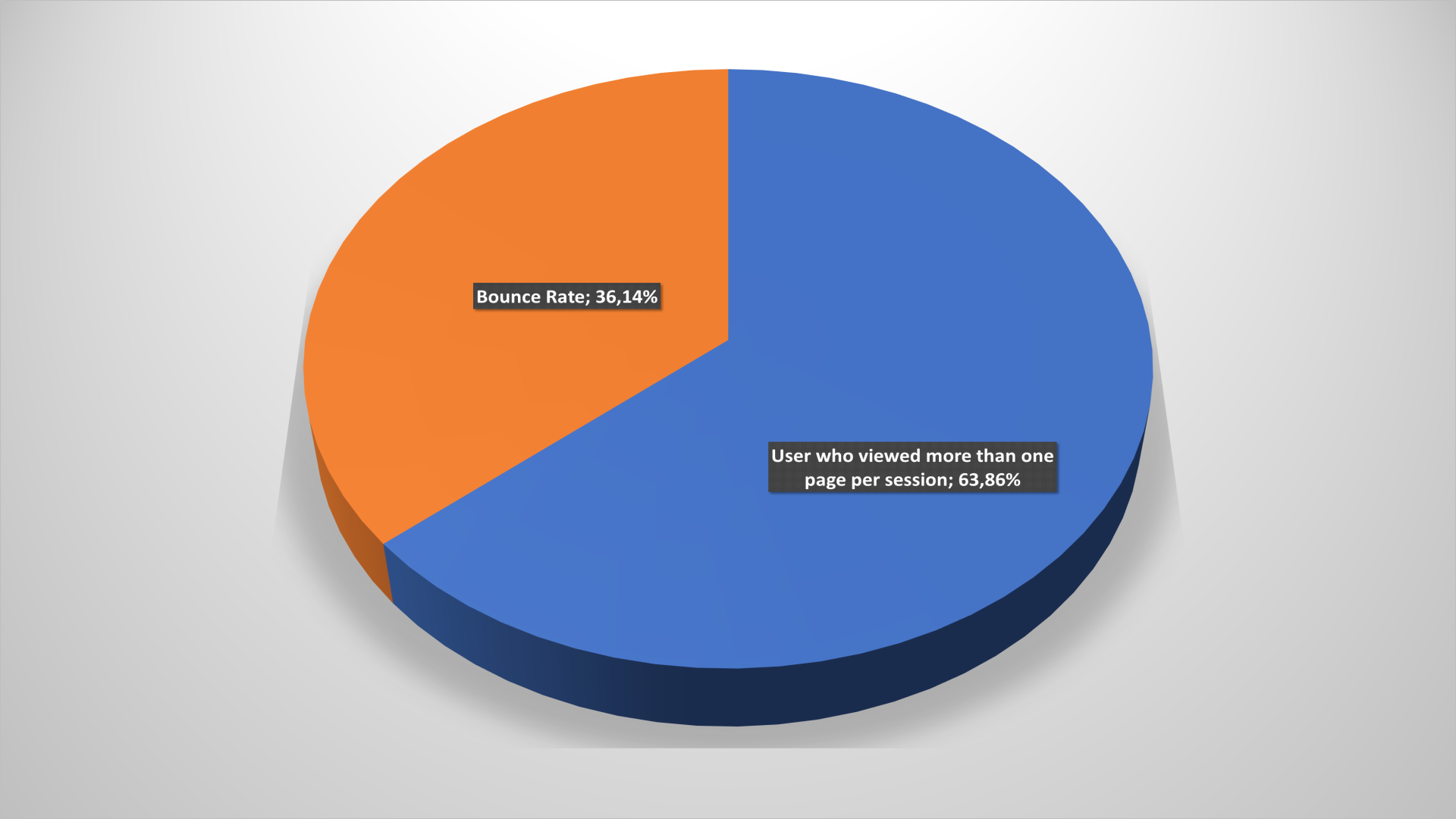

The Bounce rate number also remains stably low – within 35%, practically unchanged over the year. High loyalty, excellent viewing depth, a small proportion of users immediately leaving the site: good prerequisites for high conversion for online-retailers of clothes and shoes.

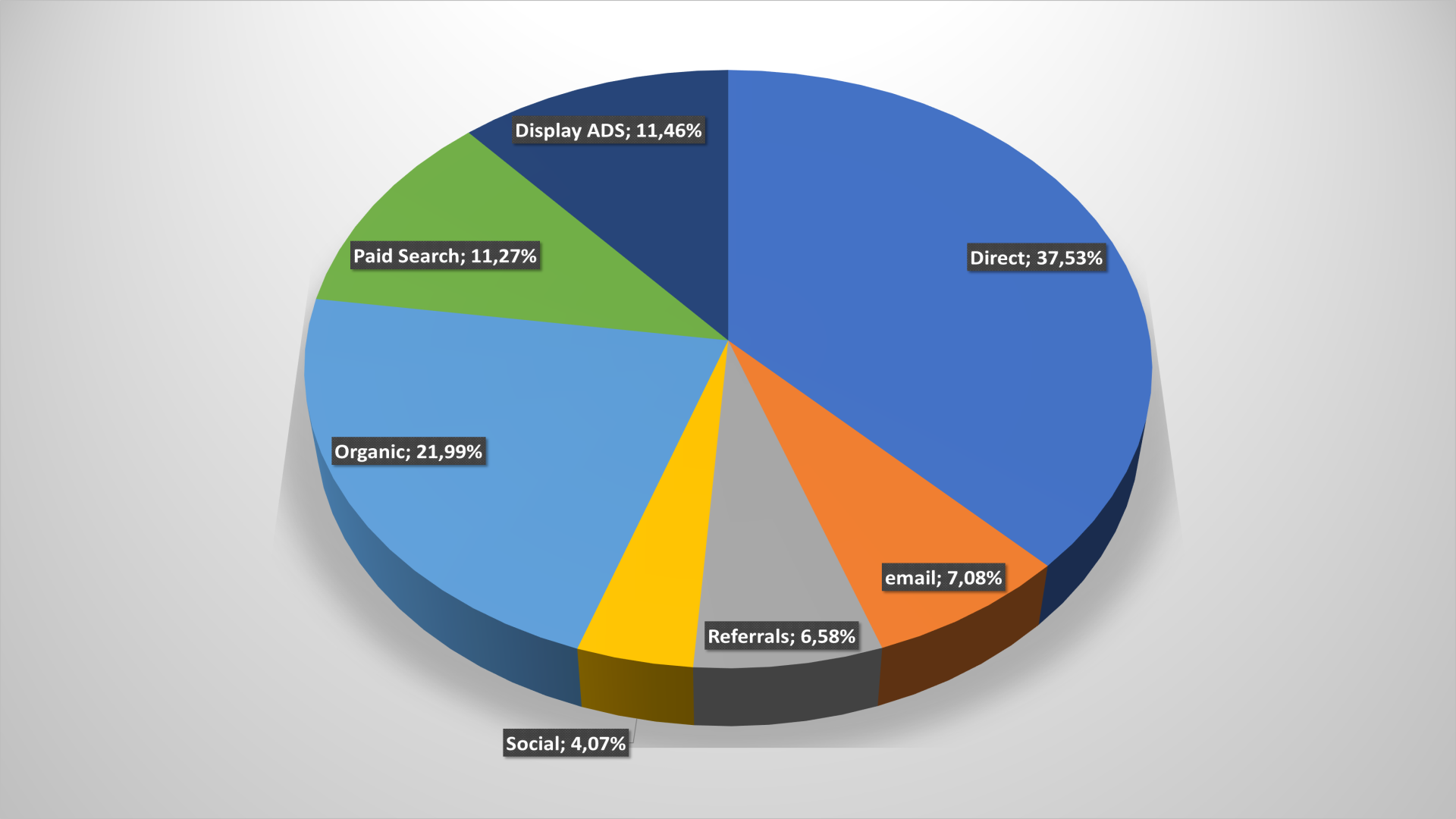

It is true, fashion-operators working on the World Wide Web have to make a lot of efforts to achieve such indicators. The visits’ share from search engines is noticeably lower than in the market as a whole, but conversions from e-mail newsletters, paid advertising, applications – on the contrary, are higher. That is, marketers of fashion-companies have to be creative to attract users.

Facebook has become the main traffic channel from social chains over the year, ahead of YouTube as in most other cases. In 2017, the situation was similar, but last year the video-content abundance played its own role, and the service from Google was able to break out in first place. However, it was not for long.

Surprisingly, VKontakte and Odnoklassniki formally banned in the country provide to fashion-stores in total almost 25% social media referrals. Something is wrong here.

Visits to sites of online clothing stores from mobile devices are becoming more and more. And this trend has been going on for several years.

High percentage of buyers and customers from 45 to 64 years old attracts attention in the age context – almost half of all visitors to online-fashion stores. Young people under the age 35 seem to prefer other shopping channels – it is for retailers on the note.

Sports & Outdoor

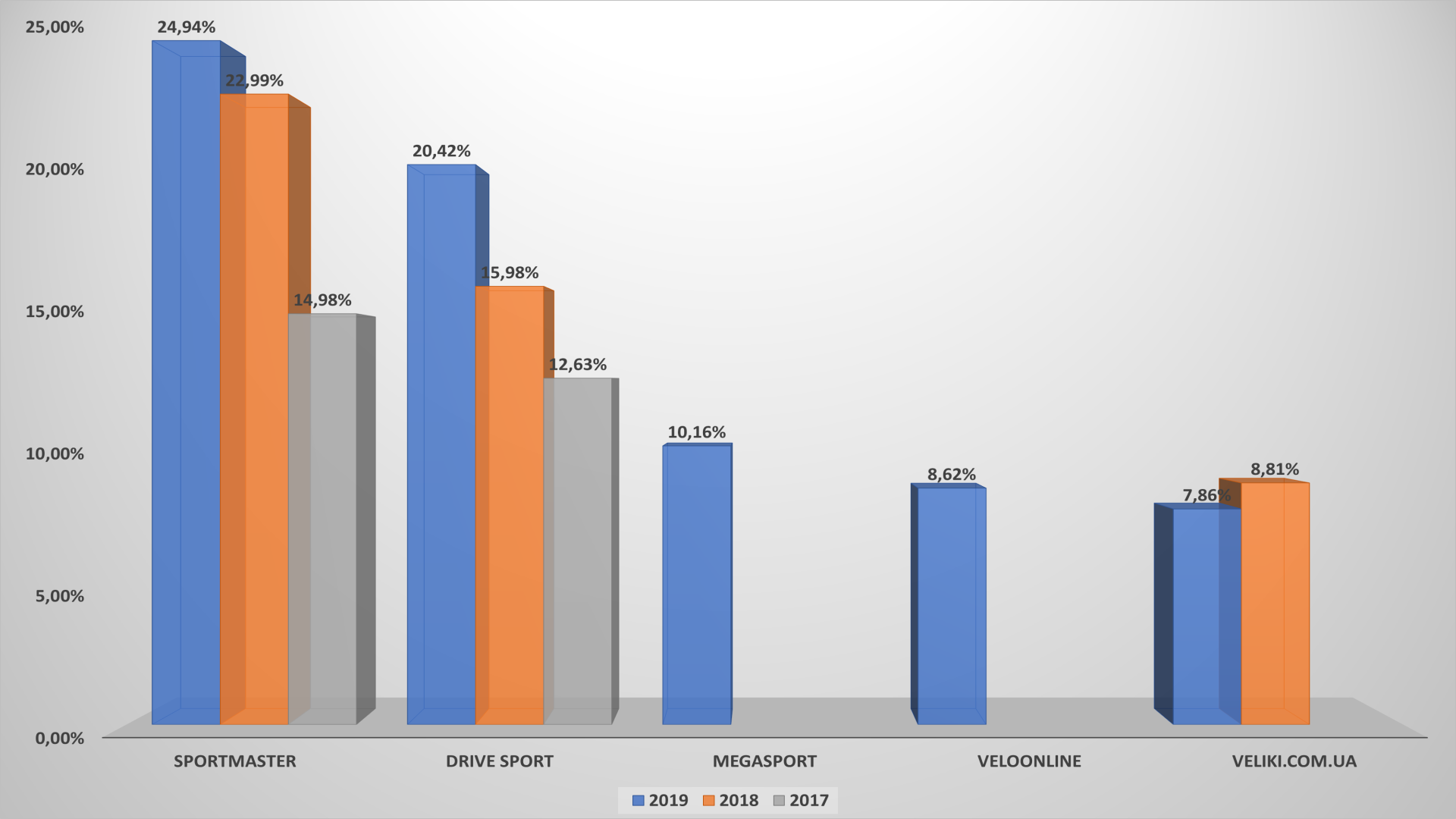

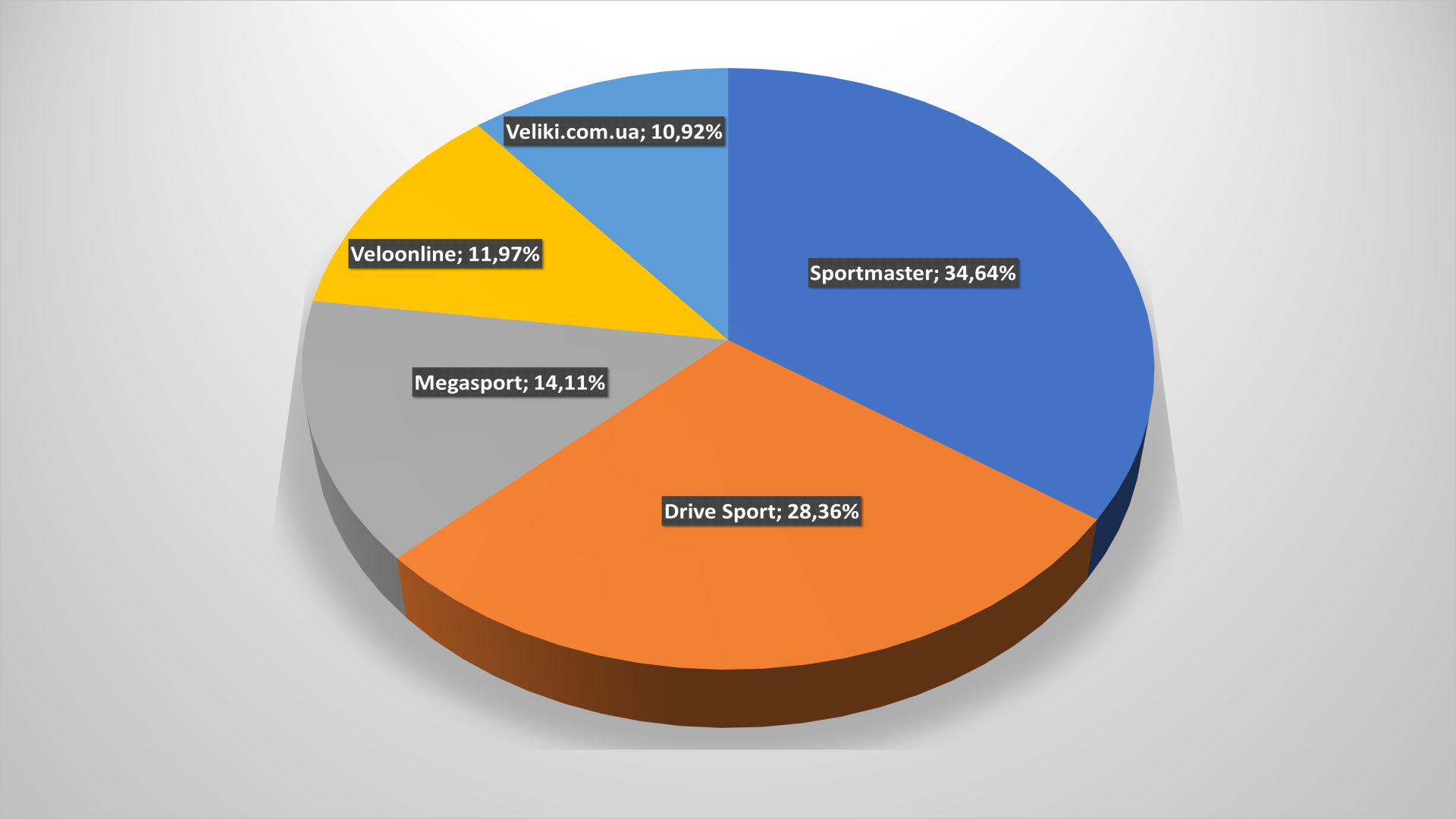

The first thing you would pay attention to in this category is the new player’ appearance. Veliki.com.ua entry the top-5 most popular sites for goods for sports, tourism and outdoor activities instead of Veloplanet’s online-store. But at the same time, leaders noticeably increased the gap compared to last year. And it is possible that in the near future in this category it can be observed a situation similar to online-gadget stores, where Citrus.ua reigns supreme.

However, if we consider the audience’ coverage not by the segment as a whole, but only among the top-5, then everything does not look so pessimistic: shares were divided fairly evenly. Sportsmaster is leading, but its gap is not as catastrophic as in some other Ukrainian e-commerce segments.

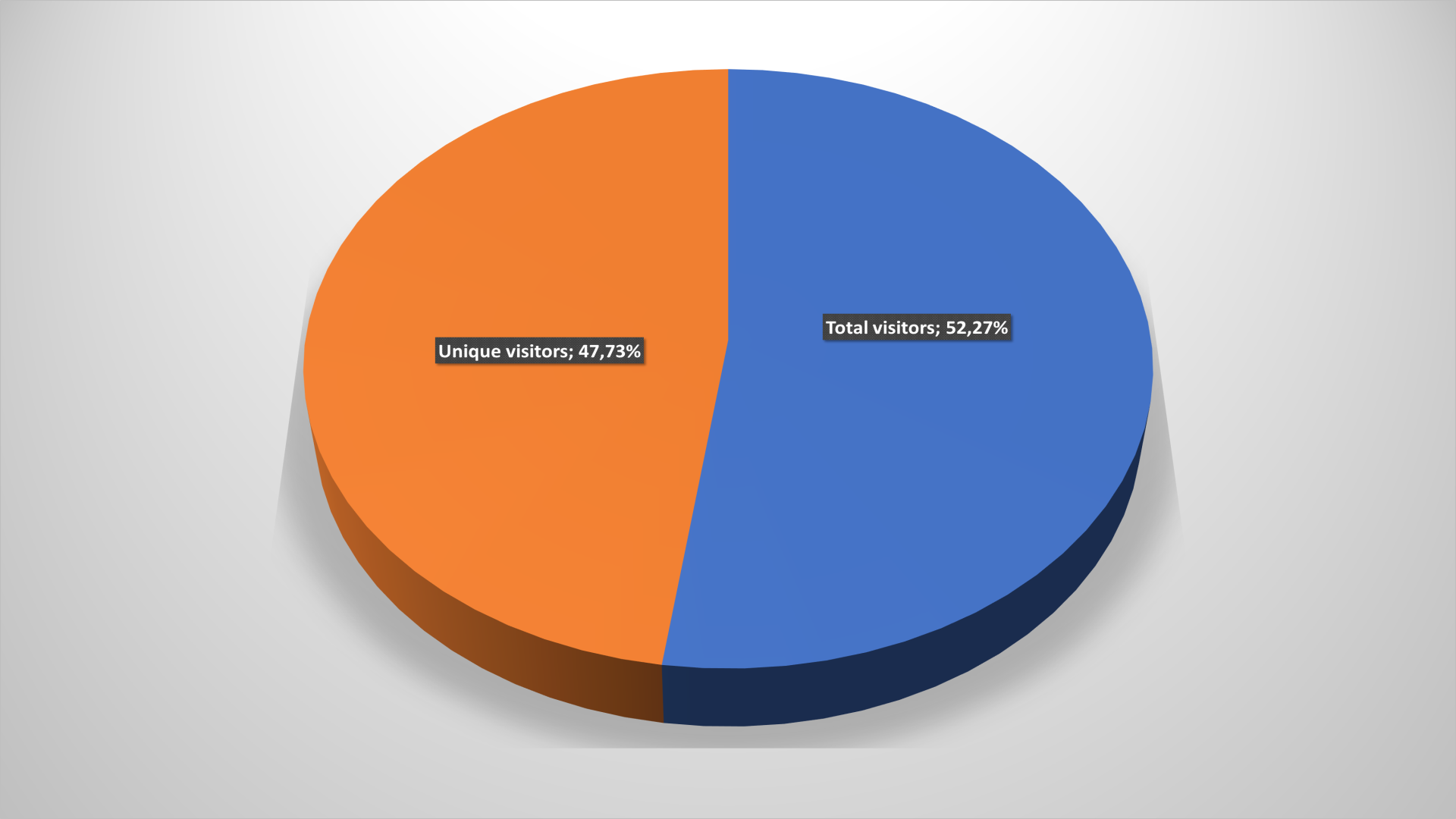

The situation with unique/repeated visits is no different from the average in Ukraine: there is a little more than a loyal audience, but there are enough repeat visits.

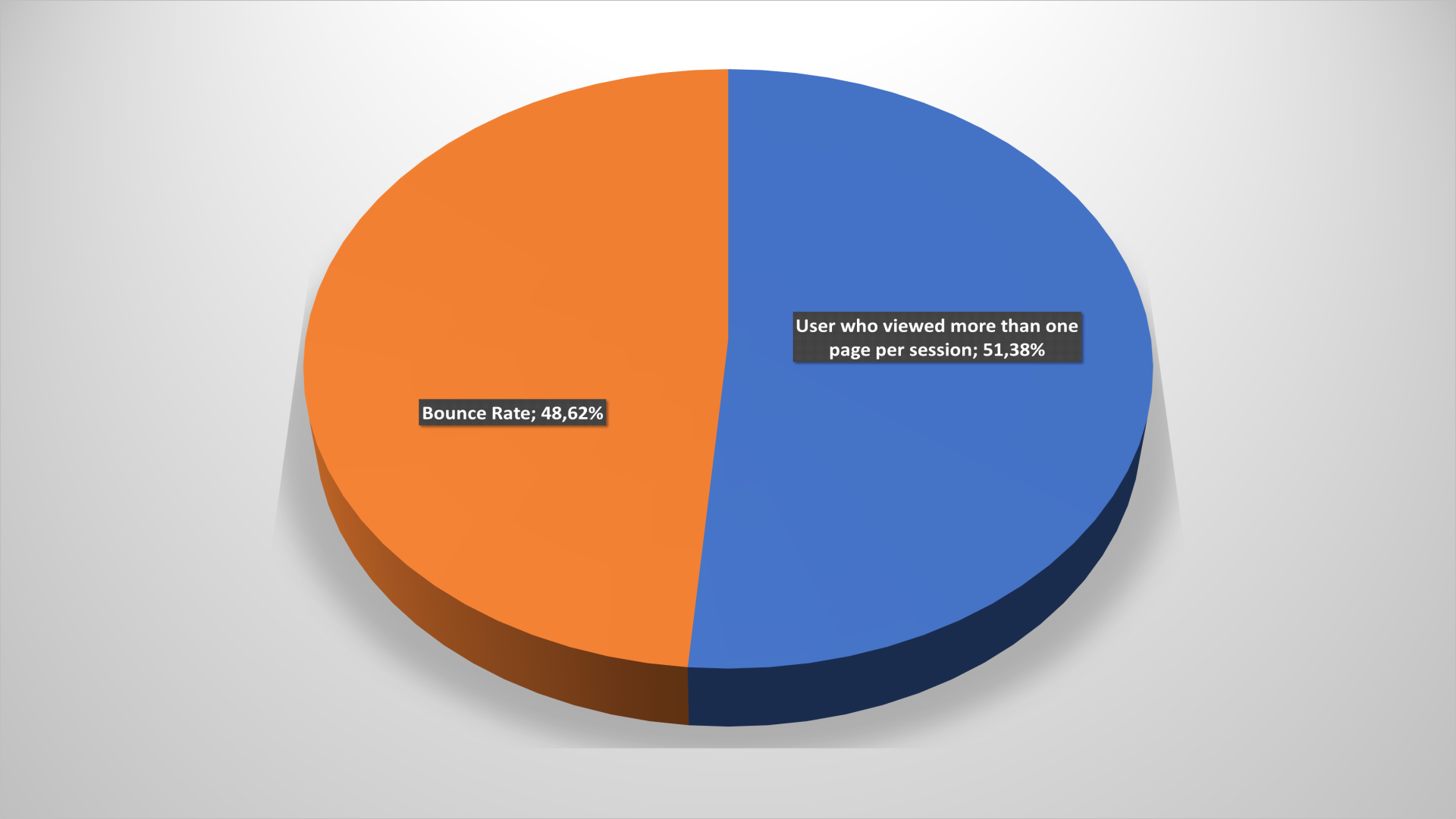

The Bounce rate number is slightly higher than in a number of other categories, but, again, nothing critical: all the same, more than half of users continue their journey through the online-store, which means – they make a purchase with some probability.

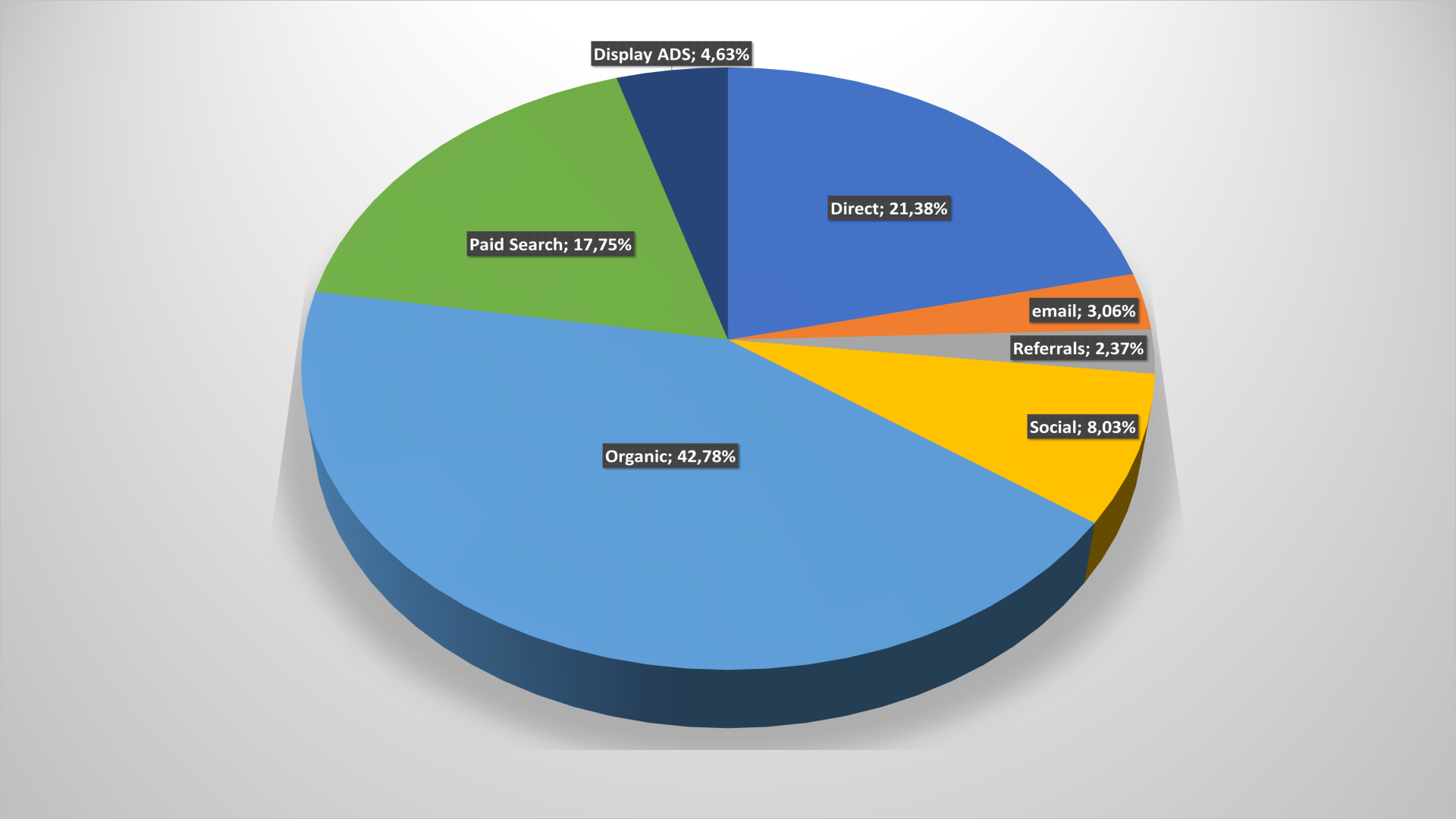

Almost half of visits to sellers of goods for sports and tourism are brought by organic search. That is, users in most cases do not yet know exactly where they will buy the selected product, and are ready to consider all possible options. It is would be also noted a fairly high share of visits from paid advertising, and from social chains.

What is striking: the transitions’ number from the Russian social chain VKontakte increased from 14 to 16.5% only in this category compared to last year. Either the blocking works are inefficiently, or customers of these online-stores will not part with the forbidden social chain. Otherwise, there’s nothing unusual: YouTube has somewhat squeezed Facebook, and other social chains generate clicks’ meager number.

Most users still visit online-stores of this category from mobile devices, but the “mobile” customers’ share has decreased from 66 to 52%.

It is worth also pay attention to customers’ age segment: 60% users are between ages from 25 to 45, and another 25% are up to 55. Most young and oldest people either don’t go in for sports, or they are paid for by their older or younger relatives.

Jewelry retail

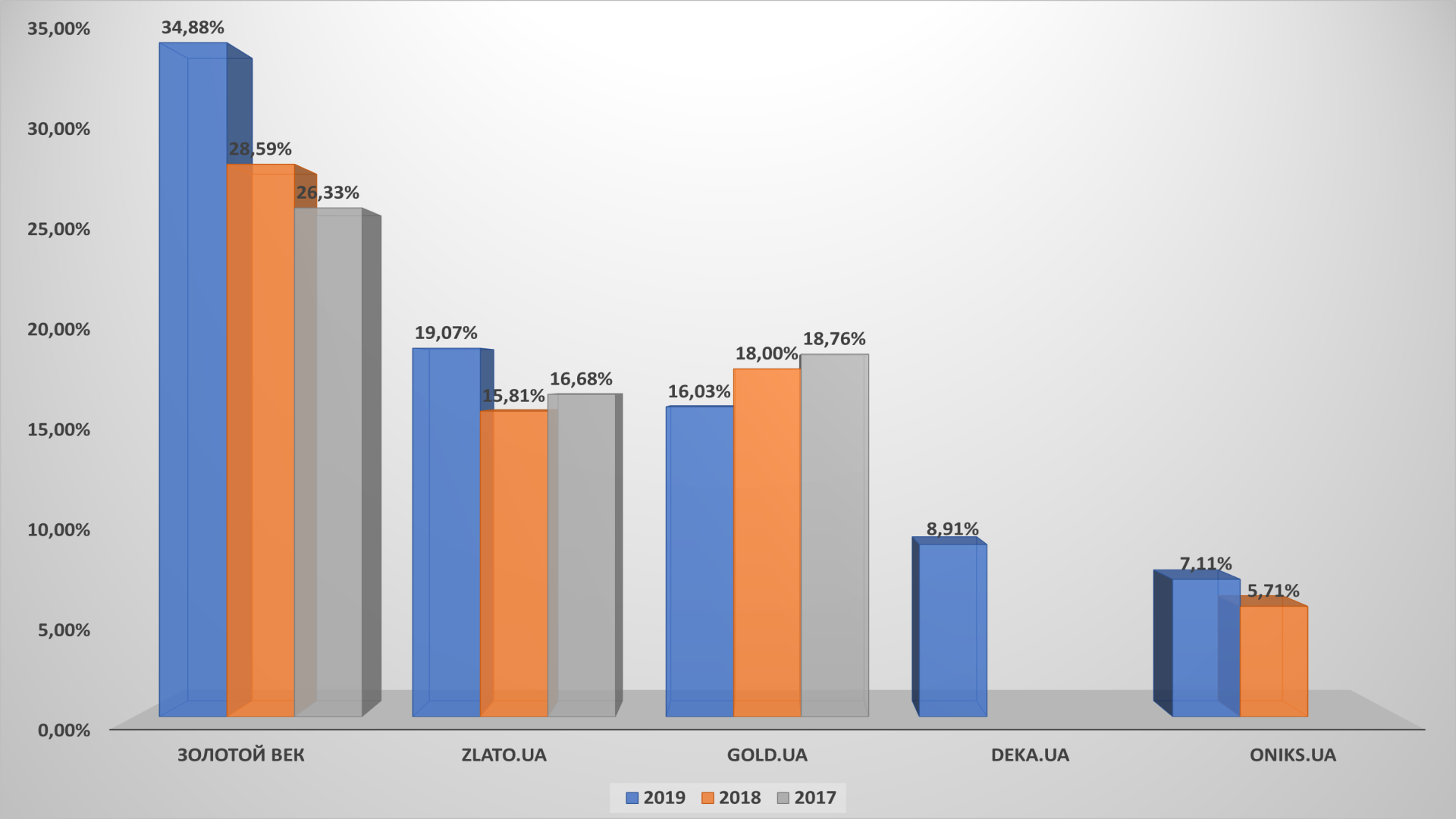

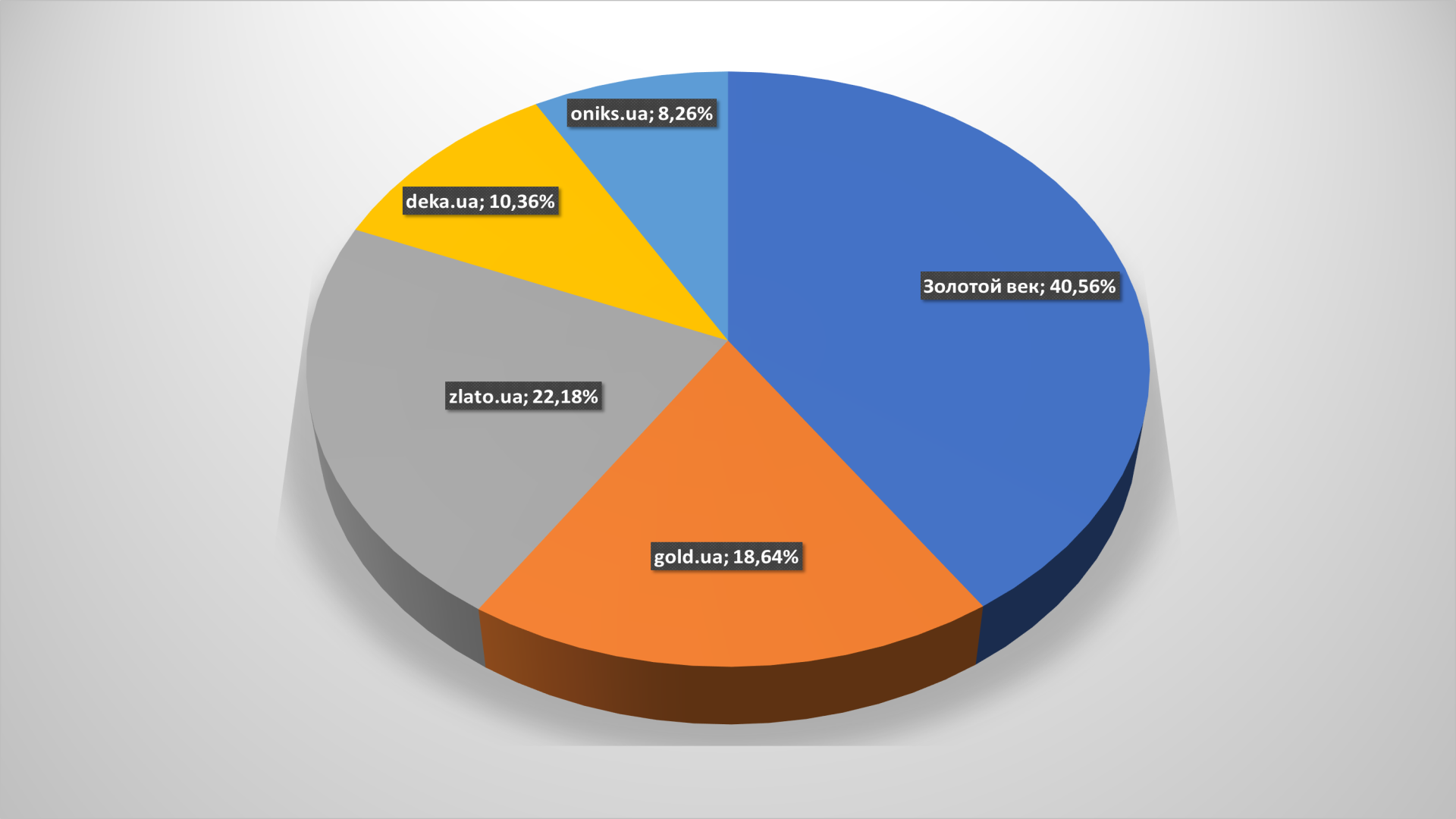

There is also reshuffles in this domestic e-commerce’ sub-segment: the top-5 left e-pandora.com.ua (which entries the top-5 only a year ago, but did not stay in it), which gave way to deka.ua. The leader – Zolotoy Vek – increased the lead as in many other sectors; good performances have zlato.ua, while gold.ua continued to lose its audience for the second year in a row.

The “Big Three” of jewelry online-retailers in Ukraine continues to confidently hold its positions, covering almost 82% audience among the first five online- jewelry and accessories stores.

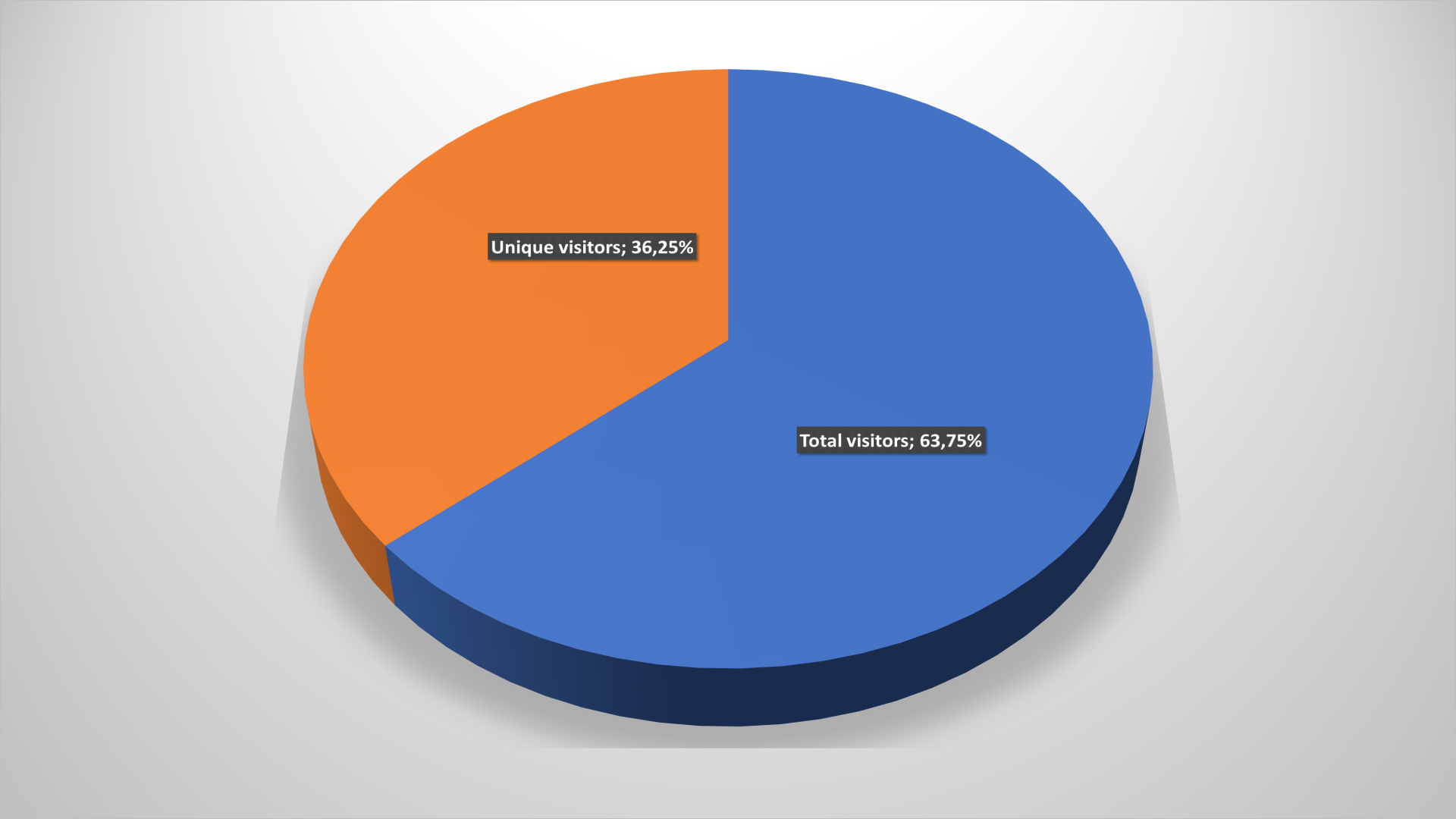

Moreover, two-thirds of users visit companies’ sites more than once a year. Over 12 months, the loyal audience has grown significantly (by 11%), and this trend has been going on for several years.

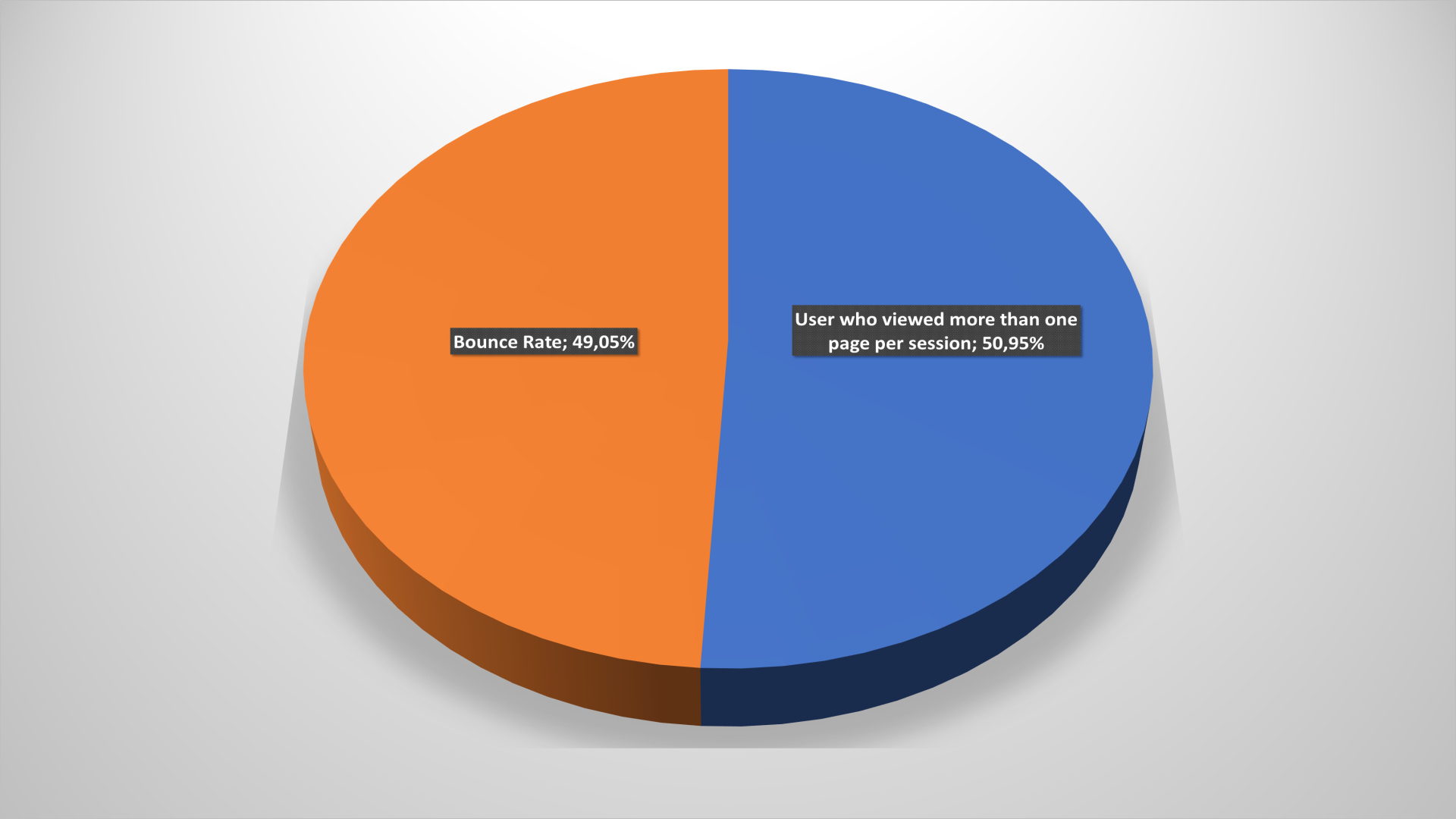

At the same time, the Bounce rate number increased. If only 31.29% users left jewelry retailers’ portals from the login page according to 2017 results, then in 2018 it was already 43.1%. In the 2019 this indicator amounted to almost half of potential buyers who came in – 49%. Either Ukrainians are used to watching models on the Internet, and buying offline, or they just went to admire jewelers’ creations.

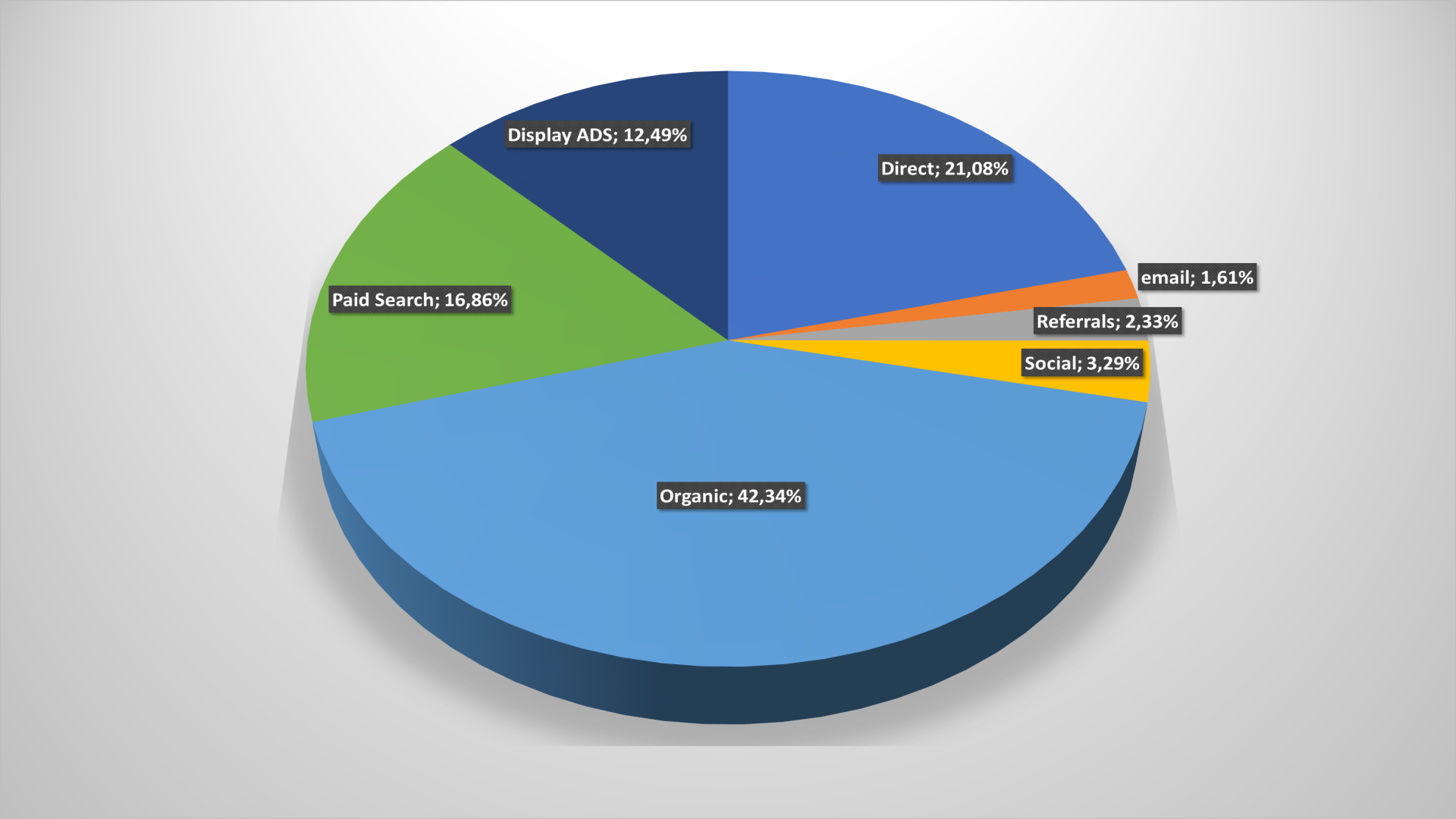

Clicks from search engines and from advertising in it are clearly distinguished among input channels. There are not so many direct calls. Most likely, users are looking for goods in Google and similar systems, and do not go directly to retailer sites. SEO and search engine optimization for jewelry market players would come first.

Although social chains provide less than 5% total traffic of online-jewelry and accessories stores, it doesn’t forget about it. Moreover, Facebook is extremely important for jewelry masters as in other categories. But YouTube has grown significantly, on the contrary, compared to last year. In 2018, it brought to stores 22.3% traffic from social chains, and in this – already 32%, higher than in 2017. This trend is different from the all-Ukrainian one.

The users’ share who visit jewelry online-stores from mobile devices has also increased sharply – from 68 to 76%. It is one of best indicators among Ukrainian e-commerce’ all segments.

The 25-44 years old’ age group is clearly distinguished among users who visit online- jewelry stores. This is who online-marketers and advertisers should rely on.

Goods for children

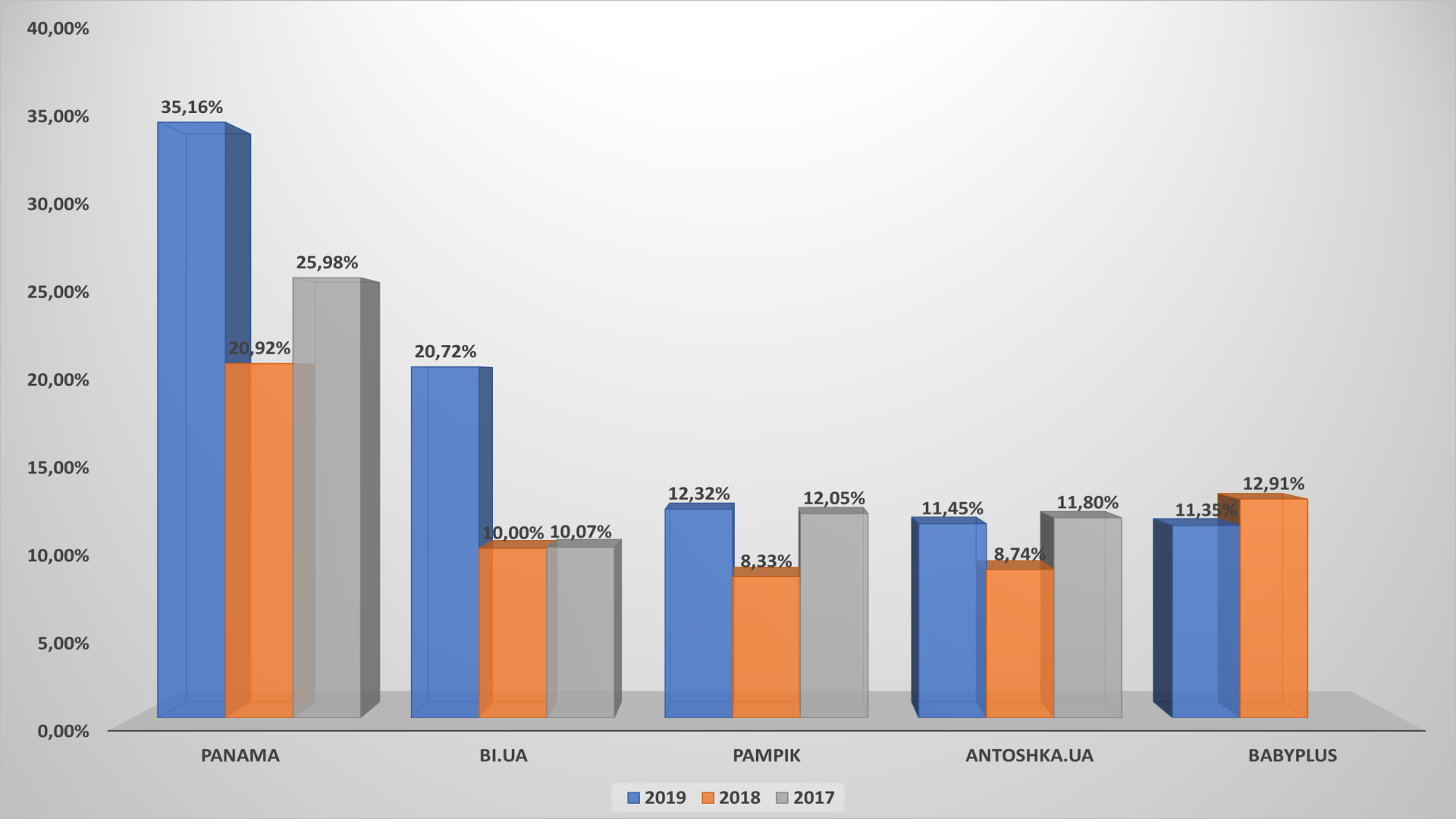

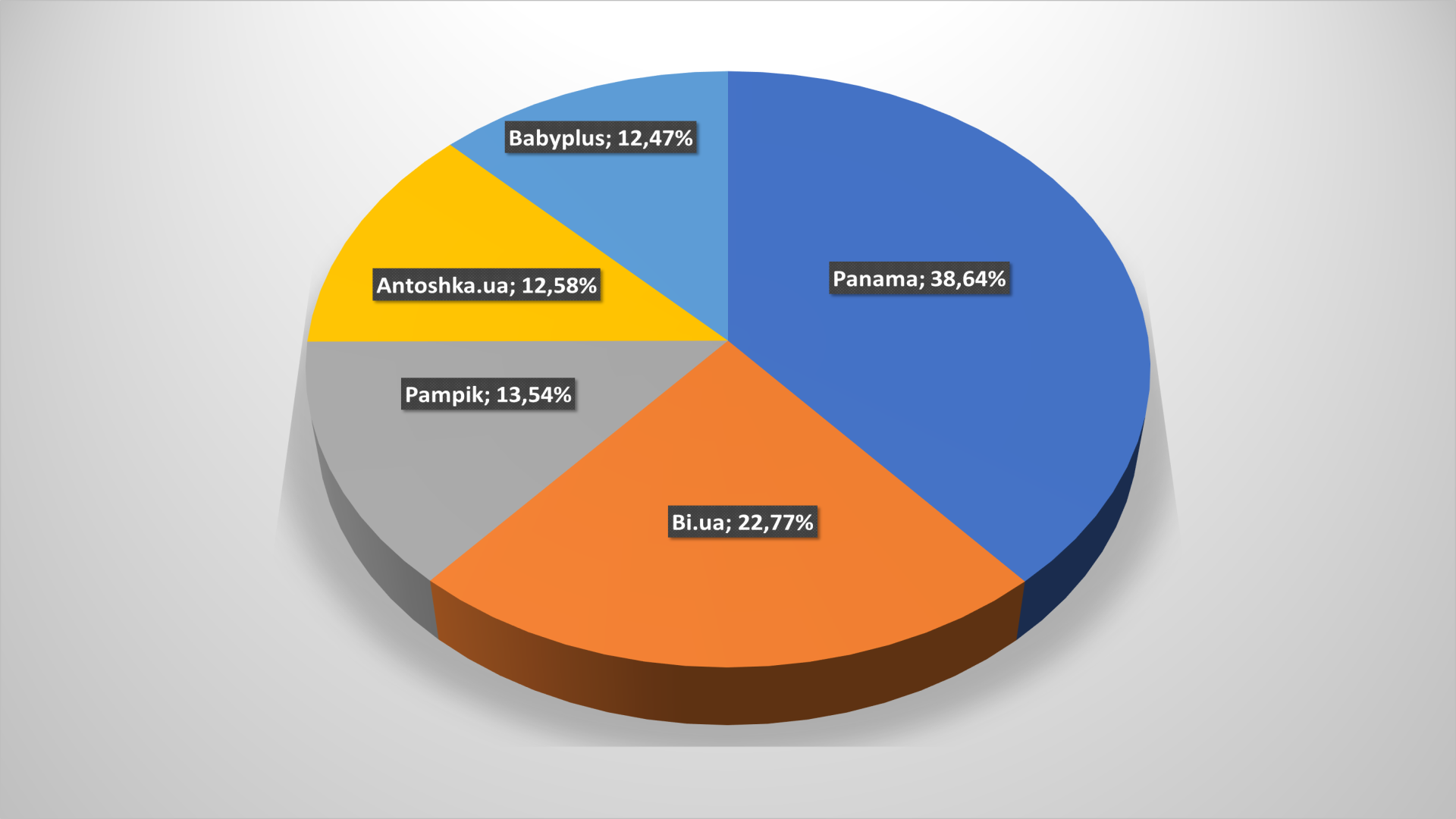

But there are no changes in the segment of goods for children’ online-retailers, unlike last year. Last year’s sensation is – babyplus.ua took the second place in this product category on the first attempt, rolled back to fifth. Market old-timers –Antoshka, Panama, Pampik, Budinok Іgrashok – returned lost positions.

On the other hand, Antoshka and Budinok Іgrashok are not classic online-stores, but omnichannel retailers, so the World Wide Web is only one of sales’ channels for it, and it is not the fact that the most important. And the fact that it is inferior in some respects to companies represented only online is not surprising.

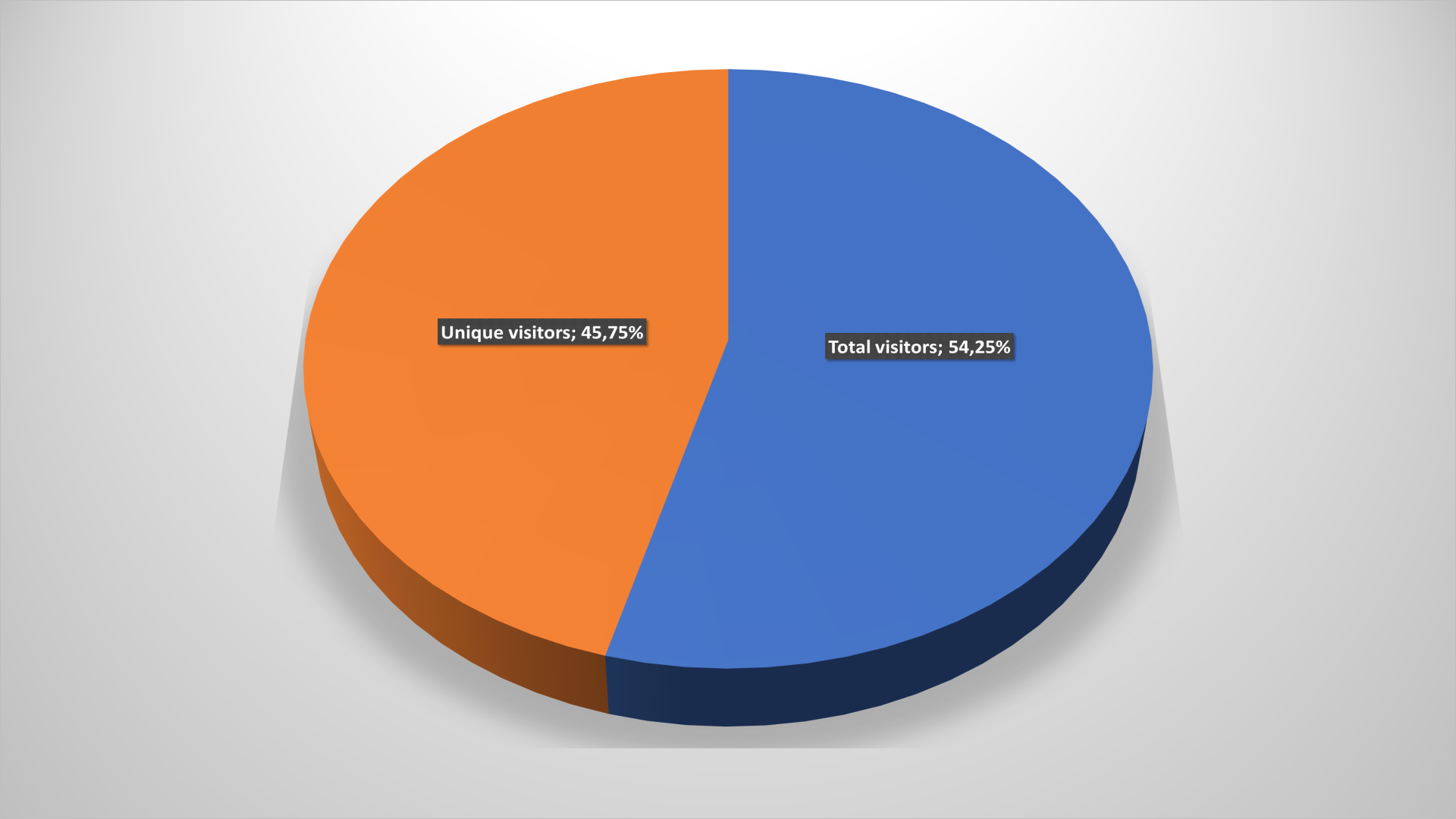

The repeat visits’ number, and, therefore, a loyal audience, on average meet general indicators for Ukraine, and have not changed much since last year.

On the other hand, the refusals’ number increased slightly, that is, visitors leaving the site without a purchase. But changes are not critical: about 50% bounce rate are the norm for Ukrainian e-commerce.

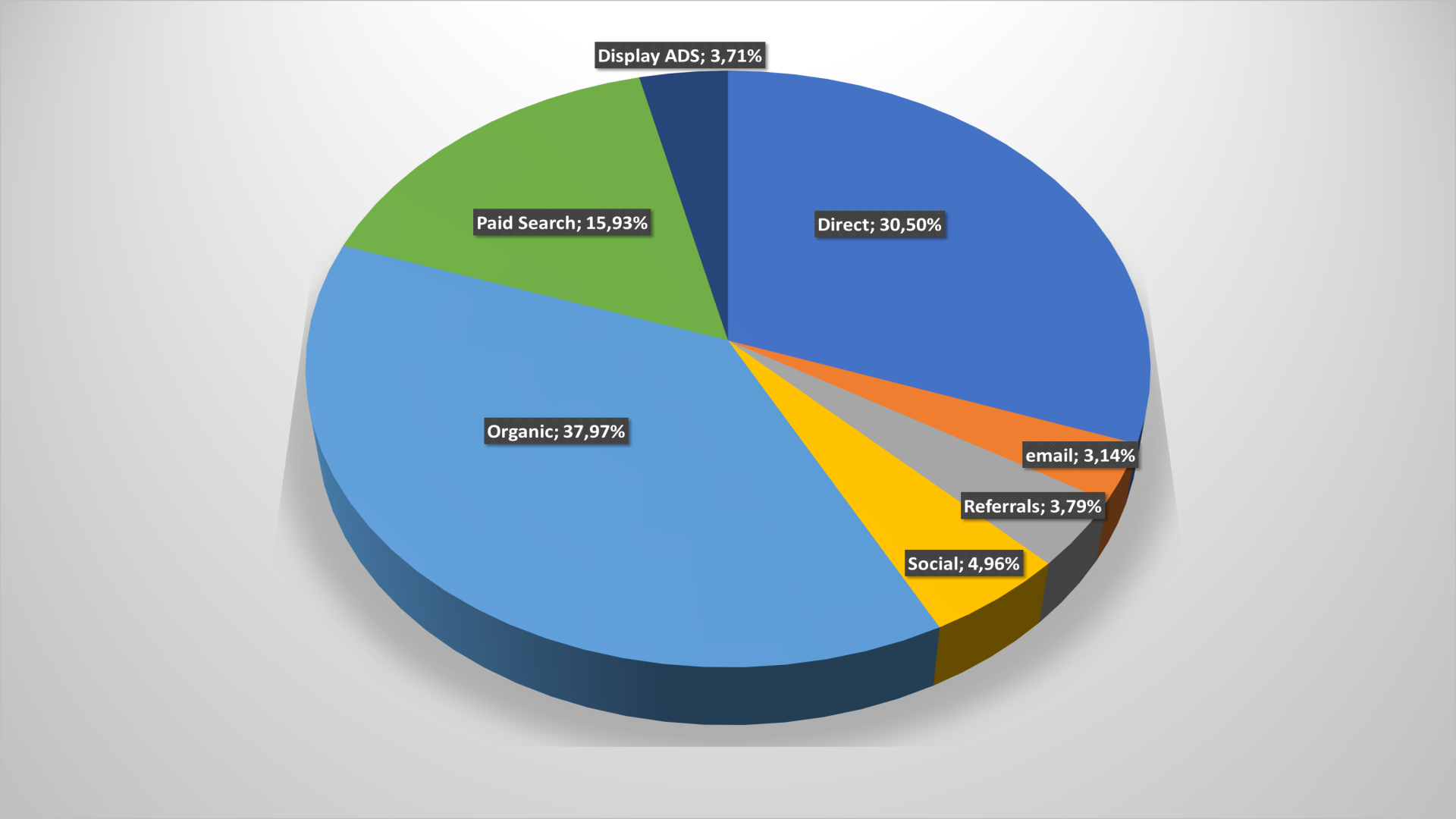

If we compare main channels of customer access to online children’s clothing stores with 2018, then the direct visits’ share has increased, and conversions from search engines have decreased. What is uncharacteristic: this segment’ retailers successfully generate traffic without investing in paid promotion in search engines. This is different from the average market trend.

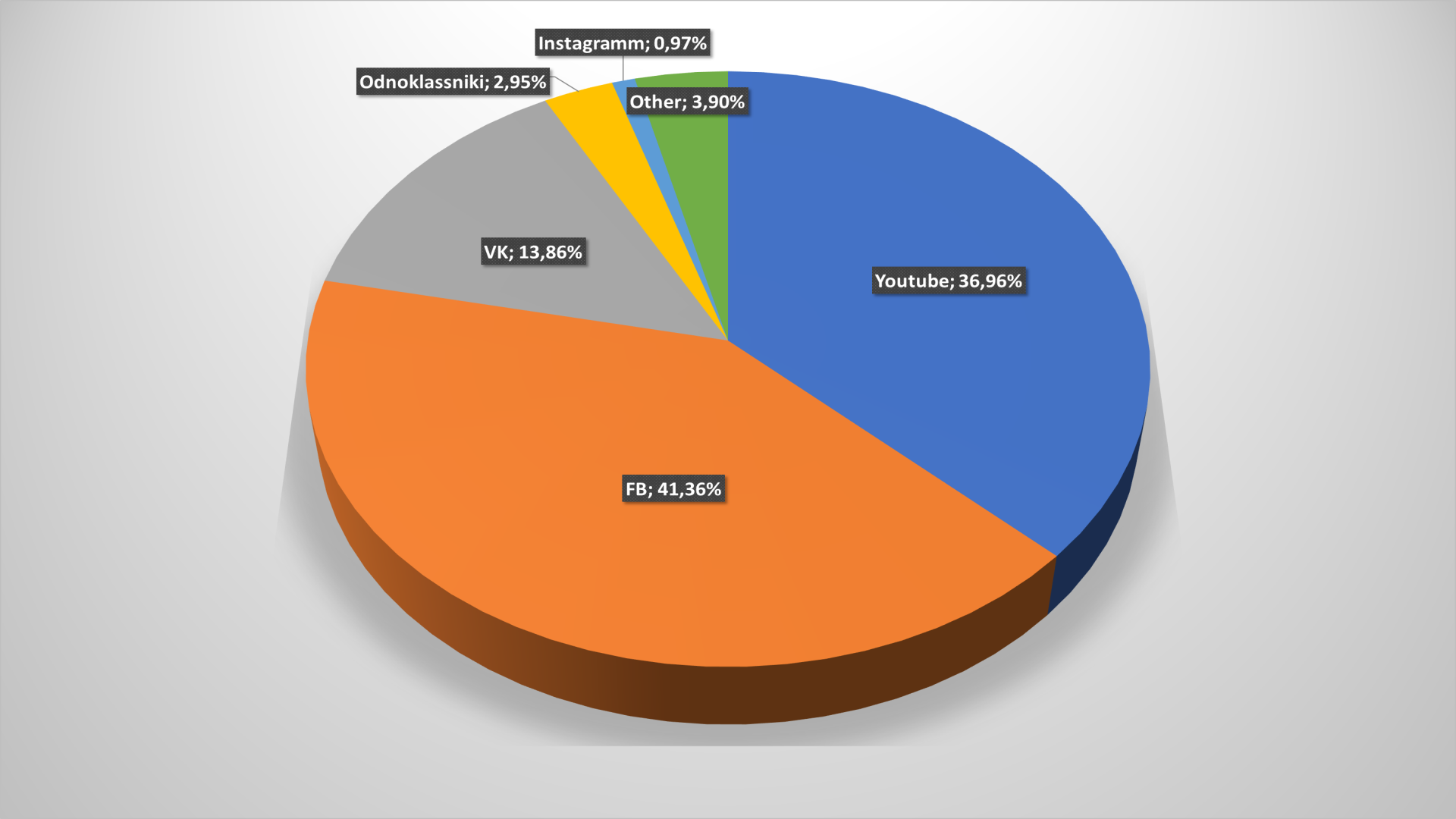

And Facebook managed to win back lost positions regarding YouTube per year in the products for children’ category. If in 2018, transitions from video-hosting provided almost 48% traffic from social chains, but now – only 37%. It is directly some kind of “roller coaster”, where among designers are Zuckerberg, Page and Brin.

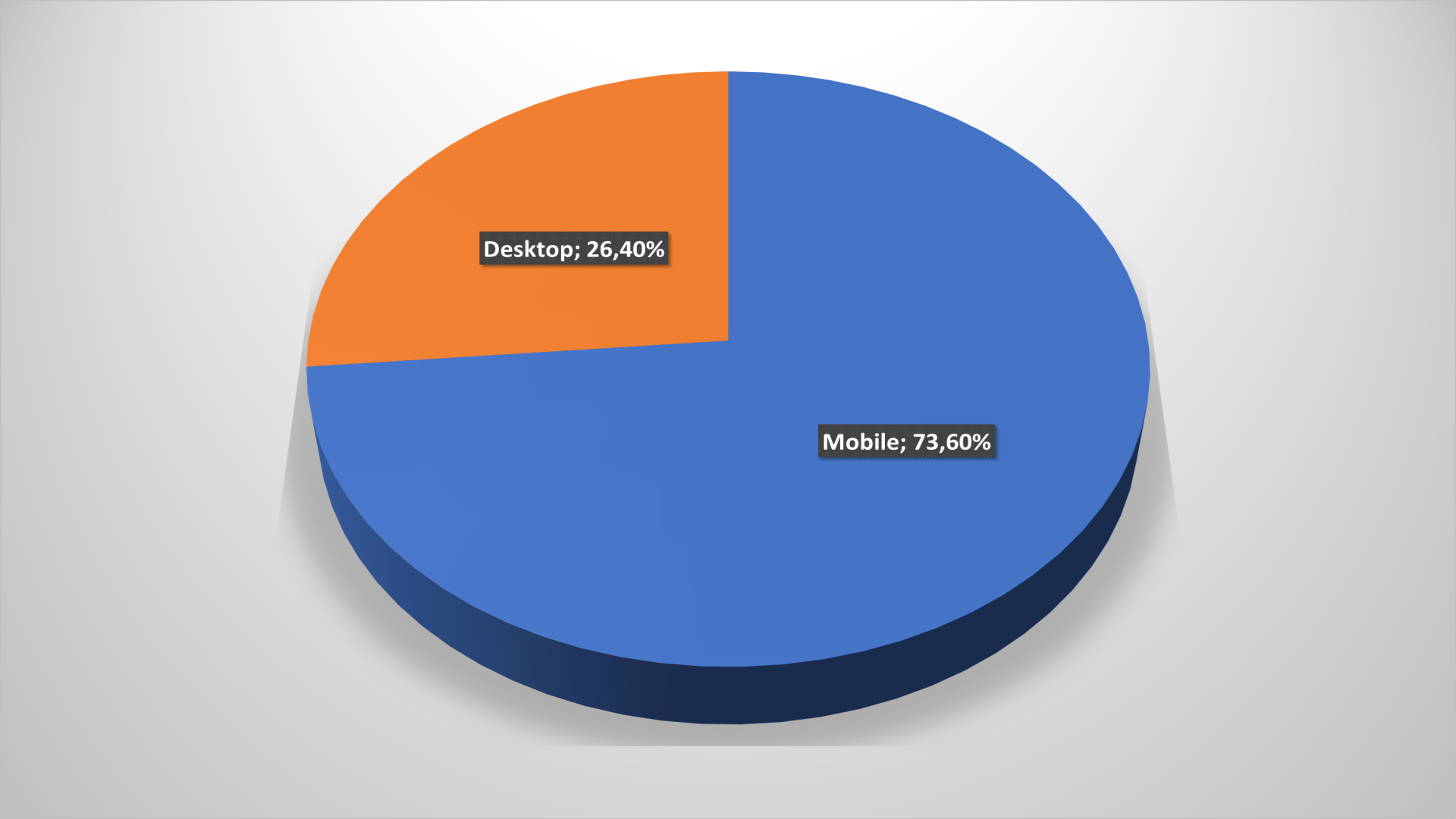

The mobile device users’ share has harshly increased compared to 2018 from 60% to 73.6%; m-commerce and 4G are coming.

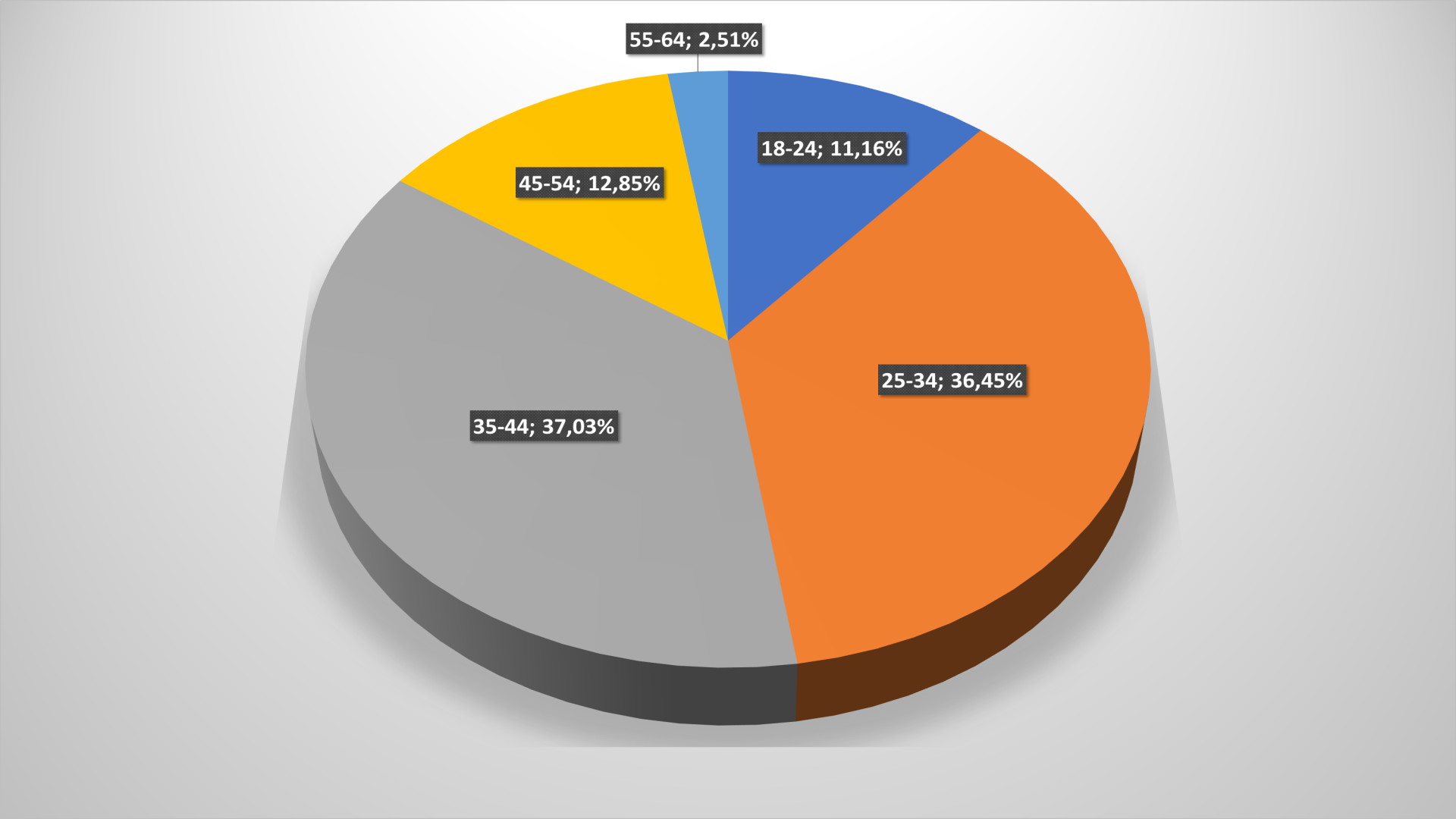

This is not surprising, taking into account the main buyers’ age in this goods’ category: 86% – from 18 to 45 years old! The remaining 15% are probably grandparents buying goods for their grandchildren’s.

Cosmetics and drogerie

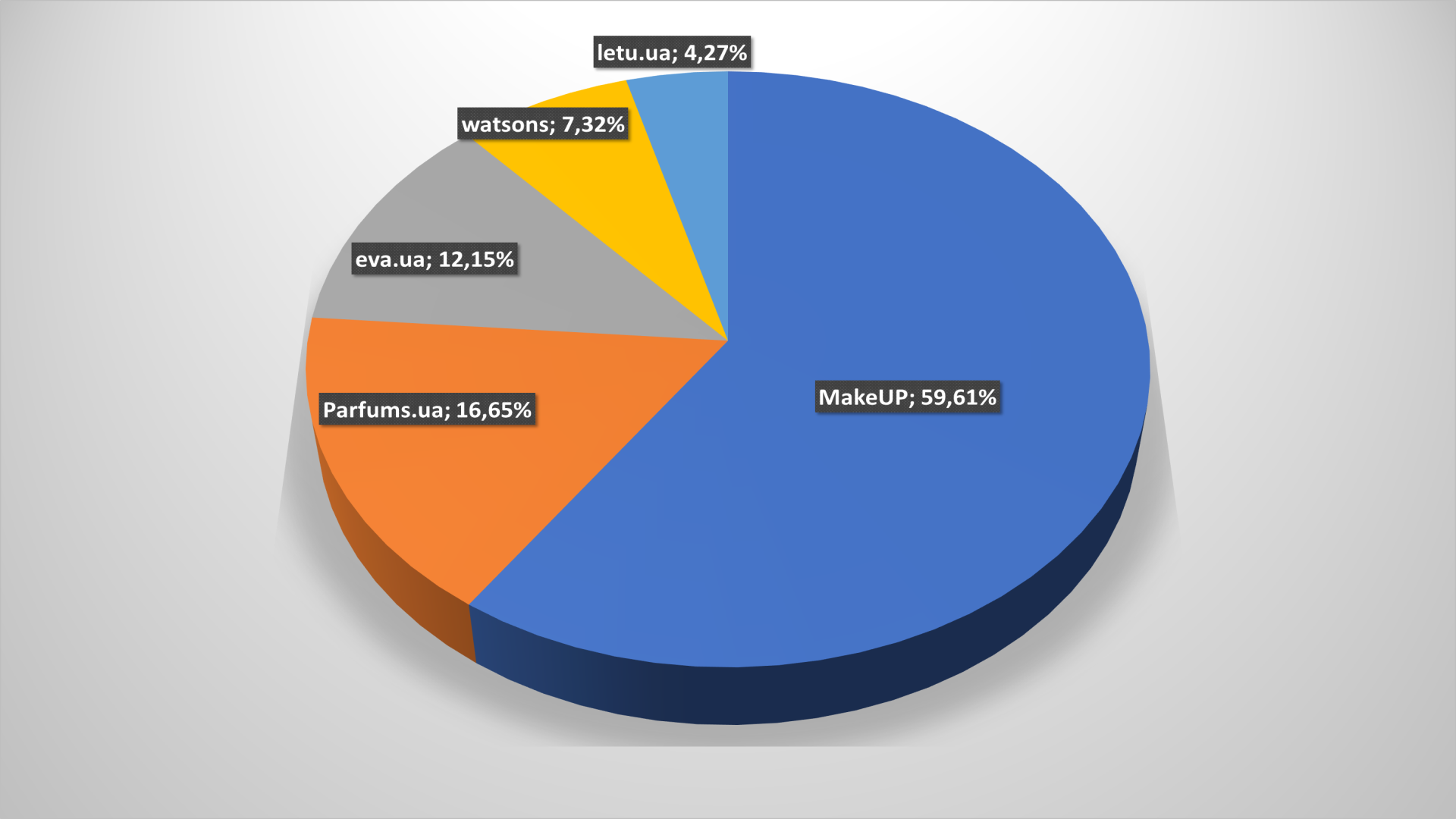

It is some changes in this segment. The largest offline-store chain for beauty and health EVA has strengthened in the top-5, while Yves Rocher Ukraine has dropped out of the leaders’ list. Its place was taken by letu.ua., which returned to the “Big Five”. It is disappointing, but the fact is that the Ukrainian representation of the French brand must to pay more attention to online-promotion.

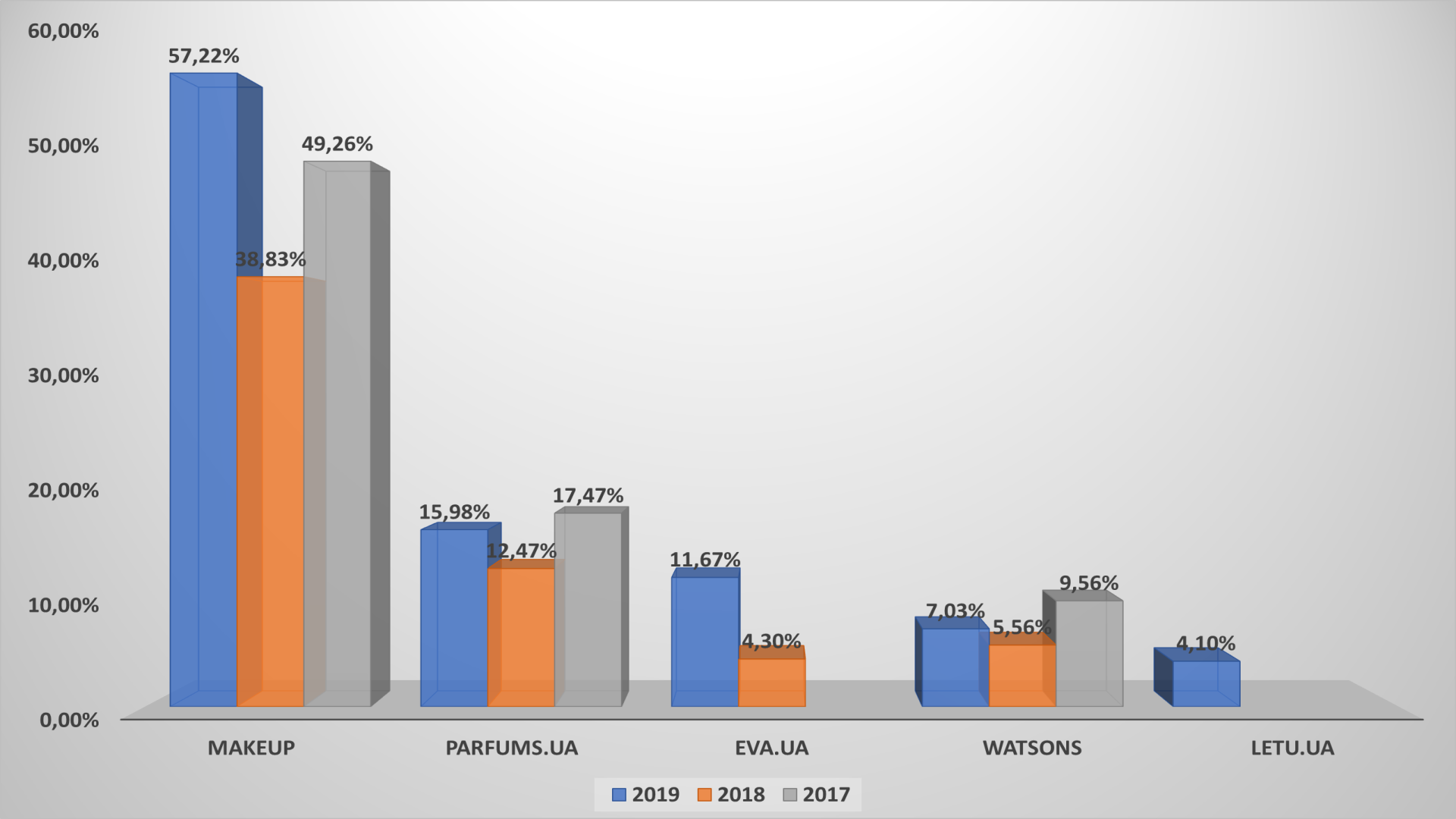

It can take the example of makeup.ua, which, after last year’s recession, turned out to be short-lived, was able to regain unconditional leadership in the segment.

makeup.ua alone covers 60% audience from the “Big Five”, so it will be problematic for others to get close to it. However, in general, the position and scope of beauty products’ retailers has not changed.

The buyers’ loyalty of drogerie online-stores can be envied by many – 63% repeat visits, which is significantly higher than the market average. Stability is the Sign of Class in this case.

The Bounce rate number is relatively low – 46%. Cosmetics and hygiene sellers still have no cause for concern.

Main input channels are traditional: the organic search and direct visits. In total, it amount 61% traffic.

Facebook contributes the lion’s share of social media conversions to online- retailers in the drogerie segment. This is the most effective tool to attract consumers to the site in its occasion.

There are more mobile device users compared to 2017: 70% versus 57%. Curious, if the trend will continue?

The age palette of online cosmetics and health products’ buyers is quite diverse. All consumers practically buy various products’ categories by online in one case or another, except age 65+.

Read more –

The Ukrainian e-commerce under a microscope: a comparative analysis of country online-stores

Read also

Respublika Park Leads Kyiv Shopping Malls in Tax Payments