Mobile-First Award 2025: Public voting for the best mobile apps in Ukraine is now open

21.09.2023 09:00

21.09.2023 09:00According to the monthly study, which has been regularly conducted among the members of the Retail Association of Ukraine since March 21, 2022, by means of an online poll of almost a hundred owners and CEOs of enterprises throughout Ukraine, three of the eight trade sectors have already exceeded the pre-war indicators in terms of the number of operating outlets.

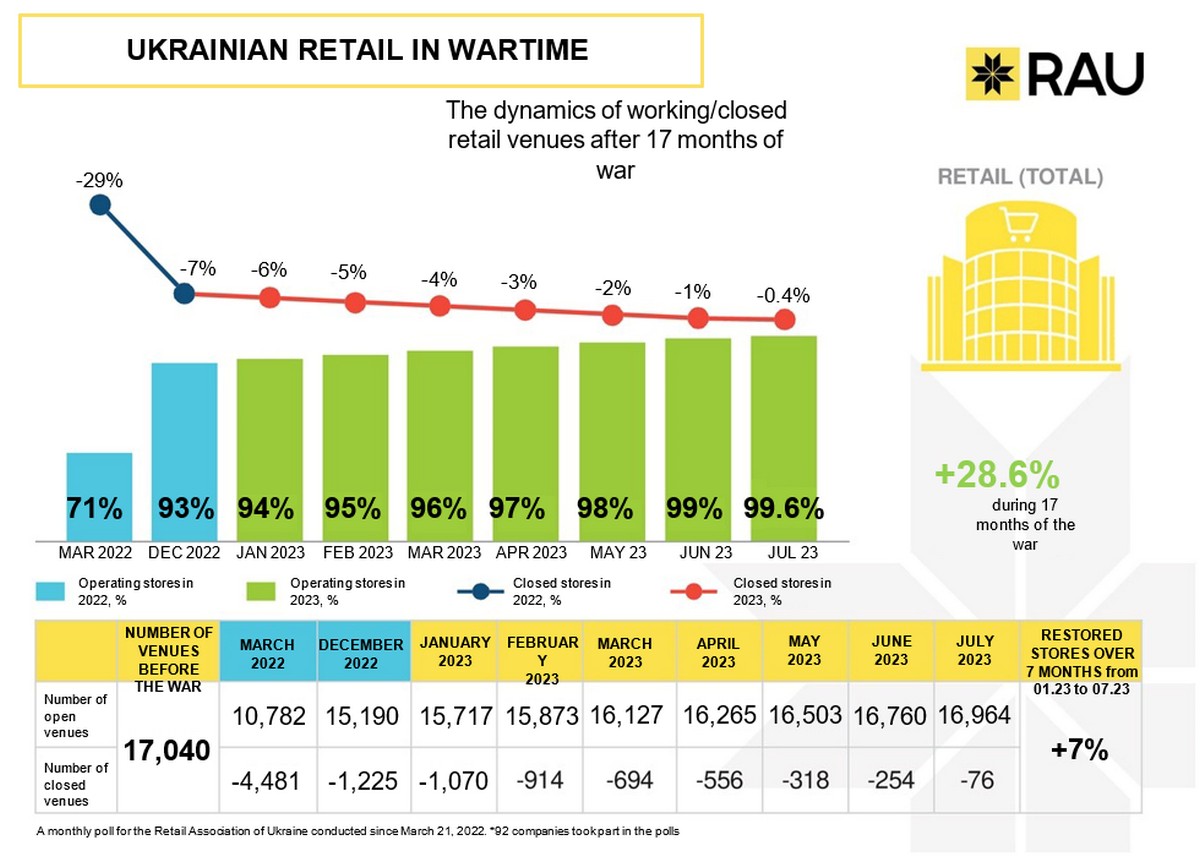

The results of the next monthly poll on Ukrainian retail status over the 17 months of war were presented during the country’s largest retail meeting, RAU EXPO – 2023. We remind that this poll covered only the RAU members, so the figures below may only reveal the general trends and surely not the losses of the entire Ukrainian retail. Thus, currently only 0.4% of retail facilities/stores remain closed. Over the 17 months of war, that indicator declined by 28.6 %.

According to the latest poll, 16,964 out of 17,040 retail outlets across the industry are now operating. While last March, almost a third of trade places were closed (29 %), currently, only 76 trade venues out of 4,481 are closed. Working under tremendous stress, the retailers went the extra mile to keep the critical commodity infrastructure operating for the public. During the first seven months of this year, 994 new stores were opened, adding 7% to last year’s indicators. Most stores were opened in June (+257), May (+238) and March (+254), while about a hundred and a half outlets were reopened in the remaining months. The process was different in each industry, but the restoration is underway in all sectors. And this is a steady trend.

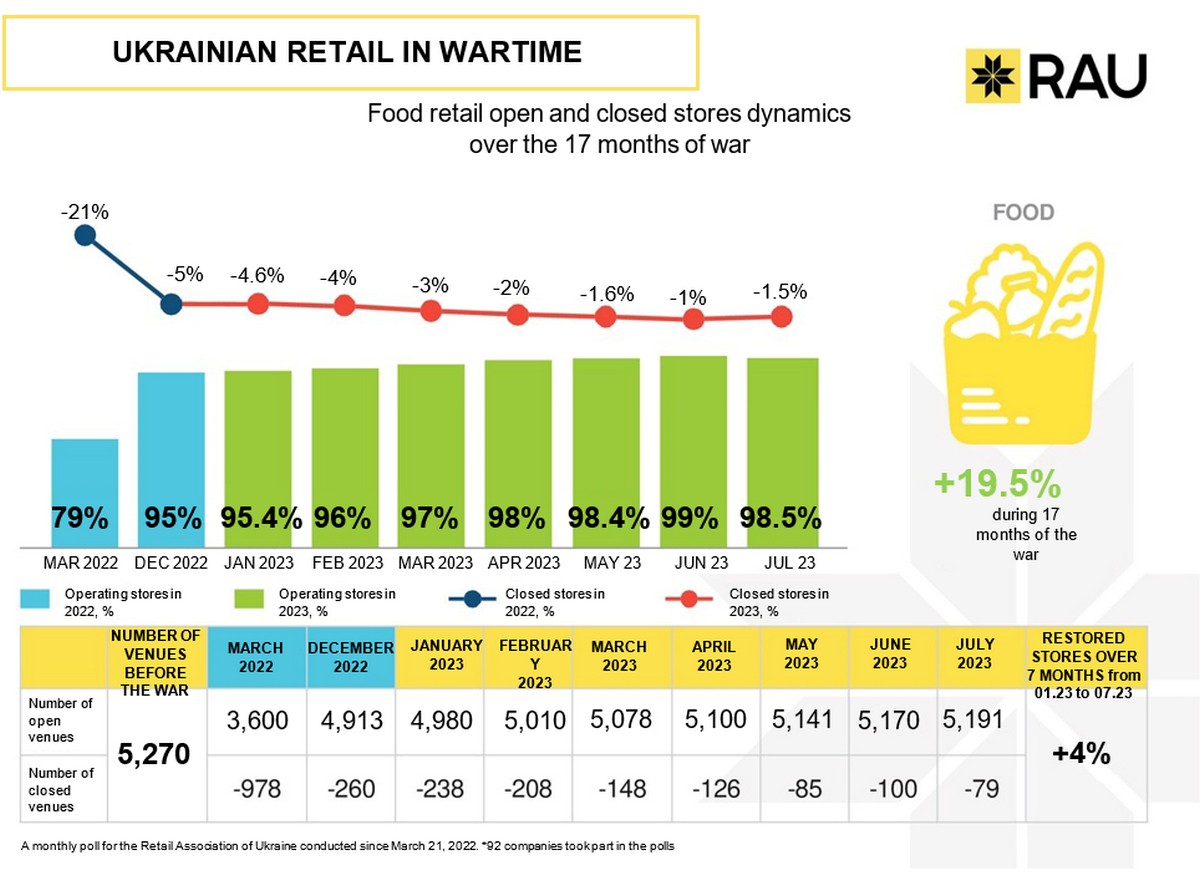

Before the war, grocery chains had 5,270 outlets, and after a month of hostilities, 21% of stores were no longer operational. As of the end of 2022, 95% of the pre-war number of stores, or 4,913 outlets, reopened. In the first seven months of this year, food chains managed to open an additional 4% of stores, reaching 5,191 operating markets. Accordingly, the number of closed outlets decreased to 79. That is 1.5% of the pre-war number. Since January this year, the share of closed minimarkets, supermarkets and hypermarkets has continued to decline steadily/ The number of outlets closed by about 20-30 per month, and the record-breaking month of March saw 60 stores reopen at once. Overall, the share of non-operating stores has dropped by 19.5% over the 17 months of the war, compared to the number of 3,600 operating markets in March 2022. Currently, food retail has recovered by 98.5%, even though losses are still being incurred due to constant shelling.

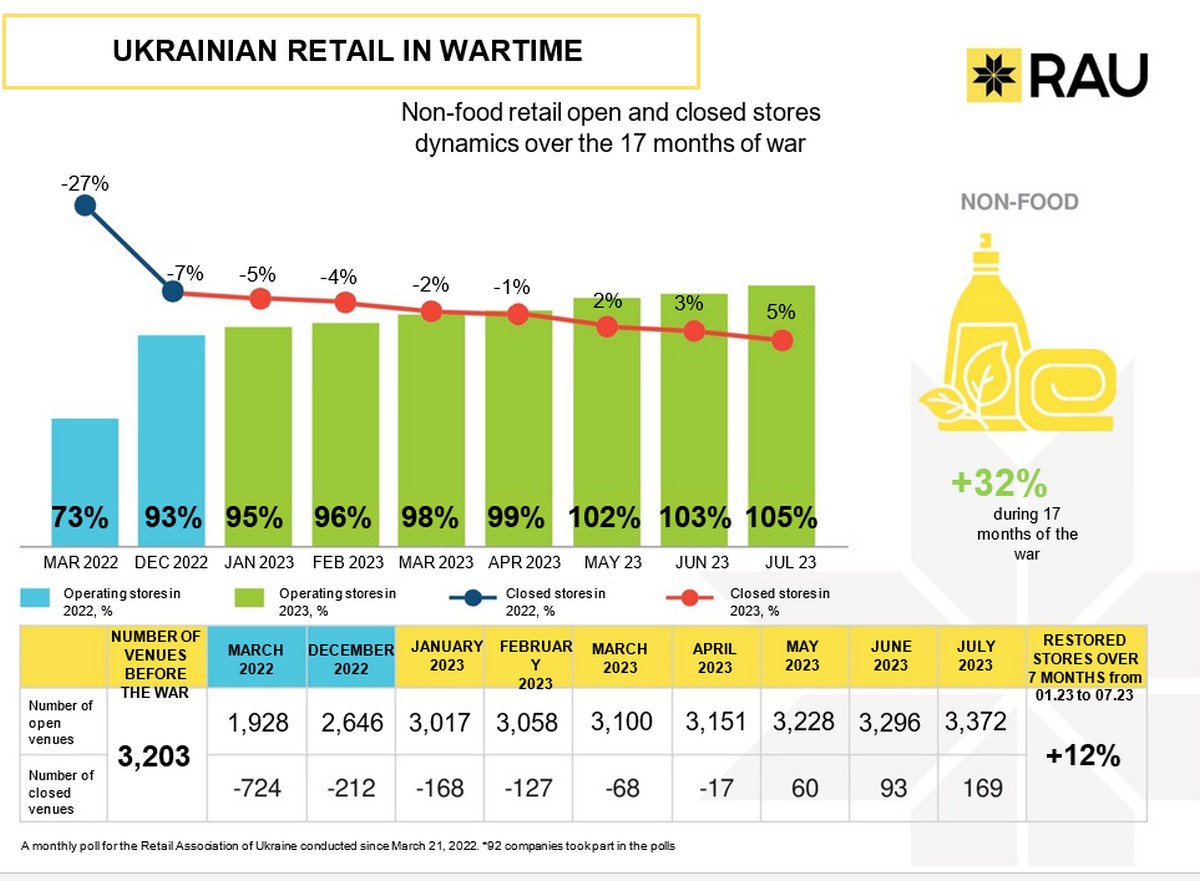

Non-food retail including makeup goods, hygiene products, and other consumer goods has a similar dynamics comparable to the food retail sector recovery. However, the initial drop was greater here, when 724 facilities, or 27% of the industry, were out of operation in March last year. And the recovery was more rapid. Thus, by the end of 2022, 93% of the stores had been restored, and the number of non-operating stores had dropped to 212, almost three times.

In 2023, the restoration trend continued, and in May, as shown in the graph, the number of stores was as high as before the war, with 60 or 2% more new outlets. In two more months, the industry added 5% or 169 new stores. Thus, in 2023, the indicator of closed stores instead of 168 non-operating outlets “changed polarity” to a positive one.

In general, since the war began, non-food retail has improved the number of operating outlets by 32% (compared to March 2022, when only 73% of chain stores were open), and by 12% since the beginning of 2023. As a result, non-food retail has become another industry that has begun expanding its chains, not just restoring losses during the war.

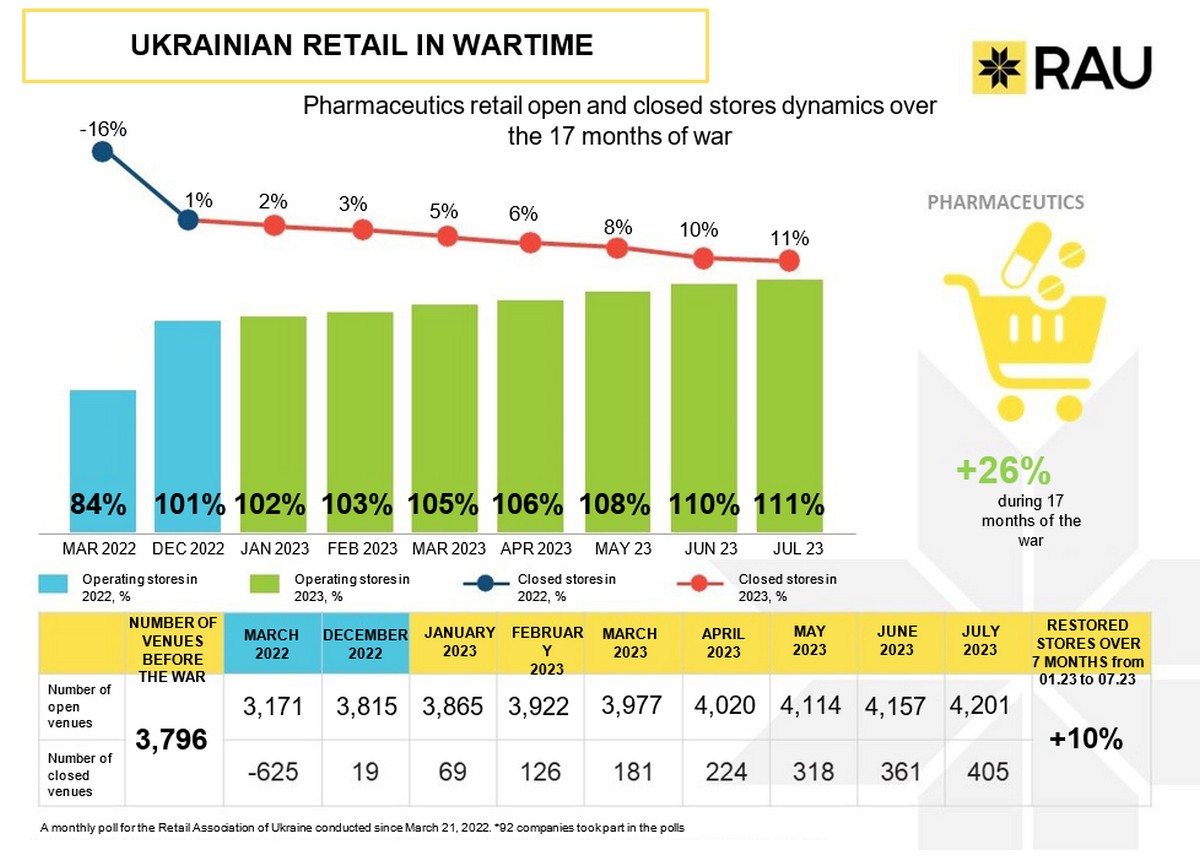

Pharmaceutics chains became the first driving force behind the restoration of Ukrainian trade. This industry has not only quickly restored the pre-war number of operating pharmacies, but has also significantly exceeded this indicator. While in March last year, 16% of pharmacies were closed, in December 2022, there were already 1% more operating pharmacies than before the war (3,815 pharmacies versus 3,796 before the war). By July this year, their number had increased by another 10% to 4,201 pharmacies. Accordingly, the overall restoration and growth amounted to an impressive 26%. Thus, while at the beginning of 2023, the number of pharmacies in Ukraine was 3,865, in July their number increased by 336. As a rule, 40-50 pharmacies were opened per month, and sometimes, for example, in May, 94 were opened at once. As medicines and medical products remain one of the most popular goods, especially in wartime, the share of positive growth in the number of pharmacies and pharmacy outlets has only increased.

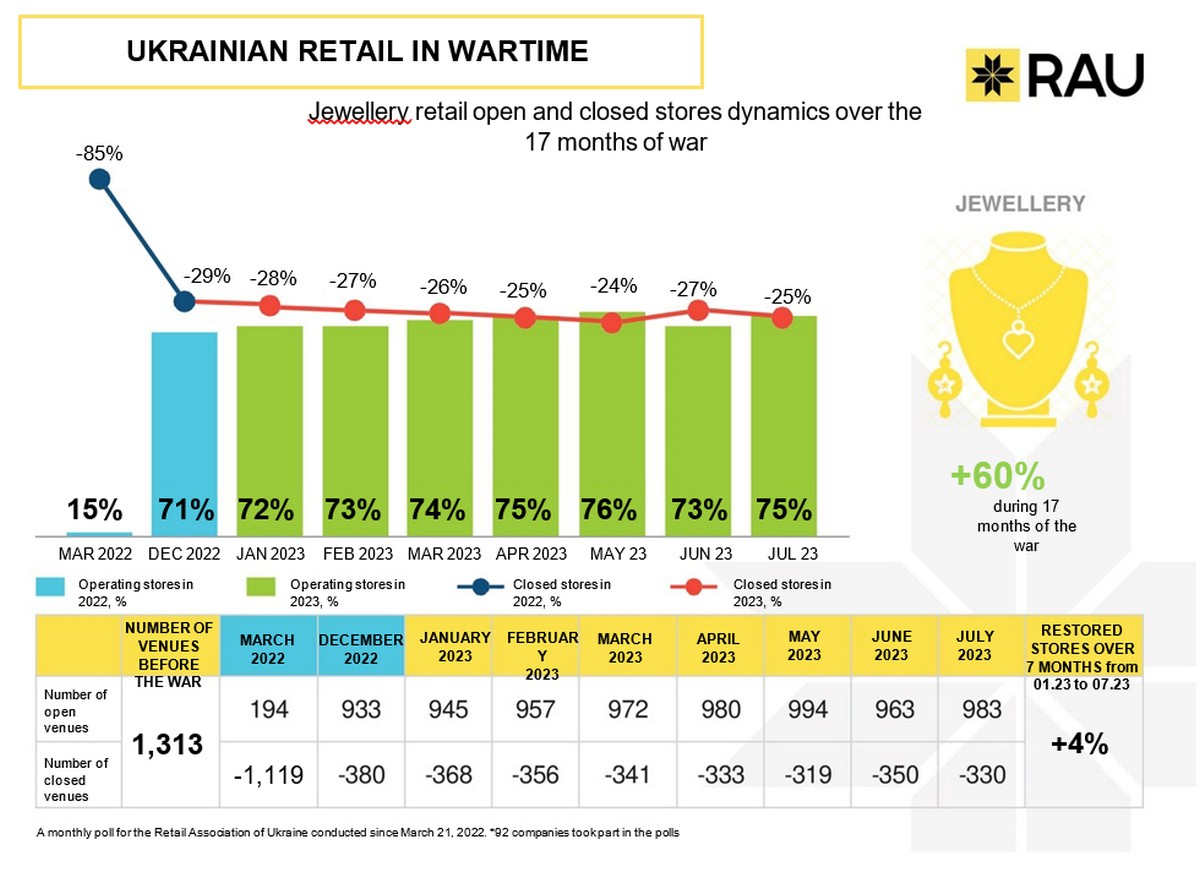

The jewelry sector suffered perhaps the largest decline when the war began, with 85% of outlets closed in March 2022. Only 194 of the 1,313 stores that operated before the war have remained open. However, 71% of the pre-war chains managed to reopen by the end of last year and then continued to increase the number of stores in operation gradually, by one per cent per month. On average, 12-15 outlets were opened per month, and consequently, 994 stores, or 76% of their pre-war number, were already operating in May. Only 319 stores were closed. In June 2023, the situation deteriorated again, and the share of operating stores dropped to 73% compared to February. However, as of July, the positive trend prevailed again, and now the number of operating stores is back to 75%, or 983 stores. As a result, over the 17 months of the war, incredible progress has been made — 60% of the industry has been restored, with a 4% increase in the first half of 2023. The market may now have reached a certain point of equilibrium between the existing supply and demand on the market.

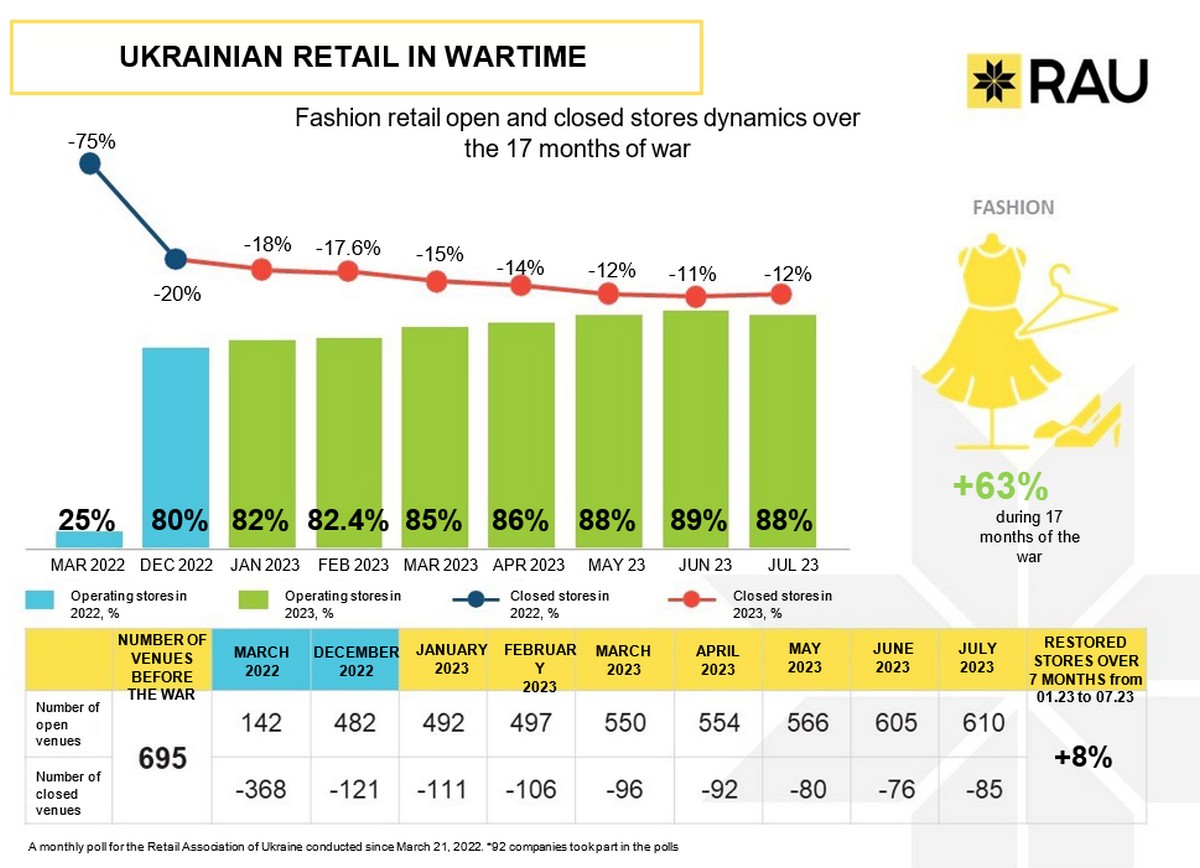

The clothing, footwear and accessories retail sector has gone through its own difficult path of challenges. There were supply chain disruptions, the closure of a number of production facilities, constant shelling of shopping malls, and later blackouts. Population migration and the purchase of only the most necessary items were added to these challenges. All this had a significant impact on the pace of the industry’s restoration. While 75% of stores were closed in March 2022, the industry has now restored to 88%, or 610 operating stores out of 695 at the beginning of the war. This is 128 more outlets than in December last year, when the industry restored to 80%. As we can see, the fashion retail sector has not only managed to find a way out of the difficult situation, but also managed to reopen 63% of stores during the 17 months of war. Currently, only 85 outlets remain closed. However, the situation with jewellery chains is similar in fashion retail, with the number of closed stores increasing slightly in summer. However, we hope that the change of seasons and the approaching period of active sales will give a new impetus to the retail sector development. This should also be supported by the growing popularity of made-in-Ukraine products.

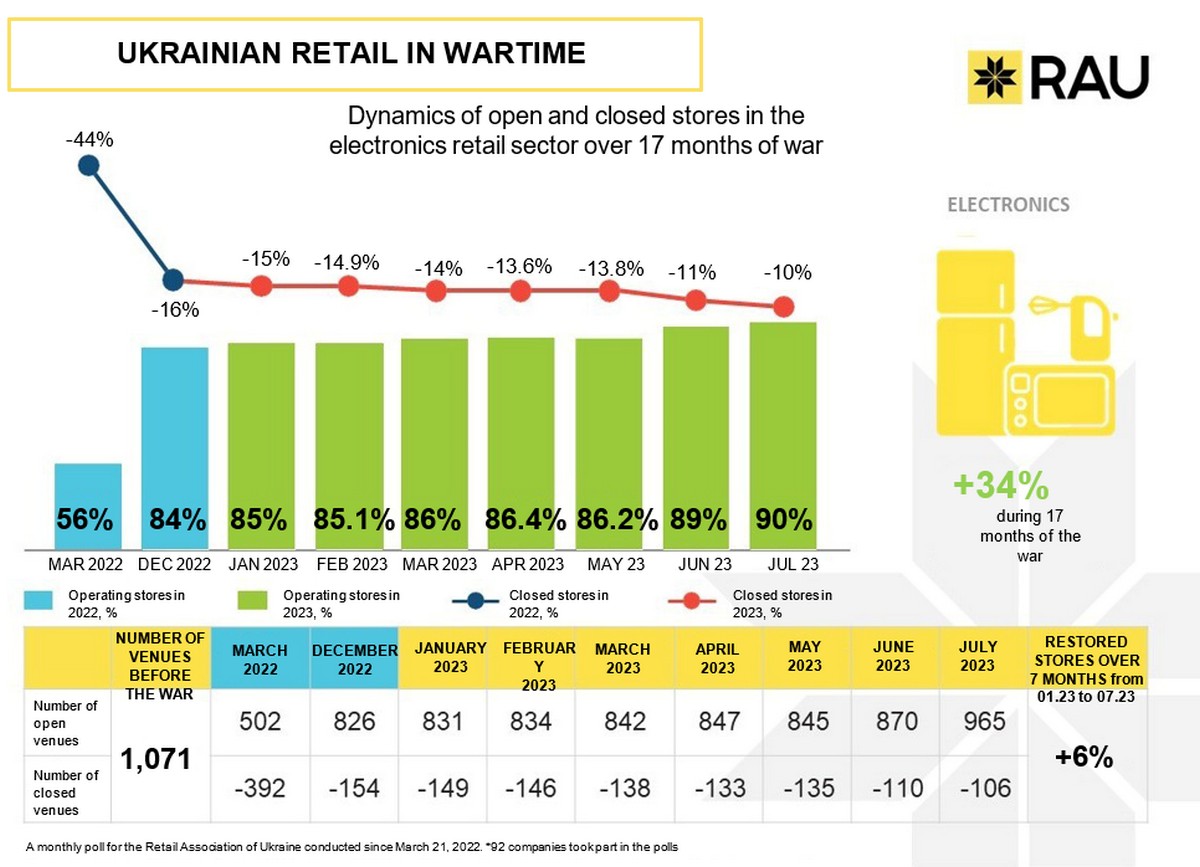

This industry, like the fashion retailers, was also heavily affected by the war. Entire distribution centres with goods were destroyed, causing large losses and affecting the pace of the industry’s restoration. However, despite the difficult working conditions, with only 56% of stores operating in early spring 2022, 85% of the 1,071 stores that had been operating before the war had resumed operations by December. Over the 17 months of the war, the industry has restored by 90%. Since appliances are not bought as often, even compared to clothing, and given the specific requirements for the size of premises and opportunities for displaying appliances, we can say that the restoration is steady, but not as fast as in other areas. The total number of operating stores increased by 6% from January to July 2023: from 826 to 965 outlets. Compared to December last year, 139 additional stores were opened.

It is worth noting a significant acceleration in the opening of new outlets. When 25 new stores were added in June, it seemed like a big breakthrough compared to the previous months (with five to eight new outlets). But in July, the number of new openings reached 95. This may be explained by the increased demand before the school season, preparations for new blackouts and the general digitalisation of many services in the country. In any case, another 1% was added.

As a result, over the 17 months of the war, we managed to reopen 34% of our stores, 6% of which were opened in 2023. The number of closed stores declined to 106, correspondingly.

Fuel sales are always relevant, so predominantly the closing of about 200 car refueling stations (15 %) out of 1,512 in operation before the war was caused by destruction or occupation by the enemy. By the end of last year, 94% of the 1,512 filling stations that existed before the war had been restored. But unlike, for example, pharmacy retail, filling station chains are hardly developing any further. Currently, 60 filling stations remain closed, which is the same as in May 2023, when 96% of the pre-war number, or about 1,450 facilities, were operating. It means that from March 2022 until July 2023, the share of the operating facilities of the filling stations network added 11 %. In 2023, this figure increased by only 2%, or 33 filling stations.

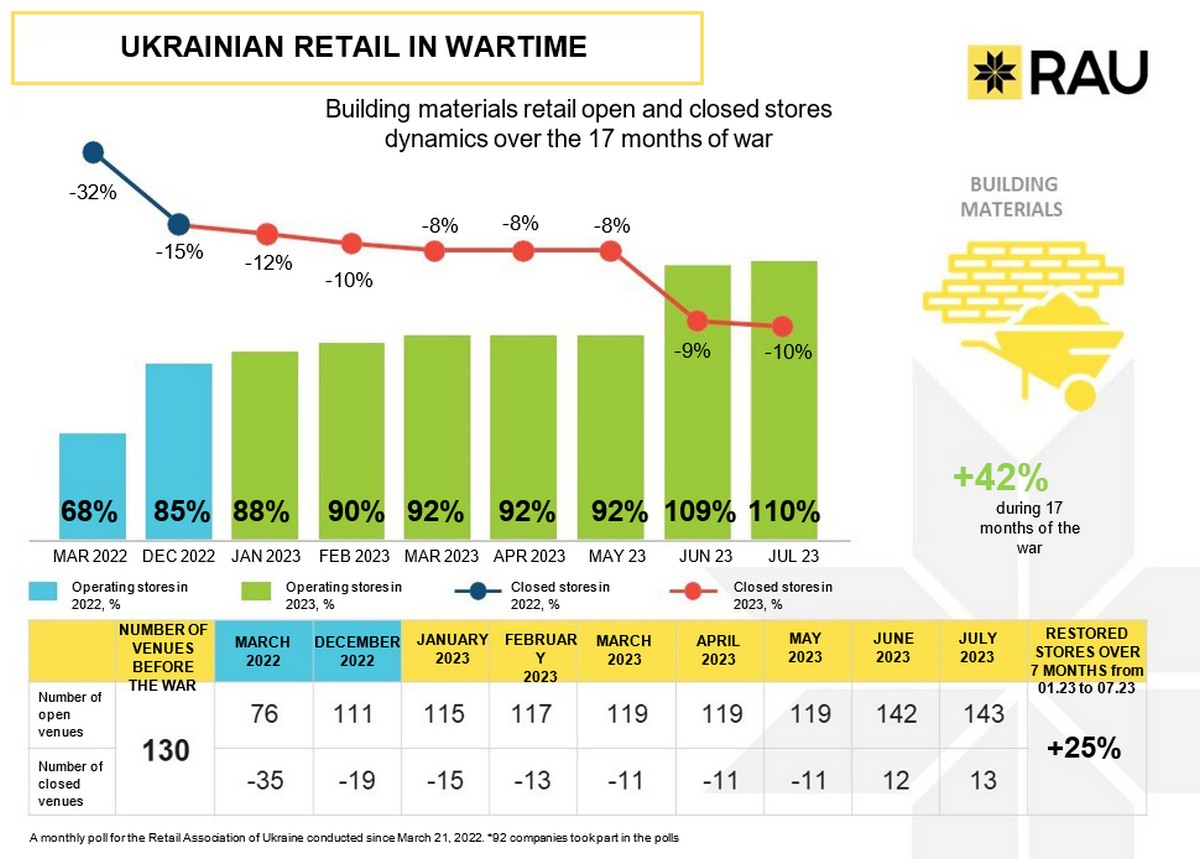

The building materials trade sector is interesting as it faced similar problems and challenges as the fashion and home appliances and electronics sectors, but managed to recover quite quickly, almost halving the share of non-operating stores last year from 32% to 15%. Thus, at the beginning of the war, only 76 out of 130 stores were operating as of March 2022, and less than 20 were closed in December.

This year, the pace of restoration accelerated, reaching 100% in May 2023, and as of July, the number of stores increased by 10% compared to the pre-war level, or by 13 stores at once. As a result, the overall growth of the industry in the first seven months of 2023 was 25%, and over the 17 months of the war – as much as 42%. Given that such stores are large facilities that require significant investment and effort to open, the dynamics of the industry’s development is impressive. While retailers opened only eight stores in the winter and spring of 2023, in June-July, with the start of an active period of construction and reconstruction of destroyed facilities, the number of outlets increased by 24 at once and reached 143 stores.

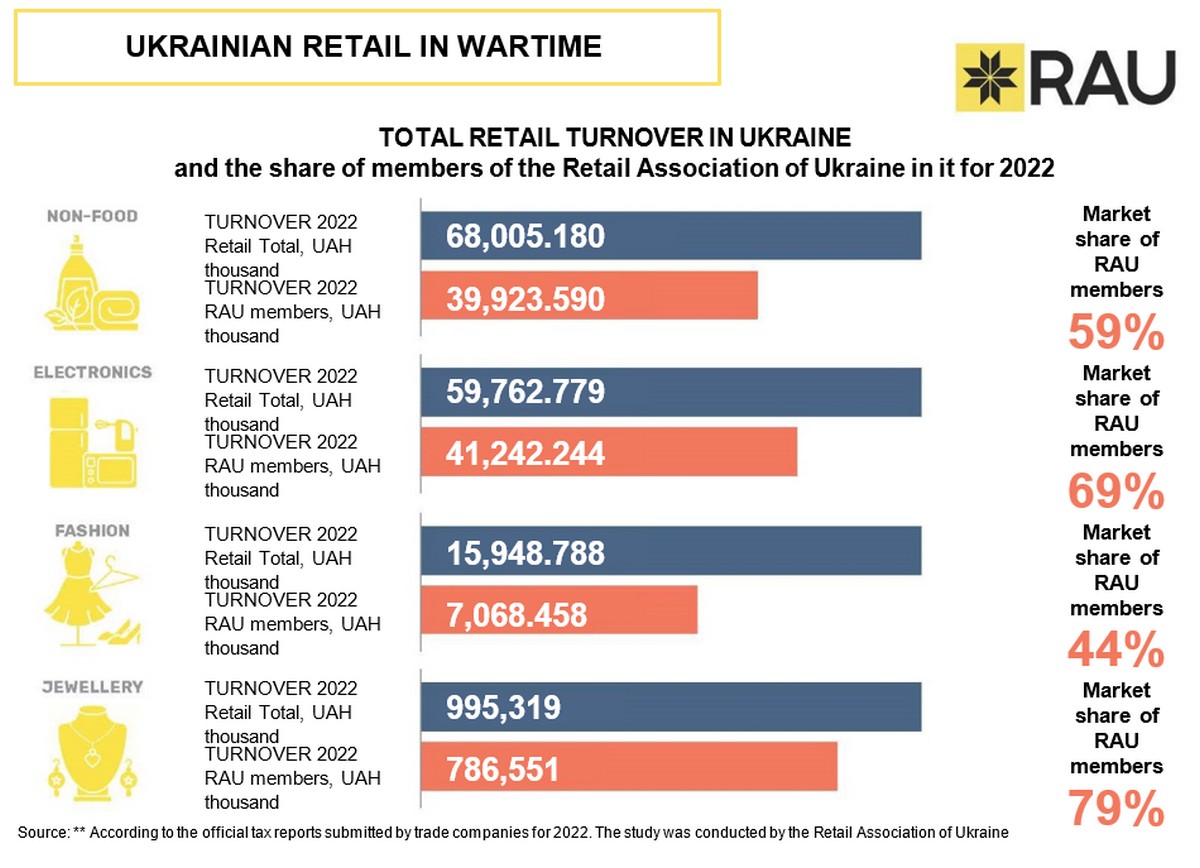

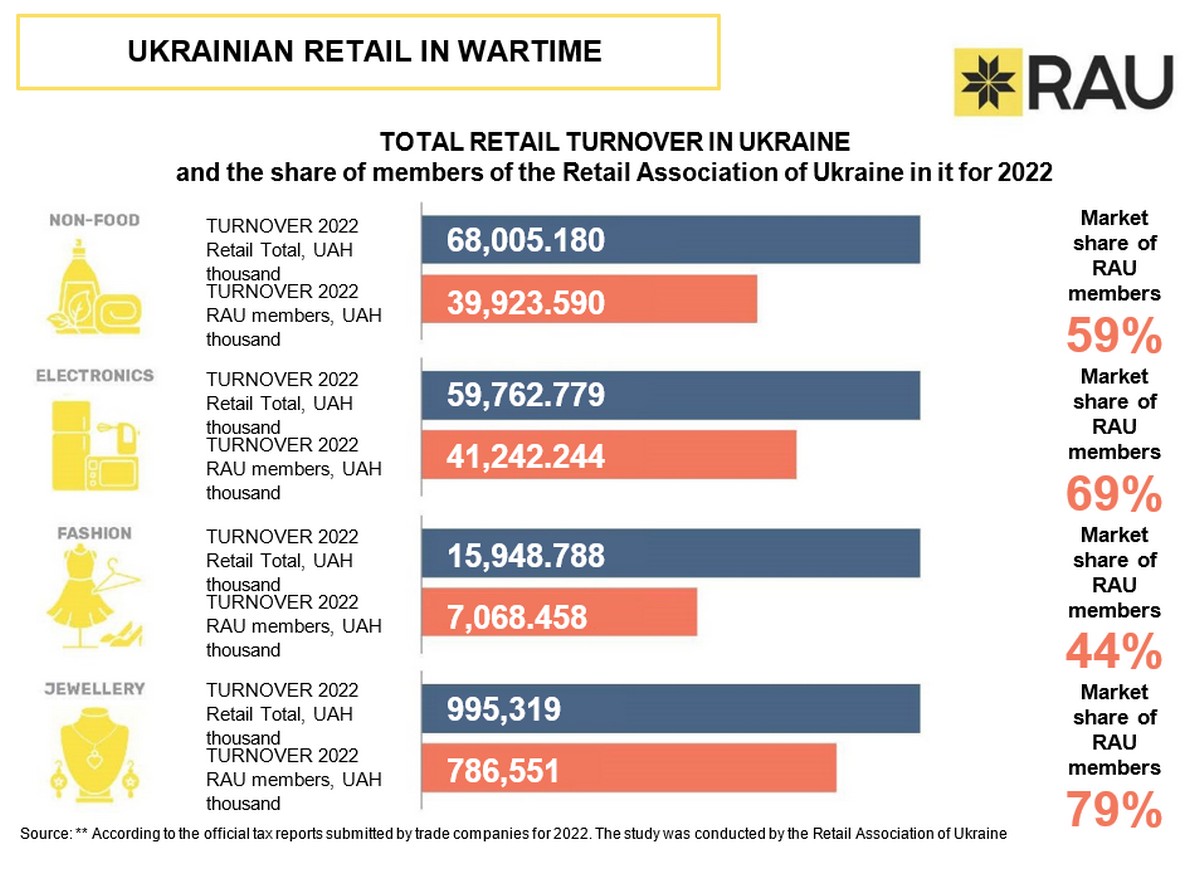

In 2021, the total turnover of Ukrainian retailers was UAH 1.440 trillion. In 2022, this indicator reached UAH 1.162 trillion, which is UAH 280 billion less. This is a direct consequence of russia’s invasion of Ukraine. It is also worth noting here that the share of the 92 RAU member companies in the total turnover is a significant 64% or UAH 742 billion.

According to the graphs, grocery chains accounted for more than half of the Ukrainian trade turnover, which is UAH 652 billion, with RAU members accounting for 63%. The three industries with the largest retail turnover in 2022 also include filling station chains and pharmacy chains with UAH 214 billion and UAH 103 billion, respectively. The turnover of non-food retail and trade in household appliances and electronics is also significant, with a total of about UAH 70 billion and UAH 60 billion, respectively. The jewellery industry showed the lowest turnover last year, which is not surprising given the share of closed and lost stores (often together with the goods). Besides, people do not buy jewellery on a daily basis, unlike essential goods.

However, the share of RAU members in total revenue ranges from 44% to 79% in almost all retail sectors, so their results are absolutely representative. Overall, all Ukrainian retailers delivered outstanding results, given the most challenging operating environment since Ukraine’s independence.

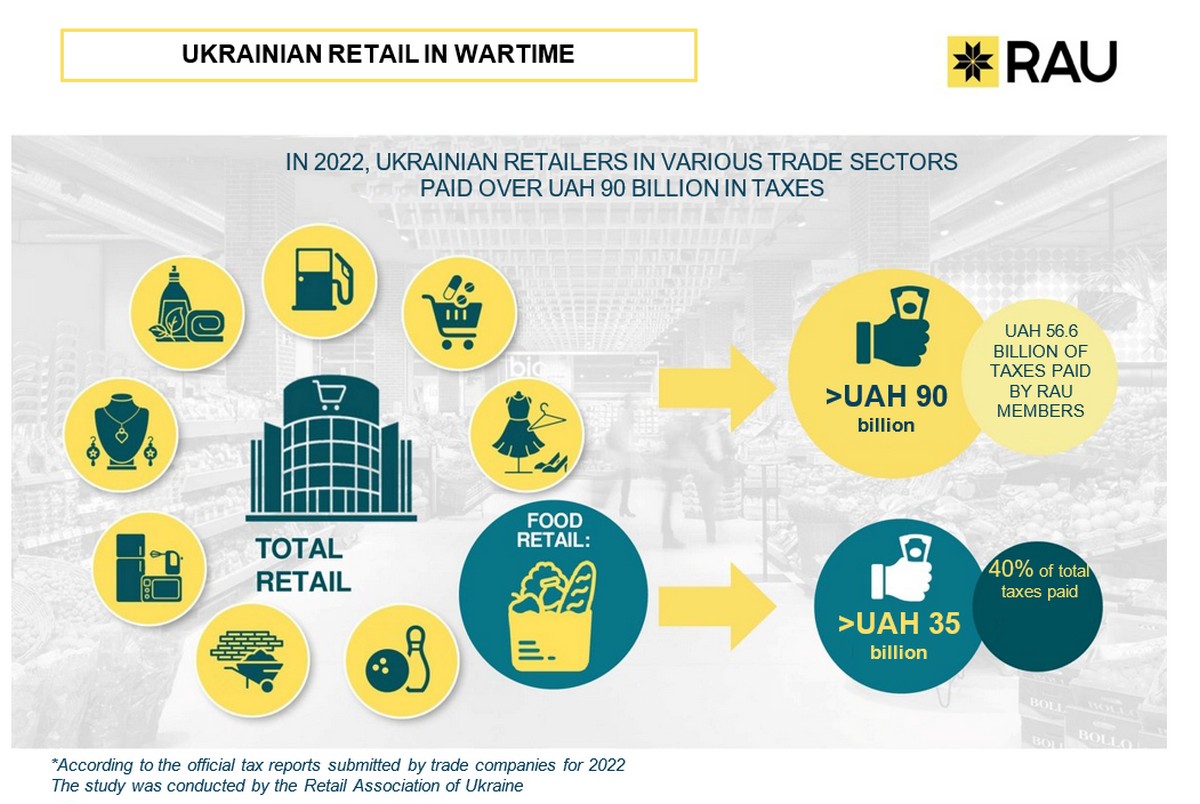

According to the State Tax Service of Ukraine, all retail companies paid over UAH 90 billion in taxes to the budgets of all levels last year. The industry remains one of the main budget sources. The majority of taxes distributed to budgets of all levels is attributed to VAT, individual income tax, and excise tax. That is, the consumption and labour payment taxes.

If considering individual areas, grocery retail is also the largest contributor to taxes paid, which is more than UAH 35 billion, or 40% of tax revenues from all trade. This is not surprising, as the consumption of essential goods is a priority for the population.

Retail trade is also one of the largest employers in Ukraine. Retailers are a source of income for hundreds of thousands of employees and millions of their family members. Suffice it to say that only 92 leading chains that took part in the RAU survey and are members of the Retail Association of Ukraine had 425,532 employees involved in the operation of their networks (16,964 stores in total) at the end of December 2022. Hence, scaled to the entire state, the figure is much higher.

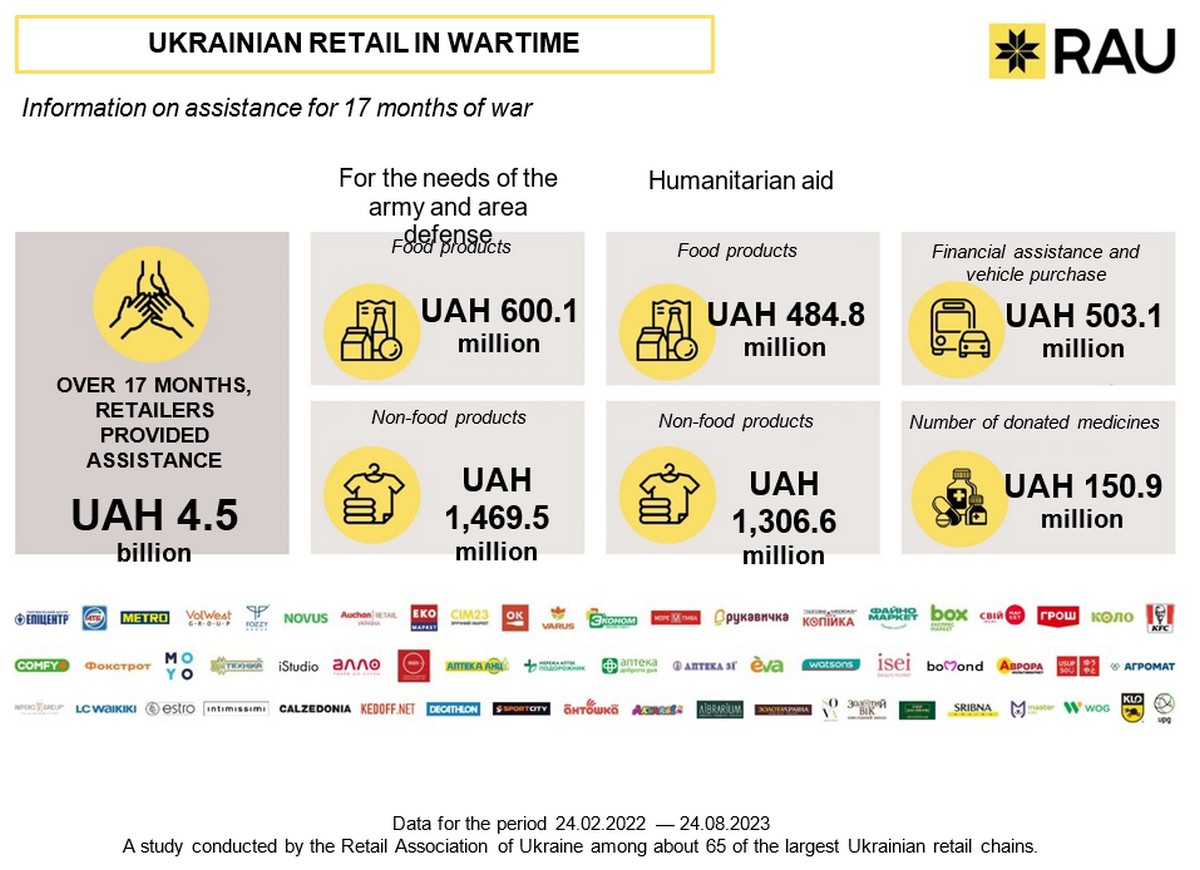

In addition to paying taxes, Ukrainian retailers contribute to humanitarian and military aid. According to a RAU survey of 65 major Ukrainian retailers, over the 17 months of the war (February 24, 2022 through August 24, 2023), Ukrainian retailers collected and donated UAH 4.5 billion worth of aid. In particular, food products worth UAH 600.1 million and non-food products worth almost UAH 1.5 billion were donated to the army and territorial defence. About UAH 485 million of food and over UAH 1.3 billion of non-food humanitarian aid was provided to the population.

In addition, retailers raised over UAH 503 million in financial assistance for the purchase of vehicles and donated medicines worth UAH 150.9 million. Retailers from various segments, including FMCG, drogerie, appliances and electronics, fashion, pharmaceuticals, and others, joined the initiative to support the army and the population.

That is, despite the fact that their financial performance is far from recovering (at least to the pre-war level), they have lost stores during regular shelling, and the difficult situation with staff, Ukrainian retailers are finding opportunities to support the front and the rear. We are very grateful to them for this.