Top-7 electronics and gadgets’ chains of Ukraine by regions and ranges

Which regions do the equipment and electronics domestic market’ leaders bet on, in what formats it prefers to develop, and where it prefers to open new stores.

The Ukrainian Retail Association presents the household appliances, electronics and gadgets market large-scale study. We analyzed the seven largest chains, with the square from 100 sq. m (except for monobrand stores), offering household and computer equipment, mobile devices and accessories. The main task was to find out: how many market leaders have retail outlets, in which regions it are represented, it prefers to open stores in regional centers or do not neglect small towns, it develops in the street-retail format or it bets on objects in shopping and entertainment centers. All data was taken from open sources, the report took into account the outlets indicated on the companies official websites on October 20, 2018.

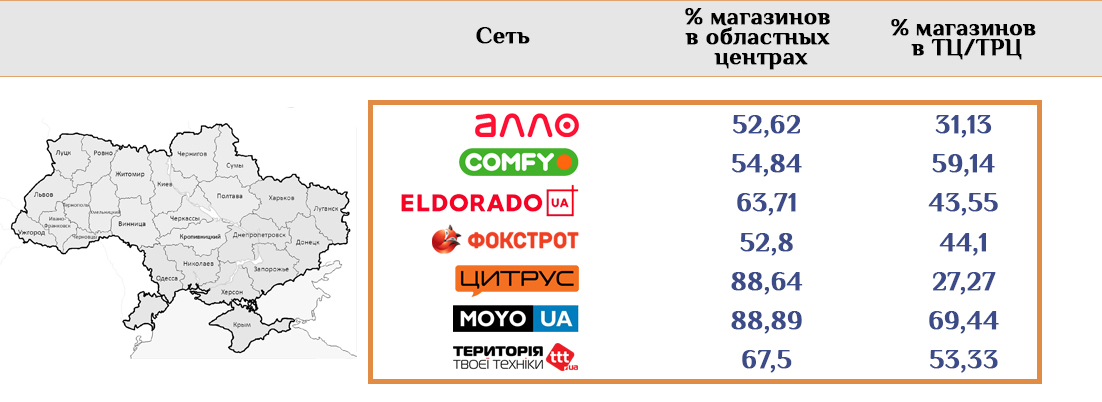

Ukraine

The undisputed leader on the number of hardware, electronics and gadgets’ stores is Allo. On December 20, the chain consisted of 363 points – two times more than the nearest pursuer has. It is worth noting that this number includes stores operating under all brands of the companies group: Allo, Kievstar, Xiaomi and others.

The second chain in terms of the stores number and the first in the total sales square is the Foxtrot. Its eternal rival Eldorado is on third place. Attention is drawn to the fourth position in the Technique Your Territory Chain rating – TTT (TYT), but there are many points opened under the partner brands among the 120 company objects: Kievstar, Lifecell and Vodafone.

Almost all retailers are represented in all geographical regions of Ukraine. The only exception is Citrus: the company has not yet opened a single store in Western and Northern Ukraine (if Kiev is not taken into account), focusing on development in the southern regions and the capital.

In addition, just Citrus, on a par with MOYO, relied on the development in large cities: almost 90% of these chains outlets belong to regional centers and Kiev. The rest of the market players decided not to ignore small cities. And the most cosmopolitans turned out to be Allo, Foxtrot and Comfy: almost half of its facilities are located outside the regional centers. Of course, the population is usually more solvent in large cities, but these three companies clearly relied on a wide audience coverage and accessibility for the consumer.

Whose the strategy will end up more successful – the time will tell.

It is also interesting – what development path have chosen the hardware, electronics and gadgets trade chains – to work in shopping malls or open objects in street-retail. And here two companies stand out from the total number. MOYO clearly prefers SEC – almost 70% of the brand’s stores are represented in shopping centers. Citrus, on the contrary, chooses street-retail: three-quarters of retailer points operate outside the SEC. Allo has a similar strategy.

But the rest do not neglect both options, and TTT distributed objects between the SEC and the street-retail more evenly than all.

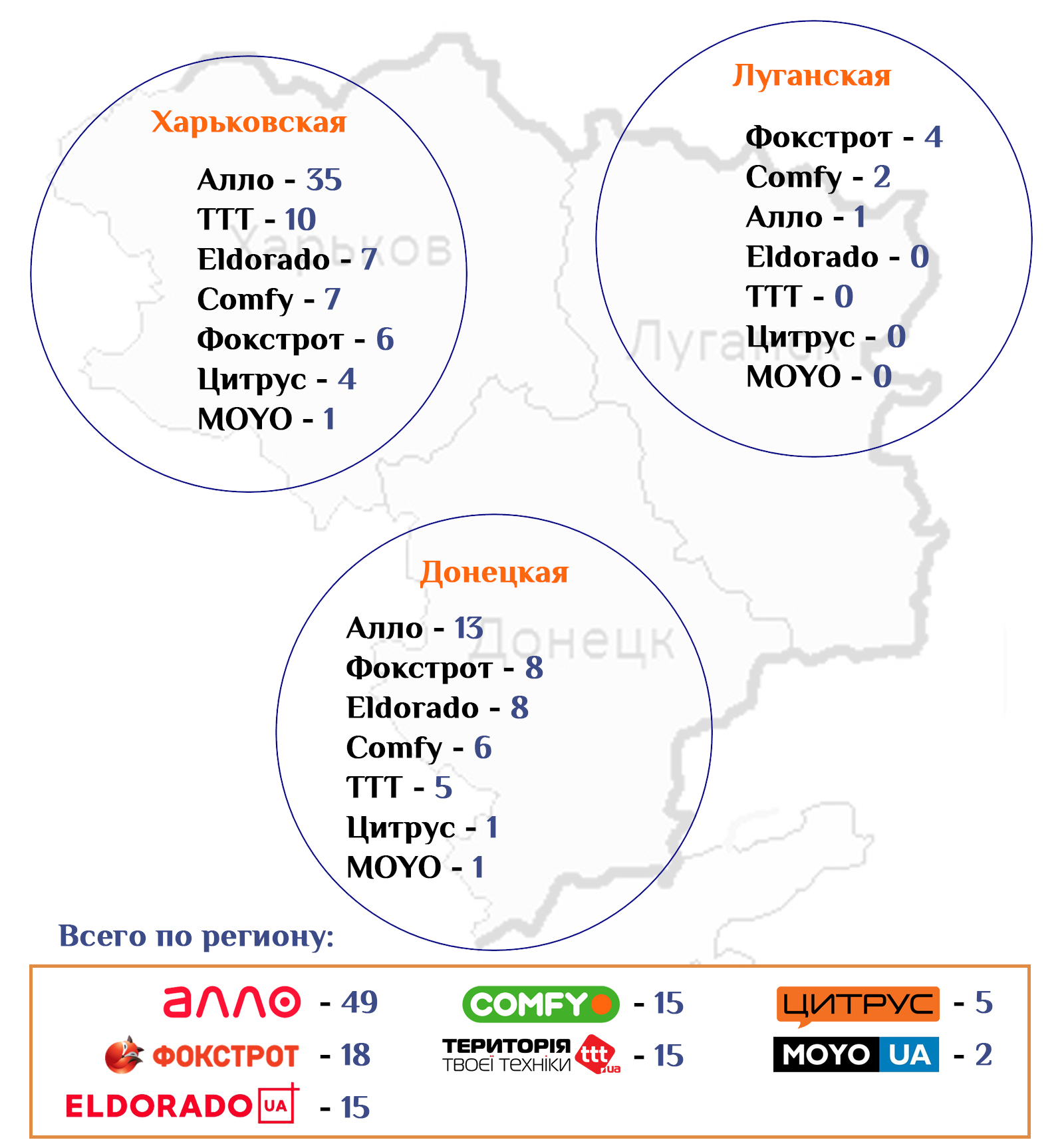

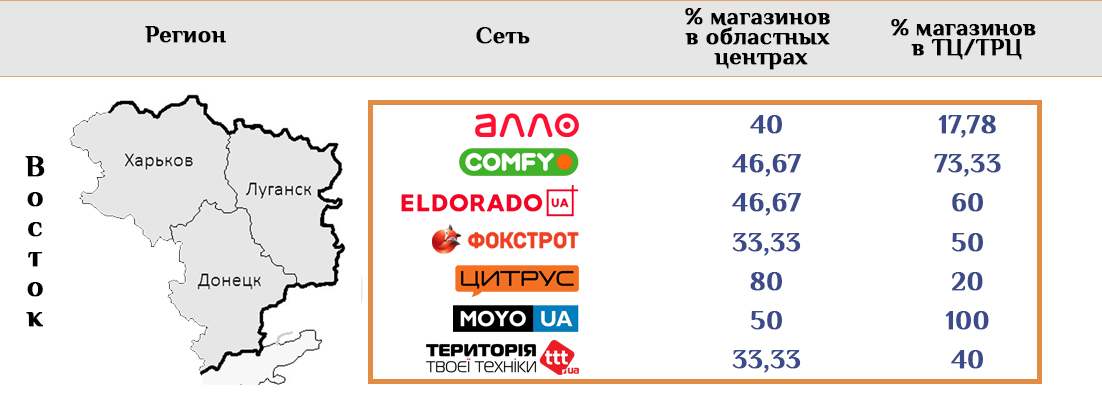

Eastern Ukraine

Of course, the Donetsk and Luhansk ranges individual regions occupied by pro-Russian militants were not taken into account by the Eastern Ukraine analysis. Therefore, it is worth remembering this reservation with regard to the location of the store in/outside the regional centers: in fact, only Kharkov appears in the study as the eastern region only regional center.

In general, the situation is similar to the all-Ukrainian on the number of stores for different chains in Kharkov, Donetsk and Lugansk ranges. Allo leads confidently, Foxtrot and Eldorado follow him, and Citrus and MOYO close “the magnificent seven”. These companies do not include clearly the Eastern Ukraine among the priorities for itselves.

There are most of all hardware and electronics stores, for obvious reasons, in the Kharkov range. It should pay attention to the fact that TTT unexpectedly ranked second, ahead of the “sworn friends” Foxtrot and Eldorado. But four chains do not work at once in Lugansk range, which is not surprising: the range was not previously considered to be prosperous even by Ukrainian standards. And the situation in the region became even worse after the Russian troops’ invasion and the hostilities’ outbreak.

It is worthwhile to immediately turn to the development strategies analysis given the reservation on the east of the country regional centers. MOYO is true to itself – both stores of the company work in the SEC. Comfy have the same tactic. Allo apparently chose to open street-retail format points. Foxtrot objects divided exactly in half: nine objects are in the SEC and nine objects are in street-retail.

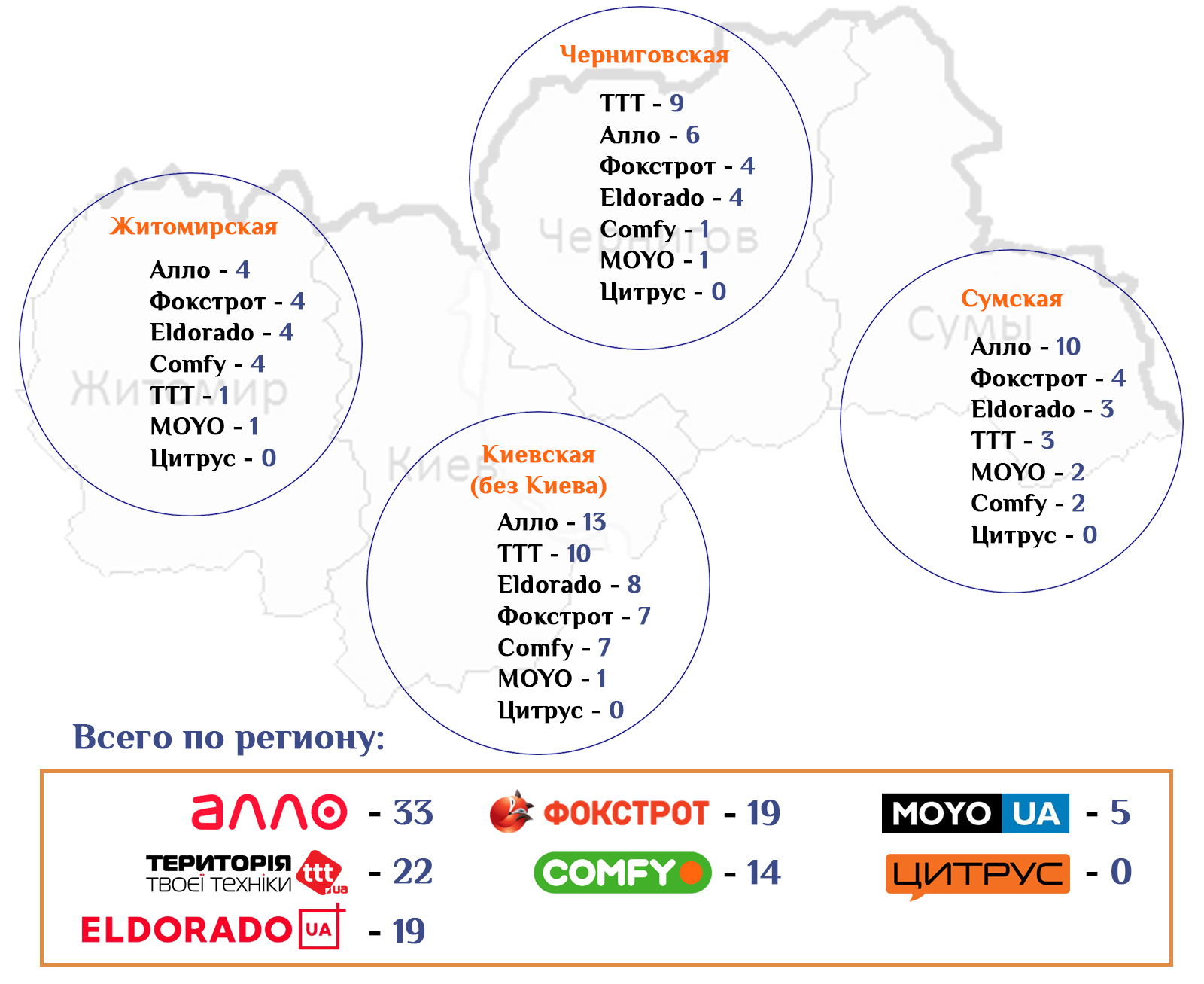

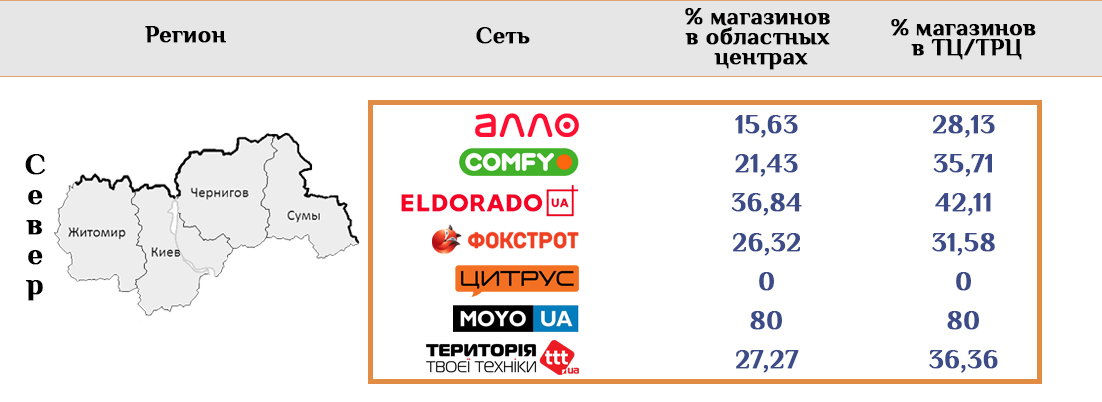

Northern Ukraine

All operators are represented in this region, except Citrus, which opened stores only in Kiev. The leader is unchanged – the Allo chain and the second line is the TTT, for which the northern ranges were in the attention focus. It even came out on top in Chernigov range.

What is surprising: a clear roll towards the north-east. There are 24 hardware and electronics stores in the Sumy range but there are only 18 in Zhitomir range. The metropolitan region is mastered most of all, which is clear, thanks to the Kiev satellite-cities, where there is effective demand.

What is remarkable: all retailers (with the exception of the missing Citrus and a little numerical MOYO) open outlets in all localities, and not only in regional centers. And it prefer street-retail, than, incidentally, may be due to the lack of quality shopping centers in northern Ukraine. And it “is need to reach” the consumer.

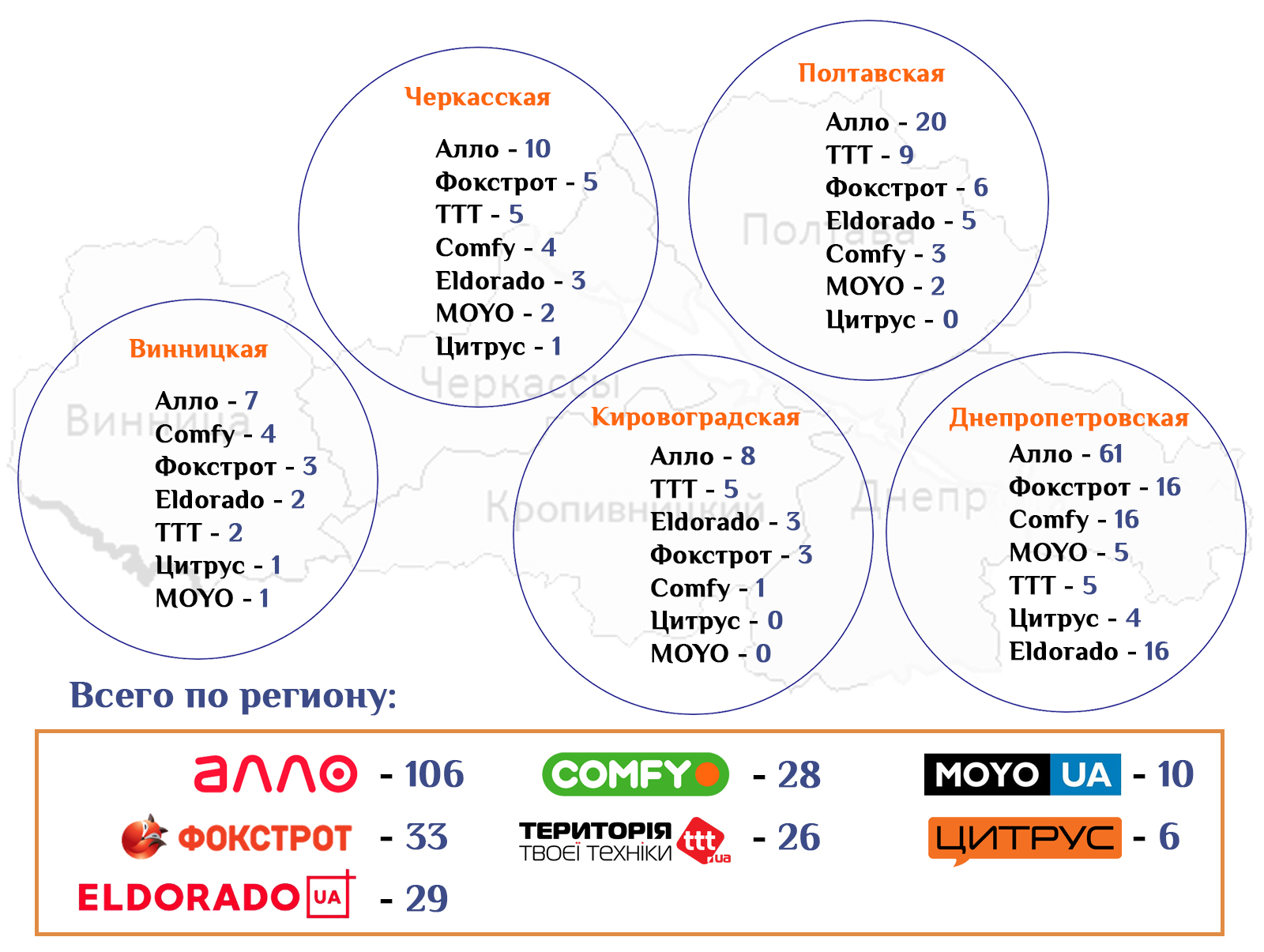

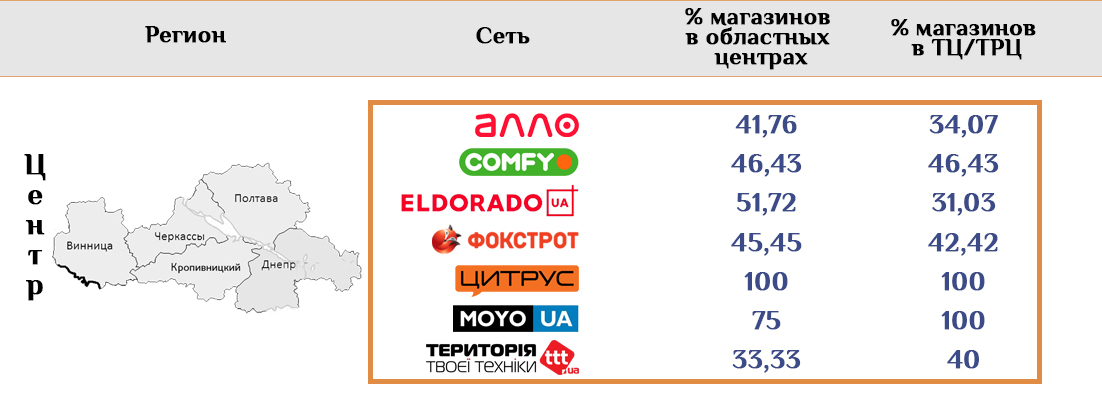

Central Ukraine

This region is traditionally the industrial and financial center of the country. So the large number of hardware and gadget shops should not be surprising: among all the geographic ranges of Ukraine, there are here the most. In addition, the region is the base for at least two large chains – Allo and Comfy.

Third of all outlets Allo are working here, with 60% of it – in the Dnepropetrovsk range. The chain is much smaller in other ranges’ region.

It is noteworthy that this is one of the few regions where Citrus stores operate only in the SEC. If this is a familiar picture for MOYO, then the Odessa company changed its principle to develop in street-retail in this case. However, we are talking only about five stores, four of which operate in the Dnepr and one – in Vinnitsa.

The rest of operators intelligently divided its attention between regional centers and other cities, and also it balanced its representation in SEC and street-retail.

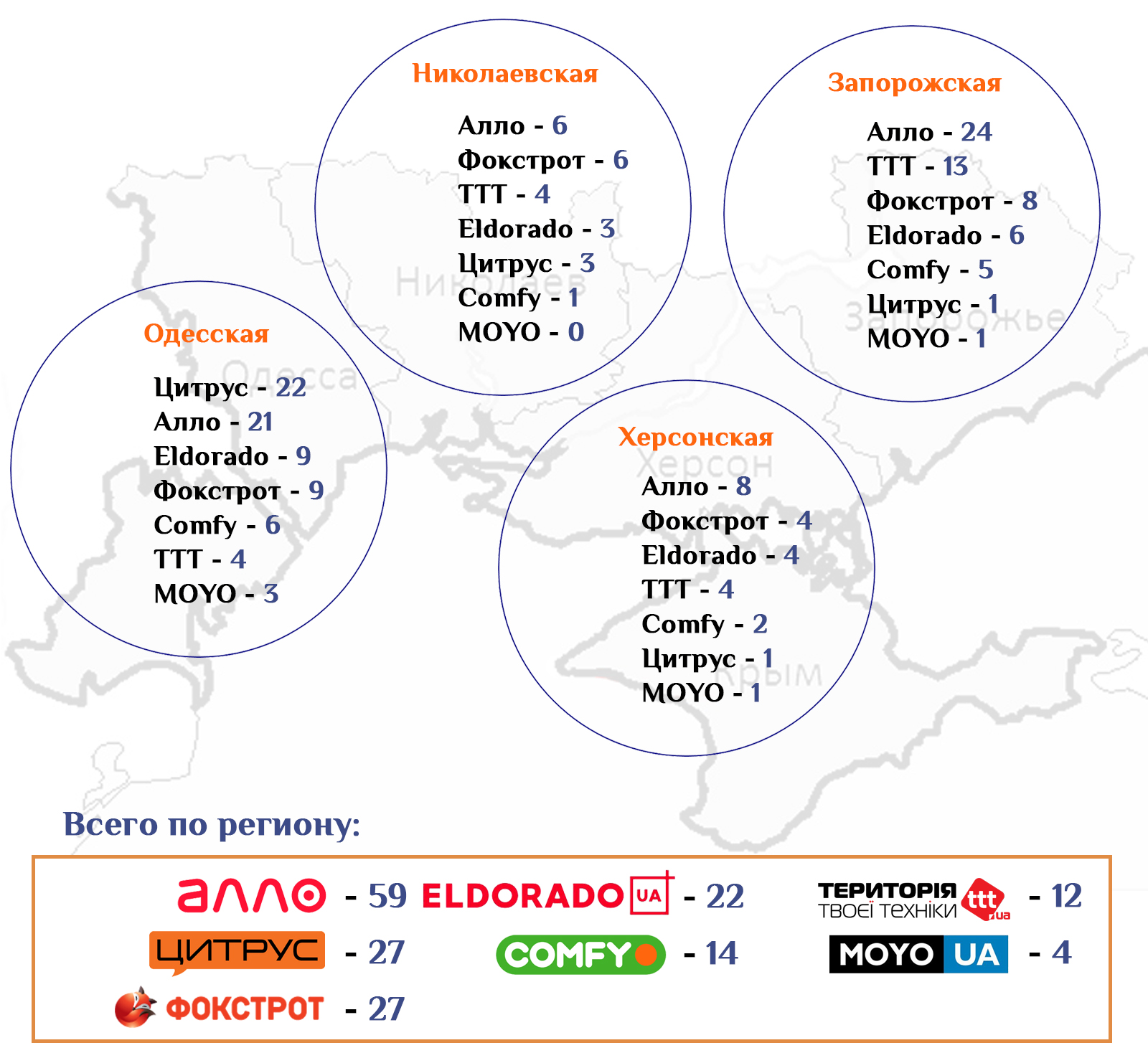

South Ukraine

The south of the country is a “home region” for Citrus. And this is clearly visible: more than half of the company’s facilities operate in these three ranges. This allowed it to take the second place in the outlets total number in the region. Most likely, if we were taken into account in our study the equipment shops located in the temporarily occupied Crimea, the situation would be somewhat different, but still the Citrus rate on the “small homeland” is obvious.

However, the leader is still the same in this region – Allo opened two times more stores than the closest rivals, with the Odessa range exception, where Citrus was ahead of everyone. But there is almost no MOYO in the south – only four stores, of which three are in Odessa and one – in Kherson.

It is also curious that TTT actually ignored the Odessa, Nikolayev and Kherson ranges – only 12 points, and it is only in the central cities. The picture coincides generally with the average for Ukraine – as for the distribution between street-retail and SEC, except that it is unusually many Comfy’ stores in the shopping complexes.

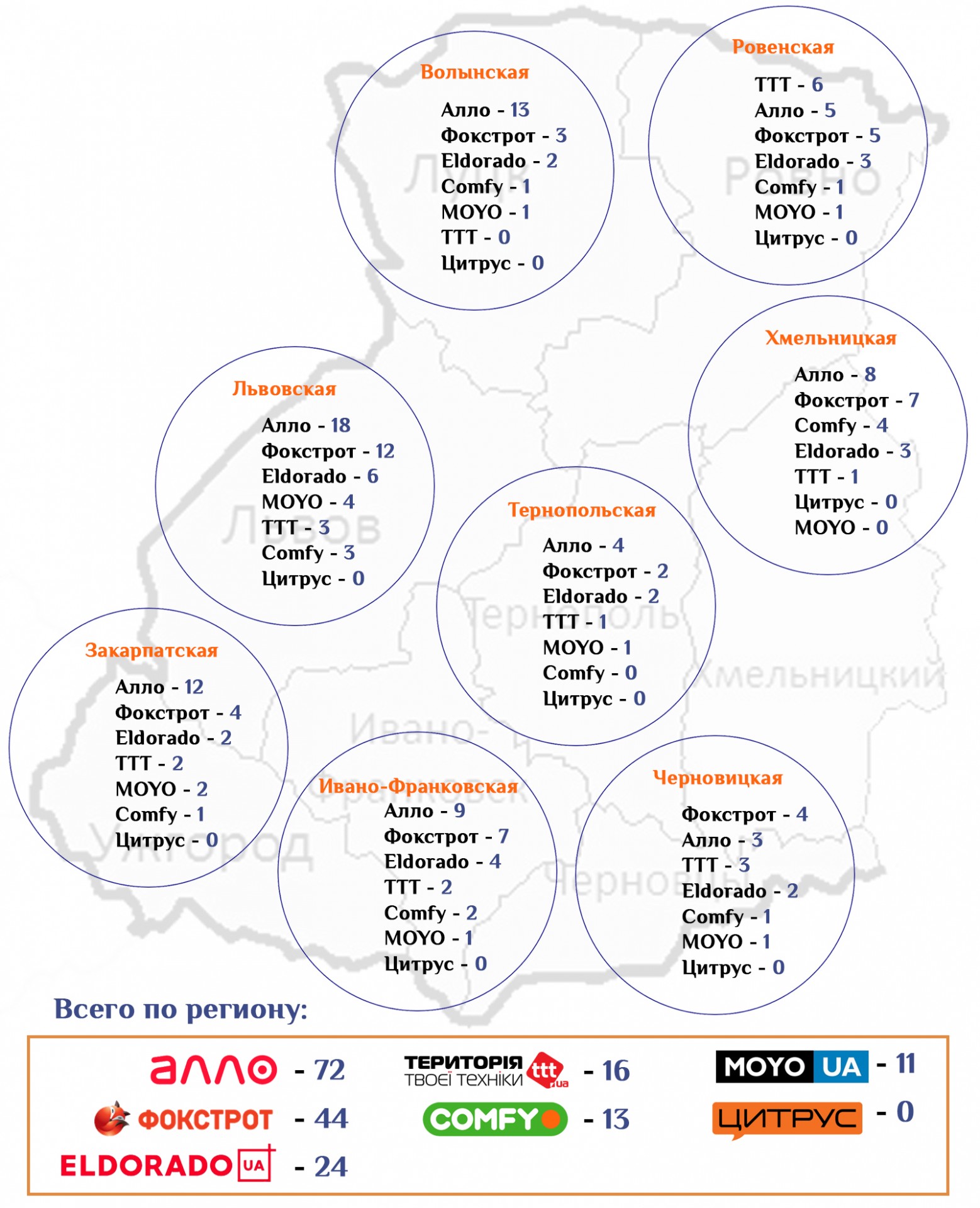

Western Ukraine

The West of the country has recently become a magnet for retailers – almost all the leading players in the Ukrainian retail market are rapidly developing this region. And the home appliances and electronics chain is no exception. So far, only Citrus is not seeking the West, but it is possible that the high-quality shopping centers’ emergence and an increase in the population’s well-being will push Odessans to expand in this direction.

But Foxtrot is represented here very widely, and we can safely say, given the difference in formats between it and Allo, that Foxtrot is the equipment and gadgets leading chain in Western Ukraine.

The Lvov range is for all market players key region, which is understandable. It are concentrated here a quarter of all electronics stores and gadgets. Allo is still ahead in terms of quantity, but Foxtrot has no rivals in terms of square and total weight for retail equipment in the range.

What is characteristic: all operators clearly betted on regional centers – even Allo and Foxtrot have more than half of the facilities located in large cities, unlike other regions. The choice between street-retail and SEC in the western regions of Ukraine is complicated by the fact that there are few new qualities SEC in the region, with the exception of Lvov. Therefore, companies willy-nilly are forced to open outside shopping malls. Even such a traditional player in this issue as MOYO is forced to open also outside shopping malls.

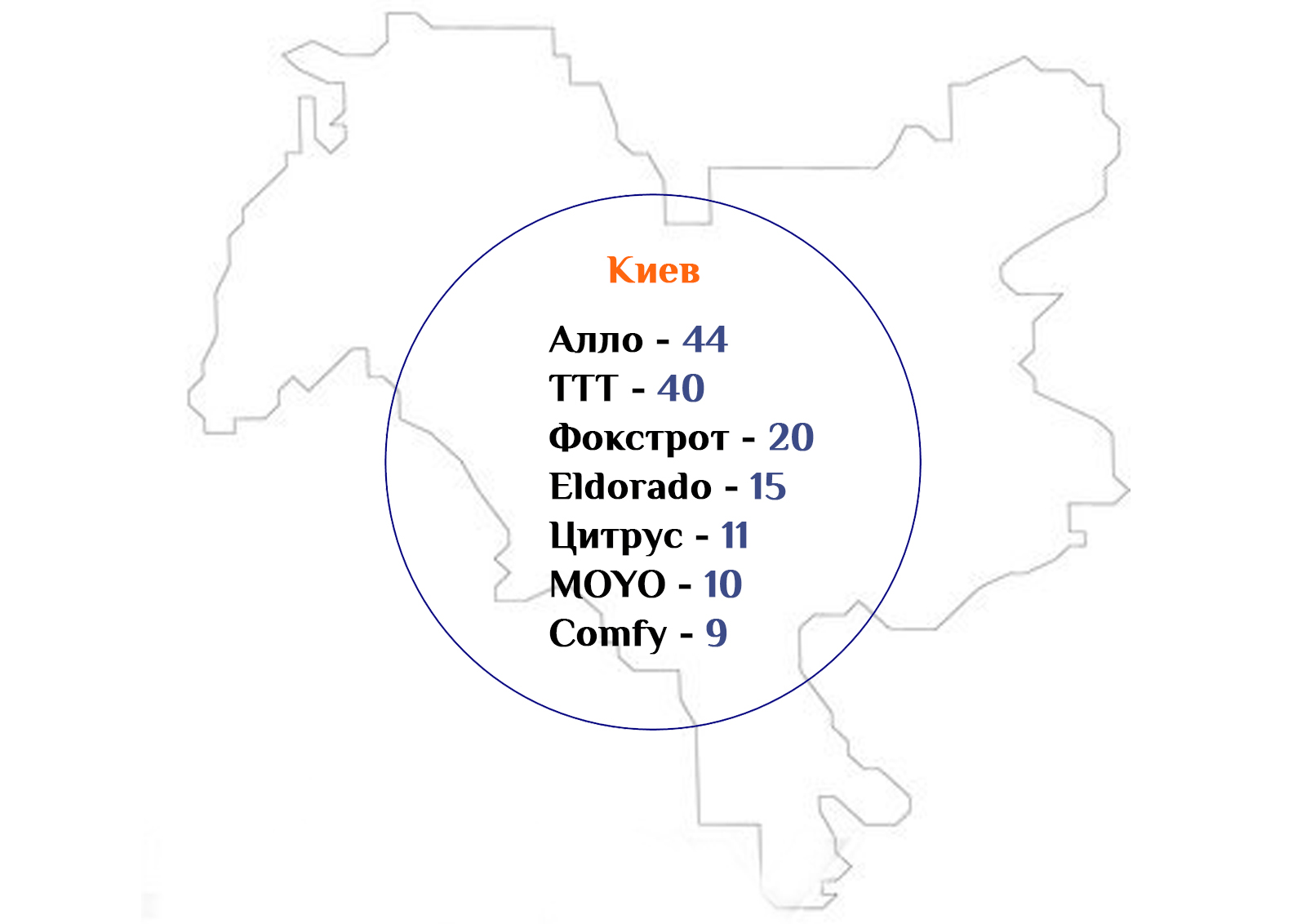

Kyiv

And finally report is about the capital. Kyiv is the richest, most solvent and attractive city for retailers. Naturally, all operators are represented here, and Kyiv provides a significant part of the total income for many of its.

Allo and TTT are leading in terms of the hardware stores’ number in the capital, followed by Foxtrot and Eldorado, and Comfy has the least outlets number among the market leaders. However, there are 150 shops in Kyiv only at the “Big Seven” – it is more than an impressive figure.

And what is clearly visible: retailers prefer to work mainly in the capital in SEC, regardless of the tactics used in other regions. Comfy placed generally all nine of its facilities in shopping centers. And only MOYO placed half of its facilities in shopping and entertainment centers, half of its facilities placed in street-retail.

At the same time, this is understandable: any of the regions of Ukraine have not such a number of high-quality shopping complexes, including those opened recently. But at the same time, in the coming years it is planned to put into operation a number of more significant for retail and development projects.

Full version of our study you can order by e-mail.

Read more –

Read also

Respublika Park Leads Kyiv Shopping Malls in Tax Payments