Special project: Analysis of retail real estate in Ukraine

The Ukrainian Retail Association presents regular large-scale study devoted to a detailed study of retail real estate in Ukraine’s regions.

Last time, on the eve of the Retail & Development Business Summit, we prepared a global analytical report on the operation of online-stores in the country. Then we analyzed attendance, time of the user’s stay on the site, depth of view, bounce rate and other parameters that help evaluate the online-store work efficiency and conversion.

This time the focus is another important industry for the retail: the Ukrainian retail real estate market. In many cases, the SC and SEC reviews are limited to the key cities for Ukrainian retail: Kiev, Dnepr, Odessa, Kharkov and Lvоv. The situation with retail real estate is much less known in other cities, and data on individual regional centers is difficult to find even for professionals. Therefore, we set ourselves the task of analyzing: how much regional cities are saturated with shopping areas, how many of the objects can be attributed to new and modern, where retailers feel the lack of space, and where the market is close to filling.

We hope that our analytical report will be useful for you!

What was considered

For the analysis, we chose all the regional centers of Ukraine (excluding occupied Donetsk, Lugansk and the capital of the annexed Crimea Simferopol), as well as two cities that are in the top-10 by population: Krivoy Rog and Mariupol. We first of all paid attention to shopping and shopping and entertainment centers with a leasing area of over 10,000 sq. m. during the research. Centers with smaller area and street-retail facilities were not taken into account, including because it is almost impossible to find reliable information about its. Specialized shopping centers where more than half of the square is accounted for by one operator also were not taken into account. Such centers include the objects METRO, AuCHAN, Epicenter, Arsen and others.

Each city was analyzed on 10 parameters:

- Number of SEC in the city

- Number of SC in the city

- The largest SC / SEC of the city

- Global Lease Area (GLA) of SEC

- Global Lease Area (GLA) of SC

- Global Lease Area (GLA) of SEC and SC

- Modern high-quality retail space (the lease area of SEC and SC, open or overhauled in the last 15 years – since 2003)

- Lease area per 1000 inhabitants

- Modern retail space per 1000 inhabitants

- Saturation with high-quality retail space by regions of Ukraine

Why considered

It is more or less clear relatively on parameters the minimum allowed area and the lack of specialization. But the reasons for which we chose precisely these criteria need clarification. The division of SEC and the SC is explained by the fact that in the regions there are enough buildings of Soviet times, even those that have undergone a major overhaul. In this case, the shopping center may well offer visitors worthy tenant-mix, but here the areas allocated for a food-court and an entertainment zone will be relatively small or nonexistent.

Meanwhile, in recent years, most research and analytical companies have noted the growing role of the Entertainment and Food & Beverage zones. More and more people go to the SEC not so much for shopping, as for a pleasant pastime, communication with friends, and meetings with colleagues and so on. Accordingly, the presence of an extensive entertainment zone and a diverse food-court becomes a SEC strong competitive advantage.

We proceeded from the same logic, singling out from the total number of retail facilities modern quality SEC / SC. Over the past 15 years, the requirements for the retail property, the design and zoning principles, construction technologies and used materials, and much more have changed a lot. Moreover – even relatively “young” shopping centers are changing rapidly, following the current trends and consumer’s wishes.

Given these criteria, we can analyze the situation with retail space in any one regional center and region. Including we can get answers to such important for retailers and developer’s issues like:

- how much is the city full of shopping areas?

- how many of its refers to modern quality areas?

- how many square meters of the SC and SEC leased area accounts for each resident, and how many of its refers to quality areas?

- how many of the shopping facilities have an entertainment zone?

If we will know the answers to these questions, we can assess whether a particular city needs a new SC and SEC, how difficult it will be to enter the region for a retailer and to choose the most promising directions for expansion and investment.

How considered

The basic information for the study was obtained from the Association’s own database and open sources. We turned to profile associations (such as the Ukrainian representation of the International Council of Shopping Centers ICSC), development, consulting and brokerage companies to clarify and re-check the information. Also, some of the data was obtained through direct communication with management companies and regional trading centers owners. The population of cities is indicated by the data of the State Statistics Committee, its regional departments and the relevant regional and city state administrations. All calculations were carried out by the Ukrainian Retail Association co-worker.

Ukraine

Western Region

Central region

South Region

Eastern region

Nothern region

Kyiv

Ukraine

In total, we counted 119 SC and SEC – 39 shopping centers, and 80 shopping and entertainment centers in the regional centers of Ukraine. Its total leasable area is almost 3.2 million sq., of which slightly less than 3 million sq. are located in objects that are open or overhauled in the last 15 years. The figures seem to be impressive, but in fact, for 1000 Ukrainians there are only 75 sq. of trade area. In this case, we need to take into account a number of nuances:

- Gosstat gives the country’s population of 42 million 364 thousand people, which hardly answers reality. The global population census has not been conducted for several years; in addition, the calculation’s methodology in the case of the AR Crimea and certain regions of the Donetsk and Lugansk regions controlled by pro-Russian terrorists is incomprehensible. In reality, the population of the country may be much smaller;

- As we already indicated, only SC and SEC of the Ukrainian regional centers (as well as Krivoy Rog and Mariupol) with a lease area of more than 10,000 sq. and not related to specialized SC take part in our study. For example, only shopping centers Epicenter have a total square of 1.5 million sq., and METRO – 183 000 sq. Street-retail and freestanding buildings premises is also not taken into account. The total square of shops Fozzy Group (chain Silpo, Fora, Thrash !, Le Silpo and others) exceeds 540 000 sq., and only a small part of it is located in the SC and SEC. If we take into account all these retail properties, as well as clothes shops located in street-retail, the average trade square for each Ukrainian will be much higher. But our research is devoted only to SC and SEC;

- As we already noted, only regional centers were taken into account, plus Krivoy Rog and Mariupol. It is a lot of retail facilities, including a less than 10,000 sq. lease area in the regional centers, satellite towns and cities of regional subordination, too. If we take into account these retail facilities by the calculation of the average trade area per Ukrainians, the situation will change somewhat.

Nevertheless, the potential for the retail real estate development in Ukraine remains is very high. What it is the confirmation: under construction and announced SEC, and not only in Kiev, but also in other cities: Kharkov, Odessa, Zaporozhye, Uzhgorod, the Dnepr and so on.

Western Region

We have included eight regions to Western Ukraine: Transcarpathian, Lvov, Volyn, Ivano-Frankovsk, Rovno, Ternopol and Chernovtsi. It is easy to see that this region is considerably inferior to other regions of Ukraine in terms of the saturation of modern SC and SEC. There are only 17 SC and SEC with a total square of 466,300 sq. at 8 regional centers. There are on the average per 1000 inhabitants of Western Ukraine – only 44 sq. of trade area.

At the same time, it is worth considering that a significant part of the region’s population does not live in regional centers, but in small towns, rural settlements and villages. If we only take into account the residents of the regional centers, then the picture by the saturation of the trade areas immediately changes for the better. For example, there are 334 sq. per 1000 people trade space in Rovno in SEC. There are for a thousand residents of Chernovtsi – 342 sq., Ternopol – 219 sq. These indicators are much higher than average Ukrainian.

But it should be noted only one modern SEC with GLA over 10 000 sq. there is in Lutsk and Ivano-Frankovsk, in Khmelnytsky and Ternopol – only two each. And there is not even a single one in Uzhgorod. The SEC Corona opening announced at the end of last year, is still being delayed.

Central region

Five regions relate to this country part: Vinnitsa, Cherkassy, Dnepr, Poltava and Kirivograd. In total, 24 SC and SEC operate in the region, of which 10 are located in one of the largest country cities – the Dnepr. What is noteworthy – that all the region trading facilities were built over the past 15 years, that is, it refers to quality SEC according to our classification.

The average trade area per 1000 population of this region is slightly less than 62 sq. But, if we take GLA per person in regional centers, the situation is changing a lot as in the case of Western Ukraine. For example, there are 327.59 sq. of trade space per 1,000 inhabitants in Poltava – it is more than a decent figure, 221 sq. in the Dnepr, and slightly less than 200 sq. in Vinnitsa. That is, the retail real estate development is quite developed in the regional centers, and the average low figure for the region is explained by the fact that a large part of the population lives outside the regional centers.

At the same time, there is a lot to grow: for example, in Kropivnitski there is still no one SEC with leasable area of more than 10,000 sq.

South Region

As already mentioned, we do not take into account in our study the SC and SEC which are located in the annexed by Russia Crimea. Therefore, we considered in this region the Odessa, Nykolaev, Kherson and Zaporozhye regions. What we can immediately be noted: there are quality retail properties with a leasing area of more than 10,000 sq. in all administrative centers of these areas. Its total area is 480 780 “squares”, and 76.42 sq. of trade space in the SC and SEC account per thousand inhabitants of the region. In total, there are 22 trade objects in these four areas.

The city, which is most provided with shopping centers, is Odessa, there are 6 SEC and 6 SC with a total rentable area of almost 275,000 sq. But the most secured in terms of “squares” per thousand populations is Kherson: almost 300 sq. Odessa was not far behind – 271.5 sq. per 1,000 inhabitants. The rest is far behind: in Zaporozhye – 97 sq. / 1000 inhabitants, Nikolaev – 76 sq. /1000 inhabitants.

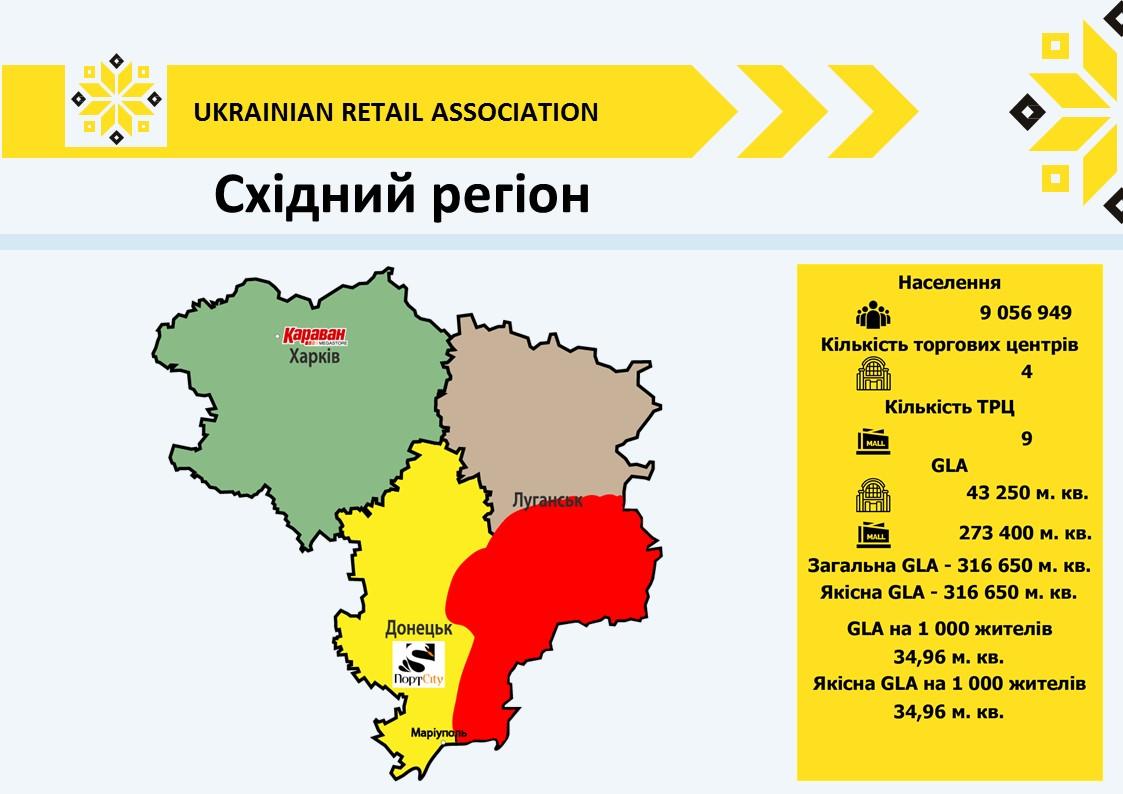

Eastern region

We have included here only three areas: Kharkov, Donetsk and Lugansk. For obvious reasons, our research does not take into account the trade objects located in the cities captured by pro-Russian terrorists. So the data may not be entirely correct: it is difficult to understand the methodology used by the State Statistics Committee to calculate the region’s population.

There are 12 objects, GLA of which exceeds 10 000 sq. in total in the region on the territory under Ukraine’s control. Eight of its work in Kharkov (the famous “Barabashovo” we did not take into account) and four – in Mariupol. As already noted, the average trade space in SEC per 1000 population may be significantly understated in the region. So it is better to pay attention to these two cities. There are 160 “squares” in the SC and SEC for a thousand Kharkov people, and for a thousand inhabitants of Mariupol – 164 sq. The indicators are decent, but it is much lower than the average European and other large cities: the Dnepr, Odessa, Kiev and others. That is, the potential for the development of retail real estate remains quite high in this region.

Northern region

We have included here only three areas: Zhytomyr, Chernigov and Sumy. There are only 7 commercial properties with a total lease area 205,100 sq. at 3 regional centers, and 61.35 sq. is for a thousand inhabitants.

At the same time, the saturation with shopping areas, again, is much higher in administrative centers. The only Zhytomyr SEC immediately provides 292 sq. per 1000 population, two Chernihiv SEC – 203.5 sq., four Sumy SEC – almost 256 sq. The situation is fine in regional centers with retail real estate, although there is potential for further growth. On the other hand, Ukraine has enough cities, much more attractive for the SC and SEC construction.

Kyiv

And, finally, we separately identified the capital of Ukraine. Almost a third of the country’s high-quality retail property is concentrated here: 14 shopping and 22 shopping and entertainment centers. Its total leased area is more than 1.2 million sq. 258.61 sq. accounts for thousand Kiev people. But Europe is still far away: for example, in Warsaw this figure is 823 sq. / 1000 people, in Madrid – 726 sq., in Prague – 521 sq., in Milan – 400 sq.

At the same time, the purchasing power in Kiev and in the regions is different in many times. So it is not surprising that most of the developers choose the capital when choosing a location for the SEC construction. SEC: Rive Gauche, Petrovka Retail Park, River Mall, Ocean Mall, Blockbuster Mall, Good Life shopping center and a number of other objects are announced for commissioning this year. The level of saturation with Kyiv’s shopping areas may come close to those of London, Paris and Moscow, after these SEC opening.

Read also

Ролики тижня: Київстар, Vovk, Повернись живим, Сімейна пекарня та відеокліп рок-гурту U2 за участю військових “Хартії”