Mobile-First Award 2025: Public voting for the best mobile apps in Ukraine is now open

24.03.2023 09:00

24.03.2023 09:00Which retailers only ponder entering the Polish market, which have already started the entry or are working on it, and which had to leave: the experience of Rozetka, Silpo, Makeup, Nova Poshta, Lviv Croissants, and others.

According to the Social Insurance Fund, almost 6,000 Ukrainian firms have already entered the Polish market, which makes up 25 % from the entire share of foreign companies in Poland. Large Ukrainian companies have also turned a keener eye to the west – these are retail businesses which were known to be more careful what concerned internation expansion. This RAU material is dedicated to entities only starting their journey, those which have already reached a certain success, and those who found the new market too unpredictable and are already wrapping up the Polish venture.

Fozzy Group, one of the leaders of Ukrainian FMCG retail, is looking for the opportunities to represent Silpo supermarket chain in Poland. Such are the unofficial reports of Polish portal Wiadomoscihandlowe.pl, noting that the company is already looking for premises for the first stores. One of the obvious benefits of the expansion is a significant amount of Ukrainians residing or temporarily staying in the country.

According to Wiadomoscihandlowe.pl, there are not so many high-quality premises in Poland which comply with the demands of the Ukrainian group. Hence, the company is considering all the options, from leasing the separate buildings to the buyout of local operators. “During the last months, the Silpo trade network has become increasingly interested in the Polish retail market. Prior to the full-scale Russian invasion, we have been studying the best retail trade practices for FMCG in the USA, UK, China, Spain, France, and other EU countries. We continue these endeavors in Poland,” Fozzy Group press service commented.

Ihor Guglya, Director of GT Partners Ukraine research company, thinks Silpo can at once become an ambassador of a lot of Ukrainian brands in Europe, a novelty for local consumers. Opening the retailer’s branded conceptual markets may be an ideal response to the competitive market of Poland. However, there are still no specific statements or terms.

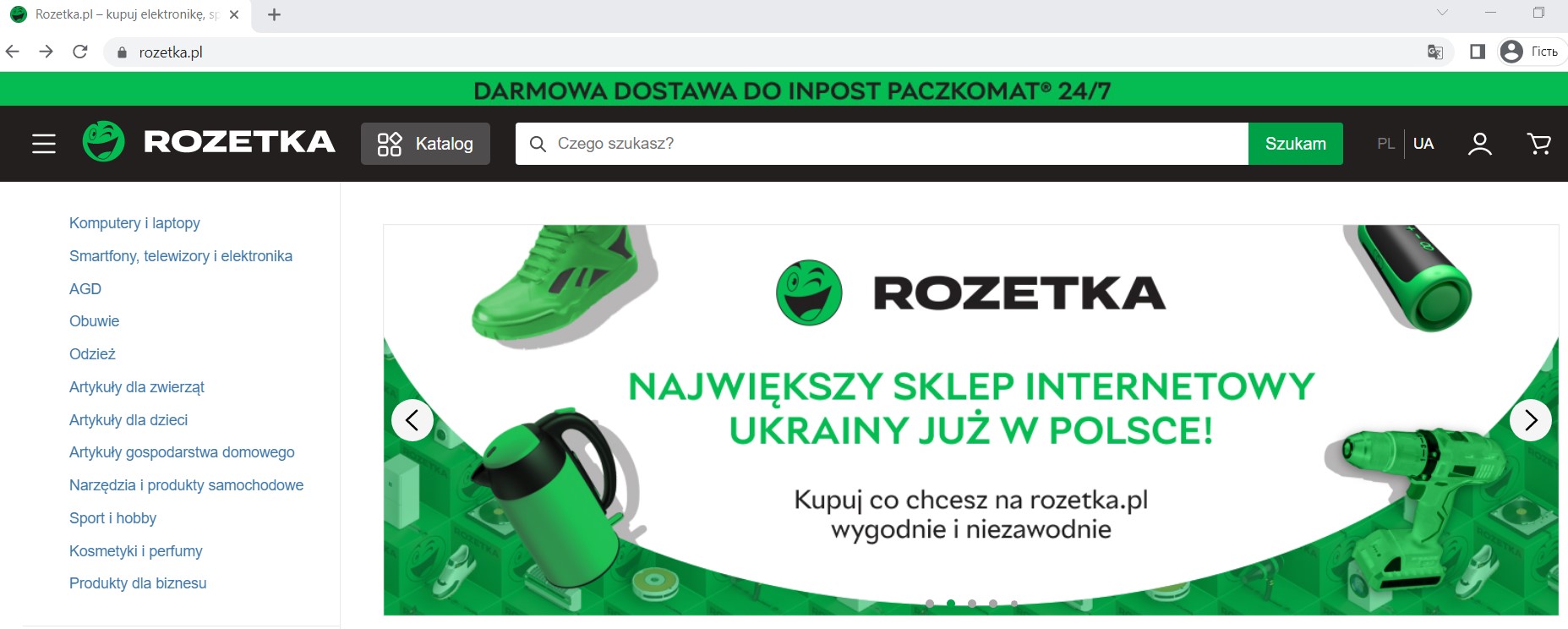

Rozetka, the largest online retailer in Ukraine, has launched delivery to Poland last autumn.‑ The company realized its first European experience was a success, for in half a year, in March 2023, Rozetka levelled-up in terms of expansion and launched an online store, albeit in a test mode for now. Rozetka Poland offers such categories of the goods as household appliances, electronics, clothes and footwear, children goods, pet goods, household items, tools, etc. The purchases are delivered throughout the country.

The items are delivered to parcel lockers or by courier at the addresses throughout Poland. The company currently has no plans as to selling the goods of third party salesman on its new online platform. Poland has its own e‑commerce giant – Allegro.pl marketplace covering over 60 % of local consumers. So, the first goal of Polish operations is to just break even. “We are testing all the processes, adding the range to the website, and arranging the logistics. We expect both a large Ukrainian target audience (over 2,000,000 Ukrainians live in Poland) and numerous local clients,” Vladyslav Chechotkin, co-founder of Rozetka, explains.

The largest beauty-sector marketplace in Ukraine, Makeup, opened its first Beauty Atelier in Poland. The company made a social media announcement to that effect. The online retailer posted job vacancies for hair experts, stylists, cosmeticians, and administrators for the residents of Warsaw.

The first Polish Makeup now operates on the minus first floor of Wola Par mall in Warsaw at 124 Górczewska Street. According to the local resources, this is rather a beauty parlor than a store: clients come here for haircuts, hairdos, and make-up services. Retail trade is currently not effected.

Nova Poshta began scaling the Polish branches last year, and on January 10, 2023, the post operator informed about opening of the first freight branch in Poland. Nova Post 01/1 is located in Warsaw at 94 Jana Olbrachta Street. Later, the company informed about opening of the second freight branch in Głogów Małopolski, at 5 Strefowa Street. Apart from these, as of March, 17 branches worked in Poland: in Warsaw, Lodz, Lublin, Wroclaw, Gdansk, Poznan, Rzeszów, Krakow, and Katowice. Currently, the company actively extends its Polish branch network.

Ukrainians can send to Ukraine and receive in Poland the freight weighing up to 1,000 kg in freight branches, including large suitcases with personal belongings and large appliances (in factory packing) and up to 30 kg in usual branches. The services are not subject to customs and customs clearance taxes. Any freight is delivered from 5 days.

Poland became the first country of the global expansion, according to the plans of Nova Poshta co-owners Viacheslav Klymov and Volodymyr Popereshniuk. The first Nova Post branch also opened in Lithuanian Vilnius on March 20.

Ukrainian Chornomorka restaurant chain opened its first Polish venue on December 9, 2022. The restaurant now operates in Warsaw at 43/49 Hoża Street, lok. 2. On February 27, 2023, Olha Kopylova, founder of Chornomorka, stated, “We are ready to sell the Chornomorka franchise to Poland. Why now? Two Czarnomorka venues have been open, and they are profitable from the first month on. Fish and oyster supplies are stable. We have a lot of satisfied guests. 70 % of them are Polish, which is an indicator of success.”

This is not the first attempt to conquer the Eastern Europe for Chornomorka, Ukrainian restaurant chain specializing in fish and seafood. After the beginning of the full-scale war, it opened its restaurants in Romania and Moldova.

Inna and Oleh Yarovyi have opened the first venue in Warsaw back in 2016 and immediately got to the Polish Records as the smallest cafe (6 square meters). However, it was not an obstacle for an active growth of the network for the next several years. Now, the Dobro&Dobro brand unites the venues in Warsaw, Wroclaw, Krakow, Gdansk, and Kalisz, with 15 coffee shops in total.

“The biggest mistake of a Ukrainian entrepreneur entering the Polish market is being sure that the Poles and the Ukrainian are similar. In reality, it is the most important distinguishing feature impacting the market, business communications, clients, consumer traditions, the range, prices, and marketing. To work with the Poles, one needs to live among them and understand them,” stated Inna Yarova, co-owner of the network, in an interview with the RAU. Currently, the Ukrainian and Polish retailers also own Sushisushi cafe and Prosecco oyster bar.

Last year, the Lviv Croissants chain also began its expansion on Poland, opening three venues: Zgorzelec, a shopping mall food court in a small town near the border, one in Wroclaw, and one in Poland – this time, full-scale cafes in large cities downtowns. The company entered the Polish market with the range identical to the Ukrainian offer – sweet croissants, breakfast grilled croissants (depending on the location), additives to croissants, and cold and hot beverages assortment.

The business model acquired in Poland resembles the Ukrainian one, that is, two types of venues are to be open: the owned and the franchised. As for the conditions, they stay the same: a lump-sum payment of EUR 10,000, and royalty of 3 % of the monthly revenue. The investments depend on the local market prices for construction materials, decoration works, equipment, interior items, stock, etc. All the large Polish cities and towns with the population of 30 to 35 thousand are of interest. In addition, the company may open a regional office staffed predominantly by Polish experts or those relocated from Ukraine.

Another Lviv-based business has prepared all the arrangements for Polish venues – Piana Vyshnia by !Fest Holding of Emotions. The company began expanding its Polish network in 2021 using a franchising model. Currently, 10 Piana Vyshnia network bars work throughout Poland only. Three of them are located in Warsaw, another two – in Krakow and Lodz, and one each in Wroclaw, Poznan, and Gdansk.

The company keeps searching for new partners both in Poland and other European cities. In 2022, !Fest opened 11 new Piana Vyshnia bars. The majority of new venues appeared in Poland and Lithuania. In total, the Piana Vyshnia franchises have already been open in Poland (10), Moldova (1), Romania (2), Hungary (1), and Latvia (1). The !Fest co-owners ponder over the entry to European market with another project – Rebernia restaurant.

Naturally, not all the attempts to conquer the Polish market by Ukrainian retailers turned out to be successful. The first try to win the hearts of the Poles was made back in 2011. Andrii Khudo, co-owner of the company, together with his partners opened Lviv Handmade Chocolate restaurant factory in Krakow. Yet poor knowledge of the local real estate market and absence of traffic research had a negative effect on business, and the venue was closed in five years.

Ukrzoloto opened the first Polish venue entitled Golden Place in 2015. In was situated in Bialystok town, in Outlet Bialystok mall. The range of the 433 square meter venue was 40 % Polish and 60 % Ukrainian. Soon enough, the second store especially designed for the Polish market was open in a large Wroclaw mall Park Hendlowy Bielyany. The company founder Oleksii Rohozhynvkyi stated that Ukrzoloto found four more platforms for Golden Place in Poland. However, the plans remained only on paper.

Later, when the network management analyzed the reasons why Golden Place failed on the Polish market, they revealed the following: excessive self-confidence, premise compromises, and staffing. “We thought uniting a Ukrainian and a Pole, that is, a manager from Ukraine and an expert hired in Poland, in one team would do the trick. We were wrong. The tandem did not work. An owner should be ready to delay all the other tasks and launch the project in person at the beginning,” they recollected.

The GastroFamily founder Dmytro Borysov announced the franchise expansion to different countries in mid-June 2022. Poland was among the potential franchisees, having the freedom to decide on the specific brands. Dmytro Borysov states that in autumn, the company sold seven franchises to its Biliy Nalyv, Mushlya, BPSHA, and GastroFamily Food Market businesses. The international venues are to be open in Poland, the UK, Moldova, Bulgaria, and Romania.

However, that was not the first attempt of the restaurant businessman to take up Poland. As it became too difficult to manage a foreign venue in 2020, GastroFamily by Dmytro Borysov had to close Kanapa Ukrainian cuisine restaurant in Warsaw. According to Mr. Borysov, before the quarantine broke, Ukrainian cuisine was rather popular among the Poles, and Kanapa worked just fine. It was the strict quarantine restrictions that made it impossible to continue managing the business. Dmytro had to sell the venue with a 80 % discount, resulting in over EUR 1,000,000 in losses.