Deloitte Report: Global Powers of Retailing 2018

It is a transformative time in retail. The shopper is clearly in the driver’s seat, enabled by technology to remain constantly connected and more empowered than ever before to drive changes in shopping behavior.

Deloitte presented an annual report – Global Powers of Retailing 2018. This year’s report focuses on the theme of “Transformative change, reinvigorated commerce,” which looks at the latest retail trends and the future of retailing through the lens of young consumers. To mark this 21st edition, there will also be a retrospective which looks at how the Top 250 has changed over the last 15 years. RAU prepared a shot version of the report.

Retail trends: Transformative change, reinvigorated commerce

It is a transformative time in retail. The shopper is clearly in the driver’s seat, enabled by technology to remain constantly connected and more empowered than ever before to drive changes in shopping behavior. “Everywhere commerce” has taken root, allowing consumers to shop however, wherever, and whenever they want — whether in stores, online, by mobile, voice activation or click-and-collect.

Across the retail industry, disruption of traditional business models has given way to unprecedented and transformative change — change required online and offline to better serve more demanding shoppers and redefining customer experience.

Innovations and transformations are happening faster and at a greater magnitude than ever, presenting challenges for retailers accustomed to balancing conventional performance metrics like growth, profitability, and space productivity.

The standards are shifting, however, as some of the world’s nimblest and fastest-growing retailers—recognized industry disruptors like Amazon and JD.com—actively forego short-term profitability in their quest instead for customer acquisition, topline expansion, and retail dominance. Established and entrenched retailers could be at risk of losing customers and market share to these retail disruptors who are able to exploit organizational and operational agility.

Stores are closing as retail spending moves online at a meteoric pace, gets overturned by spending on services, and some retailers generally lose favor with consumers. In fact, the US saw a record number of store closings in 2017, with 6,885 stores already having shut their doors by 1 December.1 Among those rationalizing their store bases are Macy’s, J.C.Penney, Sears/Kmart and a host of mall-based apparel specialists.

Stores across the globe face a similar fate as retailers close unprofitable stores to instead focus on their most productive and promising locations.

The rules of retailing indeed are being rewritten in this time of transformative change. Innovation, collaboration, consolidation, integration, and automation will be required to reinvigorate commerce, profoundly impacting the way retailers do business now, and in the future.

Building world-class digital capabilities

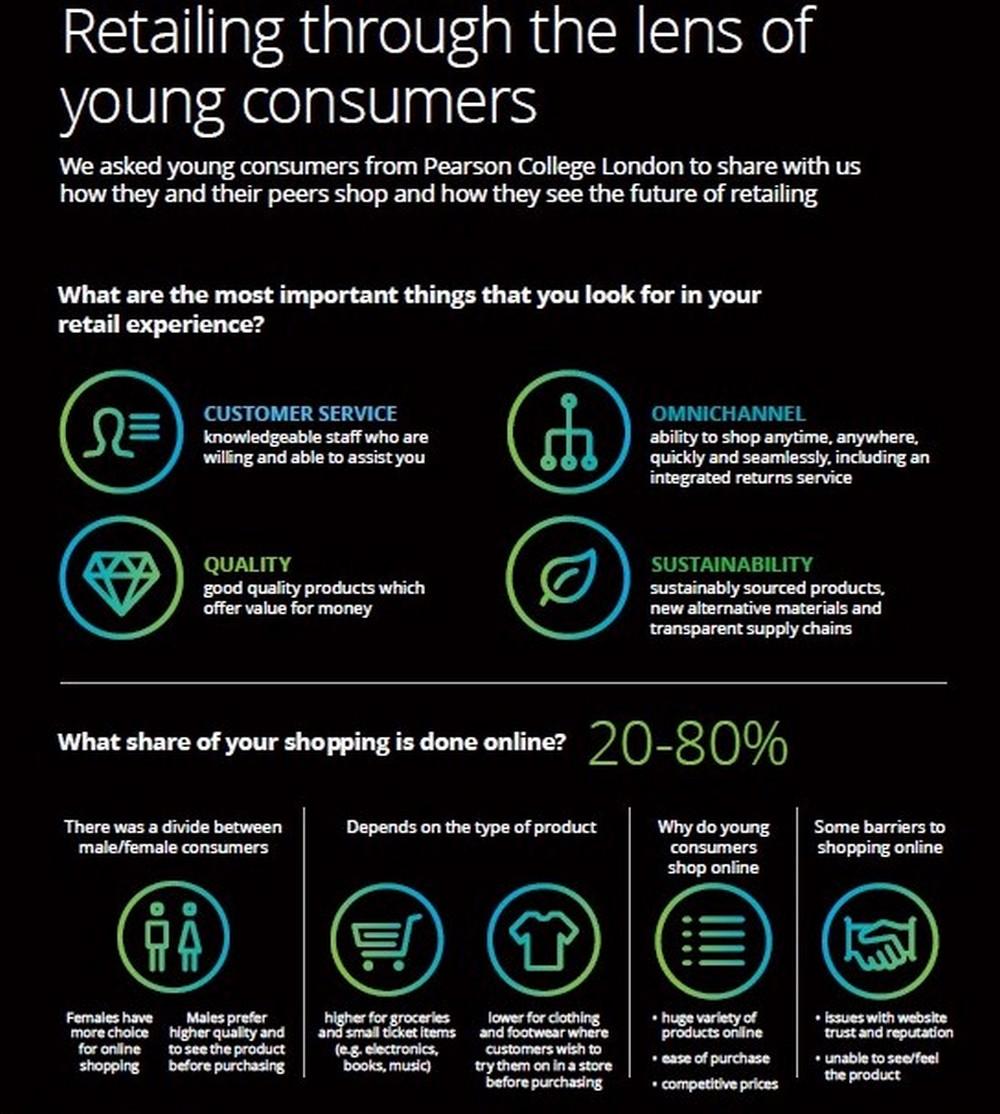

Retailers across the globe are rapidly adapting to the fact that, from the consumer perspective, shopping is not about bricks versus clicks or one channel versus another. Instead, consumers are channel-agnostic. The shopping journey and pre-shopping research is a fluid process with consumers bouncing between online and offline along the path to purchase. Just how much digital influences consumer spending is a real eyeopener.

In the 2016 report The New Digital Divide, Deloitte found that digital interactions influence 56 cents of every dollar spent in bricks-and-mortar stores, 2 up from 36 cents just three years prior. Furthermore, people who shop using different methods—including online, mobile and visits to a physical store—spend more than double those who only shop at bricksand-mortar stores, according to Deloitte’s The Omnichannel Opportunity study.

This means retailers must adequately and holistically plan, strategize, and execute across all channels, regardless of whether the ultimate sale happens in-store or online. A seamless shopping experience is no longer a nice to have, but an imperative. And it is a key reason why retailers worldwide are heavily investing in online and digital.

More than ever, the retail industry is rife with examples of companies building, buying, or partnering to attain much-needed e-commerce and last-mile capabilities. Most notably is Amazon’s rapid ascent up the Top 250 ranking from its debut at No. 18 in FY2000 to No. 6 in this year’s report. The retail giant is bigger and more powerful than ever. It continues to enter new markets, expand product categories, and test new technologies and concepts, leaving a path of disruption in its wake.

In what could be one of its biggest moves to date, Amazon gained an instant bricks-and-mortar presence when it bought natural supermarket Whole Foods Market in August 2016. The deal gives Amazon access to more than 450 physical pickup points and fresh food “distribution centers” located throughout the US. The retailer also is preparing its internally developed checkout-free Amazon Go convenience concept for prime time. A single store has been in test mode by company associates since early 2017.

Combining bricks and clicks makes up for lost time

The rest of the retailing world is not about to sit idly by and watch Amazon shoot up the retail ranks and steal market share. Many players that may have initially been on the sidelines, failing to keep up with digital trends, are now making up for lost time in a big way.

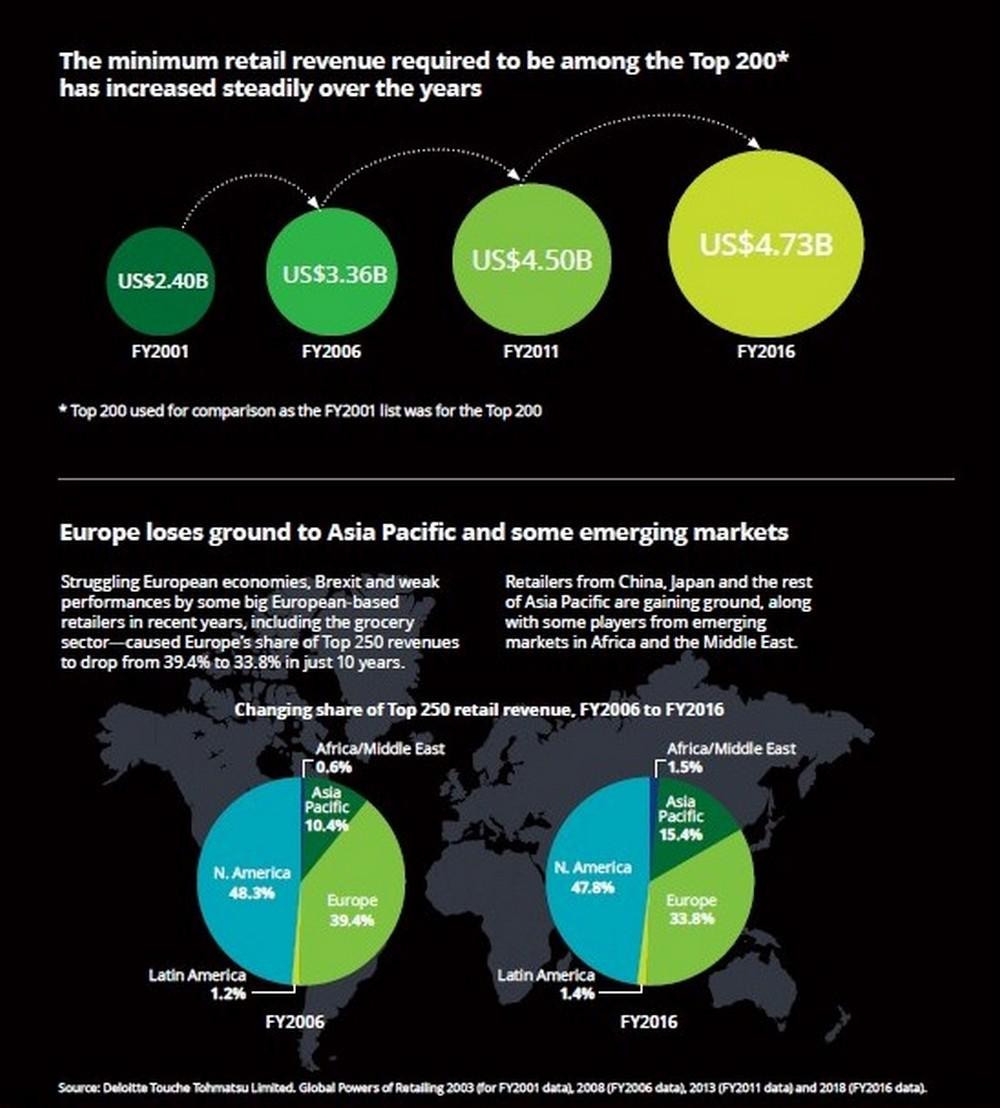

A recent study finds that global grocery sales through e-commerce channels jumped 30 percent in the past year.5 Countries leading the growth charge were China (+52%), South Korea (+41%), the UK (+8%), France (+7%), and Japan and the US (both +5%). China is the world’s dominant e-commerce—and mobile—market. Two of the top three fastest-growing retailers in 2016 are China-based e-commerce retailers Vipshop and JD.com.

The world’s largest retailer Wal-Mart has made it clear that e-commerce is one of the company’s strategic pillars.

Wal-Mart is pumping billions in capital investment to introduce Grocery Online, ramp up click-and-collect capabilities, and leverage its vast network of stores to marry online and offline assets and gain an edge over Amazon. The retail behemoth also has been on an acquisition spree of late, buying the likes of Jet.com, ShoeBuy, Moosejaw, ModCloth, and Bonobos to quickly attain e-commerce capabilities in lieu of building from the ground up.

Increasingly though, forging e-commerce partnerships, in which each party brings something unique to the table, is gaining traction.

Wal-Mart and JD.com formed a strategic alliance in June 2016, positioning the world’s No. 1 retailer for growth in China. As part of the deal, Wal-Mart sold its Yihaodian e-commerce business to JD.com and took a 5 percent stake in JD that has since grown to 10 percent. More recently, JD.com partnered with leading Thai retailer Central Group too, with plans to launch an online shopping site in Thailand in 2018.

French grocer Auchan and Chinese e-commerce technology platform Alibaba are bringing together their respective offline and online expertise to explore new retail opportunities in China’s food sector, leveraging the physical presence of Sun Art Retail Group, in which Auchan is a leading shareholder. French supermarket chain Casino has inked a deal with online retailer Ocado to leverage the latter’s technology platform to launch an e-commerce business in France. In Spain, DIA is partnering with online discount retailer MeQuedoUno to expand its e-commerce offer in electronics and other household goods.

Meanwhile, since the Amazon/Whole Foods combination was announced, it seems not a day goes by in the US without another supermarket player aligning with third-party provider Instacart on grocery home delivery. Instacart’s increasingly lengthy and impressive list of retail partners includes Kroger, Price Chopper, Publix, Stop & Shop, Wegmans, and even hard discounter Aldi. Instacart recently crossed north of the border, forging an e-commerce alliance with Canadian’s top grocer Loblaw.

Interestingly, Amazon has been busy designing some partnerships of its own to try and solve the last-mile delivery conundrum.

The retail giant broadened its collaboration with UK grocer Morrison’s to bring one-hour grocery delivery to London-area shoppers. In the US, Amazon is pairing with several shoppable recipe sites, including Allrecipes, EatLove, and Serious Eats, to add buying and delivery services, typically through its Prime Now offer. The e-tailer also recently opened the “Amazon Smart Home Experience” inside select Kohl’s department stores in Los Angeles and Chicago, including an area inside the store that accepts Amazon returns.

Creating unique and compelling in-store experiences

Physical retail stores are not going away; 90 percent of worldwide retail sales are still done in physical stores. But to compete with the convenience and endless aisle assortment offered online, meaningful customer experiences and brand engagement is crucial. Apple Stores and Nike Retail are held as the gold standard in this regard.

Other bricks-and-mortar retailers are realizing the importance of creating unique and curated merchandise offers, an exciting and entertaining atmosphere, and concierge-like service levels beyond what consumers can find online. What is starting to happen inside grocery stores across the globe is a good example.

Grocers are transitioning from providers of goods to purveyors of services and solutions, with food, health, and wellness converging in a retail setting. A host of retailers already have added instore health clinics and on-site nutritionists and dieticians. US supermarket chain Hy-Vee is now teaming with OrangeTheory fitness centers to open locations in some stores and integrate training and nutrition services. In the UK, Debenhams is trialing fitness centers in collaboration with gym specialist Sweat!

Lowe’s home improvement chain is rolling out its “Smart Home powered by b8ta” connected-home store-within-a-store experience to more stores. The fast-growing b8ta electronics startup has a reputation for exceptional service and product knowledge provided by staff known as “b8ta testers”. Now Lowe’s offers a curated selection of smart home products that encourage hands-on play with shops staffed by none other than b8ta testers to support the shopping process. Macy’s is adding b8ta outposts inside its flagship stores as well.

It would be remiss not to mention how fast fashion retailers across the globe continue to disrupt the apparel sector. Spain’s Inditex (Zara), Sweden’s H&M, and Japan’s Fast Retailing (Uniqlo) have each grown sales at a double-digit annual pace, on average, during the last five years.

These retailers have reduced the fashion cycle to about five weeks compared with traditional retailers’ six to nine months. Providing consumers immediate gratification of affordable fashion-forward merchandise differentiates these retailers in the marketplace.

Reinventing retail with the latest technologies

Few times in history have rapid advancements in technology and breakthrough innovations had the ability to disrupt retail business models in such fast and allencompassing ways. If not already, the Internet of Things, artificial intelligence, augmented and virtual reality (AR/VR), and robots should be on every retailer’s radar.

These kinds of enabling technologies and automation, among others, are staking a claim in retail as tools that both bricks-and-mortar and online retailers alike can use to further elevate their businesses and advance customer relationships.

Voice-controlled electronic devices powered by artificial intelligence technology, like Amazon Echo, Echo Dot, and Google Home, are disrupting the path to purchase. Amazon’s Echo and Dot, for example, have built-in capabilities that sync with Amazon.com for shopping purposes. With a simple voice command, shoppers order items for direct delivery through Alexa, the “voice” behind Amazon’s AI technology, without going online or stepping foot in a store. Not too surprisingly, Amazon holds 68 percent of smart speaker market share. Alexa moved into Canada in November 2017. Australia can likely expect the same when Amazon enters the region in 2018.

To challenge Amazon’s Alexa, Wal-Mart began partnering with Google in October 2017 to bring voice-assisted shopping to its customers using Google Home. Google also has recruited The Home Depot and Target as retail partners adopting Google Assistant for voice shopping.

Leading edge technology also is being deployed inside stores to enhance and personalize the shopping experience—and generally drive in-store traffic.

IKEA has integrated an AR/VR experience in its new pop-up concepts throughout the Middle East. German consumer electronics retailer Ceconomy, spun off from Metro in July 2017, has launched a VR application for its Saturn banner, enabling shoppers to browse for 100 selected products in two virtual environments. Spain’s El Corte Ingles immerses shoppers on a wine journey with its VR app promoting its range of Rioja wines.

In-store robots are being trialed by several retailers to handle routine and often mundane tasks, and improve efficiency and service levels.

Wal-Mart and Ahold Delhaize have deployed robots in US stores to support tasks such as scanning shelves and counting stock. LoweBot assists Lowe’s home improvement chain customers navigate aisles where they can find and scan products and check store availability. Russian supermarket chain Lenta recently rolled out customer service “Promobots” in its stores.

Perhaps one of the most progressive uses of technology and automation is in the emergence of unmanned stores. “Grab and go” shopping, in every sense of the word, is now reality thanks to mobile pay technology. Although execution is still in the early stages, consumers can now visit a store, self-scan items with a smartphone app, then merely tap the phone to pay and walk out the door, as in the case of Amazon Go.

While the industry is buzzing about Amazon’s physical store trial, retailers around the globe—like China’s electronics retailer Suning in Shanghai and supermarket Coop Danmark in Denmark—are grabbing attention with their own unmanned store pilots as well. In what could be the biggest trial of automated stores to date, Auchan is readying the rollout of “hundreds” of unmanned Minute micro-convenience stores in China.

Read more –

The Ukrainian e-commerce under a microscope: a comparative analysis of country online-stores

Read also

Respublika Park Leads Kyiv Shopping Malls in Tax Payments