10 retail trends to watch in 2019

From store concept advancements to an e-commerce reckoning, the Retail Dive team takes on predictions for the year ahead.

It also set the stage for the year ahead. Will stores be able to build off of the holiday season? Will more companies file for Chapter 11? What will the industry be buzzing about? The staff at Retail Dive looks ahead to the 10 most exciting trends on the horizon.

Sustainability becomes a new focus

Sustainability has become a crucial part of public dialogue worldwide. In 2018, the United Nations Intergovernmental Panel on Climate Change (IPCC) released a study estimating that there are a mere 12 years left to avoid some of the most disastrous impacts of climate change. Retail is taking note.

In 2018, a number of companies expanded sustainability efforts, with outdoor and sporting companies leading the way. In April of last year, REI announced efforts to enforce sustainability standards for its 1,000 vendors. The company also furthered investments to ‘rewild’ five American cities and expanded its gear rental program. The year also saw North Face launch its Renewed line, a collection of damaged and refurbished items to further waste reduction.

A sustainability reality check came last year when it was revealed that Burberry burned and destroyed items it didn’t sell. A forceful public backlash led to a shift in internal policies, with the luxury company vowing to increase efforts to reuse, repair, and recycle products.

But, more has to be done, and accountability is coming from an unlikely source: the UN, which launched the Fashion Industry Charter for Climate Action. The group’s mission to achieve net-zero emissions by 2050 has gained support from brands including Adidas, Gap, Target and H&M.

“We know that climate change is already introducing risks and uncertainty with implications for businesses,” said a spokesperson for UN Climate Change, Global Climate Action in an email interview with Retail Dive. “Fashion is sensitive to consumer demands [that] are increasingly not only becoming environmentally conscious but also environmentally responsible.”

Although apparel represents only one sector of the retail market, the UN initiative illustrates how crucial collaboration is if the larger industry is to create meaningful change. “UN Climate Change has convened fashion stakeholders into a dialogue to enhance collaboration and catalyze efforts to collectively identify and address barriers to climate action,” said the spokesperson.

Store concepts keep rolling

Brick-and-mortar stores continue to evolve in many ways, and more and more retailers are using physical space to experiment with technology, location size or customer services. Many store concepts in 2018 involved downsizing, with Ikea, Barnes & Noble and Nike all opening or announcing plans for small format stores. For Ikea, the move was motivated by the needs of urban shoppers, while both Barnes & Noble and Nike focused on creating community-driven spaces for customers.

For Nike that meant the Nike Live concept, which has localized products and an intimate feel thanks to its tie-ins for its NikePlus members. The concept also pushes mobile technology in stores, including in-store pickup lockers and the ability to reserve products, which also influenced Nike’s new flagship on 5th Avenue.

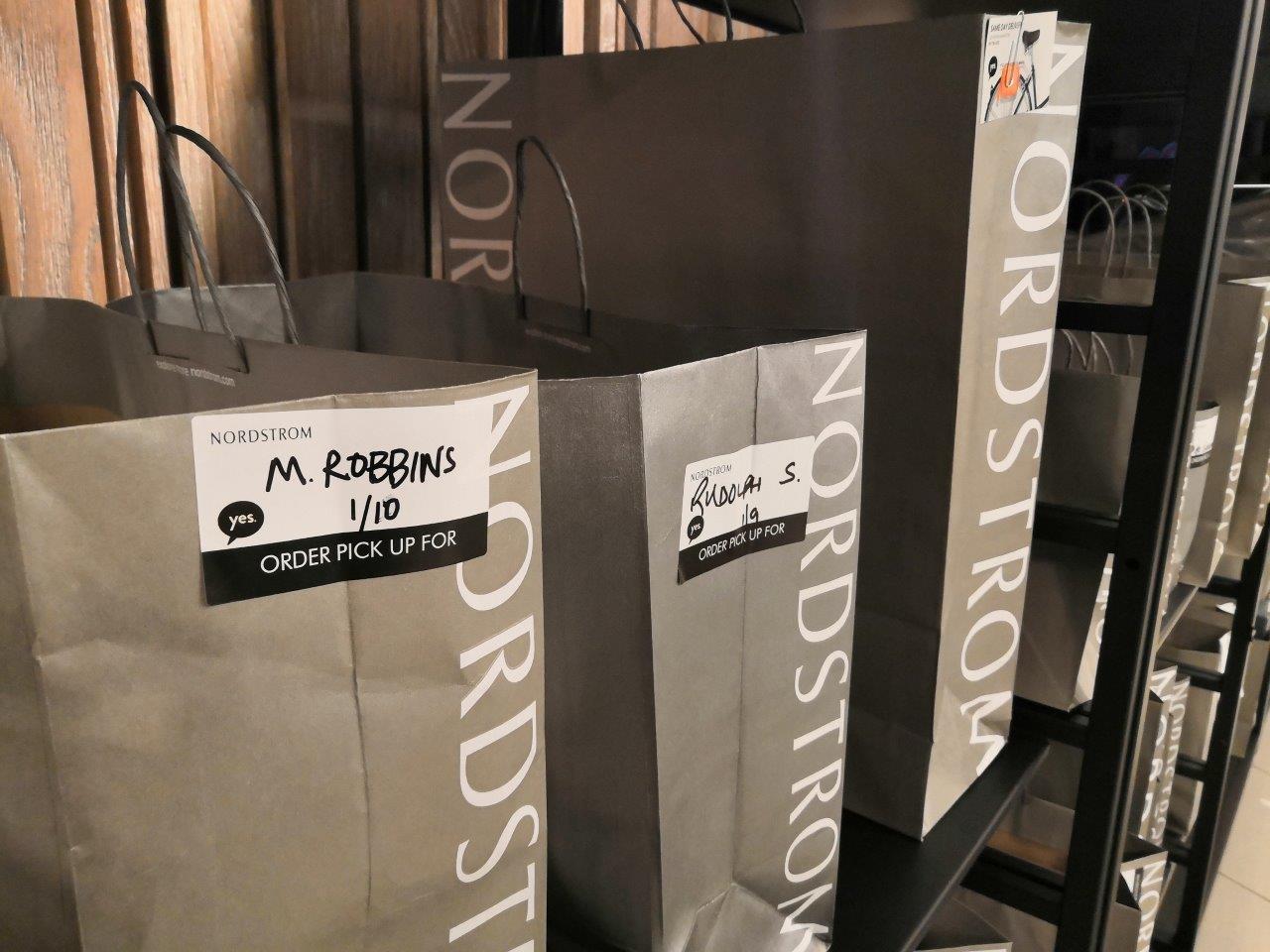

Not all the recent brick-and-mortar experimentation was mobile-focused, though: Casper announced plans for 200 stores by 2021, all to be based off current models which include house-shaped rooms for customers to test out beds; Nordstrom expanded its service-oriented Local concept and CVS announced two store concepts, one focused on its health services and the other on sprucing up its beauty offerings. Beauty startup Glossier also unveiled a highly instagrammable flagship in November, a trend Michelle Grant, head of retailing at Euromonitor International, believes will continue for the coming year.

While many of the new concepts have been the result of young players entering the industry, many traditional retailers have also upped their in-store game, Macy’s foremost among them. The retailer launched shop-in-shops with b8ta and its own concept, The Market @ Macy’s, this year. That trend will likely continue into 2019, with more department stores (and others) trying to refresh stores with experiential offerings, in-store services and fresh store concepts.

“Pop up and new store concepts are permanently part of the sales and marketing strategies of retailers and brands,” Grant said in an email to Retail Dive. “But are we getting closer to consumer fatigue?”

Retail as a service to expand this year

Retailers are exploring options to create a more personalized experience for consumers, and for good reason. Accenture and the Retail Industry Leaders Association released data earlier this year that indicated more consumers than ever want retailers to personalize their shopping experiences. Sixty-three percent of consumers surveyed indicated that they were interested in personalized recommendations, while 64% revealed they were willing to share personal data in exchange for benefits like loyalty points and automatic credits for coupons.

It’s beginning to dawn on retailers that personalization is more than just emails targeted to customers. Some companies are now employing technologies to streamline purchasing channels. Walmart recently equipped employees with an in-store app to allow customers to order and pay for items from the retailer’s website while in the physical store.

“If Walmart is really investing in anything, it’s investing in converting its customers to online customers because I think it recognizes that it’s just ultimately going to be a more efficient model for them,” Retail Prophet CEO and Founder Doug Stephens told Retail Dive last month. “They’re trying to convert consumers at the shelf … Clearly there’s this recognition that this is the model that they want to move to.”

2018 also saw efforts to expand the customer shopping experience by introducing marketplaces within physical spaces, including The Market @ Macy’s, as a means to bring different, curated brands under the larger umbrella of an established retail enterprise. The partnership works for all parties involved: retailers and malls gain merchandise diversity, the smaller companies can avoid expensive leases as they benefit from physical store space, and consumers reap the rewards of a more robust in-store venture.

More retailers are also embracing the retail as a service concept, which Stephens defines as “hosting brands in a space that is curating that space in a very particular way, employing great design, creating great online content, providing staffing, merchandising and providing great analytics.”

Retailers glean lessons from DTC success stories

The rise of e-commerce has ushered in several waves of digitally native, direct-to-consumer (DTC) businesses. Building off the early success of once pure-players like Bonobos in men’s apparel and Warby Parker in eyewear, DTC brands have now sprouted up as disruptors in nearly every category, including Casper in mattresses, Away in luggage, Glossier in beauty and Allbirds in footwear.

E-commerce and increased venture capital investments have allowed more of these kinds of businesses than ever to get off the ground. And social media has helped these digitally native brands quickly build a loyal following. But as they’ve scaled, brick-and-mortar stores have become a necessity for growth. Brands within the category are slated to open nearly 850 physical stores over the next five years, according to a report on over 100 top online retailers from commercial real estate firm JLL. Cities like New York, San Francisco and Los Angeles are the most popular places for brands to experiment with pop-up shops and inaugural permanent stores. New York’s SoHo neighborhood is a particular hotspot for experiential flagship locations.

Through partnerships and acquisitions, traditional retailers like Walmart, Target, Ikea, Serta Simmons and many others are recognizing the promise of the digitally native, DTC model. These types of legacy giants are eyeing a future where they can use more digital elements to lure shoppers into stores. And as Amazon continues to grow its market share, stores are still a major competitive advantage. Target, for one, has credited stores with fueling its digital growth and many big-box and department store retailers are pursuing plans that aim to smooth out the link between online and offline. Learning from DTC brands is just one way to do that.

Private label will grow online

Over the last several years, retailers have doubled down on private label lines. It’s a strategy that has helped mass merchandisers, especially, to differentiate in a new retail landscape where customers are inundated with an unprecedented number of places and ways to buy the same goods. Sales growth of private-label products is now three times higher than branded products, according to research firm CB Insights.

That’s playing out in a fiercely competitive way at mass merchandisers like Walmart, Target and Amazon. Last year, Target launched eight new private label brands, and Amazon added a whopping 66 between the beginning of 2017 and April of 2018.

Building up owned brands is expected to continue, but if retailers are hoping to get the best bang for their buck, they’ll need to invest in the visibility of those brands online. Fewer than 40% of retailers analyzed by Gartner L2 for an April 2018 report surface private labels on their homepage, category pages or product pages. Among other things, that report recommends retailers optimize private label for organic and second-order Google search, and balance private label and vendor brand visibility by featuring those brands together.

The retail landscape will be rearranged

While 2017’s “retail apocalypse” pretty much fizzled in 2018, plenty of stores did close last year. Downsizing from the likes of J.C. Penney, plus the bankruptcies of Toys R Us and Sears, left thousands of locations empty. The brick-and-mortar shrink, however, may have “bottomed out,” according to a note from Wells Fargo analysts Jeffrey Donnelly and Tamara Fique emailed to Retail Dive. “[S]tore closure activity feels like it has peaked,” they wrote. “[P]hysical retailers are fighting back by reinvesting in their stores and some are curtailing store closures … retail landlords have arguably done more than any other property segment to prune the dead wood – properties and tenants – from their portfolios” and investing in “higher growth retail and mixed-use projects.”

“Mixed use” tends to mean “less retail,” but, while many big box stores are joining mall anchors in a disappearing act, dollar stores and off-pricers are expanding, belying the notion that Amazon in particular or e-commerce in general inevitably decimates physical retail.

Those locations, like many renovated and new stores from legacy retailers like Target, are usually smaller and more urban than those that have dominated the American retail landscape for decades. So in 2019, the mall remains under siege, as the model faced a 9% fourth-quarter vacancy rate, a slight improvement from the third quarter’s seven-year high but quite above 2017’s 8.3%, according to real estate research firm Reis. Only the best will likely survive.

“All retailers need to avoid B and C malls, which have nowhere to go but down,” retail analyst Nick Egelanian, president of retail development consultants SiteWorks, told Retail Dive in an email. “But that said, sales at A malls are actually increasing in productivity, as are [Main] Streets, high quality open air centers and most outlet centers.”

Bankruptcies expected to slow

2018 saw several retailers declare bankruptcy. However, many analysts predict the number of bankruptcies may ease up in the year ahead.

“They will slow if for no other reason than a lot of the most troubled retailers have already filed bankruptcy like Toys R Us, Bon-Ton, and of course Sears,” Philip Emma, a senior retail analyst with Debtwire, told Retail Dive in an email. “That said, there are a lot of variables that are new to the equation that will continue to challenge those retailers who were already facing challenges.”

The Fed recently raised interest rates in December and is expected to do so again in 2019, Emma added. “But more problematic than the macro economic factors is the continued market share gains from e-commerce sites not connected to a brick and mortar retailer.”

While there are 31 retailers on the Debtwire Retail Watchlist for December 2018, Emma said there isn’t a name that will without a doubt file bankruptcy this year.

“Pier 1 for example, has been reporting terrible results. But, it still has a significant financial cushion. Unlike the start of 2018, there are no obvious names like Sears and Bon-Ton where you can unequivocally say when, not if, they will file.”

Loyalty gets more relevant

Several big-name retailers made moves to change or update loyalty programs in 2018, with Macy’s leaving the Plenti program and introducing a new one that now allows even customers without a store card to use it. Target pulled a similar move in March for a pilot loyalty program, and many other retailers have also taken 2018 to reexamine (and upgrade) their loyalty offerings. Among others, Kohl’s combined its three loyalty programs into one centered around Kohl’s Cash, J. Crew launched a card-free program and Nordstrom unveiled The Nordy Club — which also paved the way for non-card holding members to participate.

Many of the changes appeared to finally bring loyalty programs up to customer’s expectations, a potentially difficult feat when beauty retailers like Sephora and Ulta have set the bar so high (and keep upgrading their own programs to raise it higher). Even traditional players in the beauty space, like Sally Beauty, have upped perks. But the refreshed rewards programs have cropped up in just about every space — DSW launched a new program in May, which is already paying dividends for the shoe retailer, Wayfair introduced a membership-based loyalty program and Lululemon in its most recent quarter announced an extended pilot for a membership program that would cost over $128 a year.

Grant, of Euromonitor International, said we’ll likely see more updated loyalty programs next year as retailers fight to compete with Amazon and keep their programs as relevant as possible. But the types of rewards loyalty members receive are also rapidly changing. Innovations like Sephora’s members-only social platform and Nike Live, the athletics retailer’s members-only store concept, are giving shoppers more reason to join, and offer arguably more compelling benefits than the usual rewards points.

“Loyalty program features can be quickly copied amongst retailers which forces innovation to keep customers happy with their current program,” Grant said. “Additionally, better benefits will likely lead to more customers joining loyalty programs. With smart marketing strategies, the higher number of loyalty members will likely lead to greater sales.”

Shopping via tech gets more sophisticated

2018 was a year of tech and retail experimentation. Amazon Go launched and quickly expanded, 45% of purchases were completed via smartphone and companies like 7-Eleven began accepting different payment systems.

While shopping through a smart speaker, working with a chatbot or walking out of a cashierless store may still be perceived as a novelty, retailers are getting the message that convenience is paramount when it comes to obtaining goods. Implementing the mechanics that make these actions as frictionless as possible will help determine which tech stays around for the long haul, or what will be dropped when consumer experience isn’t kept front-of-mind.

There is a symbiotic relationship between companies and consumers when it comes to tech advancement, with retailers testing and adopting methodologies when customers respond positively. That partnership is bound to grow as companies push further into understanding that in-store and online spaces are merging, with the lines increasingly blurred as to where a sale can occur.

Ashwin Ramasamy, co-founder and chief marketing officer at PipeCandy, an e-commerce market intelligence company, projects that in-car shopping is the next natural step for advancements in 2019. “An embedded smart speaker in a car is a great way to introduce shopping through smart speakers. It could be for scheduling grocery or meal kit pickups. I’d think that embedded smart speakers in cars will unlock in-commute shopping faster than home speakers have been able to,” he said in comments emailed to Retail Dive.

The cost of e-commerce will force a reckoning

For years, surging growth among digital pure-players (above all Amazon) left many legacy retailers unsure of how to proceed, but e-commerce has mostly morphed into just another way to sell to customers. Exhibit A is Walmart, which stoked its digital sales some 39.4% in 2018 — a stark turnabout for a brick-and-mortar stalwart that still dots the American landscape with thousands of stores.

But for any retailer selling online, some e-chickens may come home to roost as the new year progresses. Retailers have yet to grapple with the dispiriting reality that returns are natural but, for retailers, an expensive aspect of online consumerism. In fact, analyst Natalie Berg, founder at NBK Retail, told Retail Dive that the problem is a “ticking time bomb” for retailers this year.

It’s not just returns, however. Most online shoppers expect, or at least give their highest loyalty to, retailers that offer free shipping and free returns. Amazon could arguably be blamed for helping set that expectation. But, while it’s not immune to the problem, the e-commerce giant is managing its massive shipping costs by establishing its own network and shifting fulfillment costs onto its marketplace — two moves most retailers can’t make.

Already last year some analysts downgraded their profit expectations of retailers in light of the digital strain on margins, and those concerns look to be continuing, with end-of-year retail stocks remaining below even the shaky wider market. When it comes to e-commerce, 2019 is poised to be a time of reckoning.

From: RetailDive.com

Read more –

Read also

Respublika Park Leads Kyiv Shopping Malls in Tax Payments