Public Voting for the RAU Awards 2025 Has Begun

03.05.2023 09:00

03.05.2023 09:00According to the monthly research by the Retail Association of Ukraine conducted among the association members since March 21, 2022, by online polls covering about a hundred of owners of CEOs of companies all over Ukraine, currently, only 3 % of the trade venues/stores remain closed. Over the 14 months of war, that indicator declined by 26%.

We remind that this poll covered only the RAU members, so the figures below may only reveal the general trends and surely not the losses of the entire Ukrainian retail. According to the last trade network poll among the RAU members, in 14 months, 16,265 out of 16,821 trade venues of the entire domain resumed their operations. The working entity percentages reaches 97 %, hence, there are only 3 % of closed venues. While last March, almost a third of trade places were closed (29 %), currently, only 556 trade venues out of 4,481 are closed. Working under tremendous stress, the retailers went an extra mile to keep the critical commodity infrastructure operating for the public. Obviously, it will be possible to fully restore the pre-war performance of the networks only after the territories occupied by the enemy since February 24, 2022, are liberated. However, even now different retail trade segments are actively developing at the territories free of occupiers, and further in the back line.

Retail recovery trend has started in April 2022 and is still going on, although from the beginning of 2023, the total number of working stores is adding only a percent monthly. However, even this small percentage means hundreds of reopened stored. For instance, while at the beginning of the year, more than 1,000 trade venues were closed for different reasons, now a half of them (+514) resumed their operation. If the trend persists, by the end of the first half of 2023, a full recovery might be possible, especially when the new territories are liberated.

While in autumn of 2022, the increment of working stores totaled 5 to 6 %, since mid-summer, it stabilized at 1 to 2 %, with an autumn decline. Since the end of last year, the dynamics accelerated again.

Currently, 88 % of the trade outlets closed in March are already working. In total, the number of open trade outlets increased by 26 % over 14 months. The specificities of the process depended on the trade domain, but the trade entity recovery is now evident in all segments.

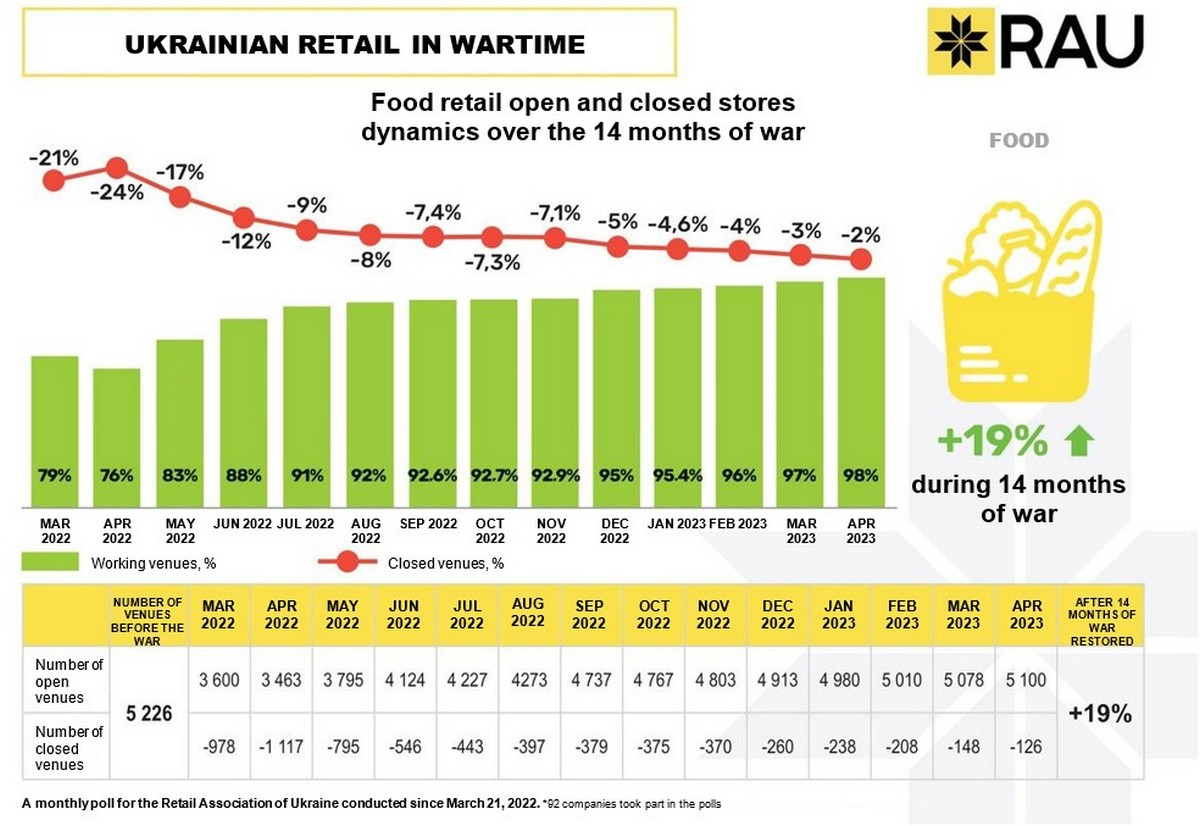

Before the war, food networks consisted of 5,226 entities. During the hardest period (after April 2022, when FMCG operators dealt with network optimization), 24 % of stores were closed. Since last May, the share of closed minimarkets, supermarkets, and hypermarkets has been steadily declining.

Generally, over the 14 months of war, the share of closed stores declined by 19 %: the number of working stores in April 2023 reached 5,100 compared to 3,600 in March 2022. This April, only 126 trade entities remained closed. It means that 98 % of food stores resumed their operation.

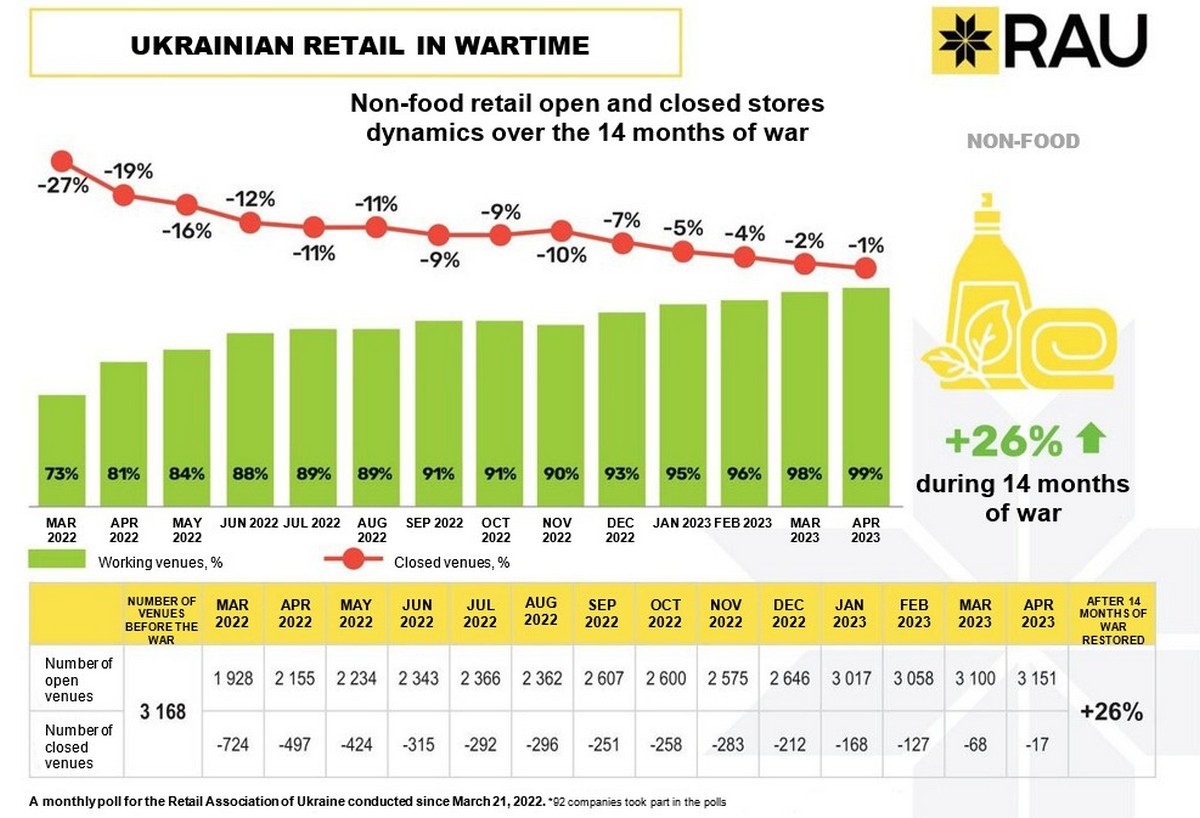

Non-food retail including makeup goods, hygiene products, and other consumer goods has a similar dynamics comparable to the FMCG sector recovery. However, trade outlets were not optimized in April 2022, which may be explained by the fact that the initial fall was more prominent (-27 %), with over 700 entities closed. The process came to a certain deceleration last autumn when for a while the number of open stores stabilized at over 90 %.

Currently, that sector evidenced even better recovery indicators compared to retail: 99 % out of 3,168 network stores are operating again. Only 17 trade outlets are closed, which is almost ten-fold fewer than at the beginning of 2023. Thus, 26 % of previously closed trade outlets resumed their operations.

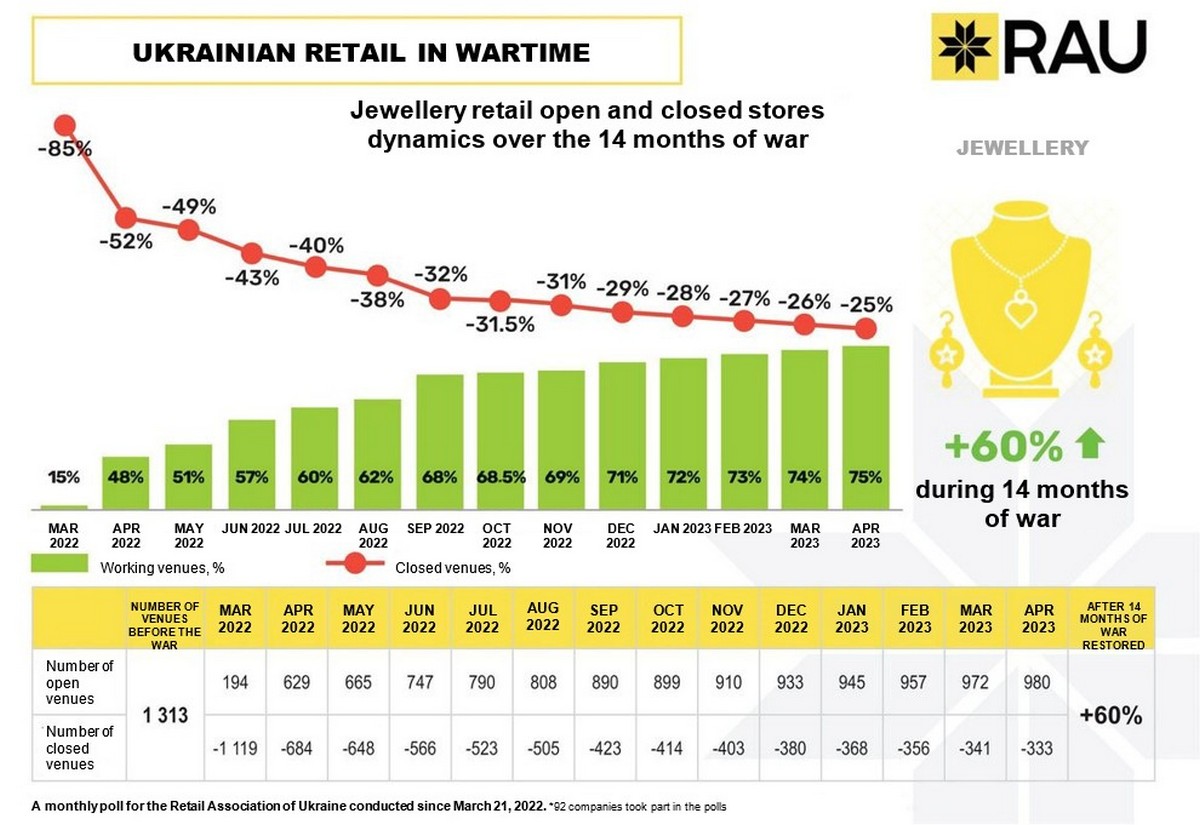

The jewellery sector was among the most recessive at the beginning of war: in March 2022, less than 200 of stores out of 1,313 were working, which is only 15 %. Only the entertainment sector which also turned out to be ill-timed revealed higher figures. In April, after the first UAF victories in the battlefield, 48 % of trade outlets resumed their operations, which accounts for almost a half of the market. During the counteroffensive in the direction of Kharkiv in September, that share even grew by 20 %, and in autumn, the index stabilized reaching almost 70 %. From then on, the domain has slowly but steadily fought back a percent a month. As a result, as of April 2023, 980 stores are open, which is 75 % from the pre-war figures.

333 trade outlets remain closed, and in December 2022, there were 47 more. Generally, the percentage of reopened stores increased by 60 % in 14 months.

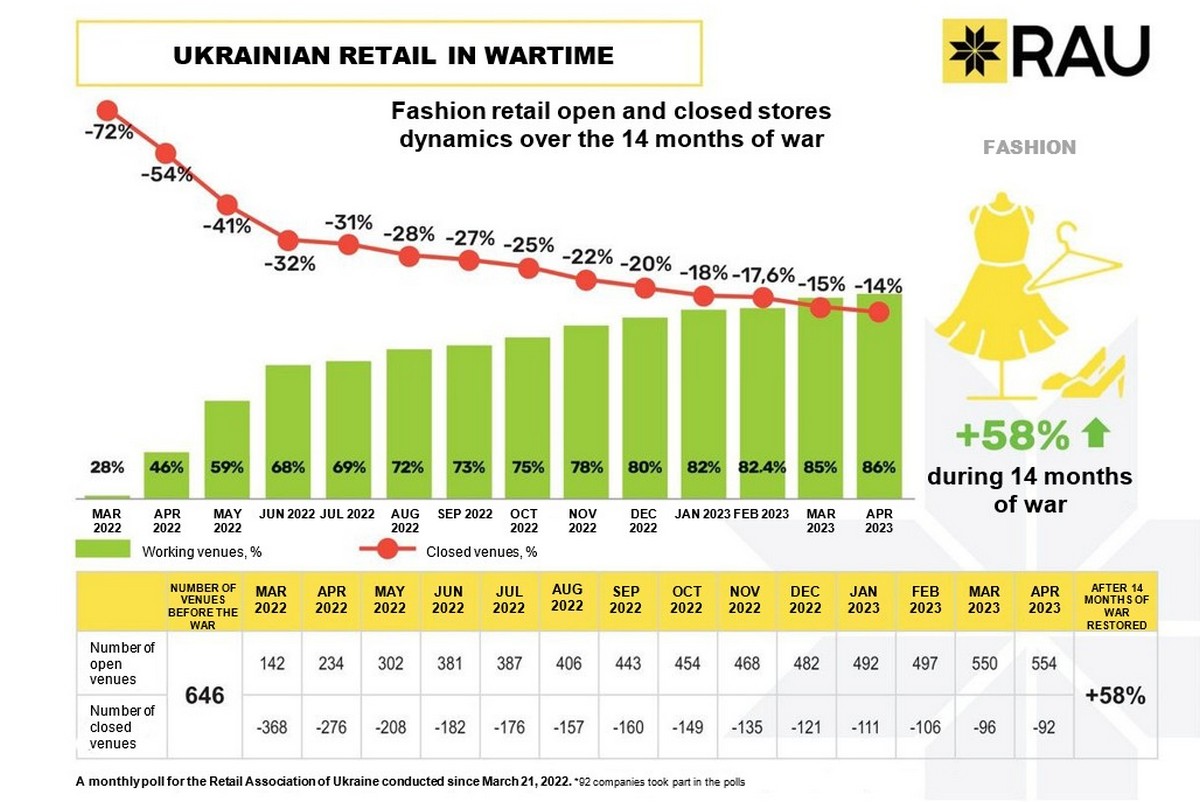

Trade in clothes, footwear, and accessories took a hard blow from the disrupted supply chains and losses or closing of production sites in Ukraine. Additional issues appeared due to currency exchange limitations for import purchases and massive population migration. In addition, at first, people bought only food and basic commodities. Thus, in early spring 2022, only 28 % of stores out of 646 trade outlets were in operation. At the same time, closing some foreign brand showrooms for security purposes, the change of seasons, and increased demand for items made in Ukraine became the preconditions for business recovery. In summer, 68 % trade outlets of networks were in operation, and by the end of last year, their share increased to reach 80 %. Currently, over 14 months of war, 554 stores, or 86 % of the network trade venues are open. It means that their share over time increased by 58 %. Less than a hundred of stores remain closed.

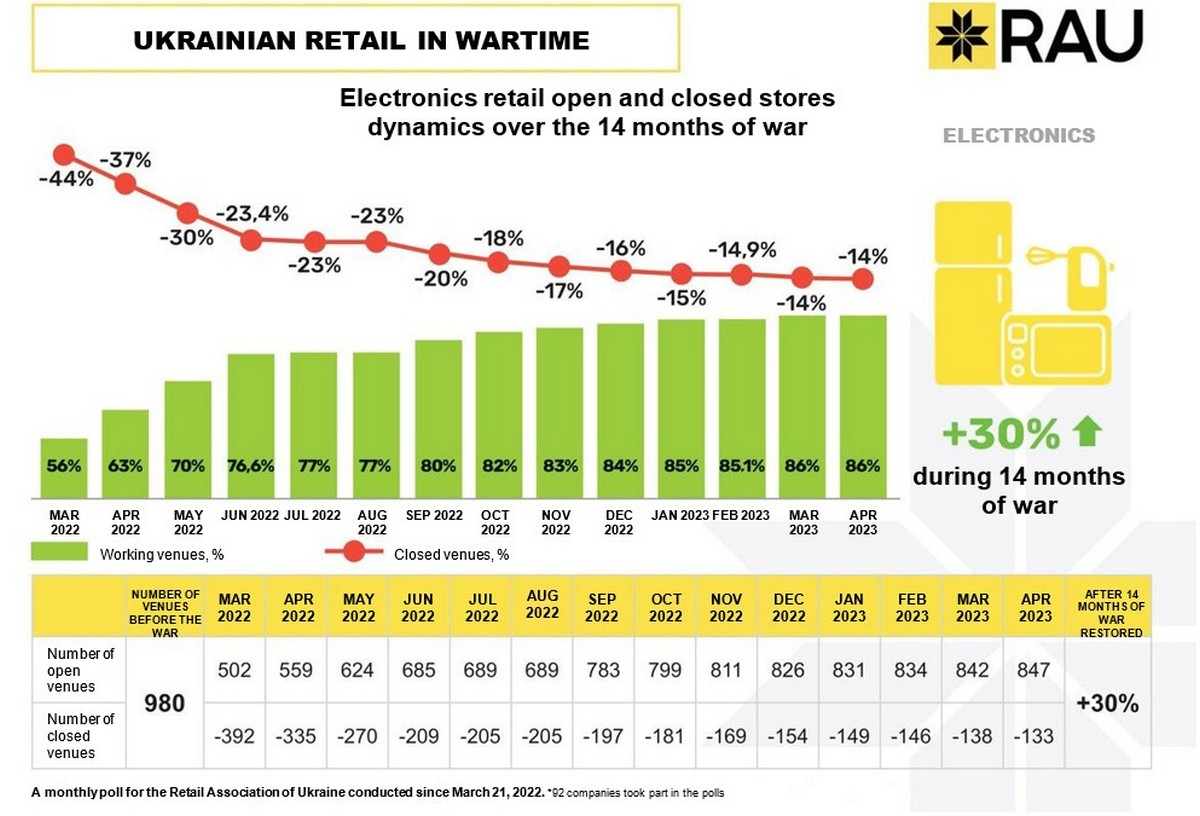

What concerns household appliances and electronics, the recovery goes on, yet at a slower pace. This is caused by the peculiarities of this retail market, for people tend to buy devices not so often compared even to clothes. Thus, since January 2023, the share of stores out of operation stabilized at around 15 %, and in three months, it only added 1 percent with 16 trade outlets reopen. However, compared to last March with a little more than a half (56 %) out of 980 stores in operation, the progress is obvious. Thus, after a sharp fall in the number of trade venues out of operation last spring (44 to 23 %) and a gradual increase of the number of open stores over the next months, generally, 30 % of stores managed to resume their operations during a year of war. The number of closed stores declined to 133, correspondingly.

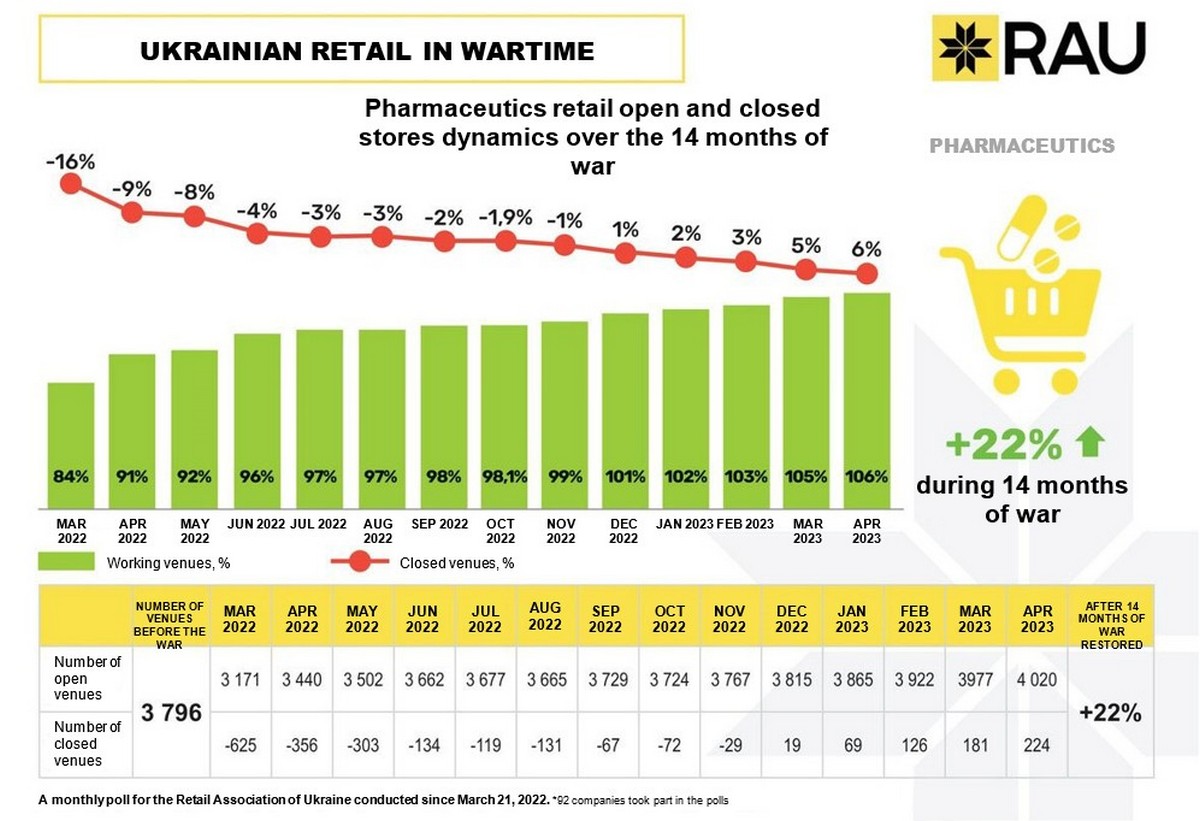

Drugstore networks are by far the only example of a retail domain which not only managed to quickly restore the number of working trade outlets but even exceeded the pre-war figures. Thus, in last November, only 29 drugstores and pharmacy service points out of 3,796 in operation up to February 24, 2022, were closed. It totals less than one percent. Thus, by the end of last year, the drugstore networks managed to open even 19 new trade outlets more compared to pre-war period. This is not a surprise: drugs and medical supplies are one of the most demanded categories of goods both in peaceful times and in wartimes. Further, the share of a positive increment in the number of drugstores and pharmacy service points only gained momentum, with over 4,000 entities in operation in April 2023. This evidenced a 6 % growth compared to pre-war period, which is 224 trade outlets. Thus, since March 2022 until April 2023, the number of drugstores in operation increased by 22 %, covering for the 16 % fall and yielding a growth of 6 %.

Fuel is always a high-demand product, so predominantly the closing of about 200 car refueling stations (15 %) out of 1,512 in operation before the war was caused by destruction or occupation by the enemy. Correspondingly, as the Ukrainian army liberated the territories and recovered the undamaged car refueling stations, the percentage of working venues gradually grew. 5 to 7 car refueling stations were open in a month on average. The exclusion happened in June, August, and September, when two dozens of car refueling stations or more were recovered. Recovery rates of these venues is also gradual. As of April, 1,447 or 96 % of car refueling stations were in operation. It means that from March 2022 until April 2023, the share of working car refueling stations network added 10 %. Specifically, 28 more venues were open in January through April 2023, and currently, only 65 car refueling stations are closed.

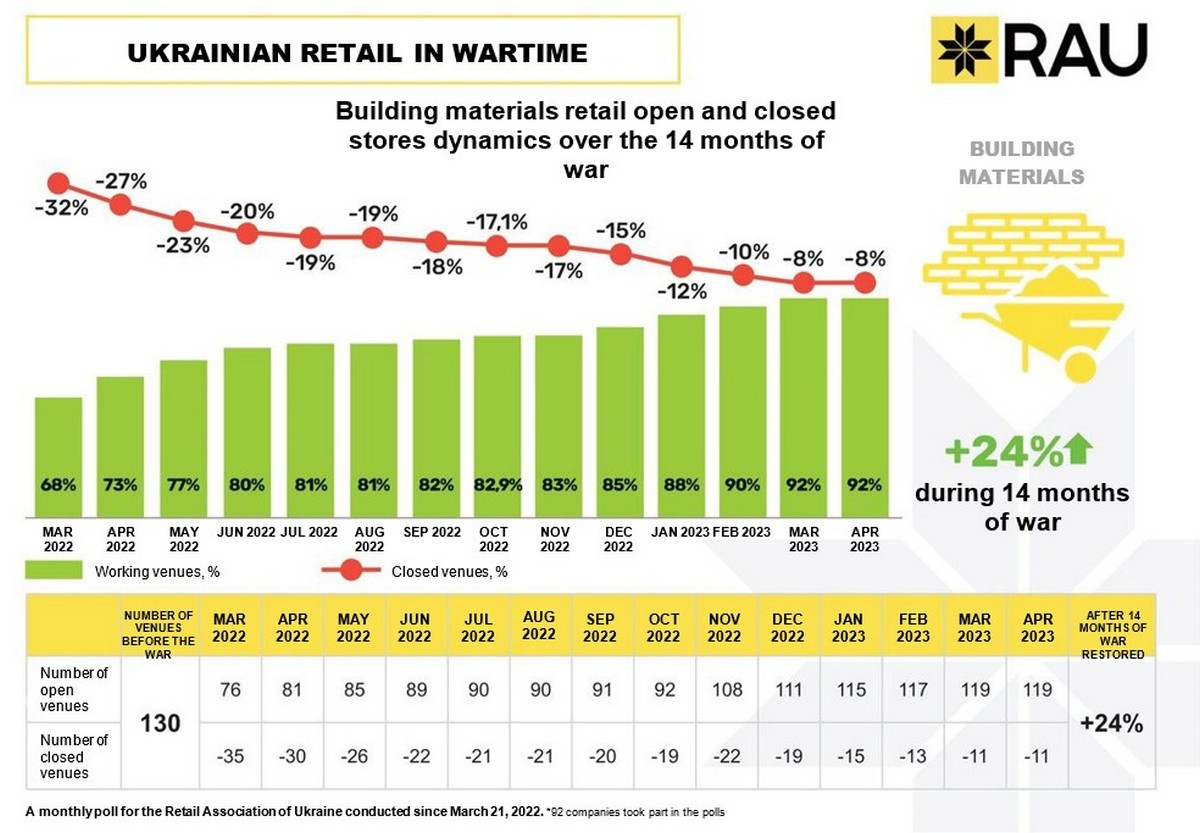

A very gradual recovery can also be seen in the building material trade. At the beginning of war as of March 2022, only 68 % out of 130 stores worked. Over the next three months, already 80 % venues were open in that domain, but the figure managed to reach 85 % only at the end of last year. In four months of 2023, the retailers opened eight more stores to total 119, which is 92 % of the pre-war figure. This is 7 % higher compared to December, and generally during 14 months of war, that retail sector evidenced a 24 % growth in the number of operating stores. Currently, only 11 locations are closed. Considering that stores of this kind are situated in large premises and demand significant funds and effort to be restored, the process is naturally slow. For example, after the relative lull, Epicenter K opened two new stores in Kyiv and Lviv in September 2022, and made a renovation in one of the Kyiv locations at the end of the year.

What concerns entertainment centers, since the beginning of war they have suffered the most. Thus, in March 2022, only 13 %, which is 6 out of 50 entities, remained afloat. However, over the year the number of entertainment centers increased by 81 %, and in March 2023, already 47 entertainment complexes could receive guests. Last year’s autumn faced the largest acceleration in the number of reopened venues, when the rate of closed entertainment centers declined approximately three-fold. By April 2023, the number of entertainment locations out of operation additionally decreased to only three places.