Public Voting for the RAU Awards 2025 Has Begun

14.05.2019 10:30

14.05.2019 10:30Critics of Brexit are calling for another Referendum on the final Brexit deal, with the explicit aim of having the public vote again on whether to stay in the EU.

Should I stay or should I go? The Brits answered this question originally posed by the Clash with a “go” in 2016. But almost three years after the Referendum on the EU withdrawal, it turns out that there are various possibilities for what this “go” could mean. These include a so-called “no-deal Brexit,” Theresa May’s long-negotiated withdrawal agreement and a customs union.

The political uncertainty surrounding this historical event makes it impossible at the time of the editorial deadline to predict whether and when the United Kingdom will leave the EU. But there is no doubt that the outcome of the Brexit Drama will have a major impact on the development of retail in the United Kingdom. However, in our special chapter on the country, we evaluate other trends such as the so-called “trading-up” phenomenon currently in evidence.

Our study offers a detailed assessment of the technical consumer goods segment and revealshow “click-and-mortar” retailers are catching up with online-only retailers in Europe.

From a pan-European perspective, the study also discusses key retail benchmarks such as retail turnover, sales area provision and the distribution of purchasing power. Whether you’re an investor, project developer or retailer, our insights offer valuable support for your decision-making.

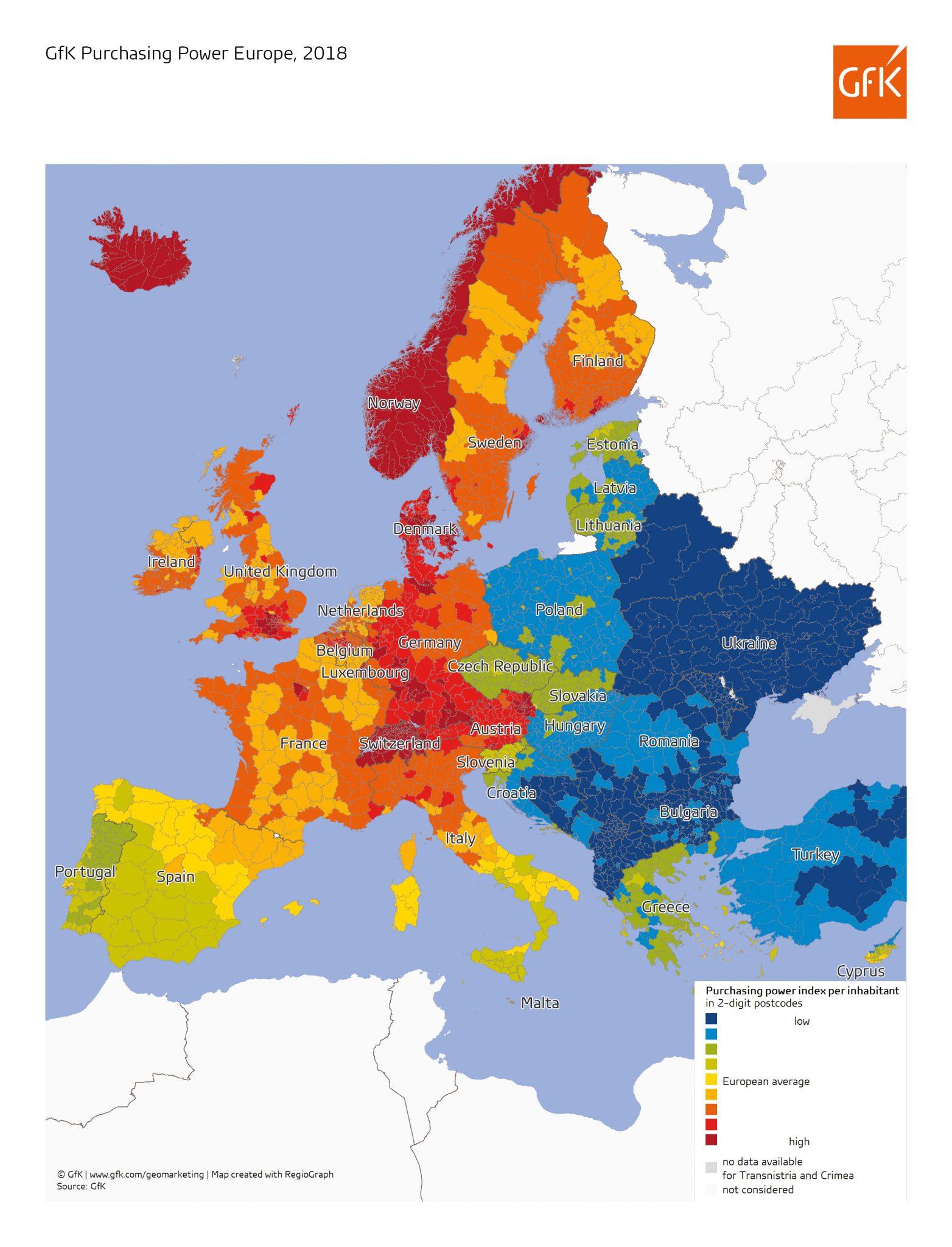

For more than 30 years, the key goal of the European Union’s cohesion policy has been the dismantling of regional and international economic disparities among the member states. The EU is closer than ever to achieving this goal with respect to per capita purchasing power, at least at the national level. more per capita purchasing power in the EU-28The ten EU nations with the highest per capita purchasing power gains this past year all have below-average purchasing power and were admitted into the EU as part of or after the eastward enlargement. Increasingly tight job markets in these nations have led to sizeable pay increases. For example, citizens of the growth forerunners Latvia and the Czech Republic have €8,030 (+10.3%) and €9,492 (+9.3%) at their annual disposal, respectively. This moves them closer to the European average of €16,878 (+3.0%), although continued progression in that direction is likely to require the ongoing support of the European Union.

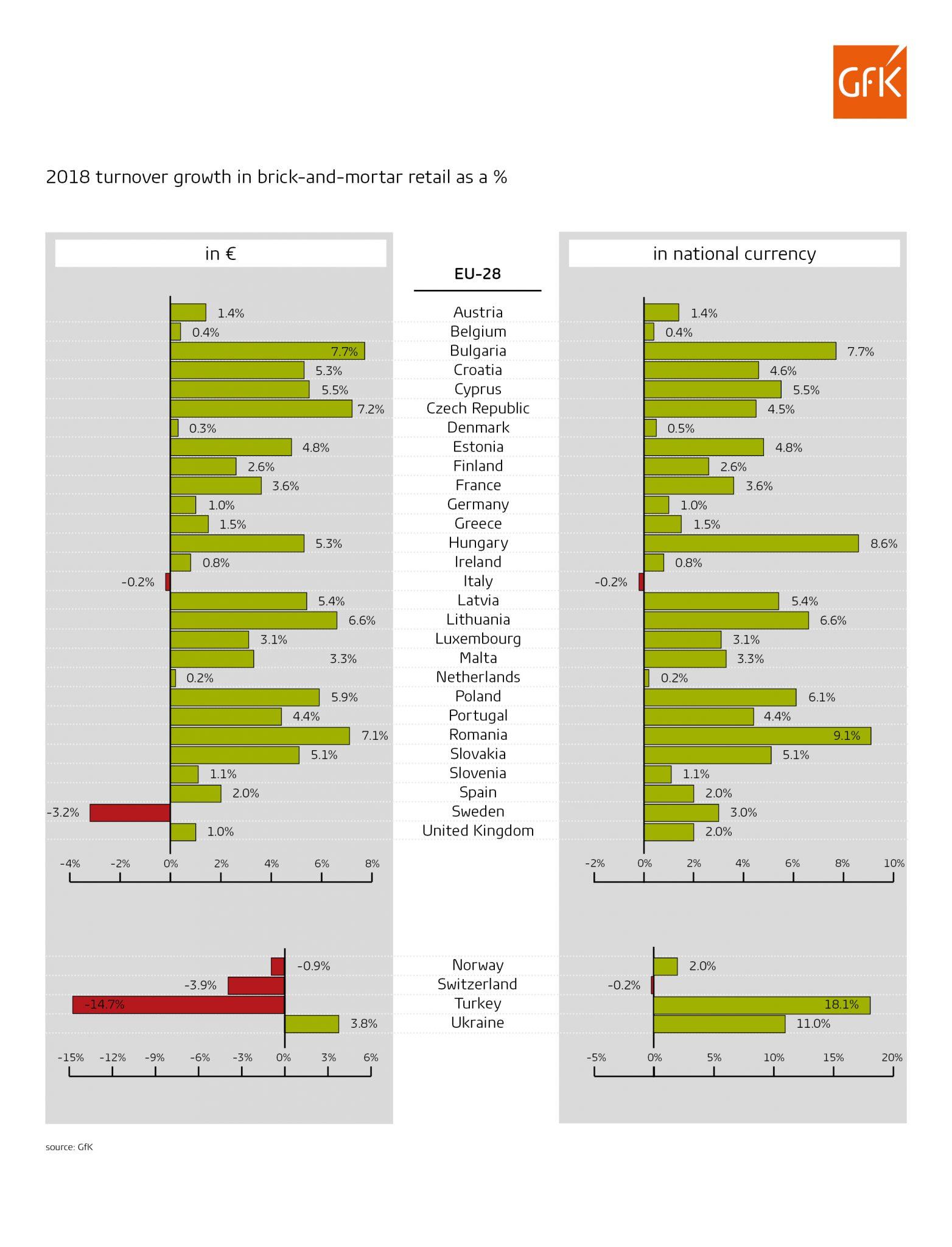

The Italian government coalition consisting of the Five Star Movement and Lega Nord issued a decree for the introduction of a poverty relief scheme known as “citizens’ income” at the beginning of 2019. This was preceded by an at-times intense dispute with Brussels, which was concerned about negative consequences to Italy’s creditworthiness stemming from its large public debt and credit-financed reform.Even so, the reform in question should at least have a positive impact on retail over the short term. This silver lining is urgently needed, because Italy’s brick-and-mortar retail underwent a nominal turnover decline of -0.2%* in 2018.The other large western European markets of Spain, the United Kingdom and Germany experienced only nominal turnover gains in brick-and-mortar retail. Only in France with growth of 3.6% were these gains high enough to result in notable turnover increases in real terms. For the EU-28 as a whole, the nominal turnover growth of +1.9% hovers around the level of inflation.

Eastern Europe presents a different picture. Despite substantially declining populations, both Bulgaria(+7.7%) and Romania (+7.1%) continue to be the European forerunners along with the Czech Republic when it comes to growth rates in brick-and-mortar +1.9%brick-and-mortar turnover in the EU-28 retail. Hungary (+5.3%) and Poland (+5.9%) were not able to achieve last year’s growth rates, but this is partly due to exchange rate effects.

The majority of European con-sumers are currently subjected to opposing forces. On the one hand, this consists of uncertainty over Brexit, trade conflicts and weaker growth prospects in important export markets such as China. But on the other hand, consumers have a more robust labor market, higher wage increases and mod-erate prices for crude oil. This means that the purchasing power gains in real terms enjoyed by citizens in the majority of EU countries tend to go toward savings rather than retail purchases given the dampened consumer climate. In light of the continued dynamic growth in online retail, we anticipate nominal turnover growth of +2.0% for the EU-27 nations, a figure that is only slightly above the rate of inflation.By contrast, we expect positive growth for Spain: At the beginning of 2019, the minimum wage was increased by +22%, which will directly and indi-rectly benefit 2.5 million people according to the Spanish government. With this in mind, we predict nominal turnover growth of +2.4% for the Iberian nation. Given the expected inflation rate of +1.2%, this should equate to a turnover increase in real terms for brick-and-mortar retail.

France also experienced a meaningful develop-ment at the beginning of the year. The tax systemwas finally changed from an annual collection for the expired calendar year to a monthly deduction at source taken from income. This could negatively affect consumer mood. But due to a fiscal stimulus effect coming into play in 2019, we expect that turnover in brick-and-mortar retail will increase by +2.8% despite the growing savings trend. Romania (+7.0%) and Lithuania (+5.9%) are antici- pated to have the highest growth rates among the EU nations. In the Baltic state, rising incomes and tax relief in the current year are leading to strong growth in disposable income.

Read more –