Special Project: Ukrainian e-commerce in figures, facts and pictures

The Ukrainian Retail Association presents the second annual analytical report on the domestic e-commerce largest players’ work in different segments.

All retailers, including those working in online-trading, try to get to know own buyer as best as possible. And at the same time they try to compare: how their client differs from a competitor’s buyer, and who is generally interested in purchasing one or another product on the Internet. Such information can be to collect and analyze is not an example easier by online-stores than its offline-colleagues: modern services provide the ability to get almost any data.

What was counted

We set a goal to prepare the Ukrainian e-commerce market most extensive analysis, to make the domestic consumers’ approximate portrait who buys goods online, and also to analyze the leading online-stores approximate portrait in different segments.

And then the obtained data compare with the last year’s research results and find out: what trends prevail in Ukrainian e-commerce, whereat would players pay attention, how the consumer behavior changed during the year, market share and so on.

Similarweb and alexa.com services were used for gathering information, which were supplemented with data from other open sources.

We prepared a detailed analysis on e-commerce various sub-segments, in addition to the general report. We have separated to avoid comparing players with incomparable indicators, department stores into a separate category (such as Rozetka), where you can buy almost anything – from jewelry and lures to snowmobiles, yachts and professional equipment. At the same time, there are no classic marketplaces in the report – olx, prom and others – because it does not sell own products, but act as a platform for the contact between the buyer and the seller.

How it was counted

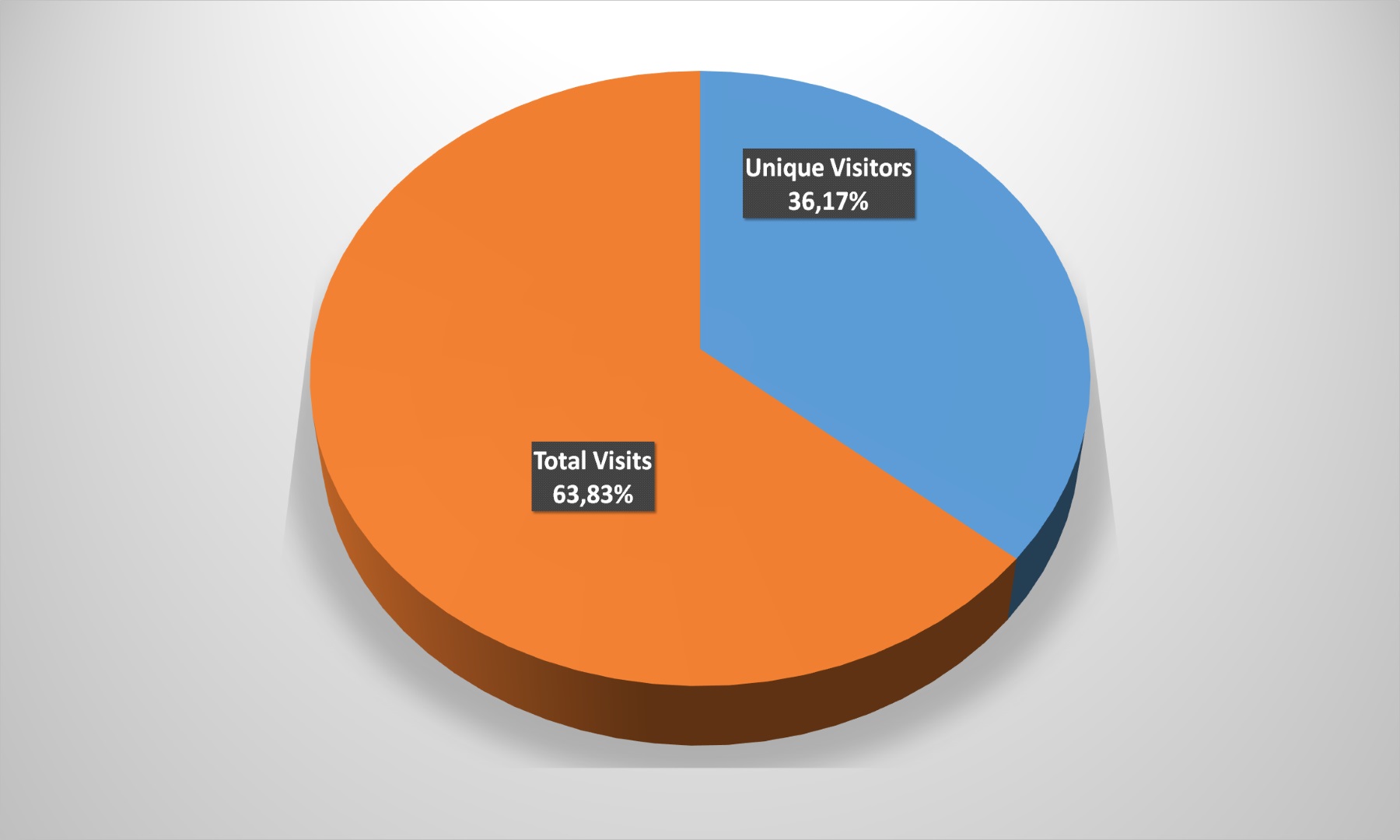

The period from November 1, 2017 to October 31, 2018 was analyzed, since different profiles retailers have different “peak” sales periods. The selected time period made it possible to cover all possible fluctuations in demand. The study examined eight segments: department stores, portable electronics and gadgets, home appliances, fashion, sports goods, jewelry retail, goods for children, cosmetics and drogerie. Several parameters were taken into account in each of it: the users age, the main input channels, the devices used (PCs and laptops or smartphones and tablets), the unique visits and failures number, the prevailing social chains in a particular segment.

Why it was counted

This report allows, like any analyst, online-retailers to find out own strengths and weaknesses, get acquainted with the buyer’ portrait in the segment and compare it with own customer data. In addition, information about the main traffic channels and the most effective social chains will help adjust SEO- and SMM-promotion strategies to increase brand awareness and attract new users. This information assess the need and prospects for creating and deploying of the mobile application and adaptive layout, and also extract a lot of other useful information..

We hope our analytical report will be useful to you!

Ukraine

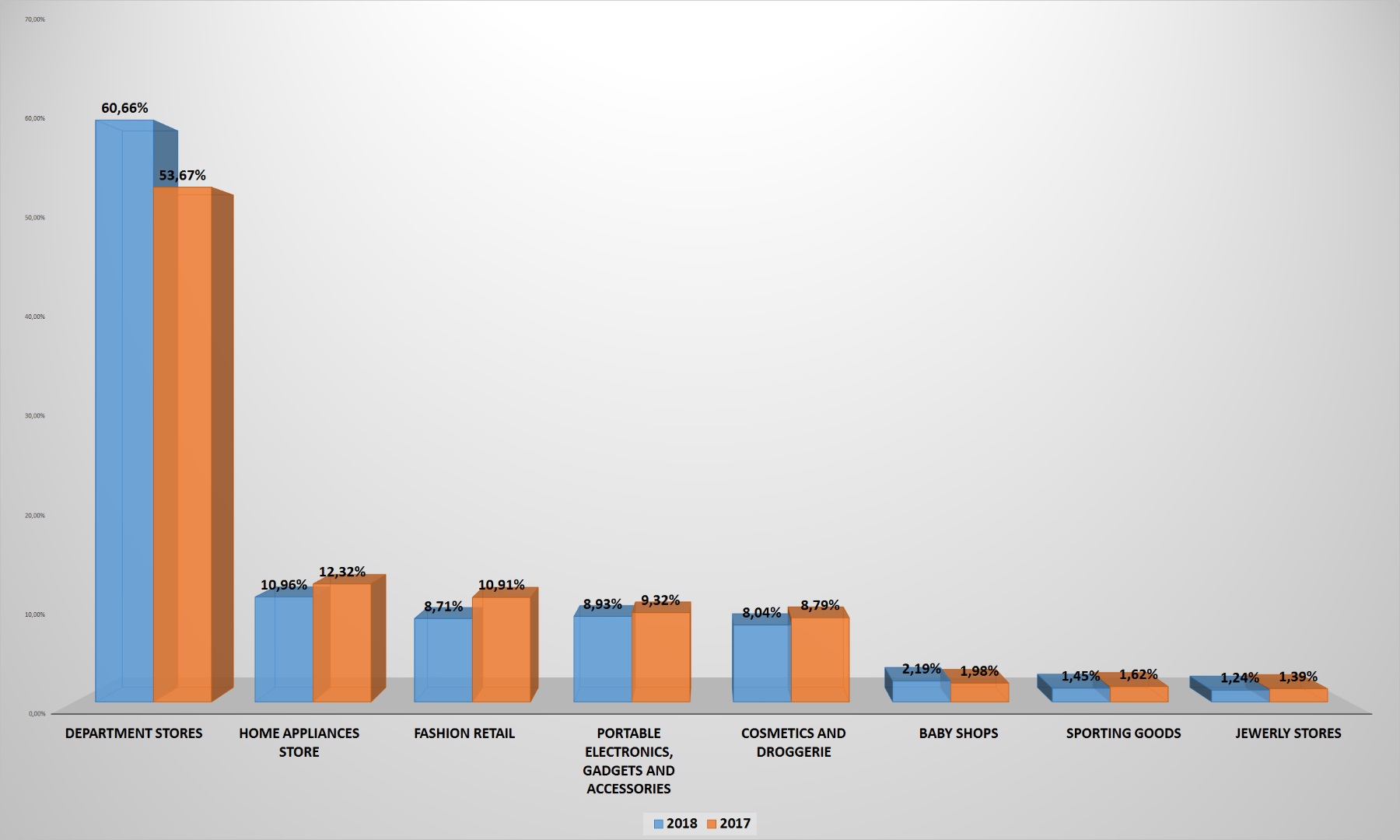

If you take the domestic e-commerce as a whole, then the most popular segment of online-stores is obvious. It has not changed compared with the last year: universal portals, where you can buy everything – from toothpicks to gaming computers and more. It only increased the audience reach – from 53.67% to 60.66% UAnet users – and strengthened its leadership for the year that has passed since the last survey.

At the same time, Ukrainian online-commerce other segments have somewhat lost in coverage, which is not surprising: after all, the sales volume is growing through the Internet in our country by 20-30% annually, according to all data. So, the second in coverage terms – household appliances – lost audience reach 1.3%, the third – fashion – 2.2%, the fourth – gadgets and electronics – 0.4% and so on. Only children’s goods online-stores slightly increased the audience – by 0.2%, in addition to the “universal”.

However, all these fluctuations are within the statistical error limits in most cases and can be explained, for example, by a general increase in the UAnet users’ number, local changes in consumer preferences and other unpredictable factors.

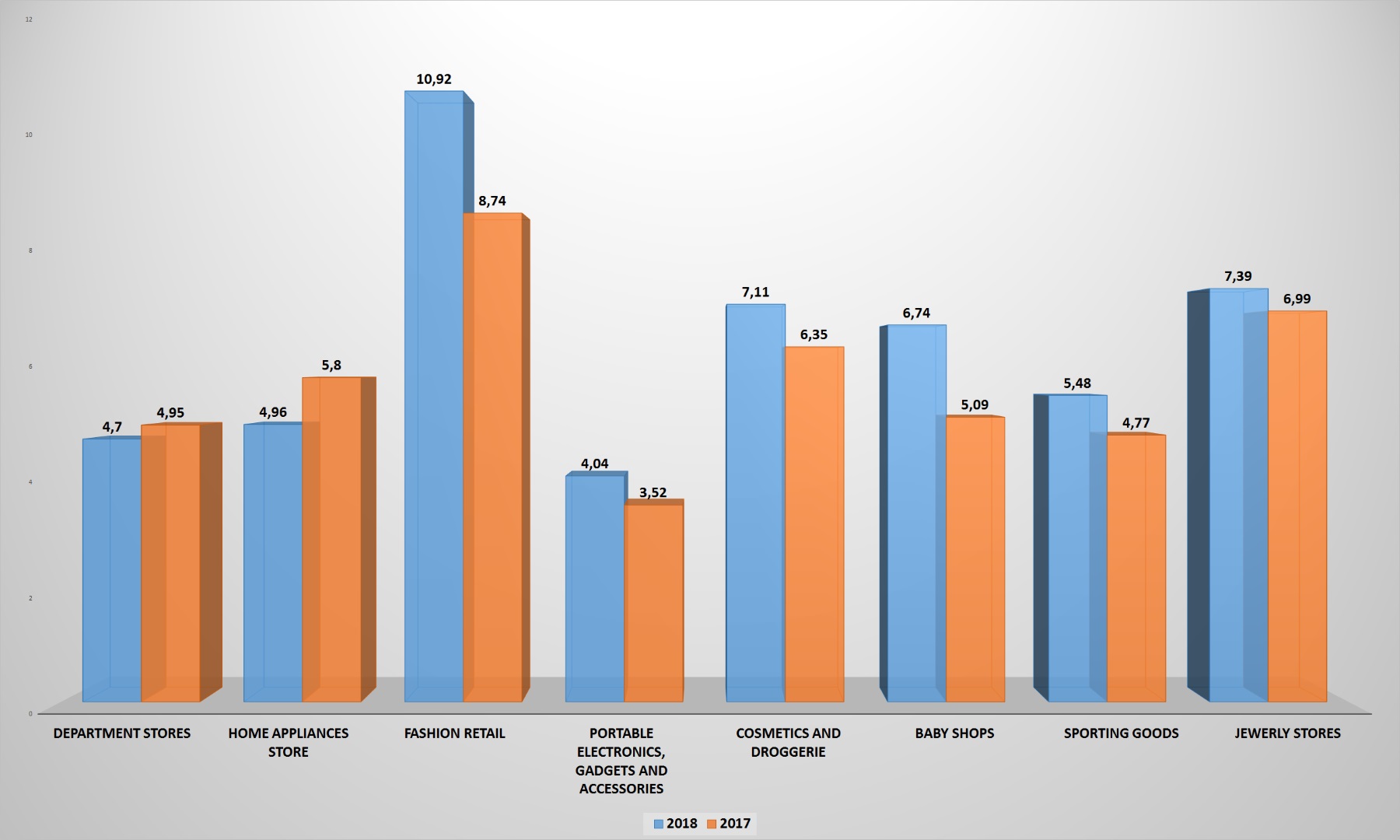

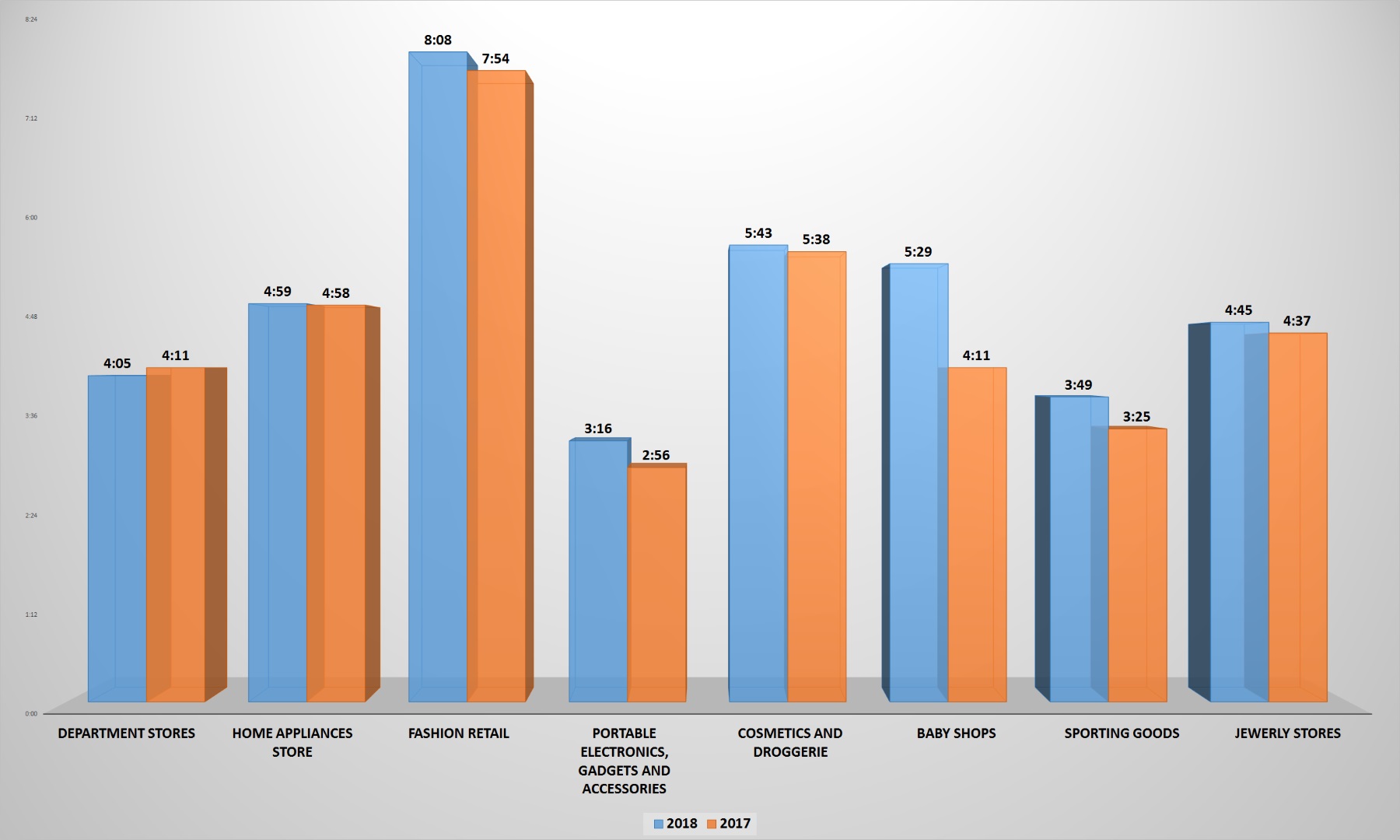

But if “universals” are out of competition on the audience reaching, then other sectors lead in two other key indicators – the time spent on the site and the viewing depth. Users stay the longest time on fashion retailers’ sites: more than 8 minutes. The cosmetics and drogerie segment is in the second place in the duration terms, in third place – children’s products.

Moreover, portals offering products for young Ukrainians were able to increase the consumer’s time on the store’s site most noticeably: by 1 minute and 18 seconds. The rest can only dream about similar successes: for example, users began to spend even less time on universal portals than in 2017.

Buyers are determined with portable electronics, gadgets and accessories choice faster than all, as in the past year. Most likely, clients had already determined in advance what they needed, and only specified specific technical characteristics and nuances.

The viewing depth corresponds to the time spent on the site at Fashion-retailers: on average, a user looks at almost 11 pages with outfits in order to select the favorite product. It is characteristic that this indicator grew significantly as compared with last year: at that time it was “only” 8.7 pages, which, however, did not prevent online-clothing stores being confident leaders.

The “cosmetics and drogerie” segment retained second place in viewing depth terms. Perhaps because these online-stores customers majority are women, and in order to make a choice they need to carefully study the range offered.

The transitions number has decreased from page to page in two categories: department stores and household appliances and electronics. Either consumers began to choose goods faster, or the supply decreased, which, however, is unlikely.

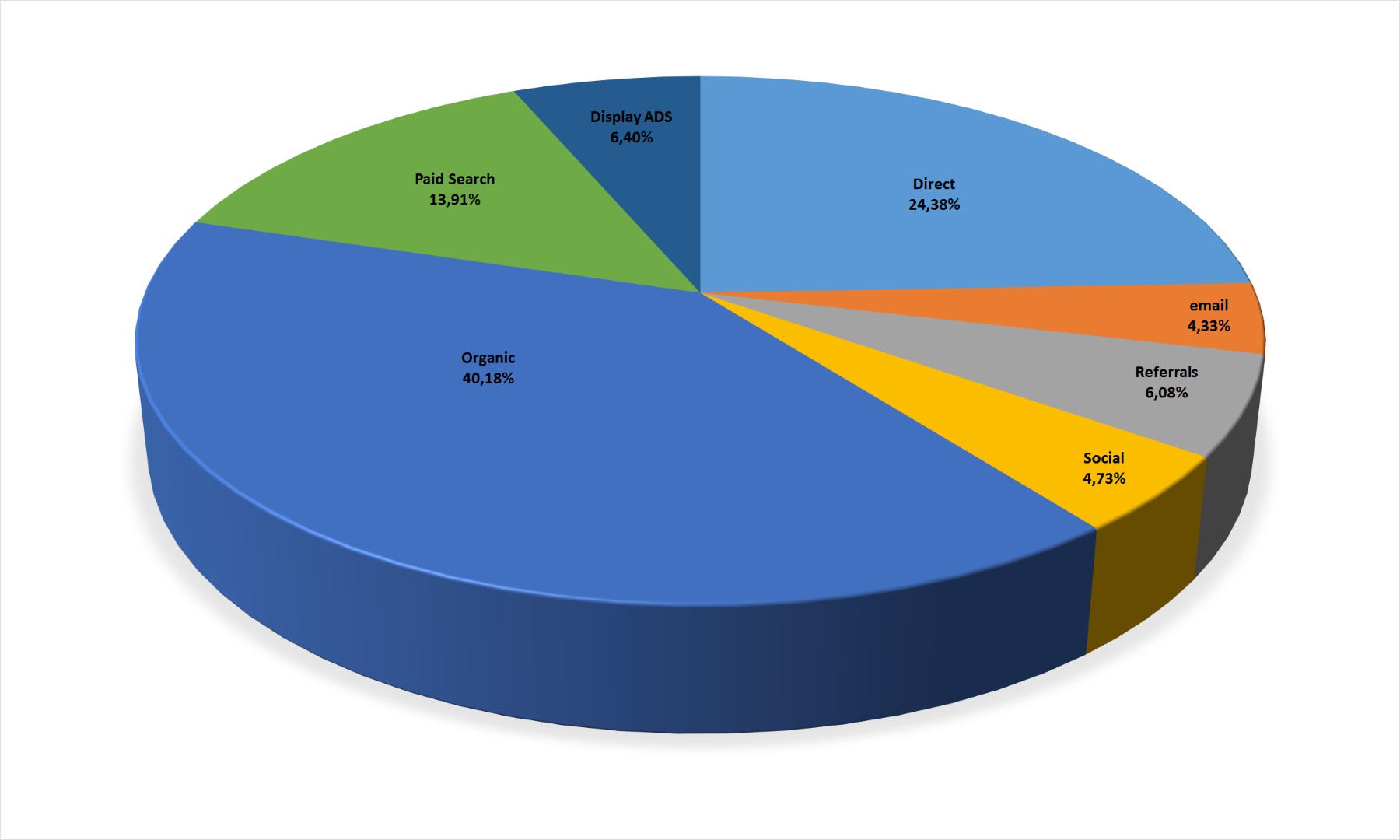

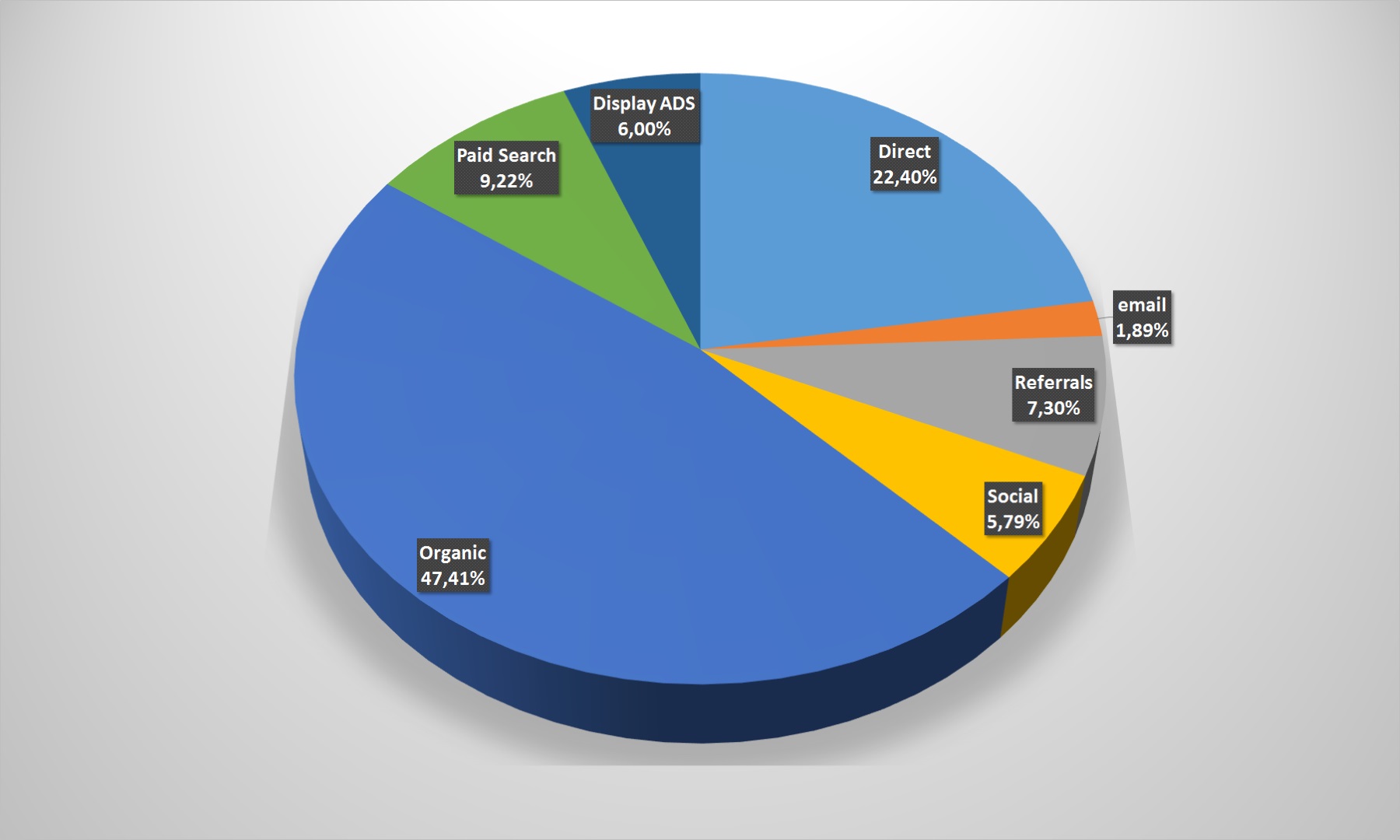

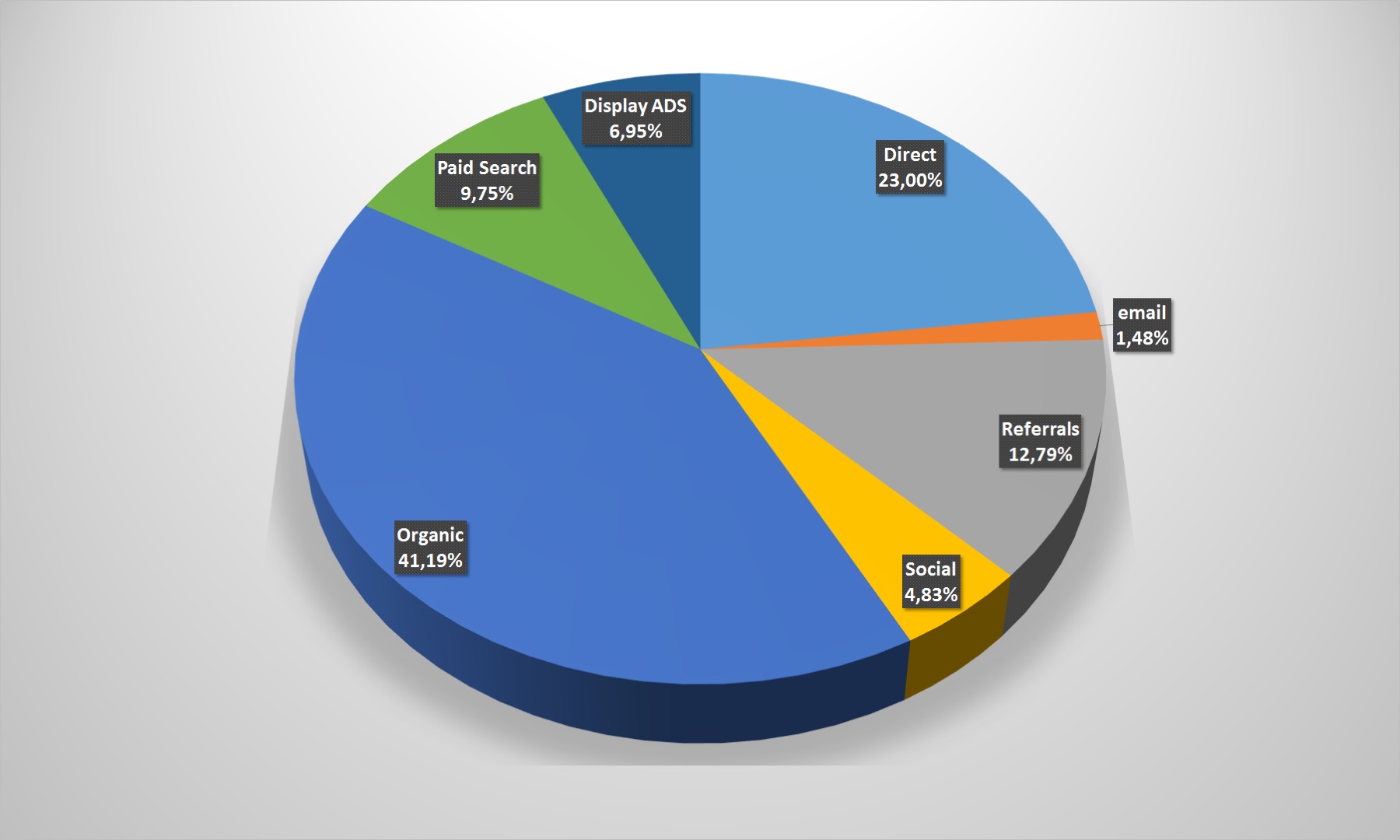

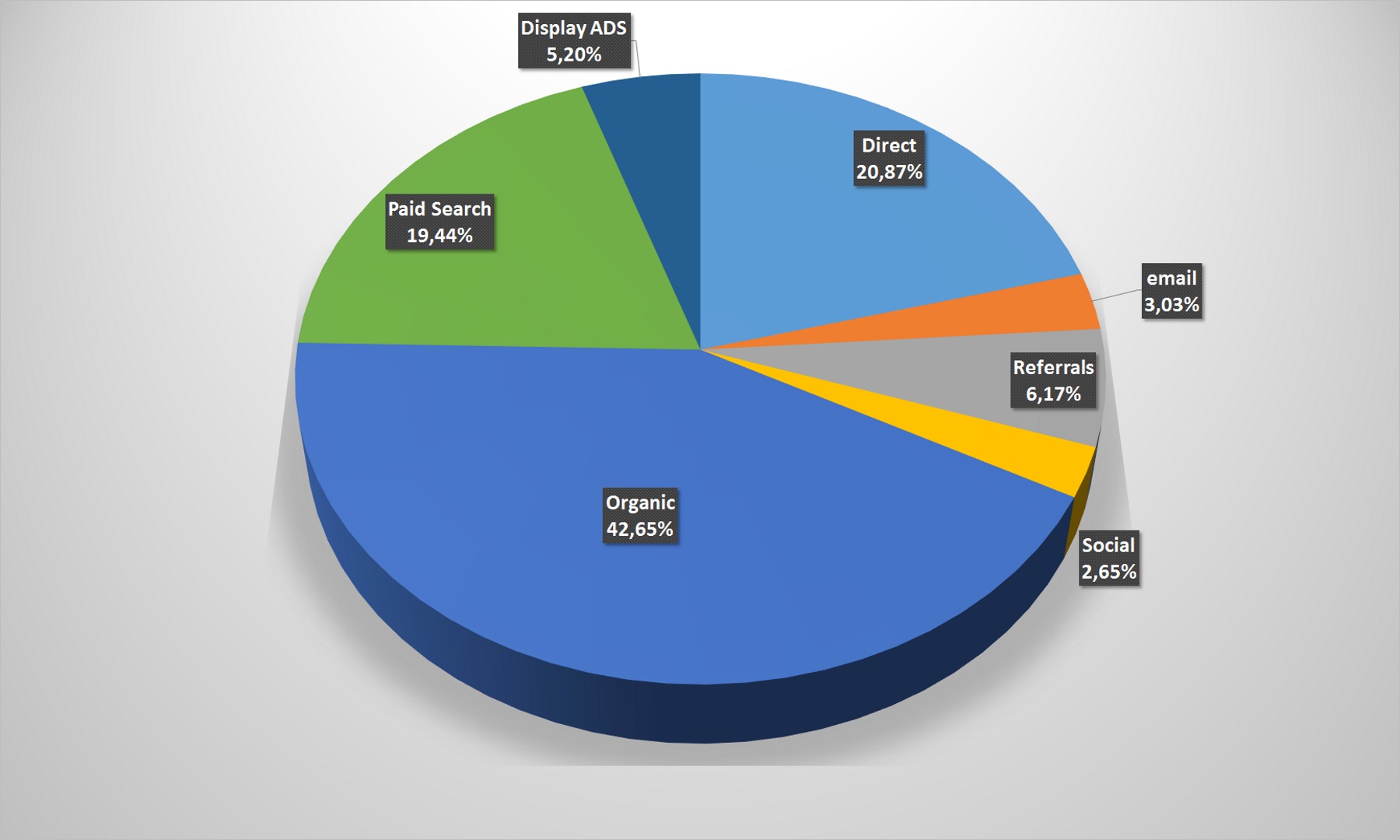

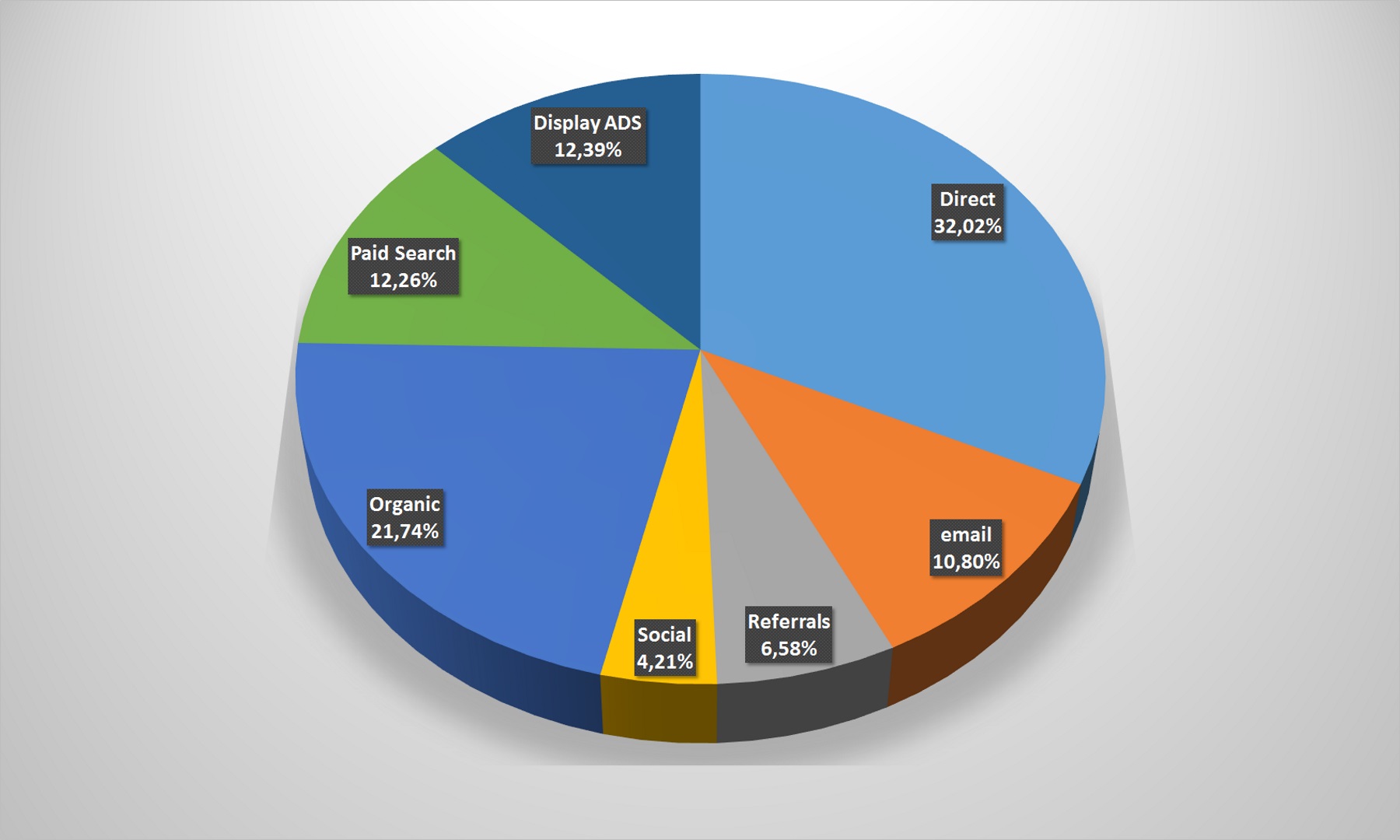

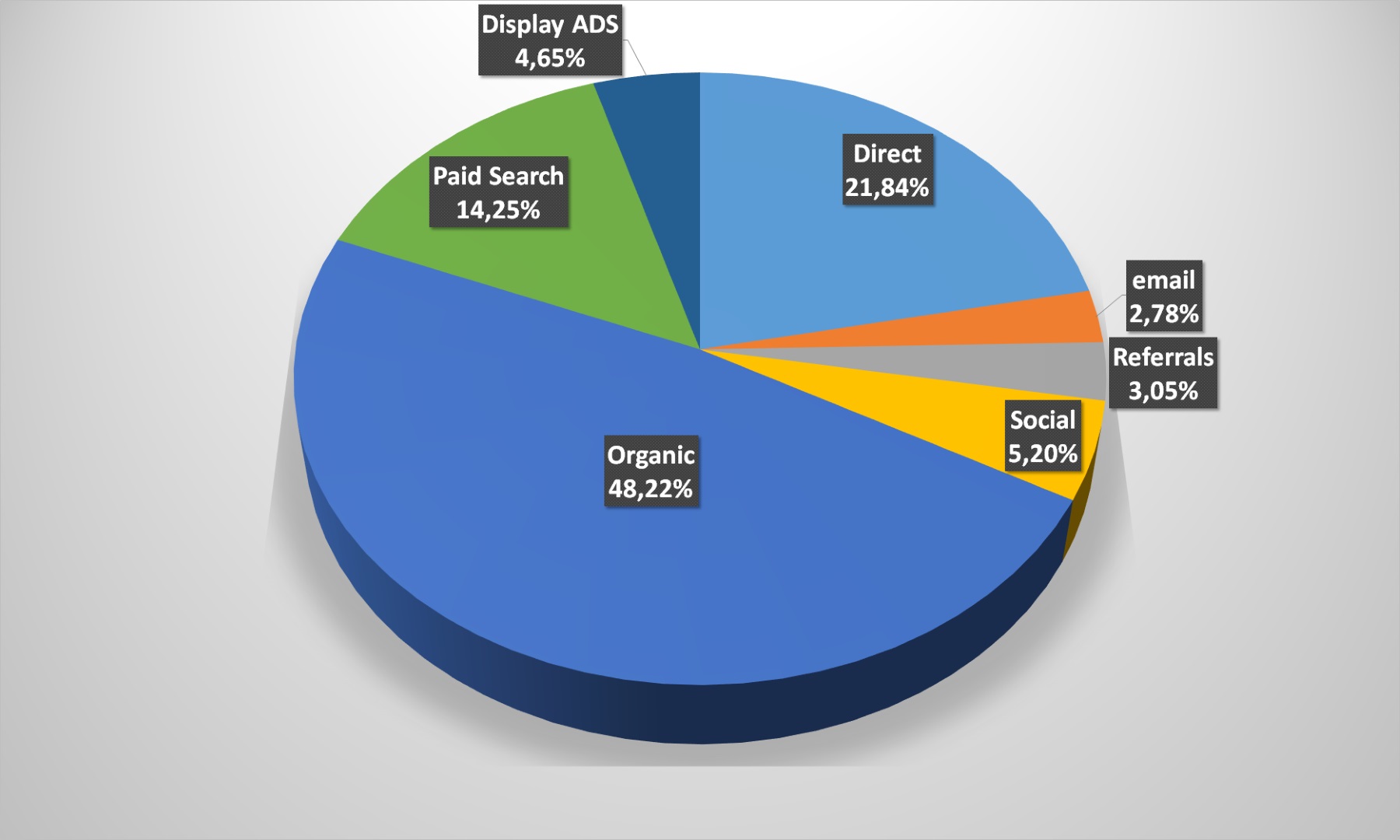

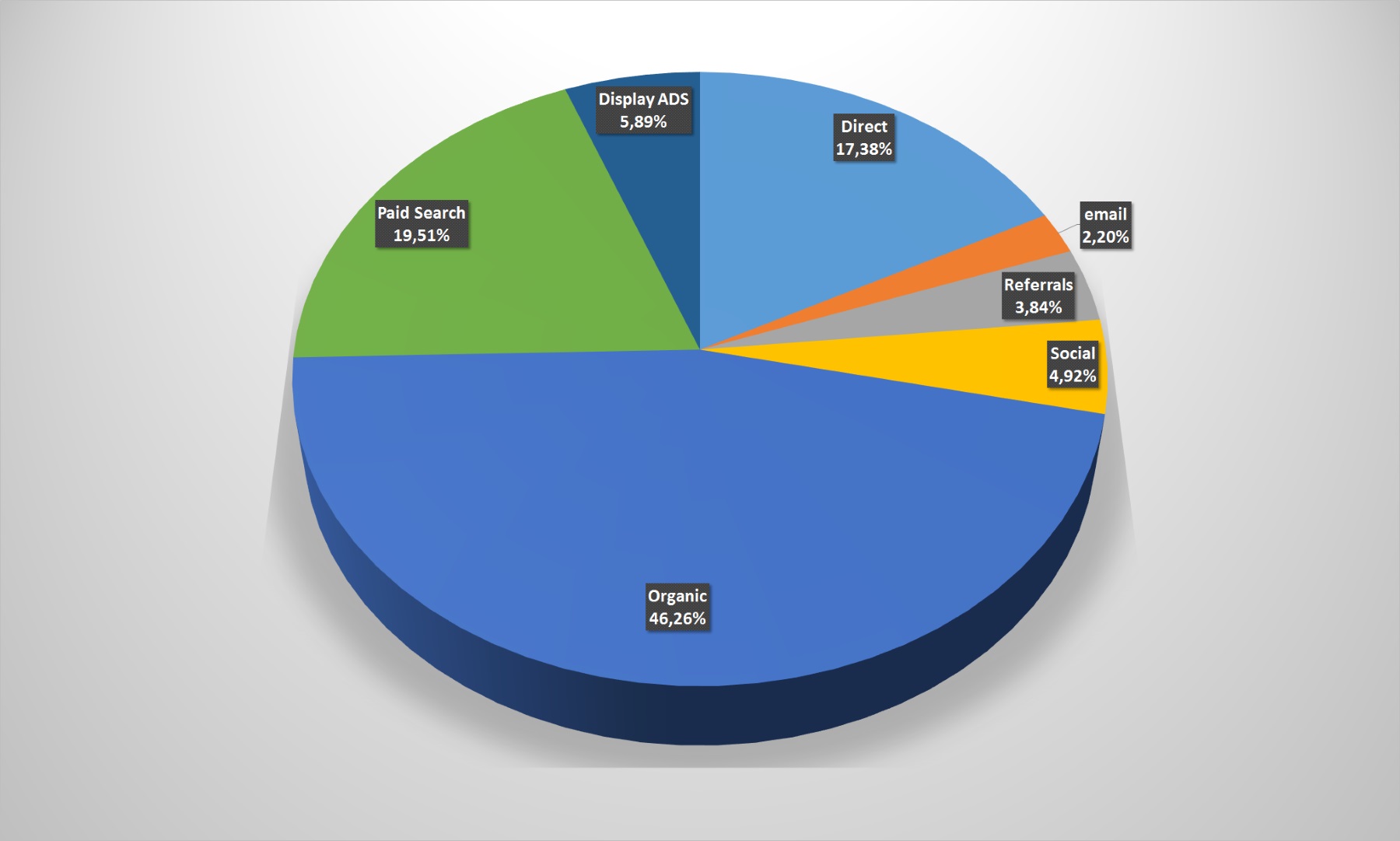

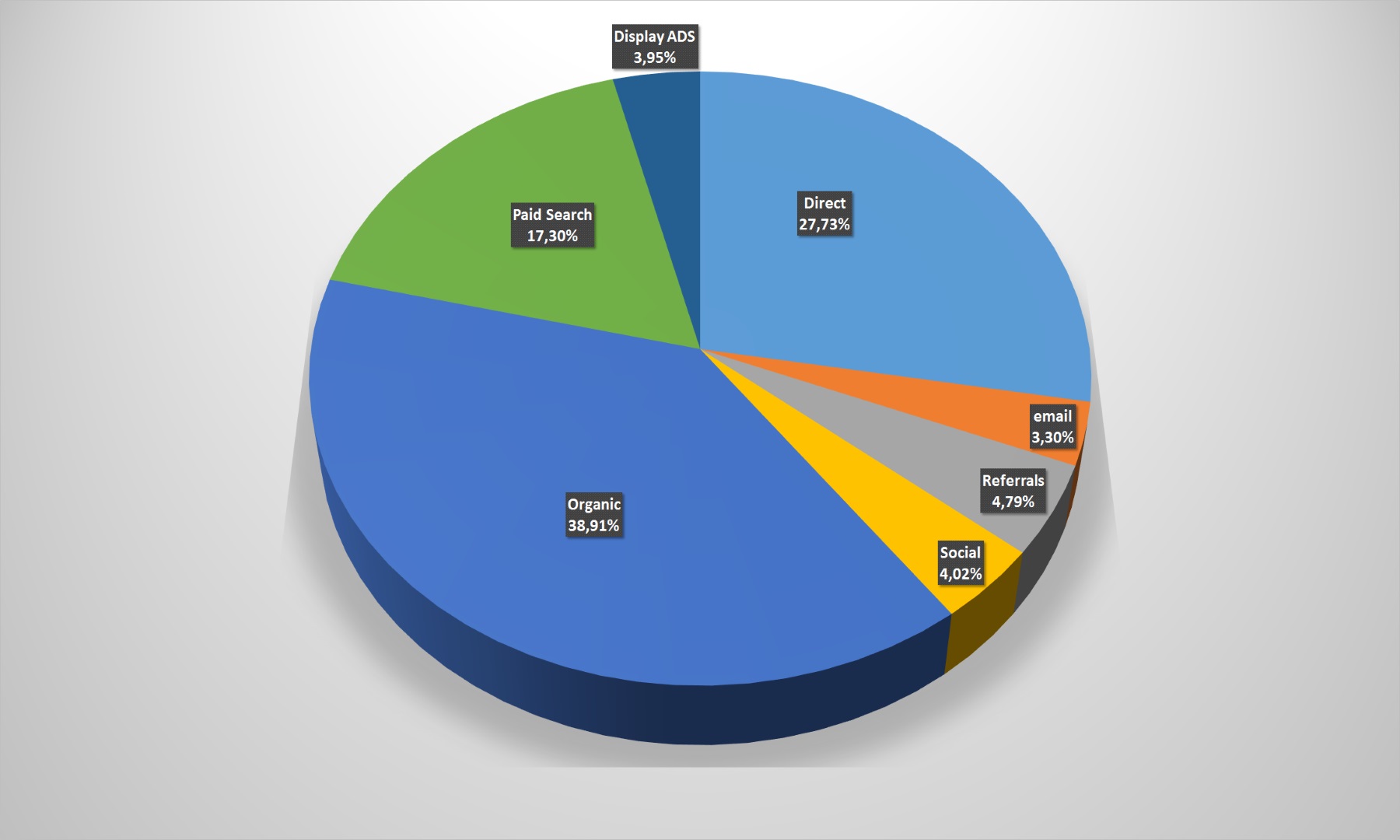

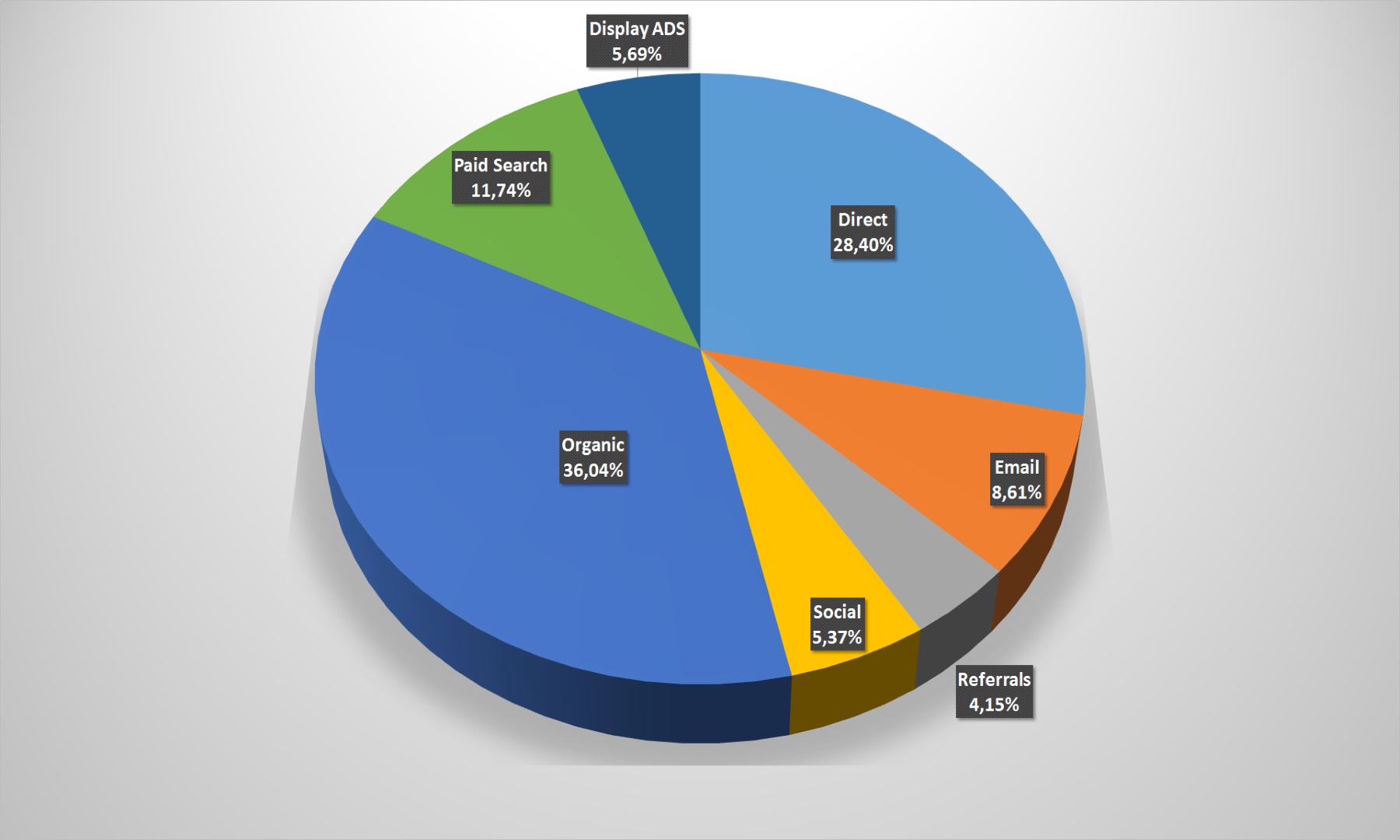

There is information by entry points, or how users get to the retailers’ site. There are two main channels: organic search (in google and other search engines) and direct visits (the direct, when the buyer goes directly to the store portal). The both channels’ share increased compared to last year by 3% and 5% respectively. That is, now the consumer attracting is becoming increasingly difficult by e-mails, paid advertising, cross-references. Content, loyal audience and SMM-promotion is the secret of success!

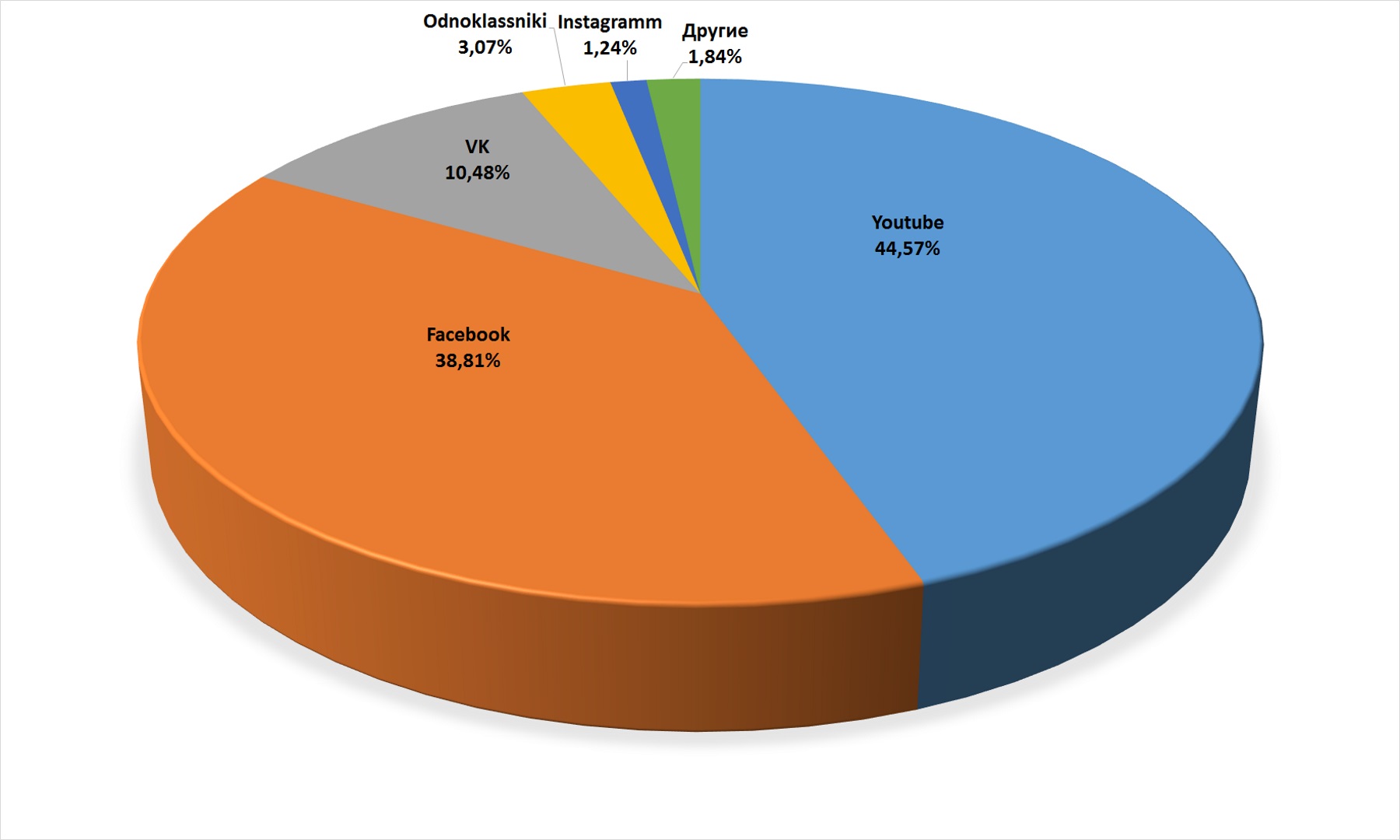

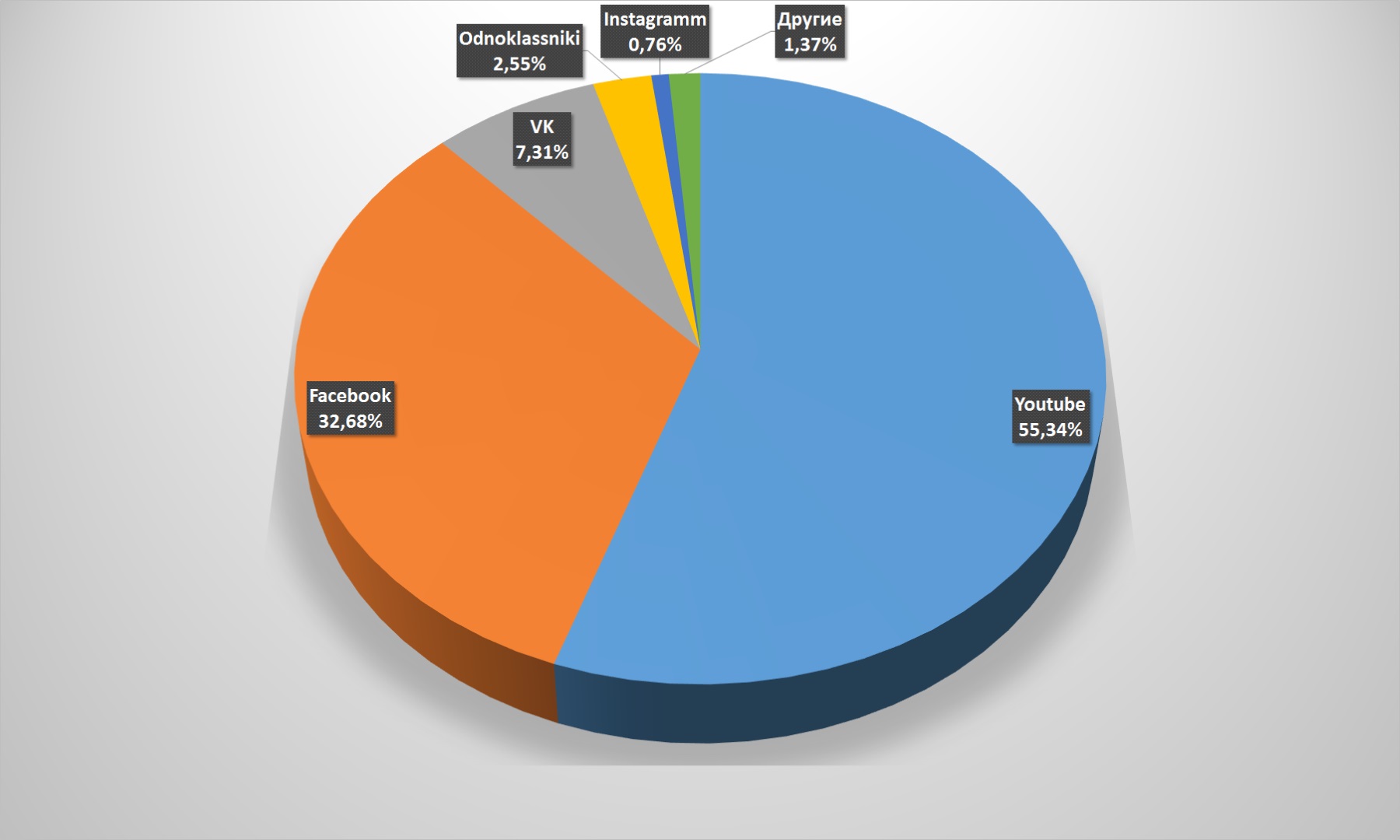

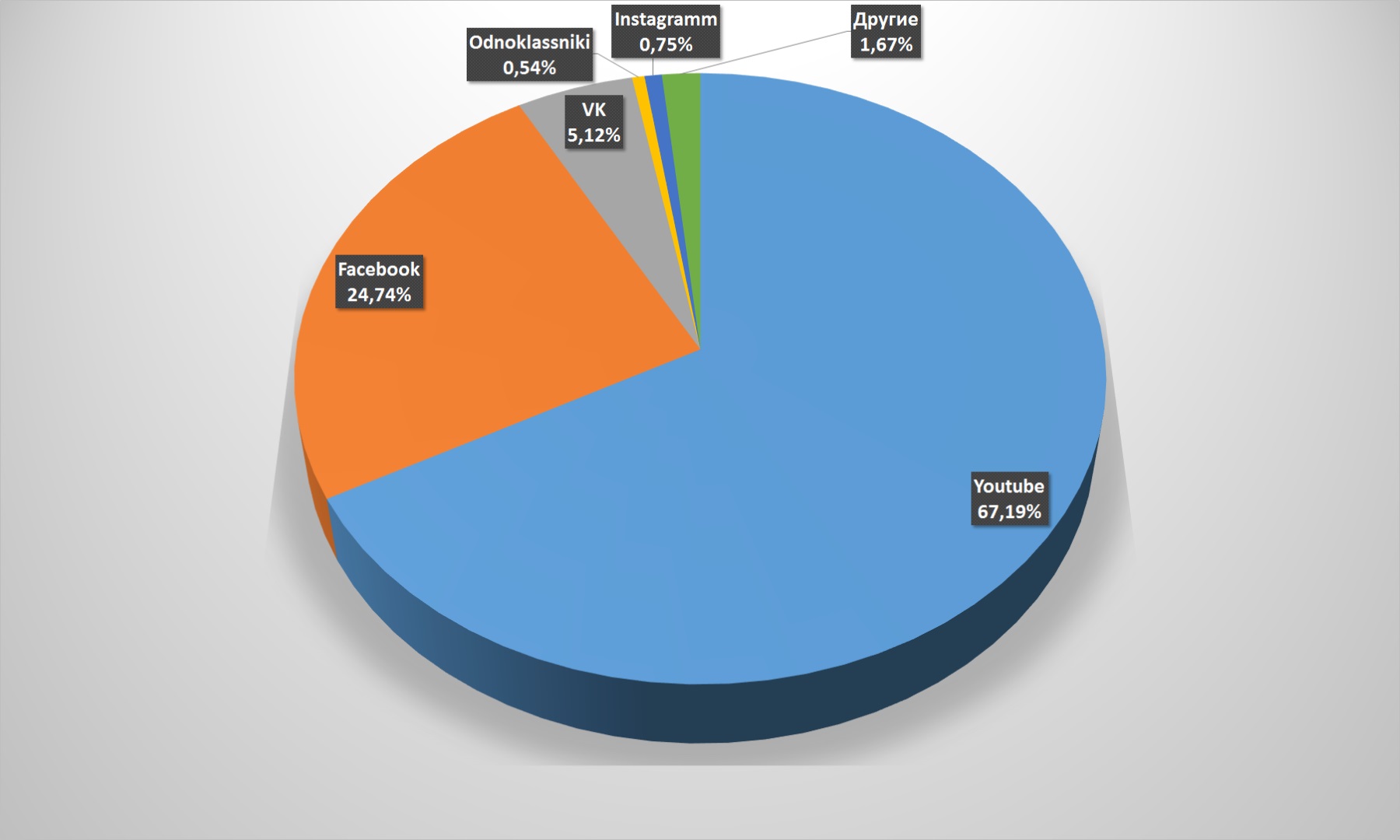

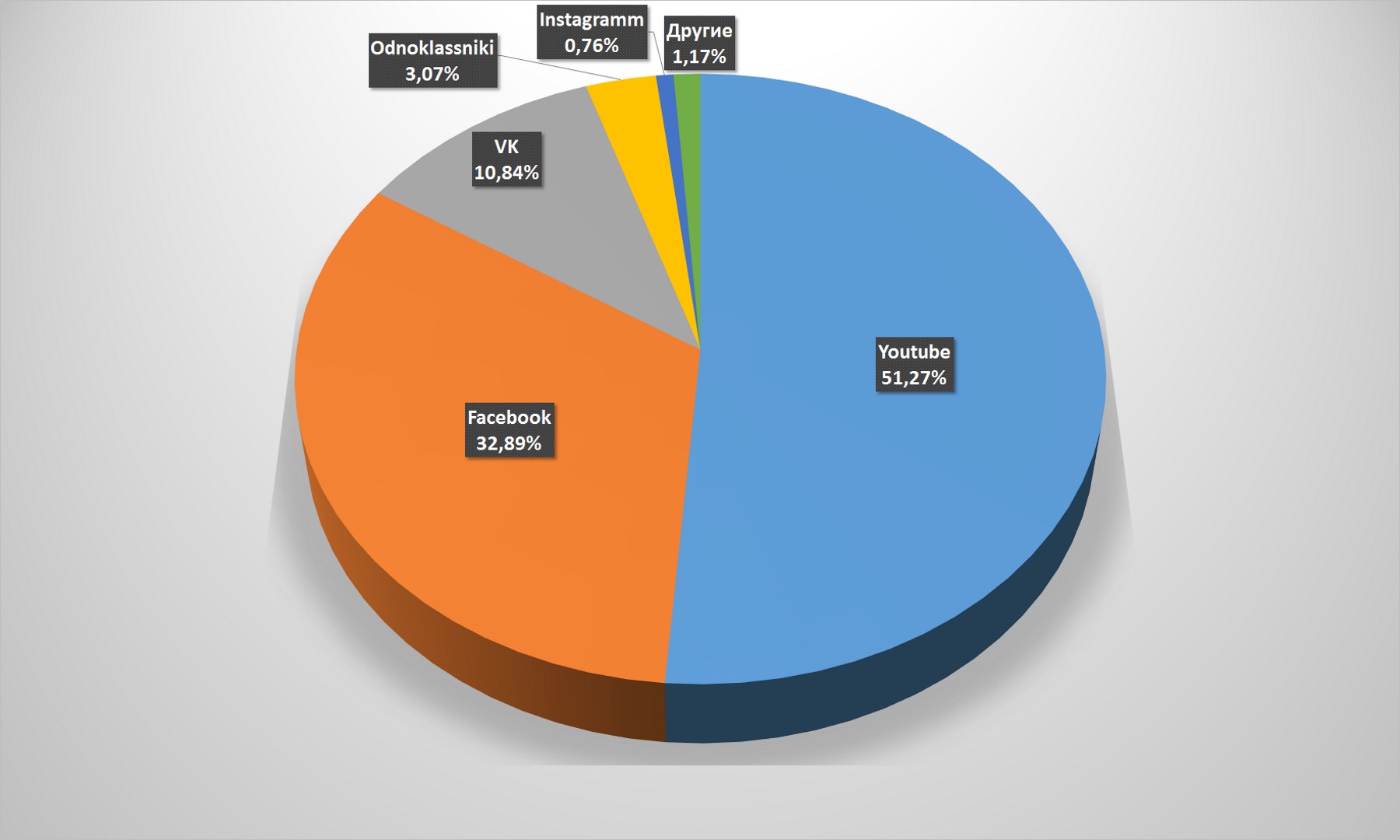

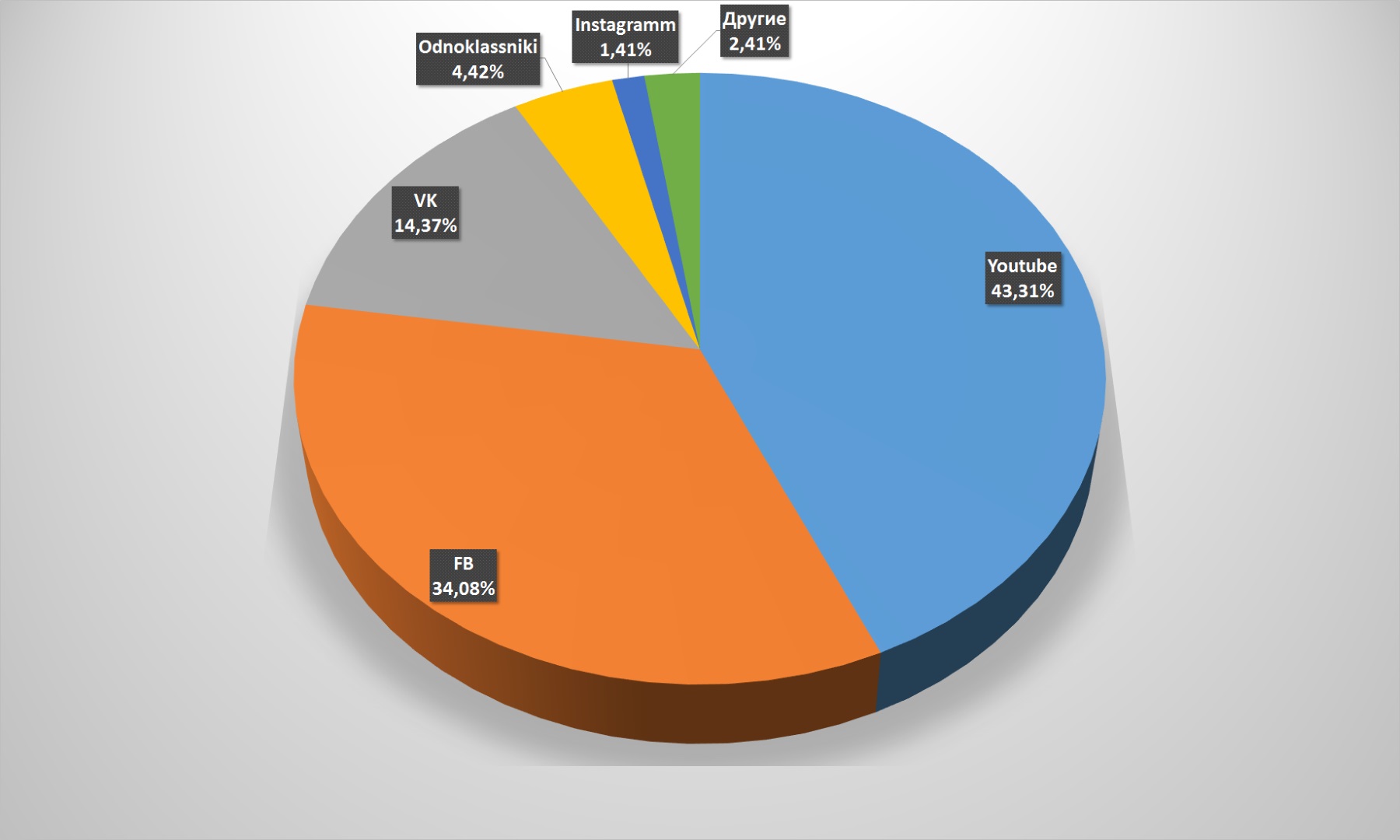

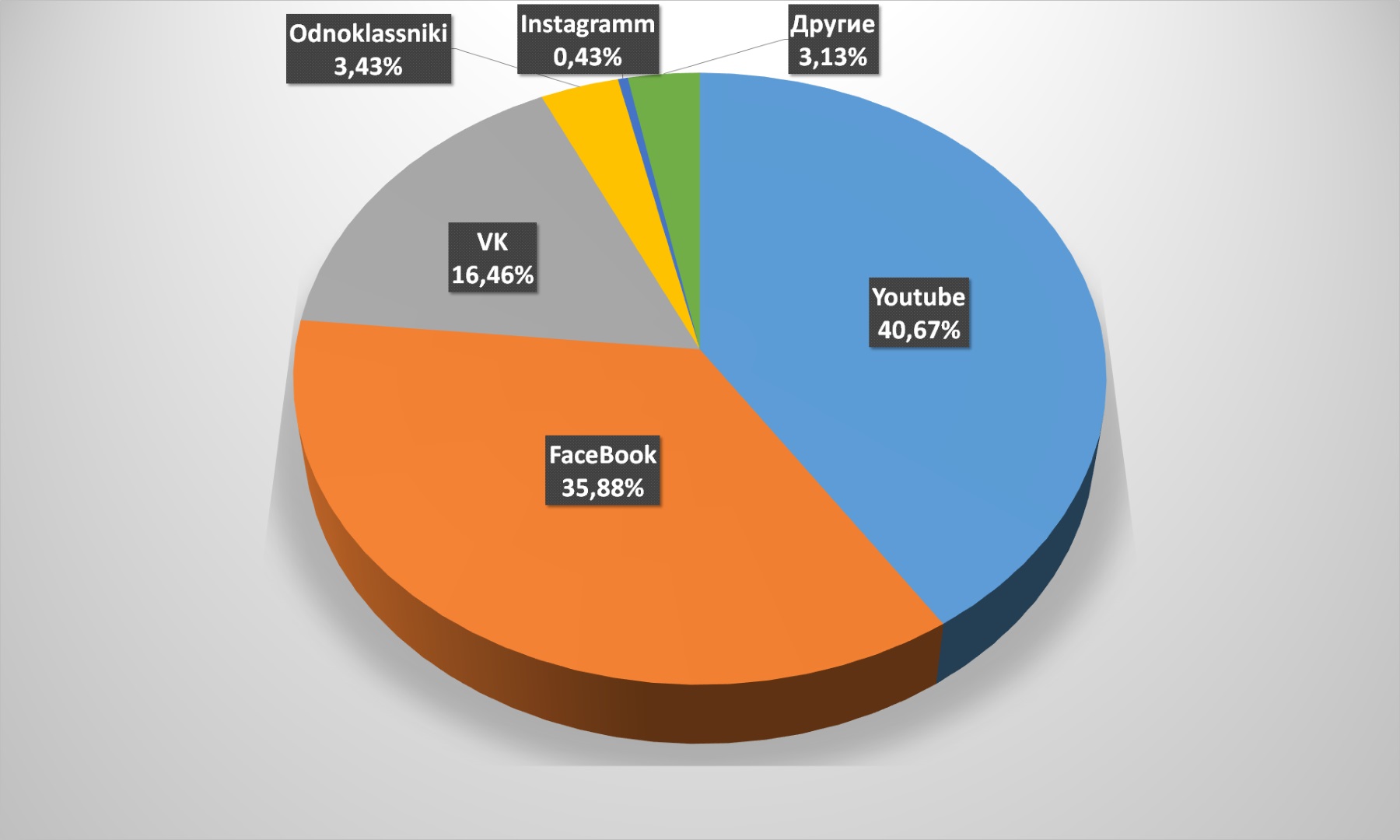

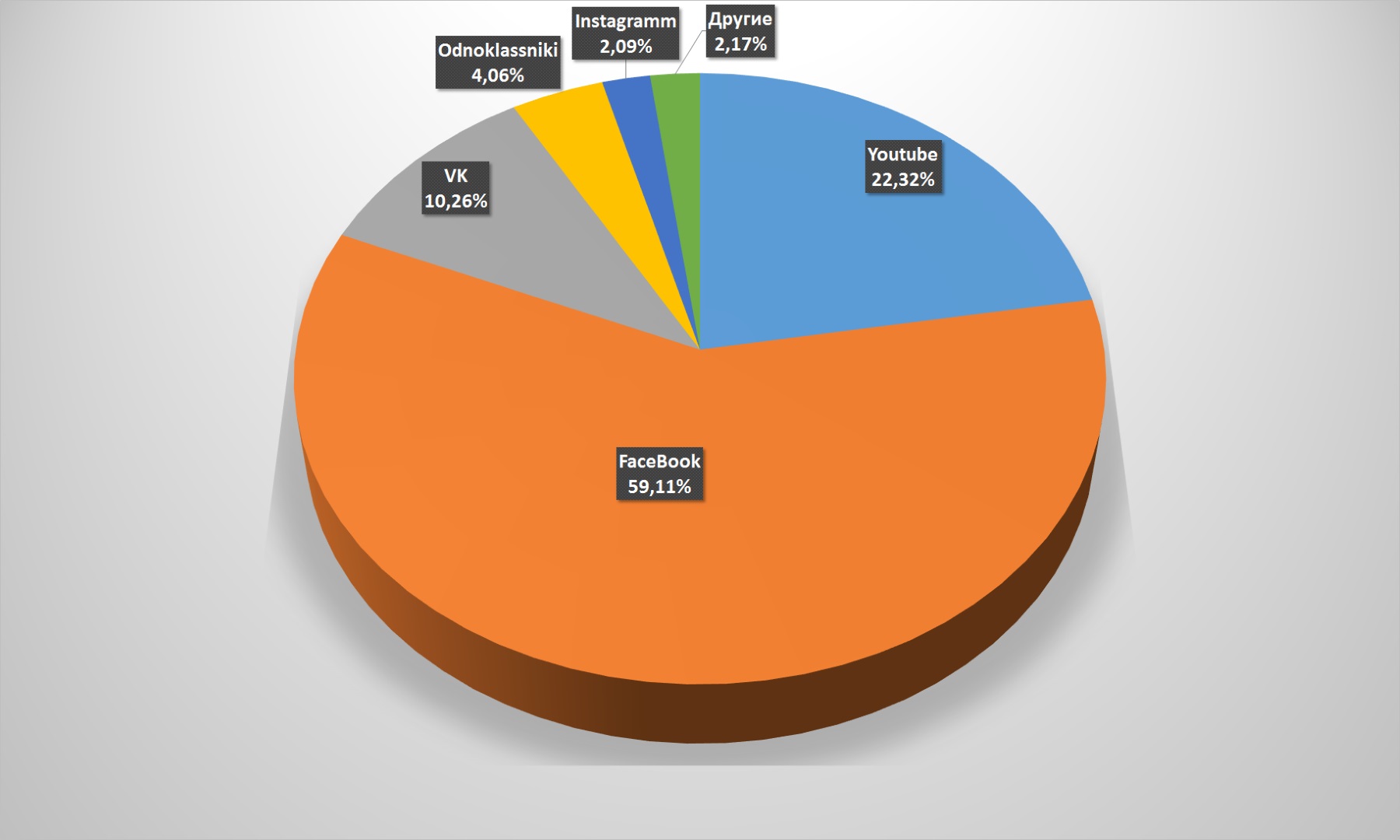

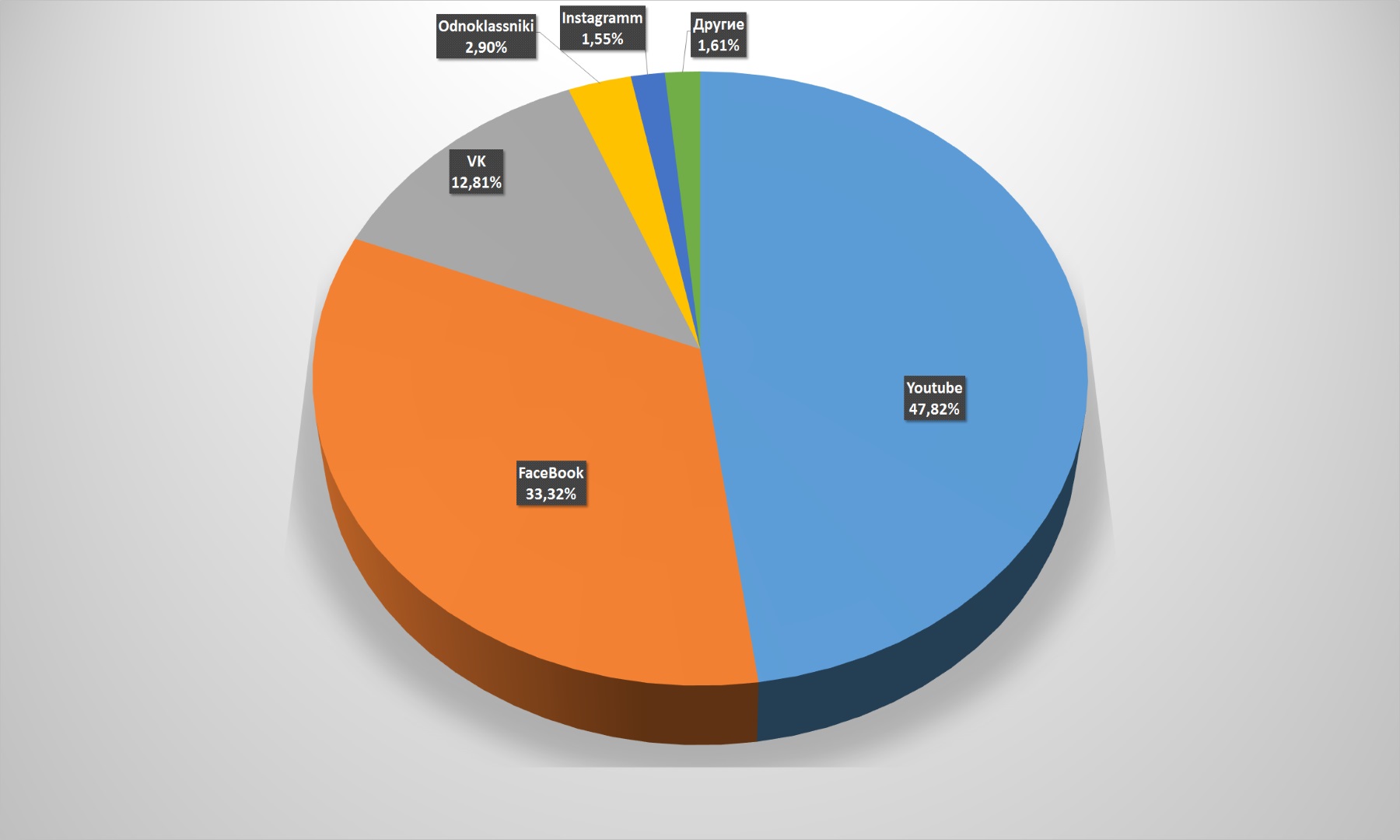

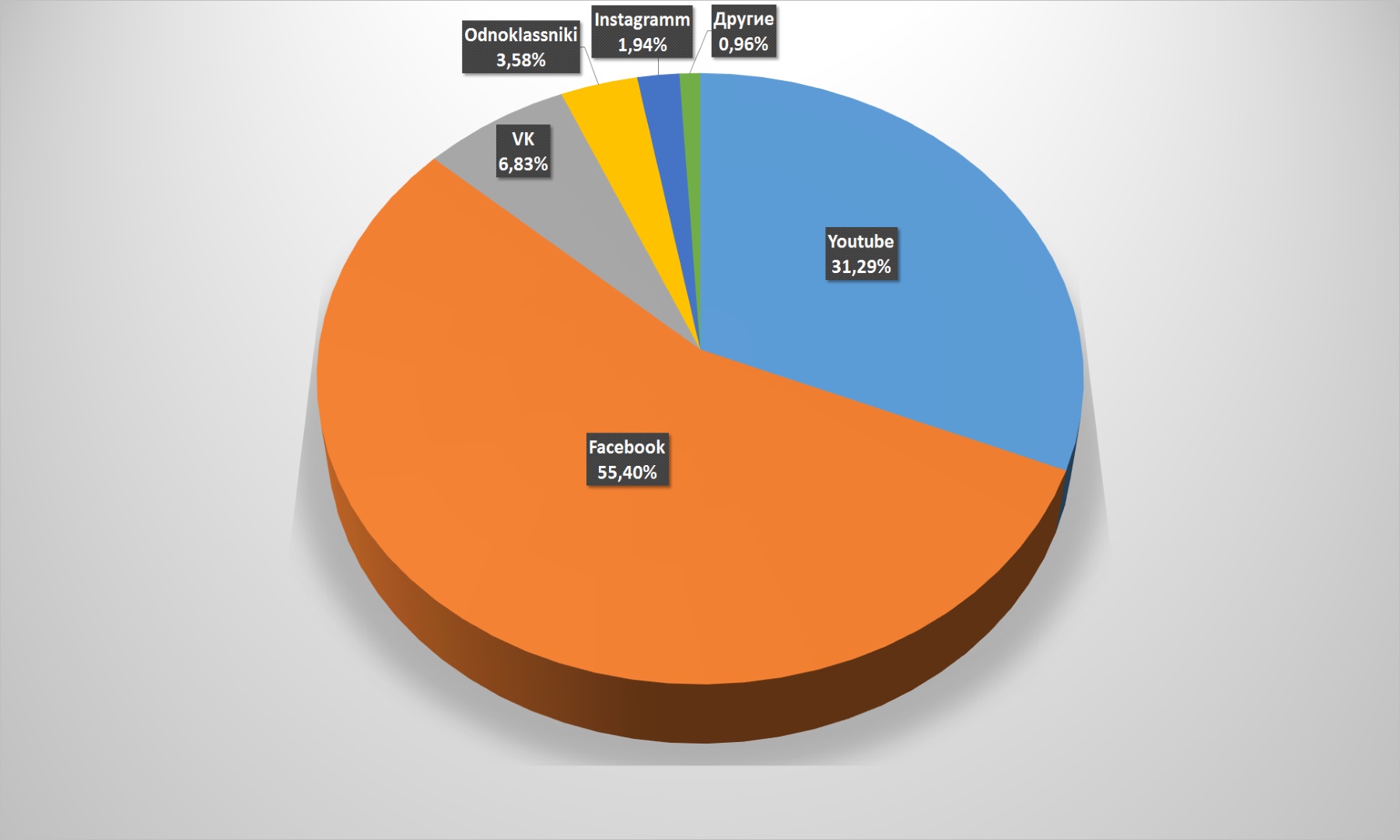

If we analyze traffic from social chains separately, then it provides only 4.73% clicks to the seller’s website. YouTube – (44.57%) and Facebook – (38.81%) are the main traffic providers. The Vkontakte share has slightly decreased from 12.93% to 10.48%, compared to 2017. The remaining social chains remain unimportant for attracting users to online-stores.

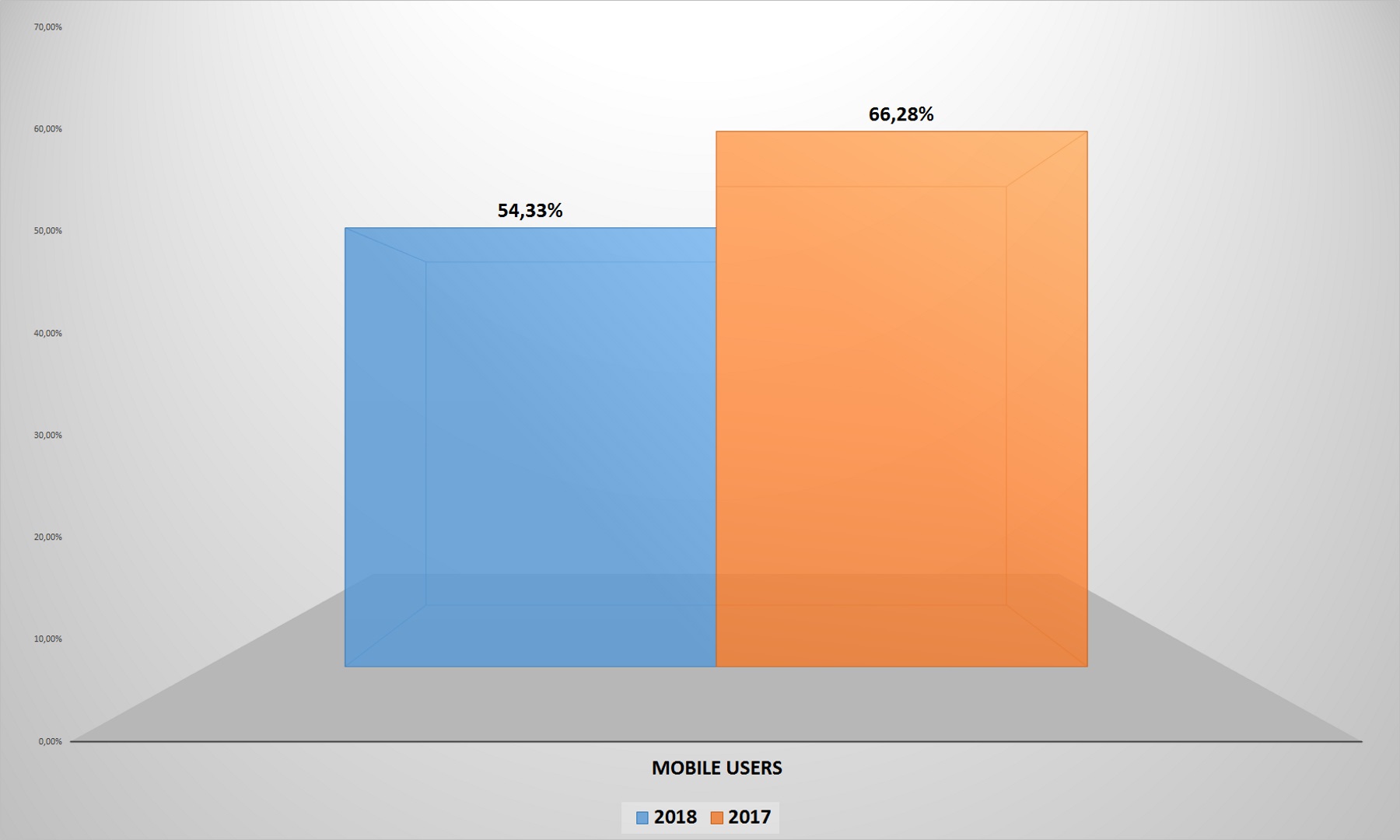

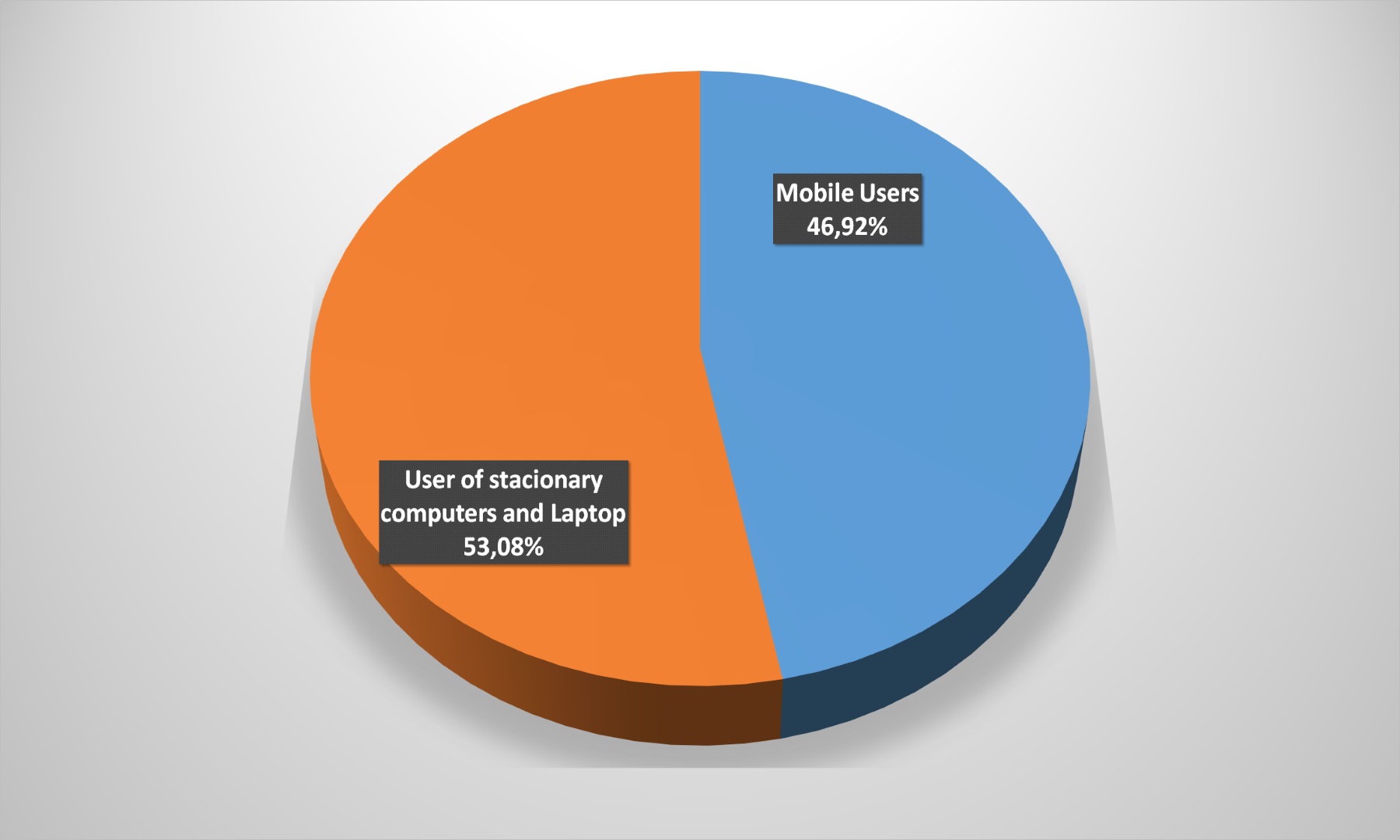

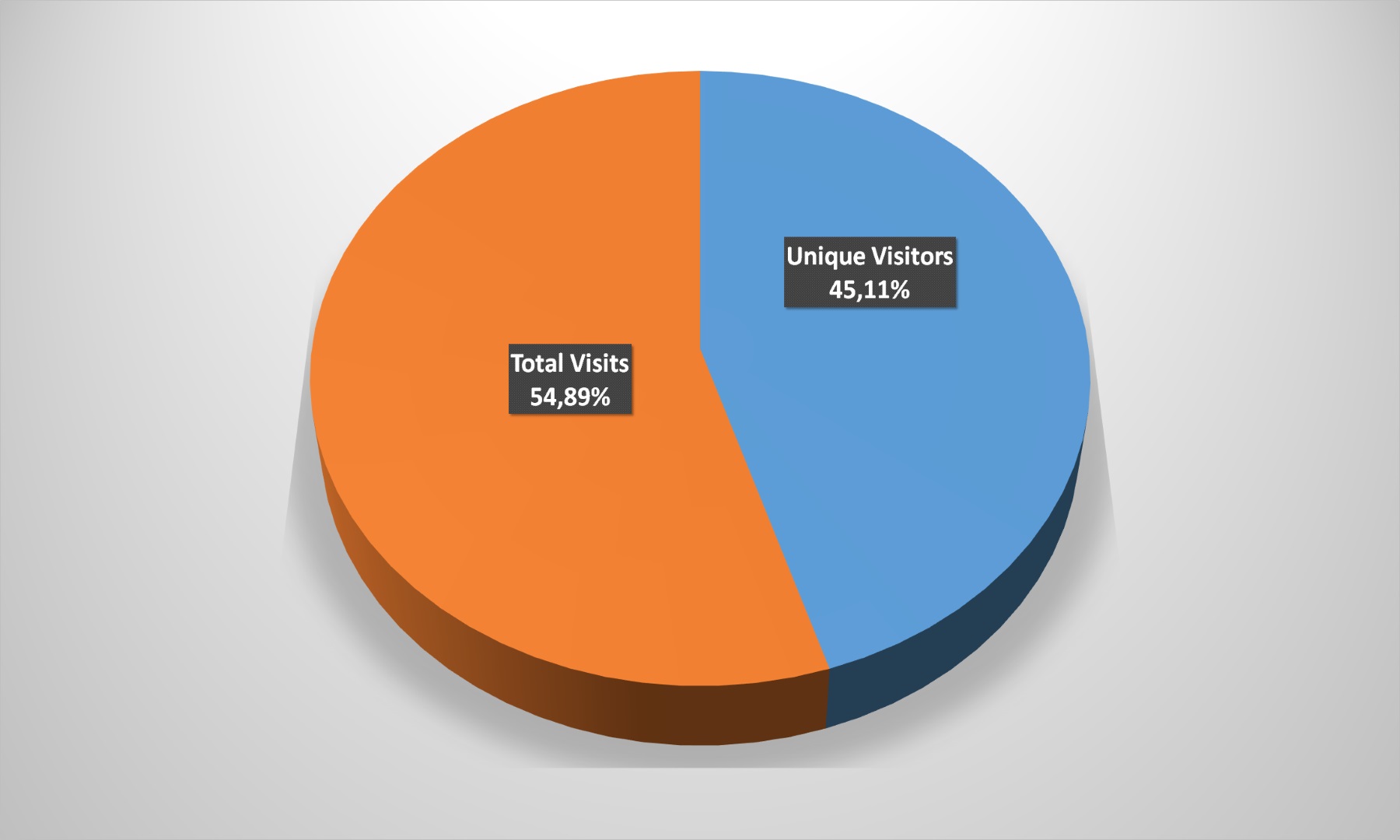

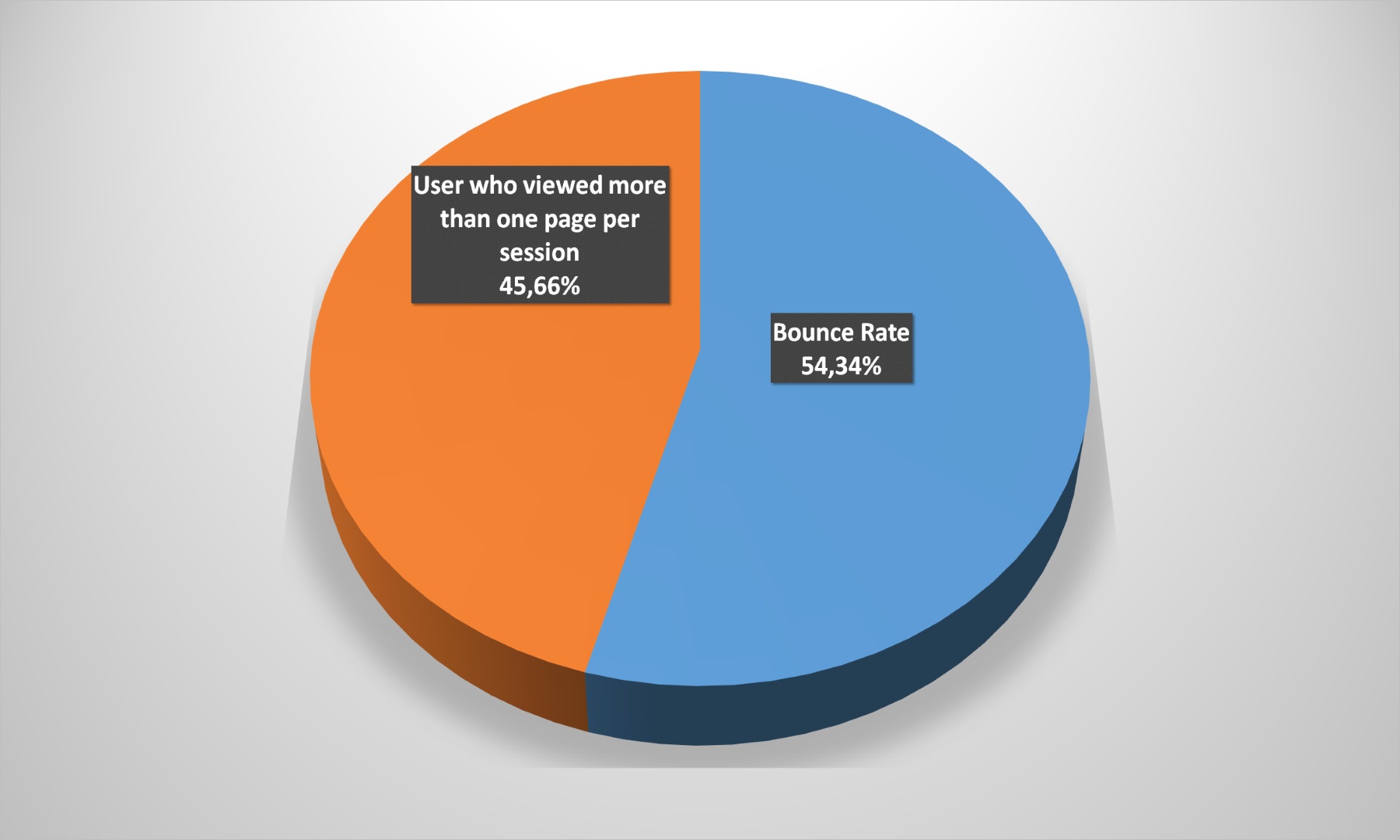

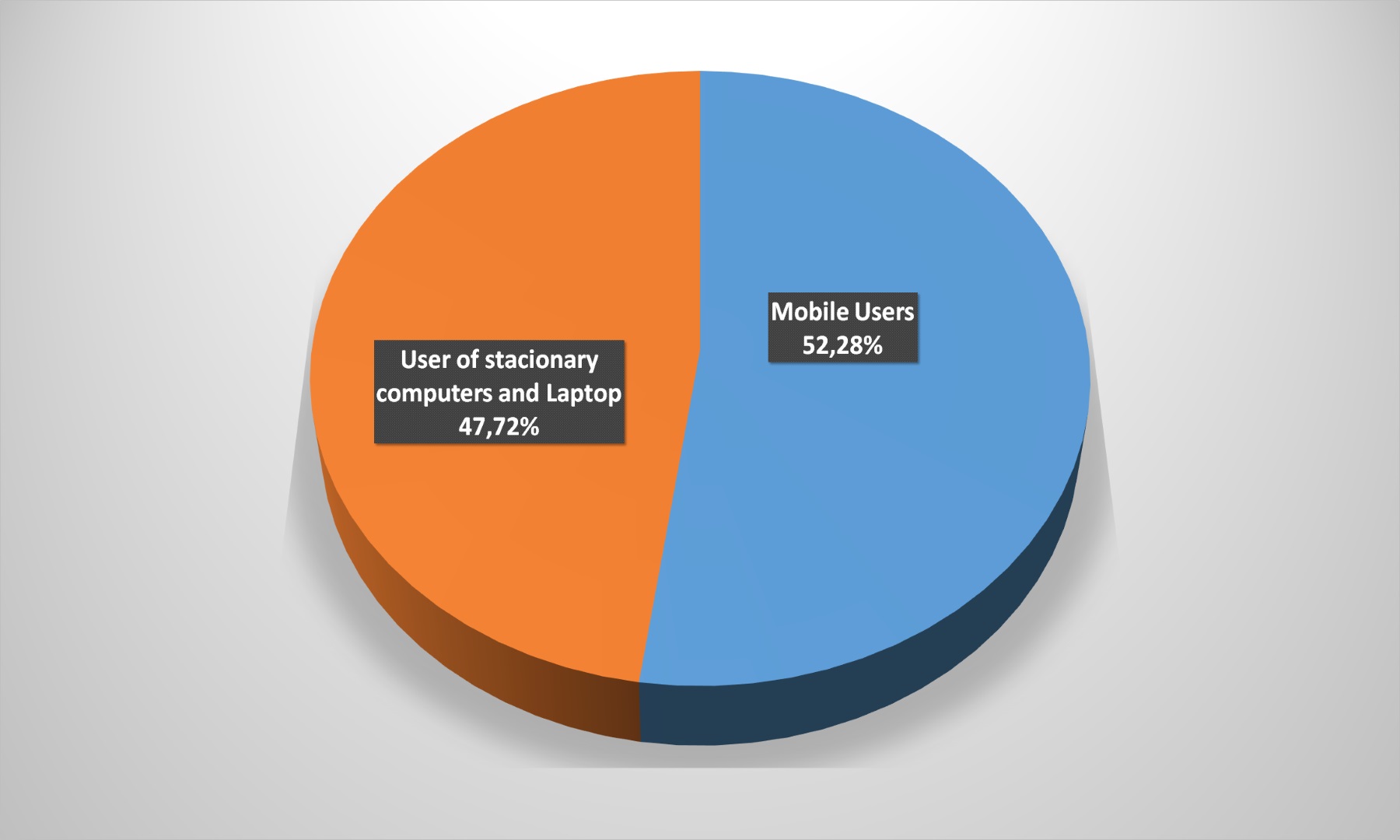

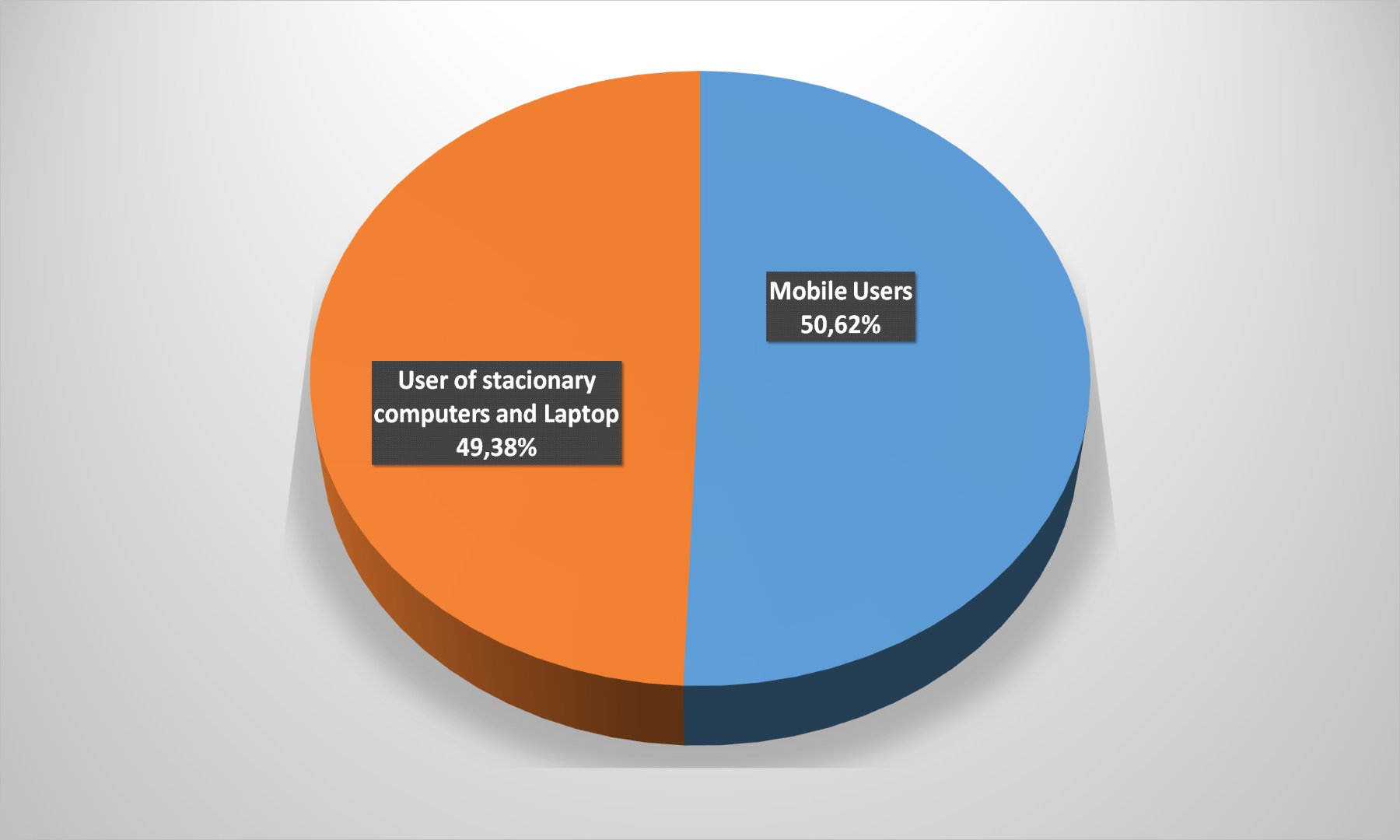

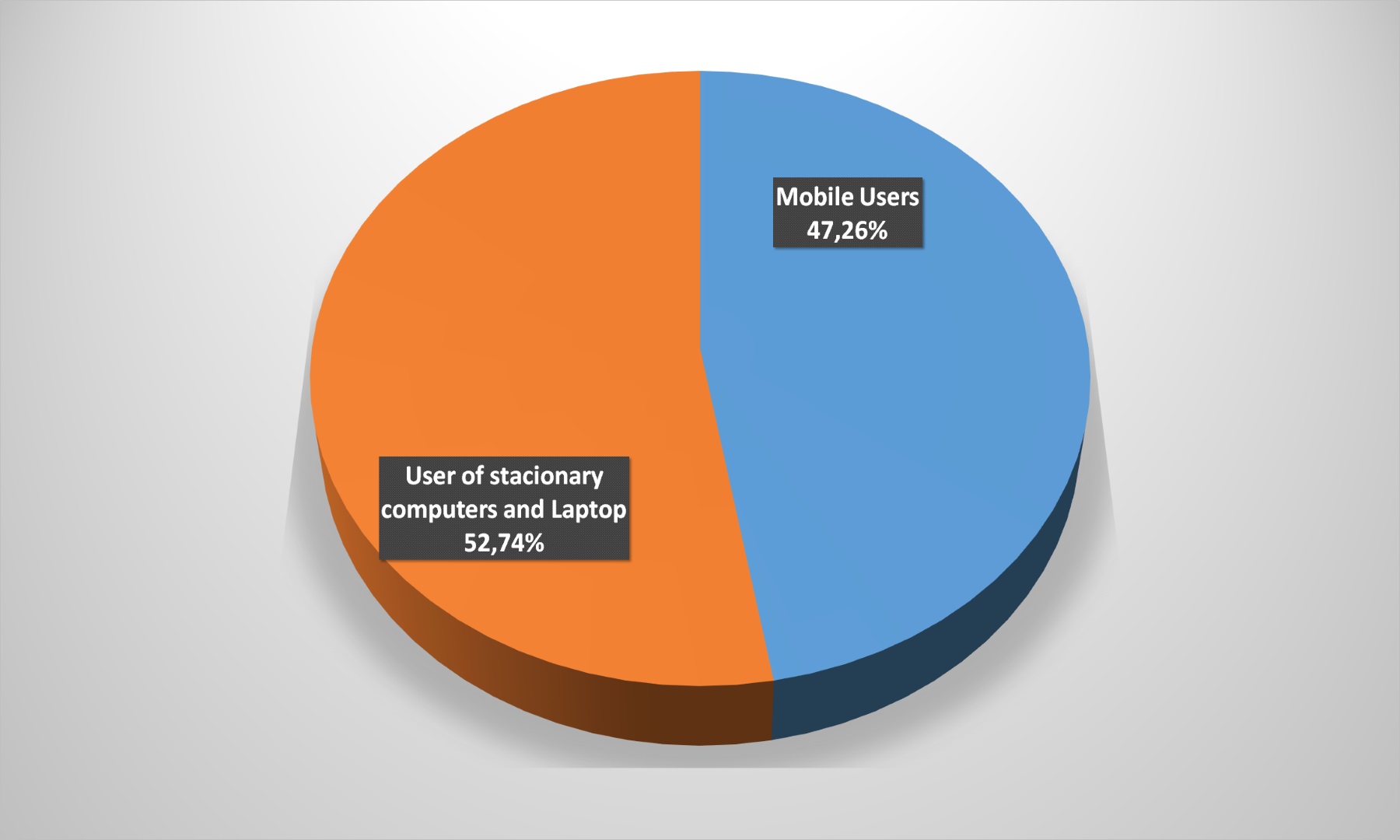

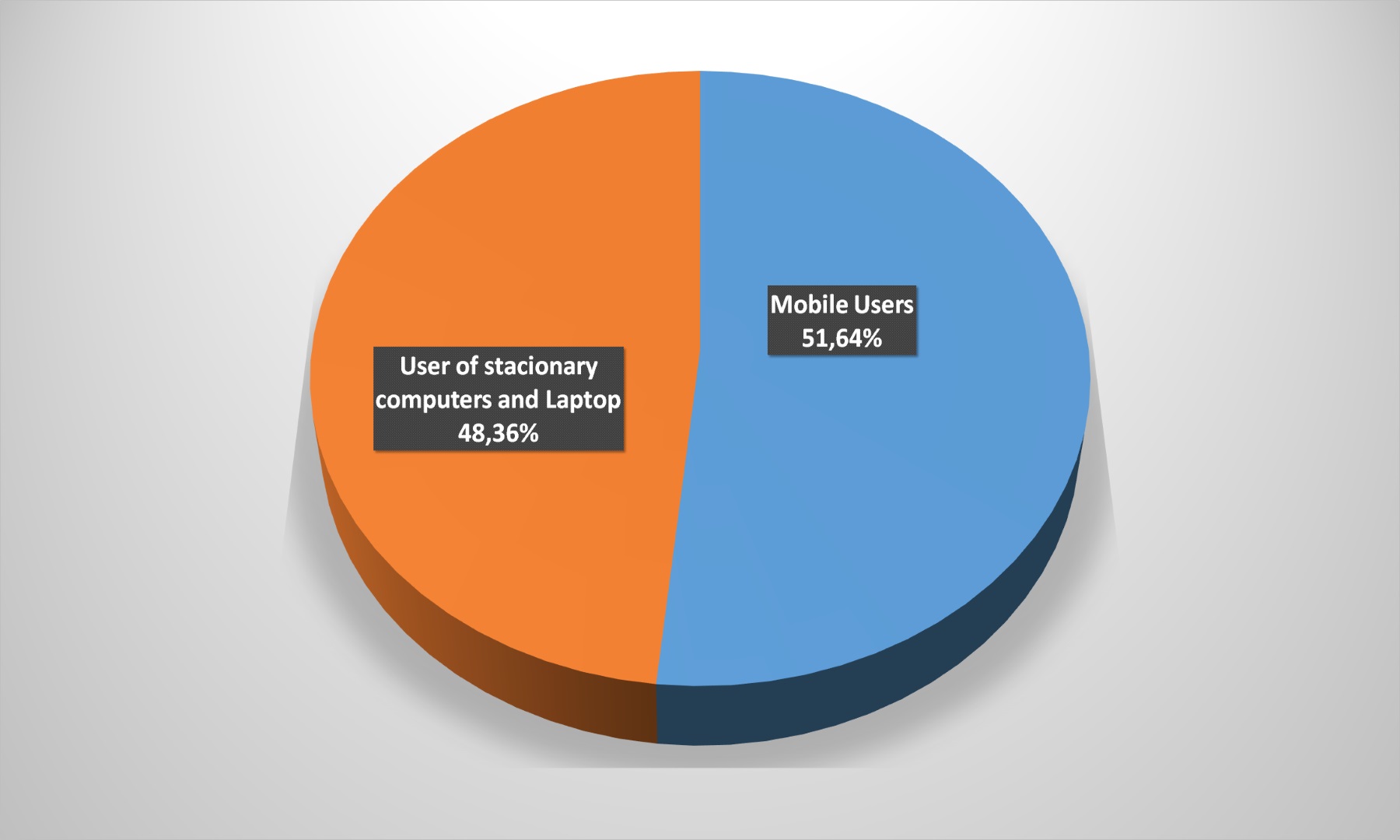

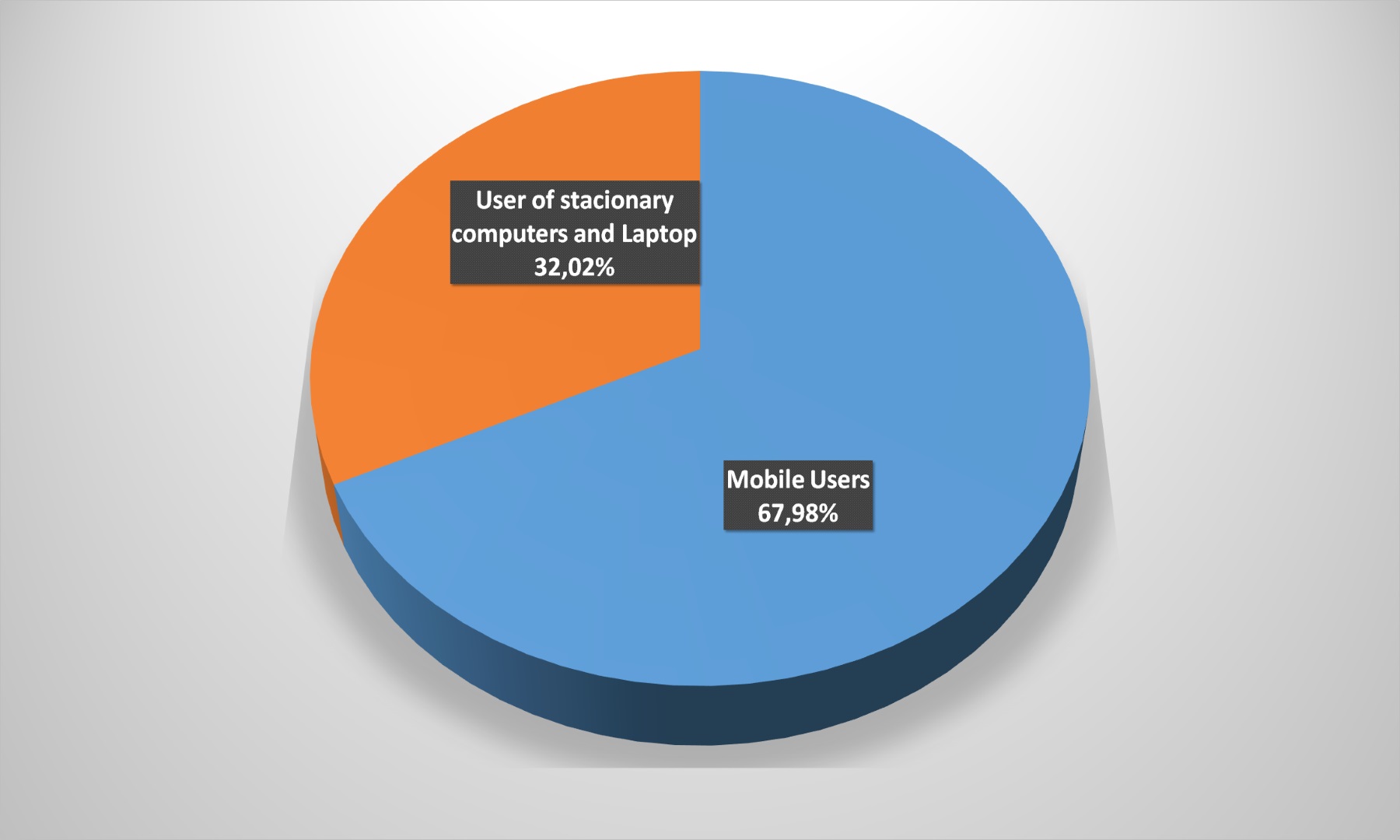

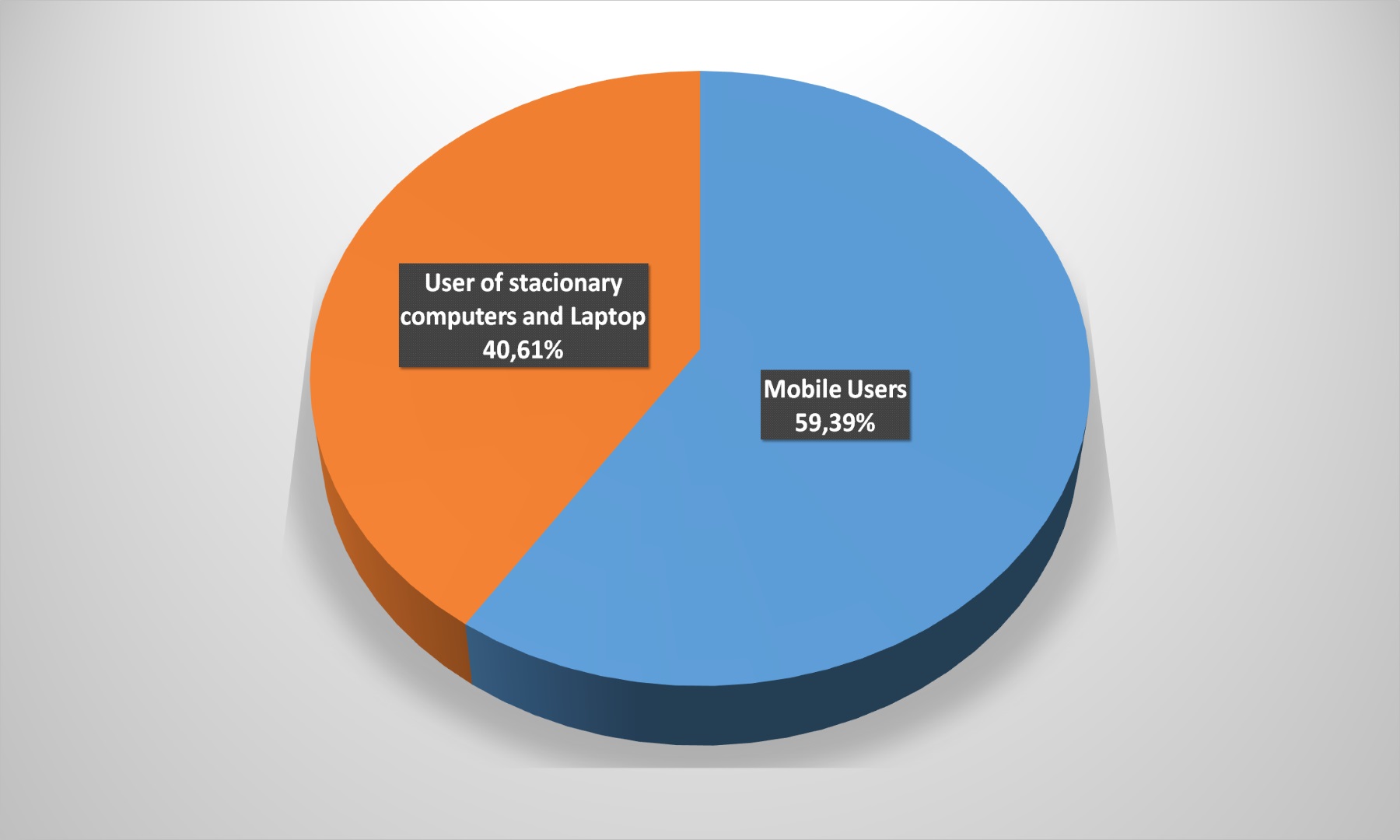

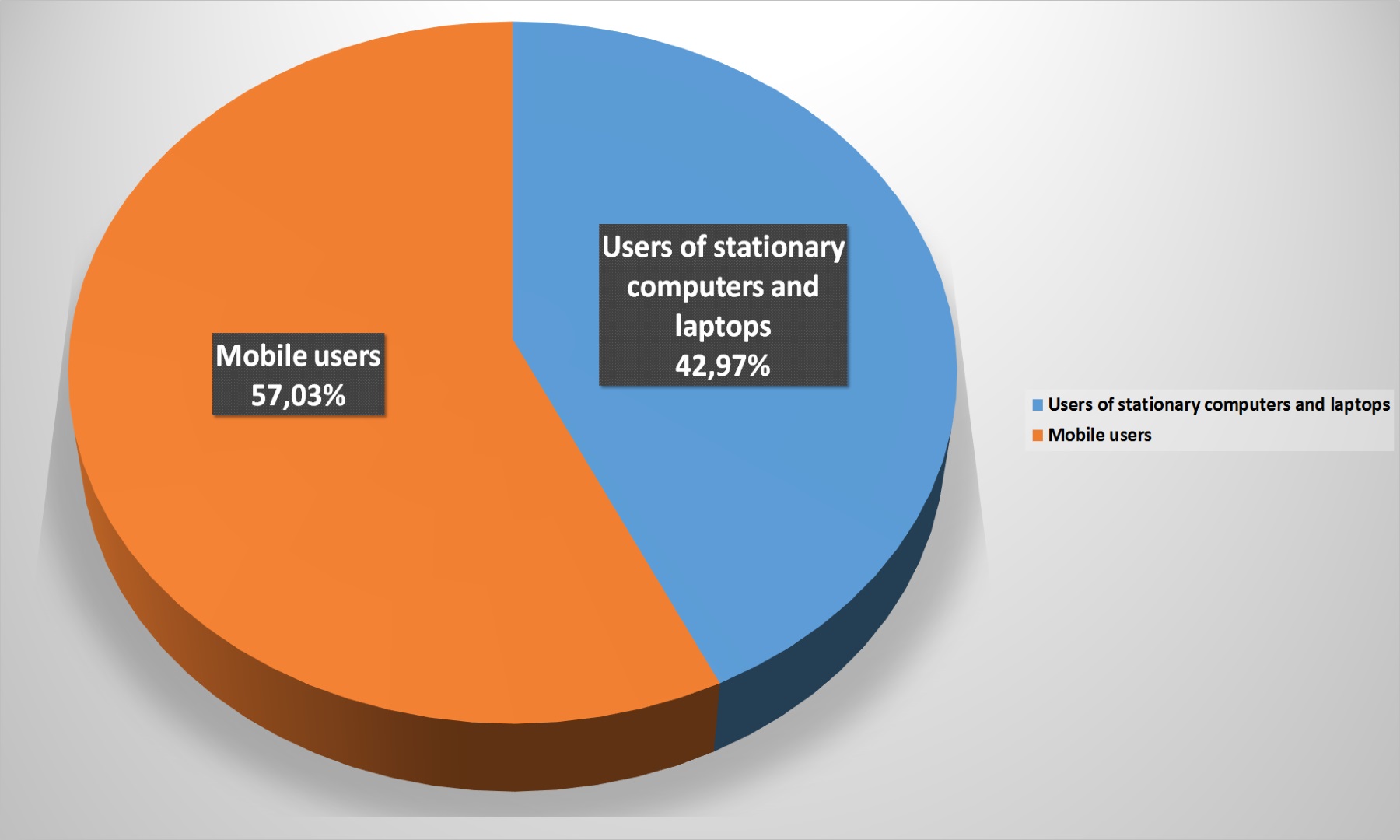

What is surprising: the visits proportion from mobile devices has fallen noticeably when compared with last year. All experts note the m-commerce growing role and advice to pay close attention to this direction development for online-retailers. But the fact remains the fact: if in 2017, users 66.28% visited store site by mobile, then in this year –only 54 33%. It may be worthwhile for e-commerce market players to analyze the functionality and convenience of its portals mobile versions and to adjust tactics, making websites more user-friendly.

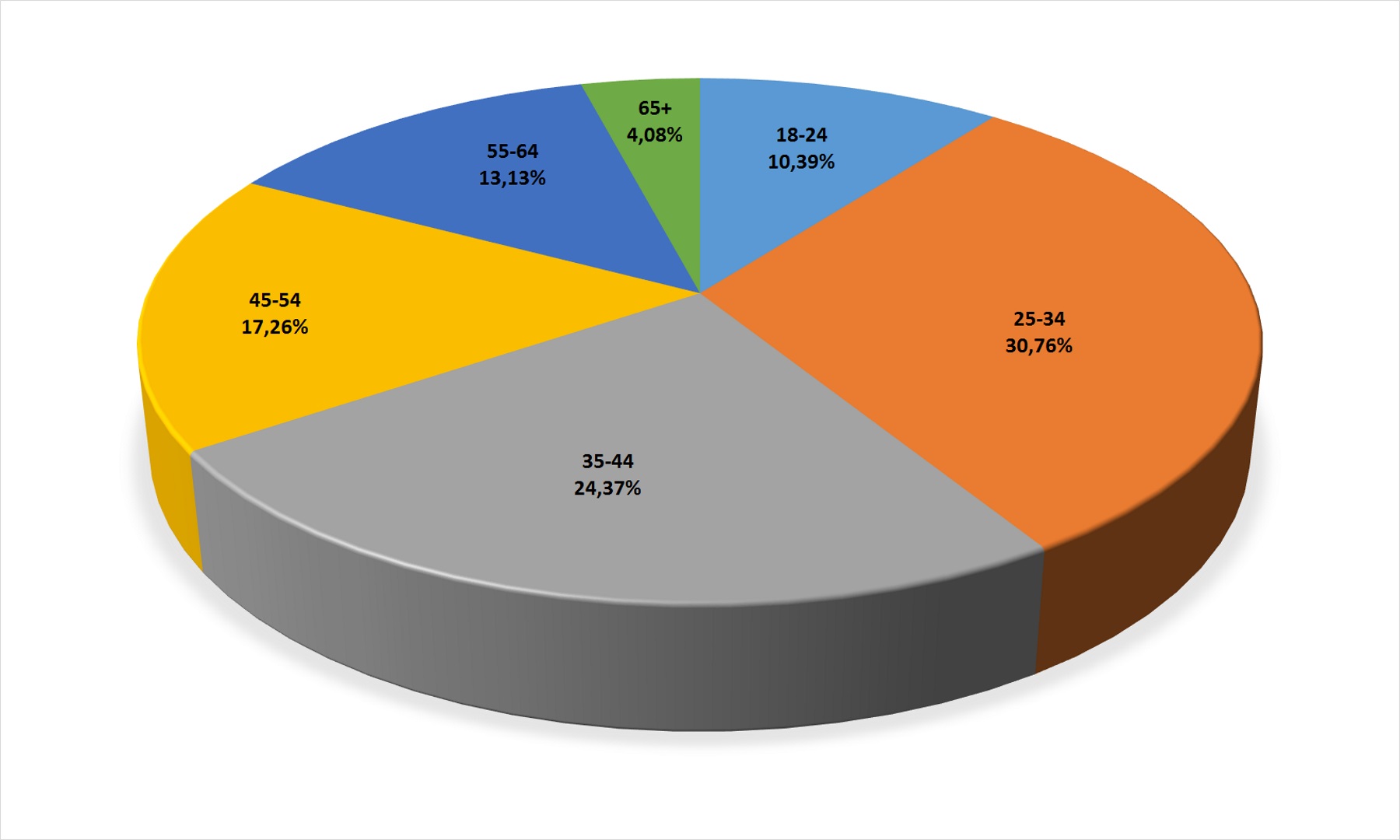

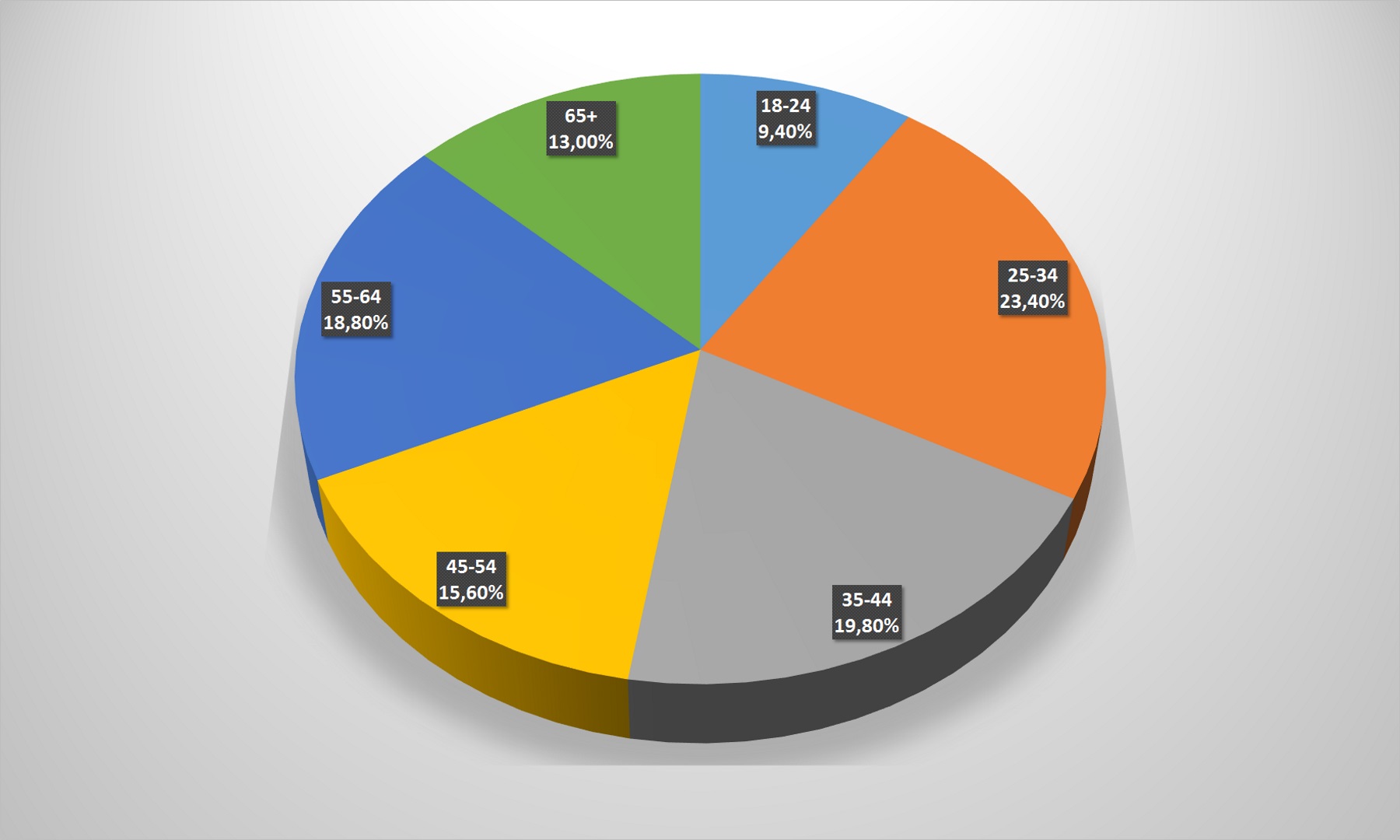

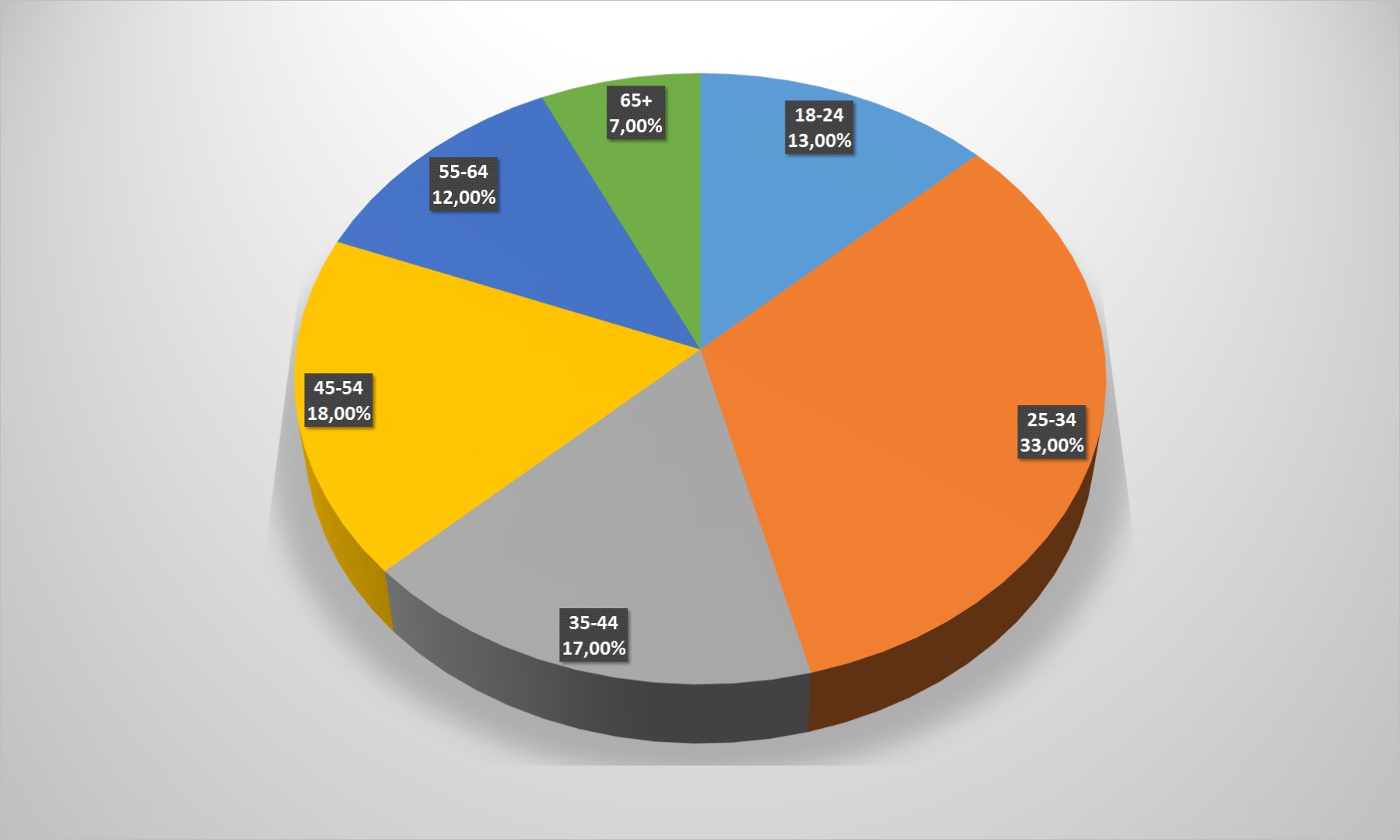

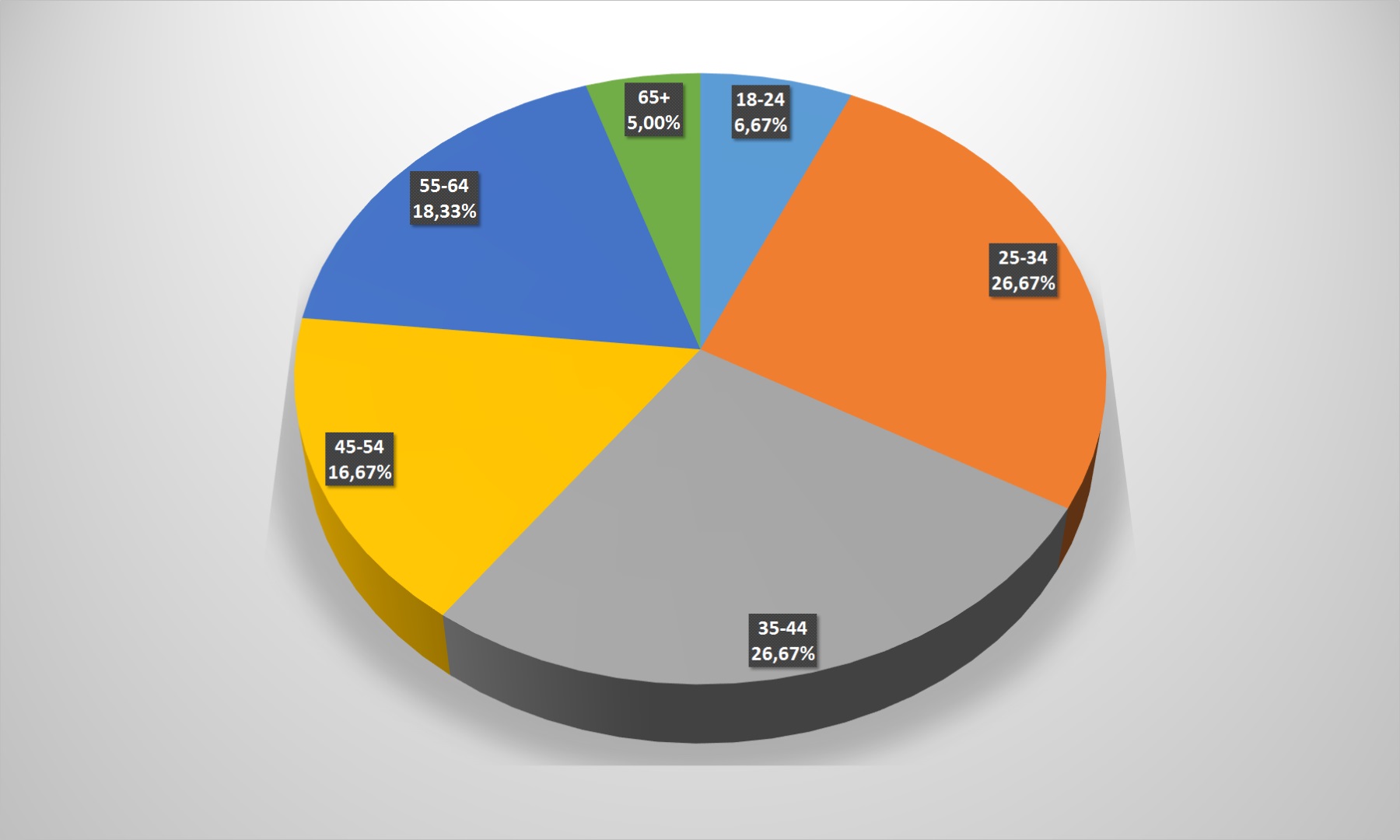

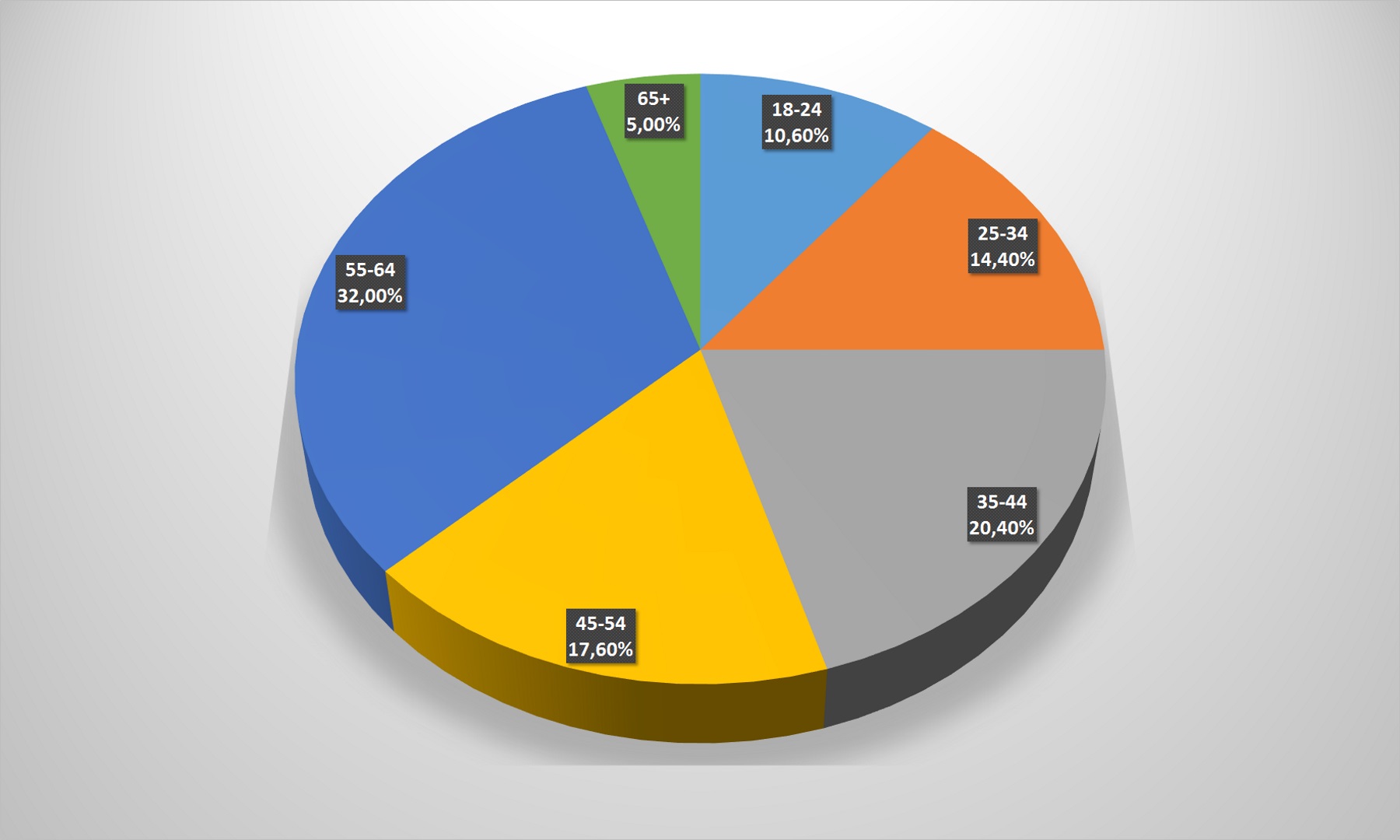

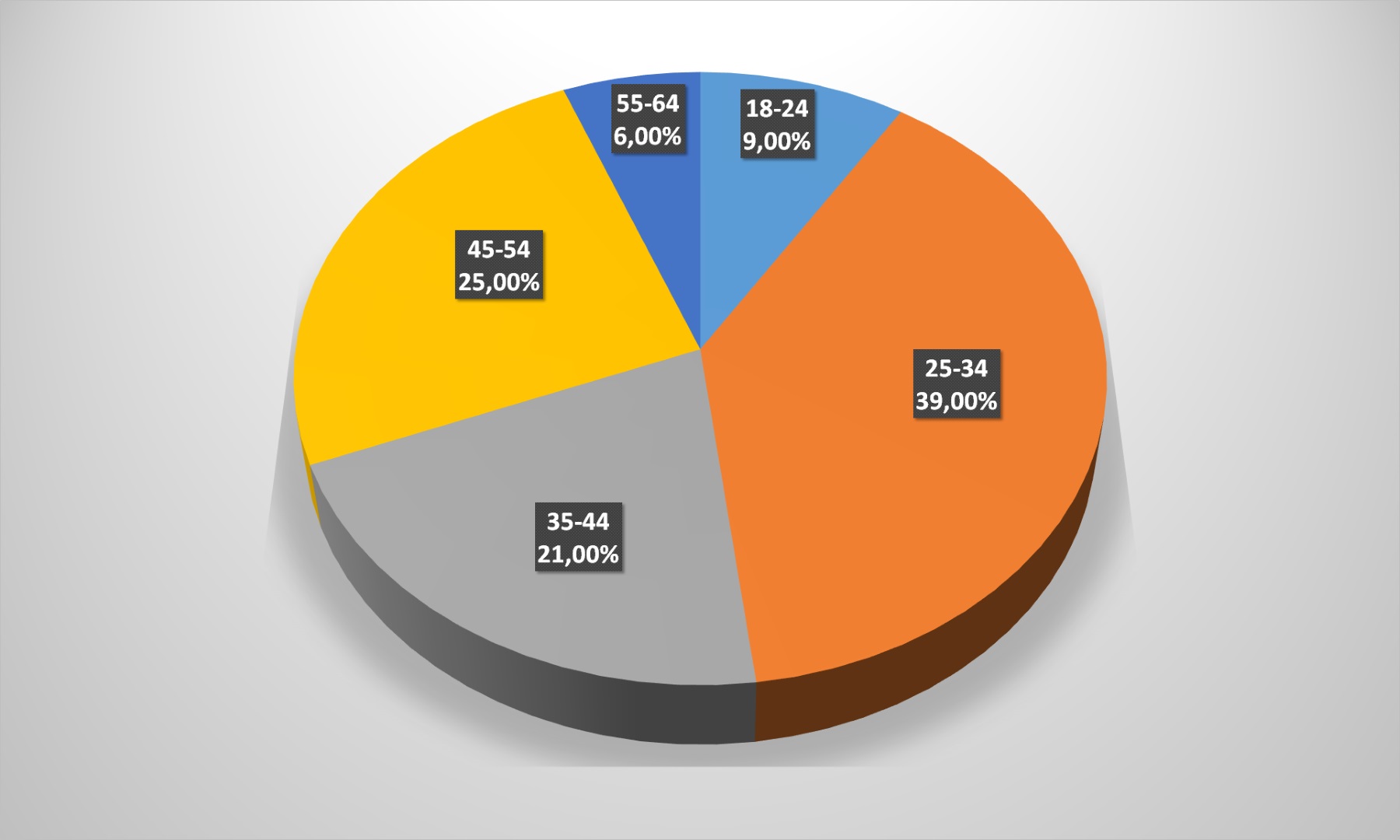

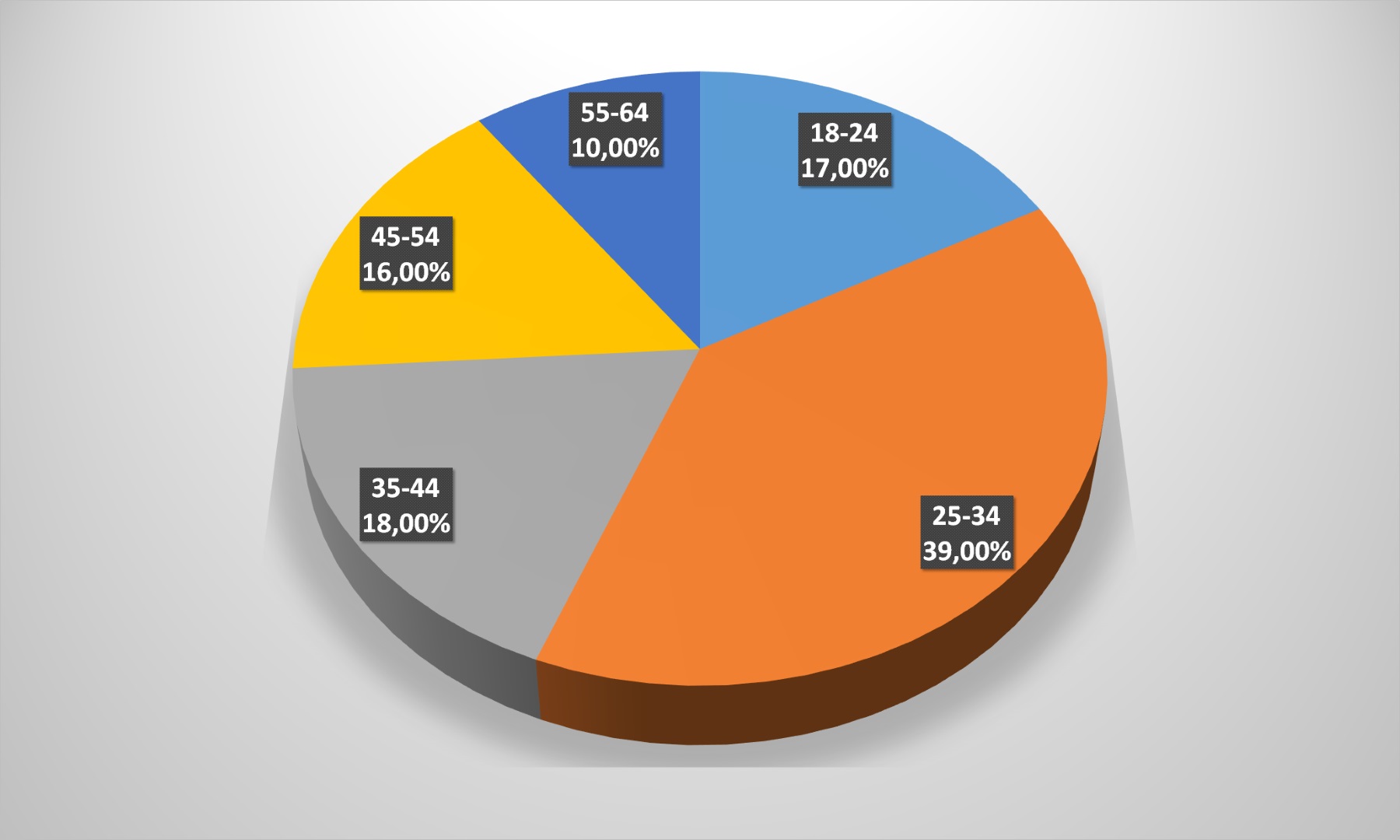

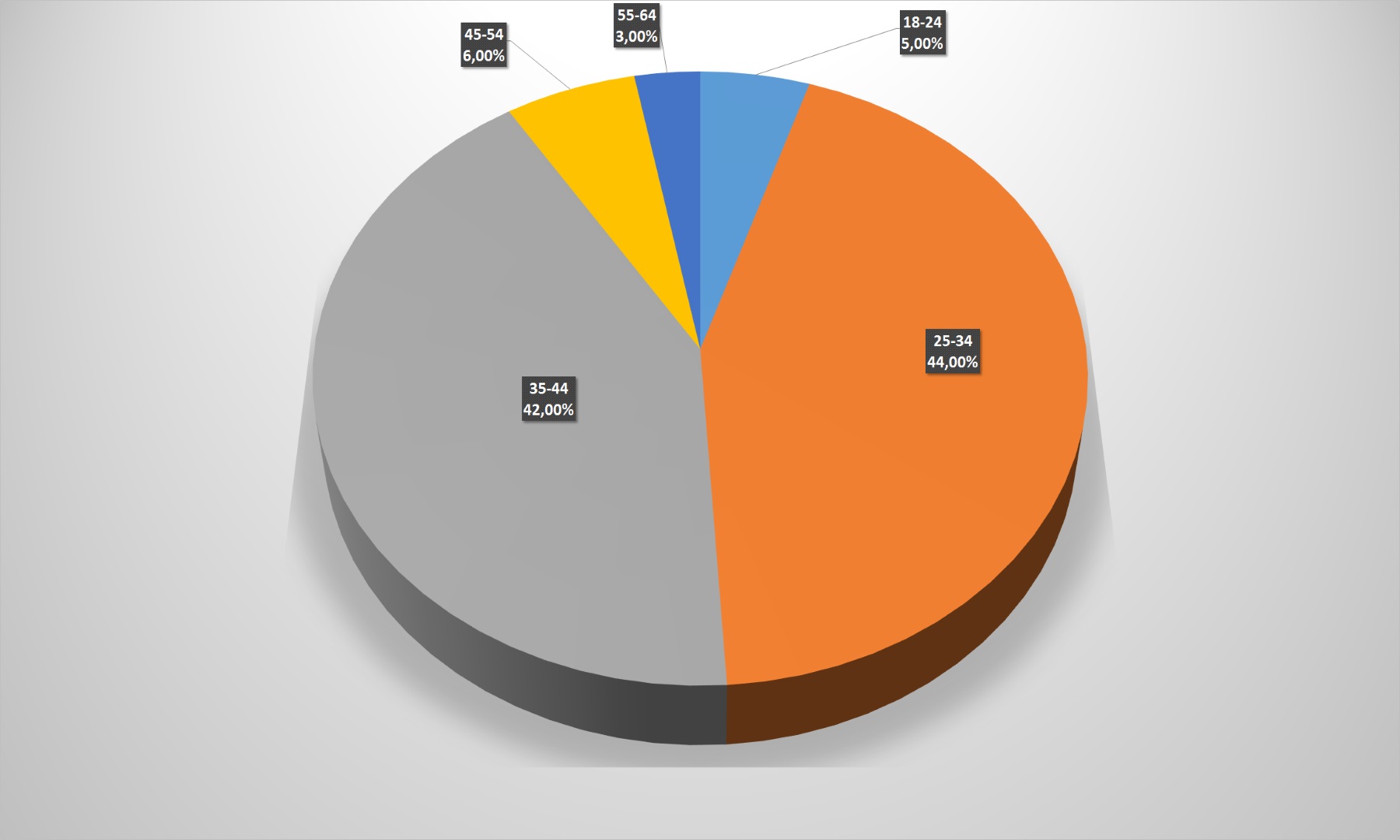

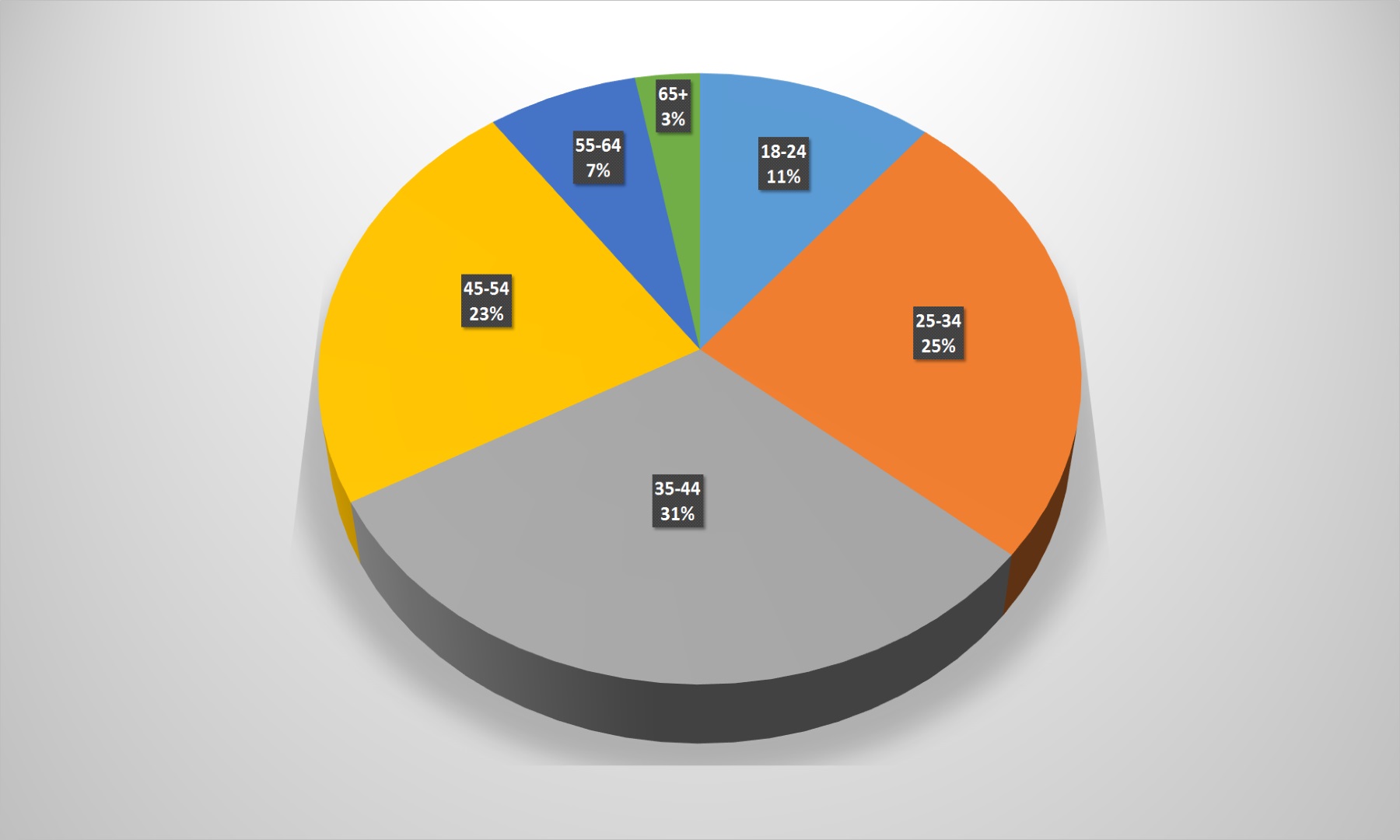

The overall age users range brought no surprises. People from 25 to 44 years old are more than online-store customers 55%, age groups 18-24 and 45-54 years are another 27.5%. The older generation (over 55) provides Ukrainian online-retailers with a modest 17%.

Department stores

If we consider the domestic e-commerce individual segments in more detail, almost “under the microscope”, then you can find a lot of interesting, and partly unexpected trends.

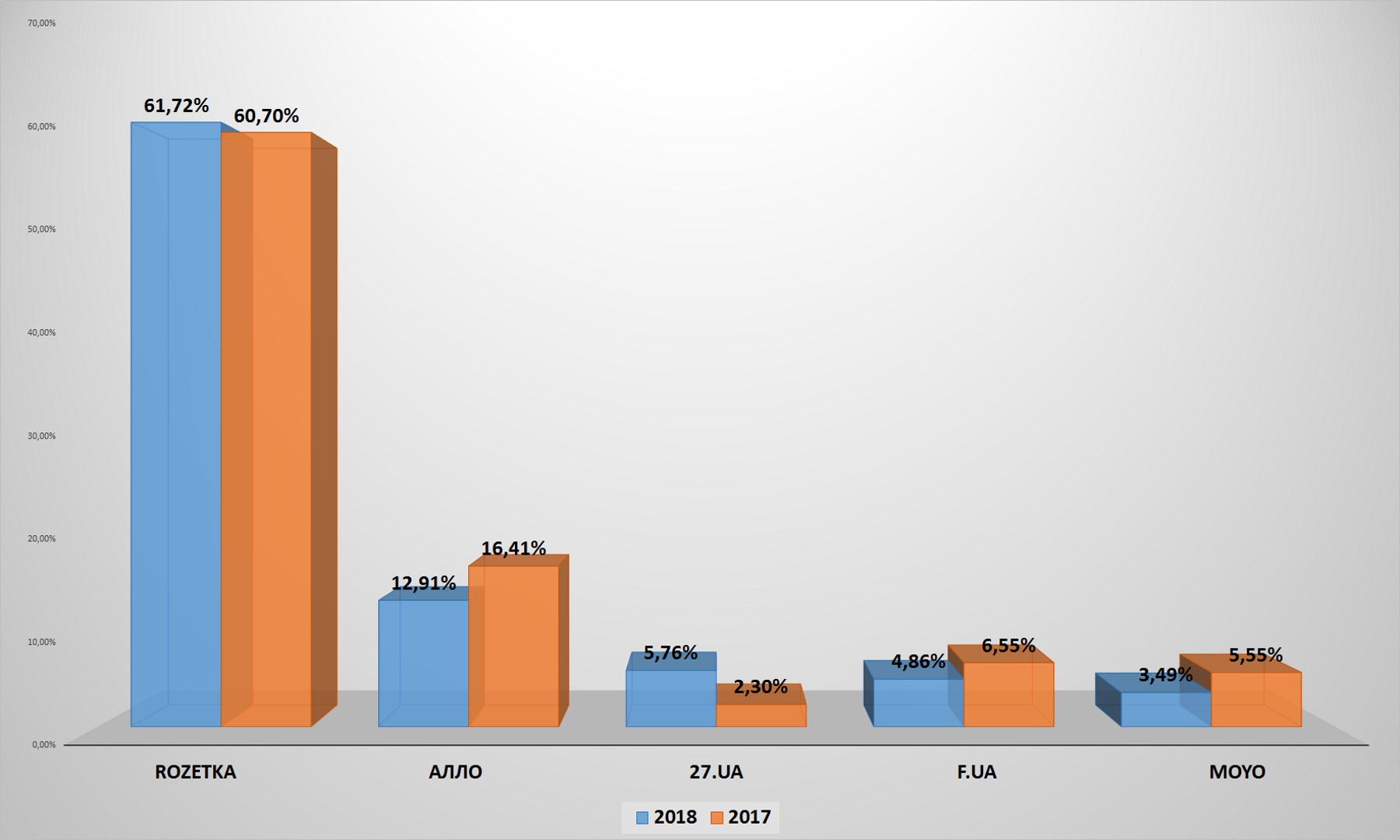

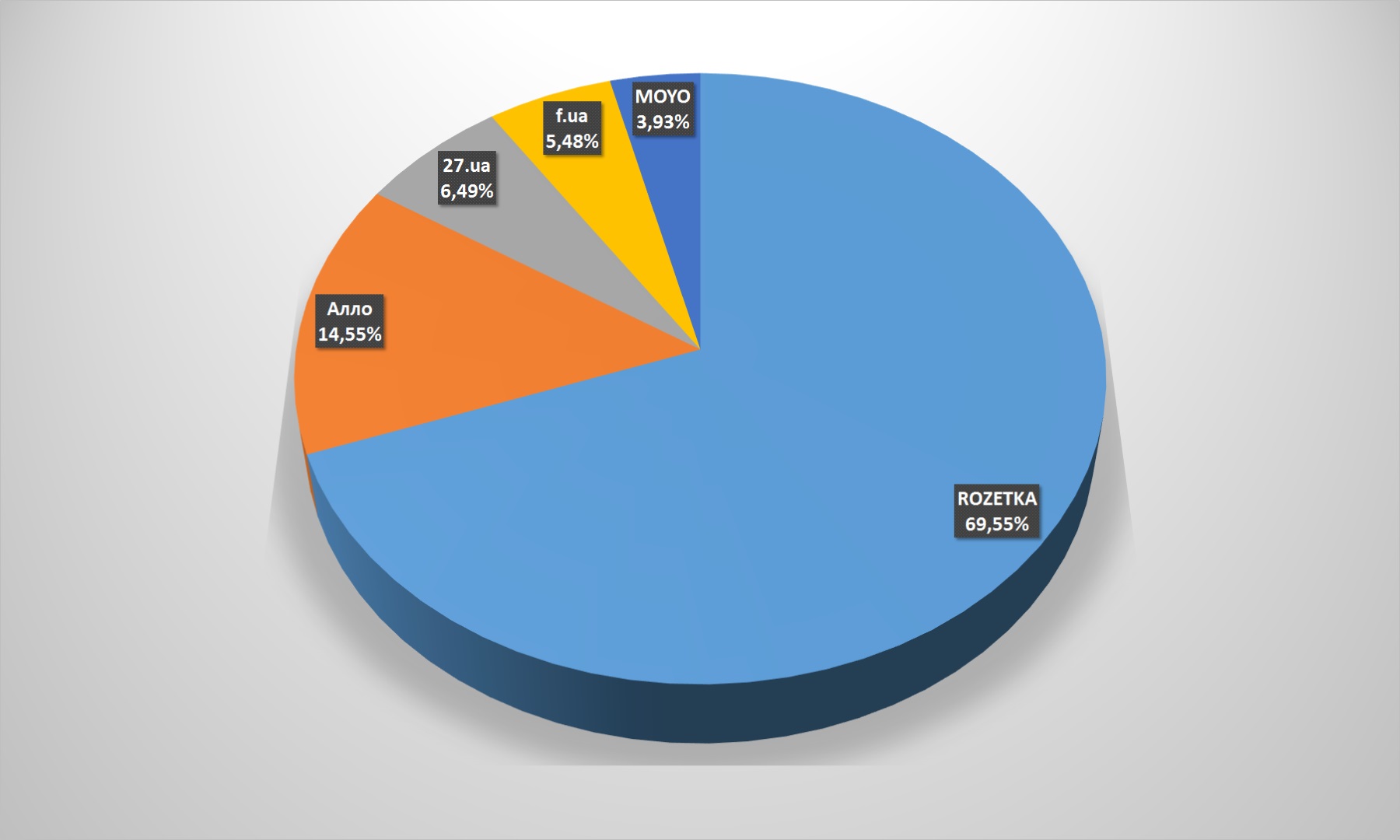

Rozetka.ua is confidently leading among department stores – none of the competitors even came close to the largest Ukrainian marketplace. It would be clarified that the audience coverage in the diagram below (as well as in further cases) is indicated as a percentage from the segment total attendance, but not only among the named key players.

So, Rozetka controls almost all visitors 62% to the universal online- stores. Over the year, marketplace coverage grew by more than a percentage. But this indicator, by contrast, declined for many other players. The only player who managed to increase coverage more than doubled – 27.ua. It is impressive growth, however, for the project, which initially positioned itself as a “Rozetka killer” growth rate is clearly insufficient. The remaining universal online-retailers even lost in coverage.

Vladislav Chechetkin brainchild is also unshakable: almost 70% – in audience reaching terms the among the top-5 positions.

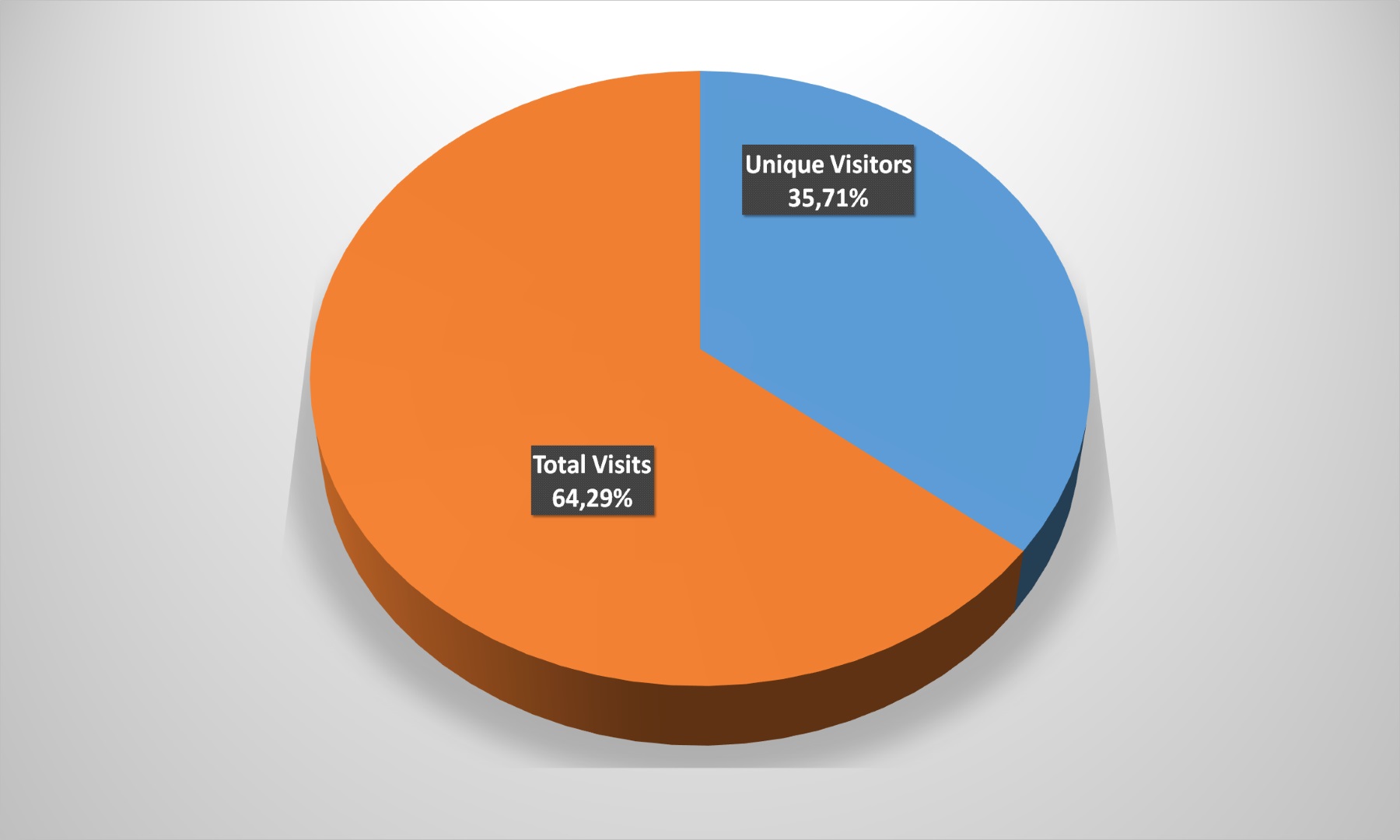

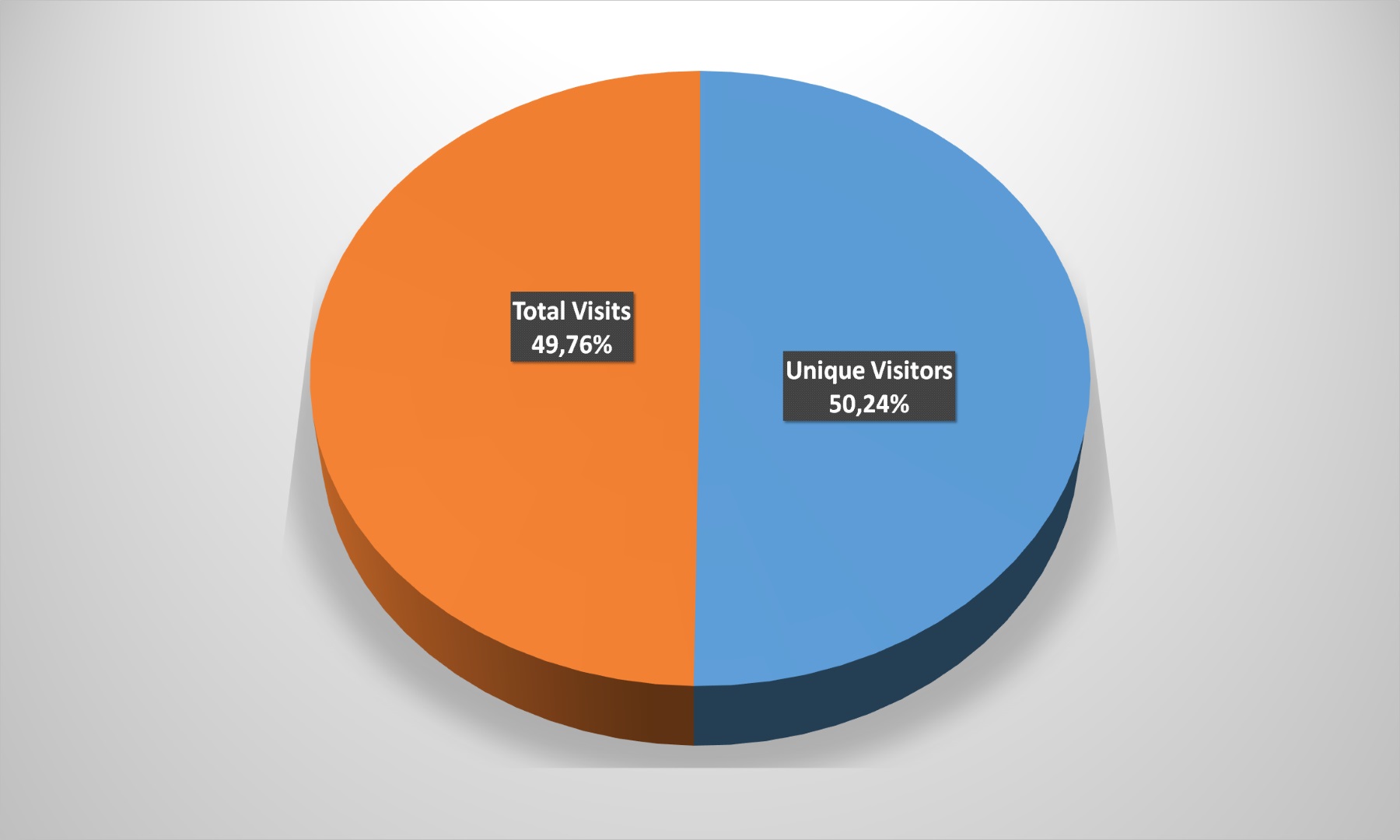

But this segment has managed to substantially increase the audience loyalty compared to last year. If in 2017 the ratio of users who visited the site once a year and repeated visits was 48.55 / 51.55, then the picture has radically changed in this year. Nearly two-thirds of visitors visited universal online-stores at least twice in 12 months, and maybe – more often.

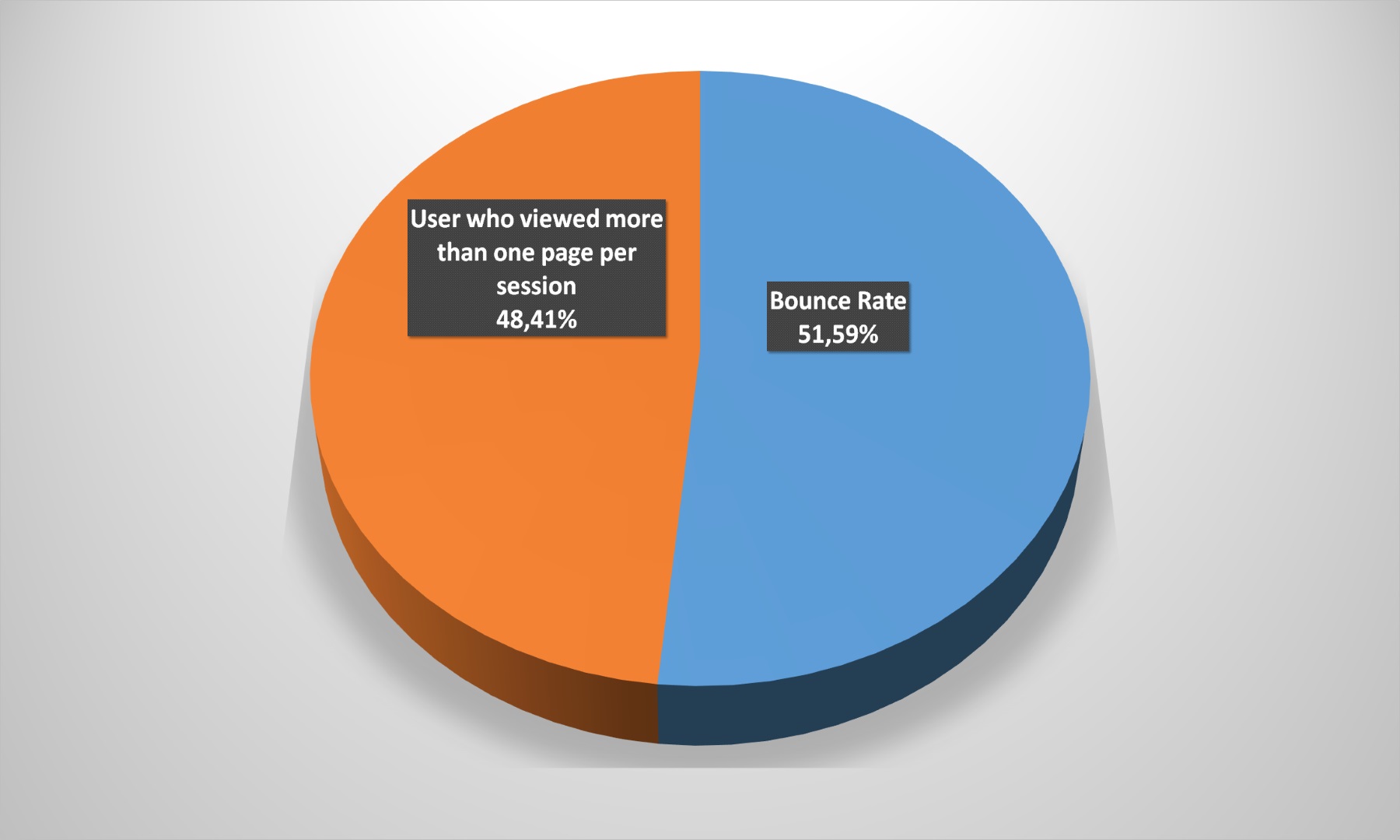

However, almost half of the customers leave the site, viewing only one page, which means guaranteed without a purchase. At the same time, last year more than visitors 57% left without a purchase, so it can be stated that retailers achieved some success in this case.

Another interesting factor is the channels to attract customers to the universal online-stores’ sites. The organic search role is much more important, compared to the average Ukrainian indicator – customers 47% enter the retailers’ portal simply by searching for information on the Internet. SEO-optimization for “universals” works for lovely eyes. 22.4% of “users” go directly to the site, the rest come through paid advertising, hyperlinks, social chains and even applications via stationary computers.

It is for comparison: last year organic search gave to online-stores this category traffic 35%, pin calls – 17%, but cross-references – as much as 21%! Just this entry channel was reduced three times at once.

What is remarkable: the social chain as an input channel increased its value is not significant, remaining almost at the same level. But there was a certain restructuring inside it.

In 2017, YouTube provided transition 62% to universal online-stores’ sites from social chains, and Facebook – 25%. This year, the Facebook share has increased dramatically – right up to 33%, but the video service has somewhat surrendered its positions.

The users’ number visiting the online-store website from stationary computers has dramatically increased as in Ukraine in average, for some reason. Accordingly, the visits number from mobile devices has decreased. If a year ago the ratio was 56/44 in the mobile favor, then this year the “stationary” took revenge.

This, in part, can be explained with some changes in the online-shoppers age categories. Compared to the average Ukrainian indicators, Department stores are much more likely to be visited by people aged 45+, while “over 65” users give massive visitors 13%.

Portable appliances, electronics, gadgets and accessories

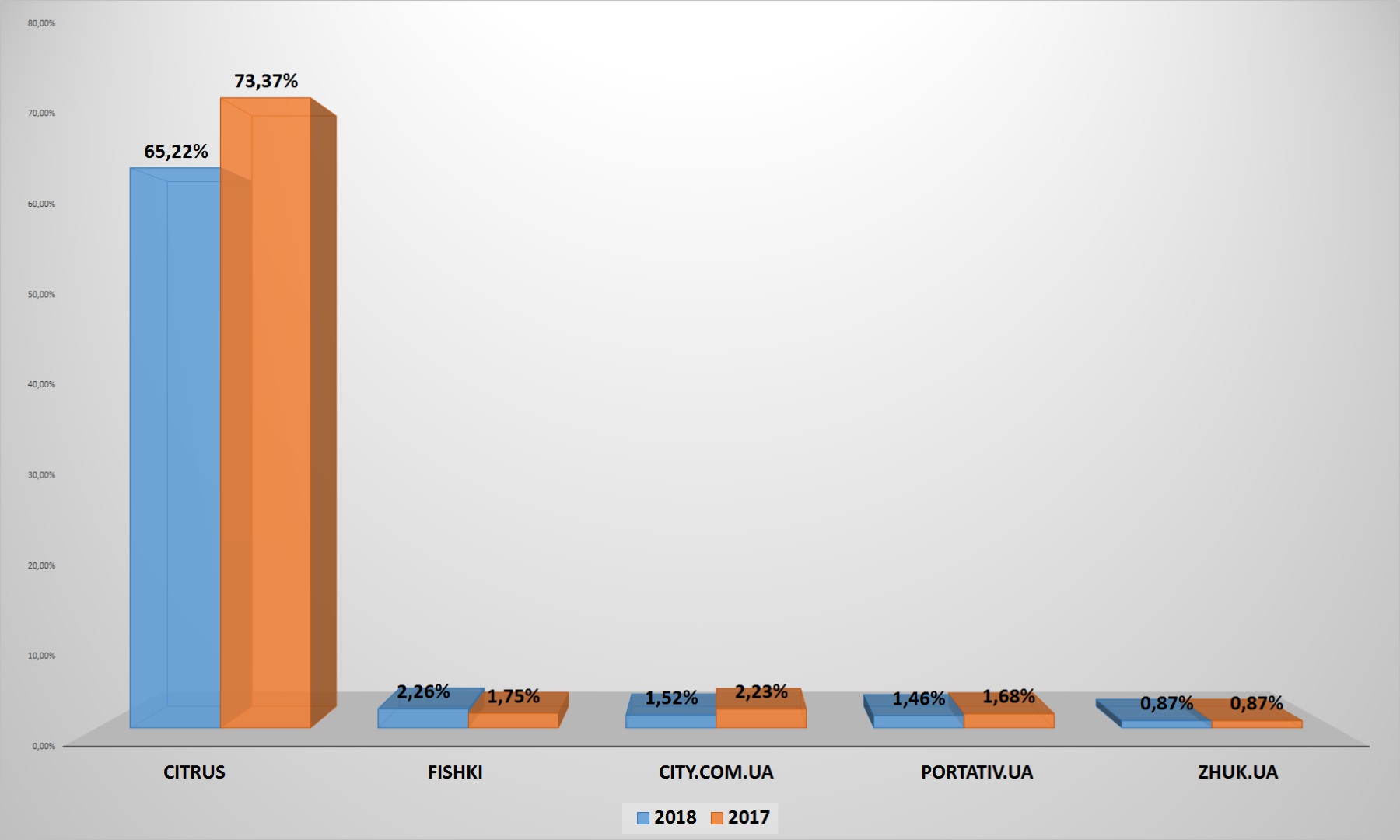

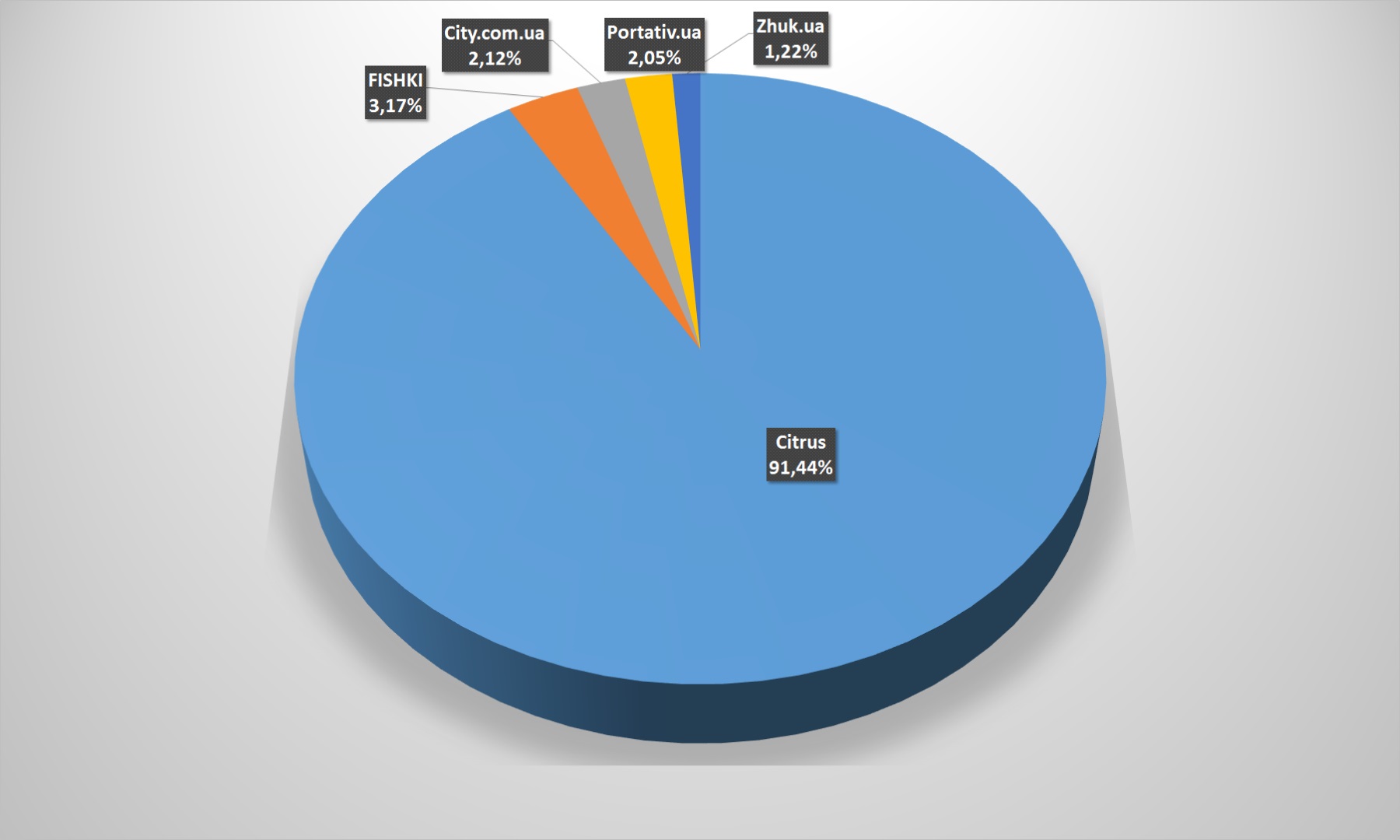

There is a distinct leader in the segment as in the department stores case. This is the online-store Citrus.ua in this case. Its overall coverage in the segment decreased slightly compared to last year, but this did not affect its strong leadership.

It has no equal at all among the five largest online-retailers – if we look at the situation from such an angle, we can safely call Citrus.ua a monopolist in this segment.

But, the audience loyalty, in general, slightly decreased compared to last year in this category. In 2017, users 58% returned to gadgets and accessories online-stores’ websites, and in this year – 55%. The drop is insignificant, and may well be explained by the new customers’ influx, but this trend is clearly worth paying attention to next year.

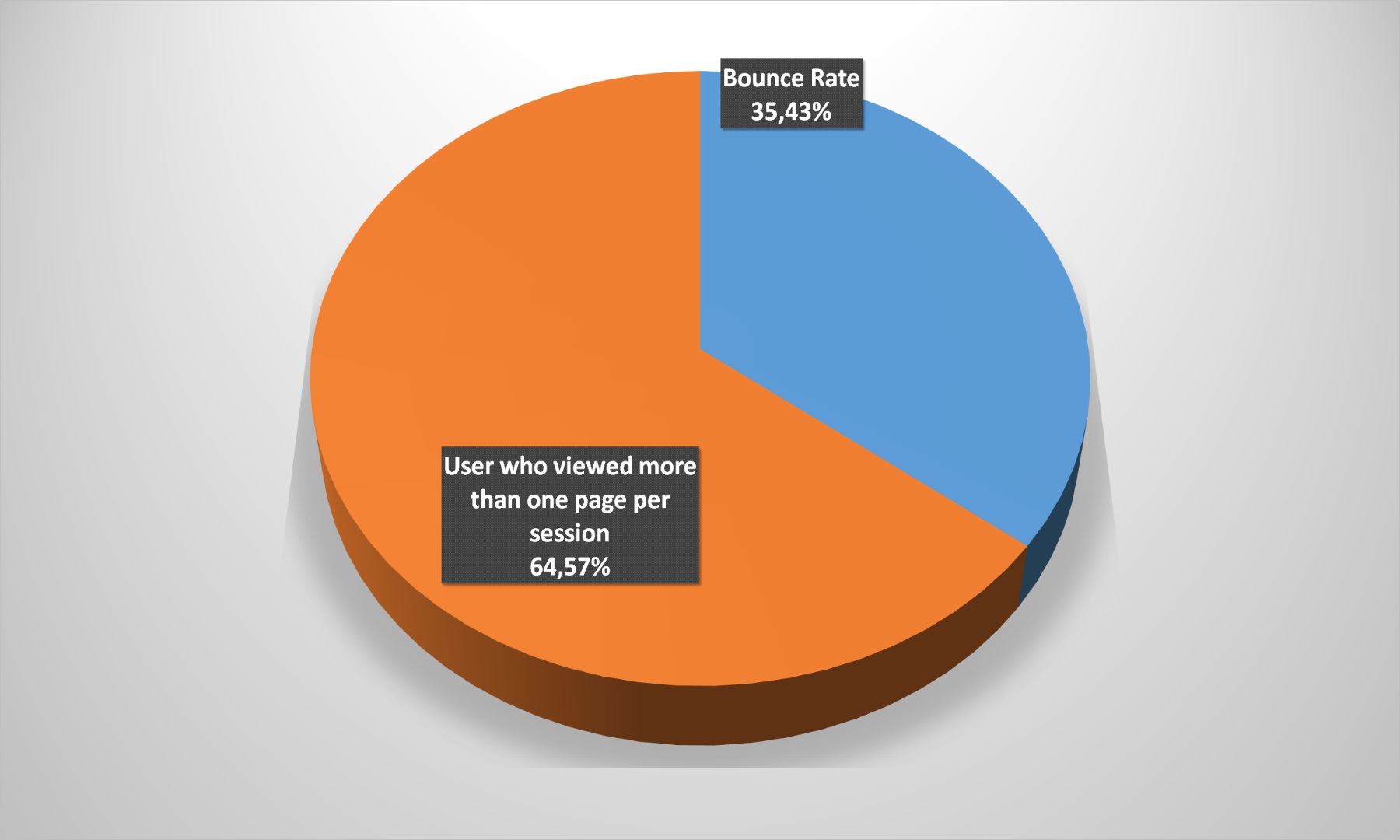

Moreover: the failures number has significantly increased. If a year ago, only users 42% left the entry page in electronics and portable equipment portals, now customers 54% are already leaving without making a purchase. It is the alarming trend given the reduction in loyal audience.

Traffic from search engines and the direct visits number (due to a corresponding reduction in referrals) managed to increase the gadgets and related products sellers. But this is characteristic of all Ukrainian e-commerce and it is unlikely to be able to compensate for the growth in refusals and loyalty loss. The social chains share has remained virtually unchanged.

Retailers clearly continue to bet on YouTube – more than traffic 67% from social chains is provided by this channel, unlike the previous category. But it is traditionally difficult to increase sales with its help. And here the Facebook share has declined. Transitions from VKontakte have fallen, but this is not surprising – this social chain has been banned in Ukraine for quite some time, and it is strange that it keeps the figure at 5% transitions.

What else is the portable equipment online-retailers peculiarity: the mobile users prevailing share remains. However, such products main buyers are young people, so visits 52.3% from mobile devices are more than explainable. And a year ago, there were visits 68%, that is, the m-commerce general fall trend is affected this category as well.

The age slice confirms all of the above: gadgets and accessories buyers 67% are users under 45 years old. The older generation does not chase the newfangled novelties.

Home Appliances

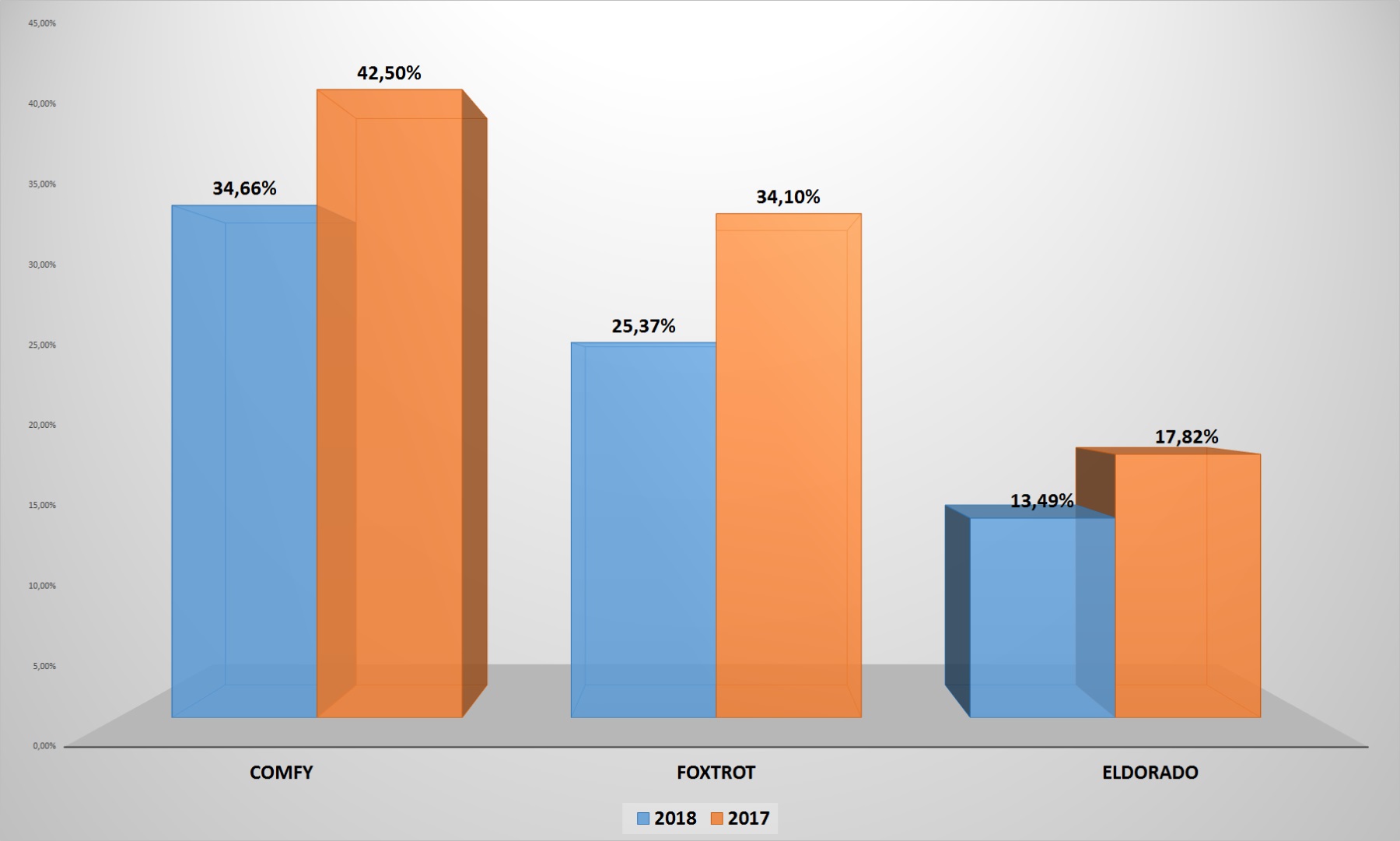

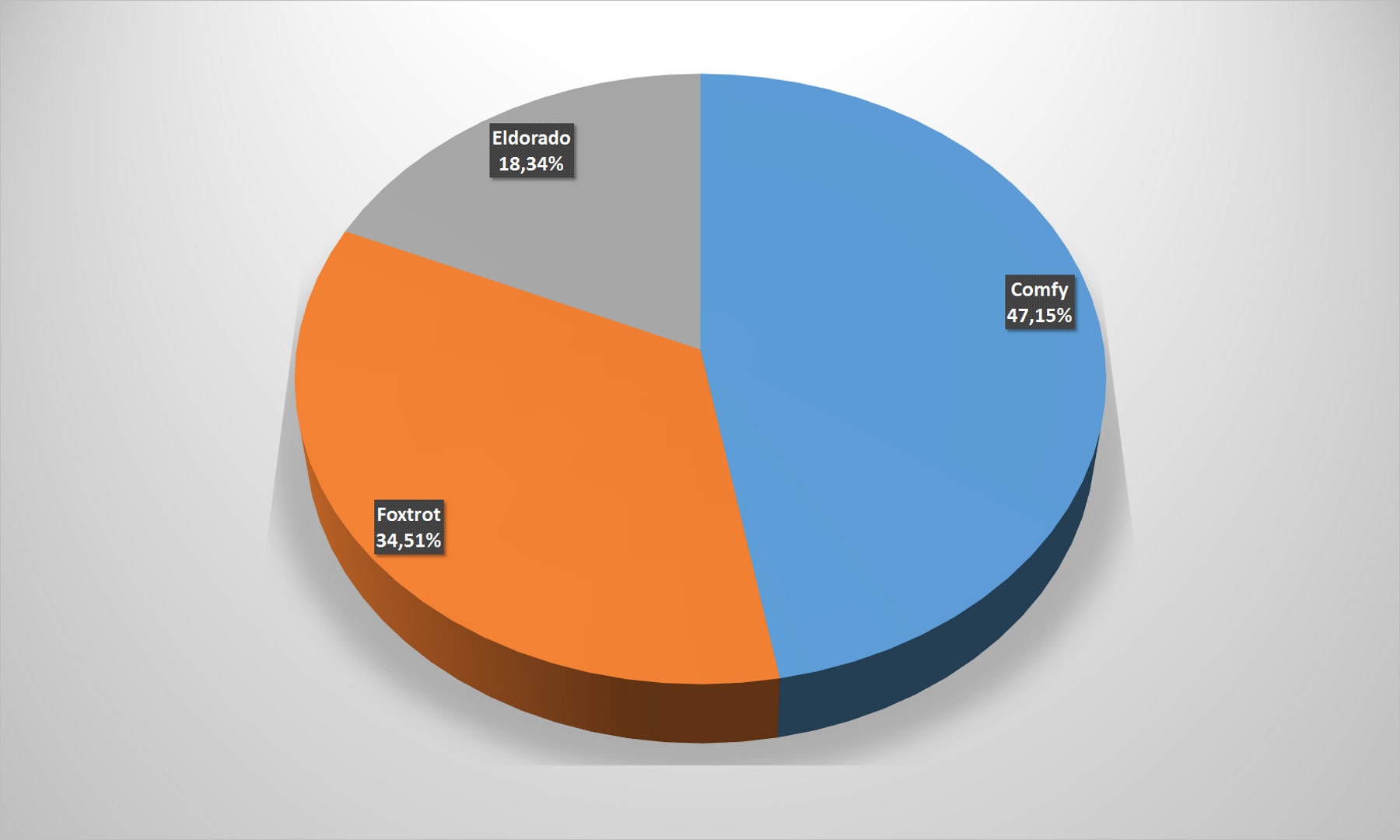

There are only three significant players in this Ukrainian e-commerce segment, since the others are several times inferior to it. But, what is noteworthy, earlier, small shops, almost imperceptible against the three leaders’ background, are beginning to confidently bite off its own cake piece at the top-3. If in 2017 Comfy covered this segment UAnet users 42.5%, Foxtrot – 34.1%, and Eldorado – almost 18%, but now the situation has changed completely.

All market leaders have lost coverage, which can be a reason to think about the promotion strategy in the Internet. It is necessary especially considered that all three retailers distinguished by provocative advertising campaigns, which were vigorously discussed in social chains. The result is negative.

And, nothing has changed, judging by the forces alignment in the top-3: Comfy even increased its advantage over two competitors – from 45% to 47%.

It is also unusual that users who visited the store site once a year, and those who visited the portal two or more times – approximately 50/50, shared approximately equally. Last year there was a similar situation, with small shifts in tenths of a percent.

But this is not the only difference of the category from all others. The failures’ number, i.e. exits without making a purchase, remains one of the lowest among all Ukrainian e-commerce segments – 42%. Users carefully study as a minimum the assortment presented on the portals, and as a maximum – they immediately draw up the favorite product purchase.

The situation with traffic channels is not fundamentally different from the average Ukrainian indicators, in general on category. But a rather significant share of the paid advertising search attracts attention: competition for consumers forces online-stores to invest money in such channel to attract users.

Social chains, despite its image importance, in fact provide only the total traffic 2.65% to home appliances and electronic sellers. It would seem – it is possible to neglect this direction, but all companies operating in this segment pay much attention to SMM-strategies. The transition main part to the online-stores pages gives YouTube, as in most other categories. Facebook is in second place. The VKontakte share decreased by 4%, but still remains significant – 10% compared to last year.

Mobile device users with stationary PCs users shared approximately equally in the case with household appliances and electronics. Over the year, the category lost mobile traffic 13%, but this trend is characteristic for all Ukrainian e-commerce, as has been repeatedly noted.

The most citizens solvent categories dominate, that it is not surprising, among household appliances and electronics online-buyers: the age is from 25 to 55 years. The rest are less than a third of customers.

Fashion

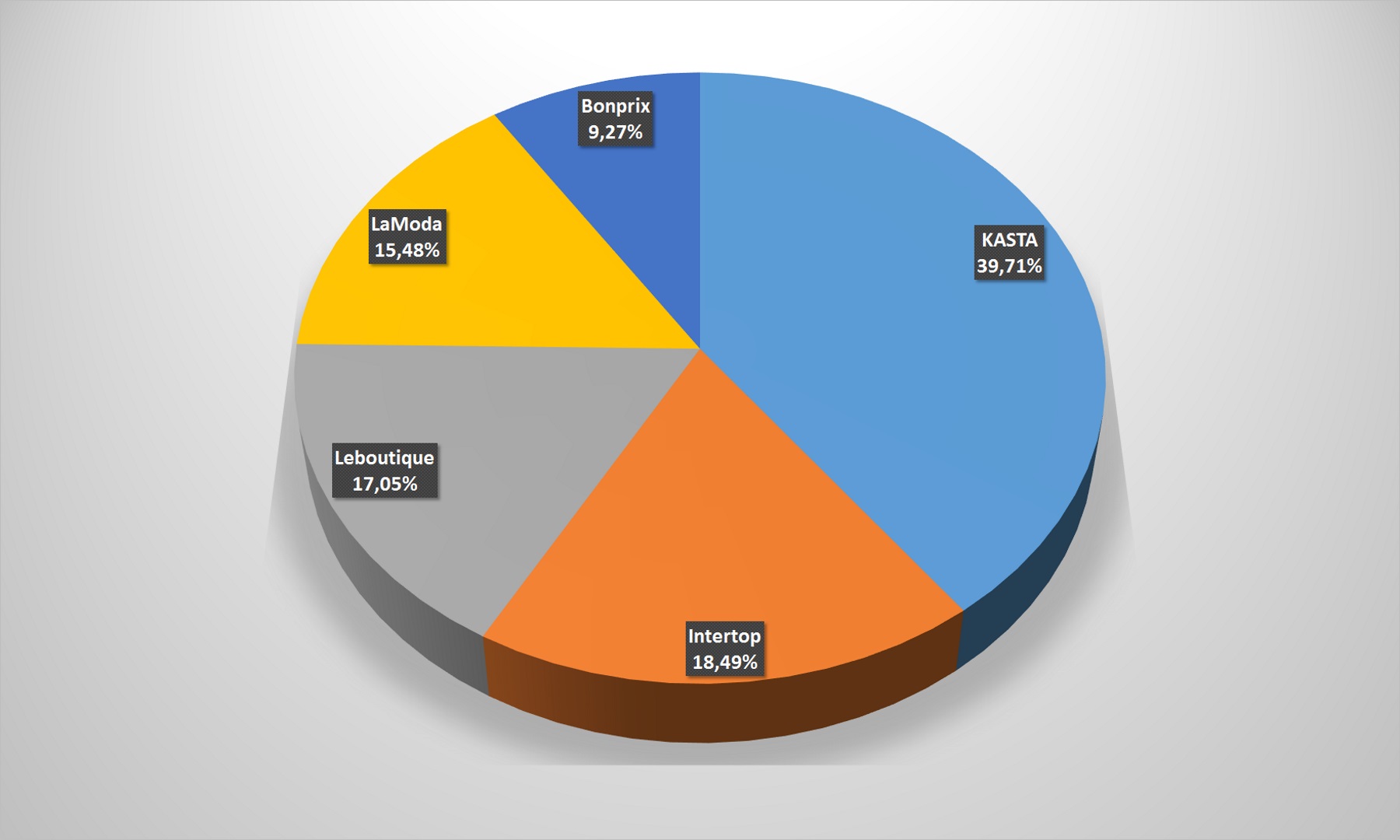

It is worth noting that only Intertop sells mainly its products, from the represented companies, analyzing this direction’ leaders. modnaKasta, Lamoda and LeBoutique are already working in the marketplace-format. But since its own stocks are the goods significant percentage, it would be wrong to exclude it from the online-stores rating and refer only to marketplaces.

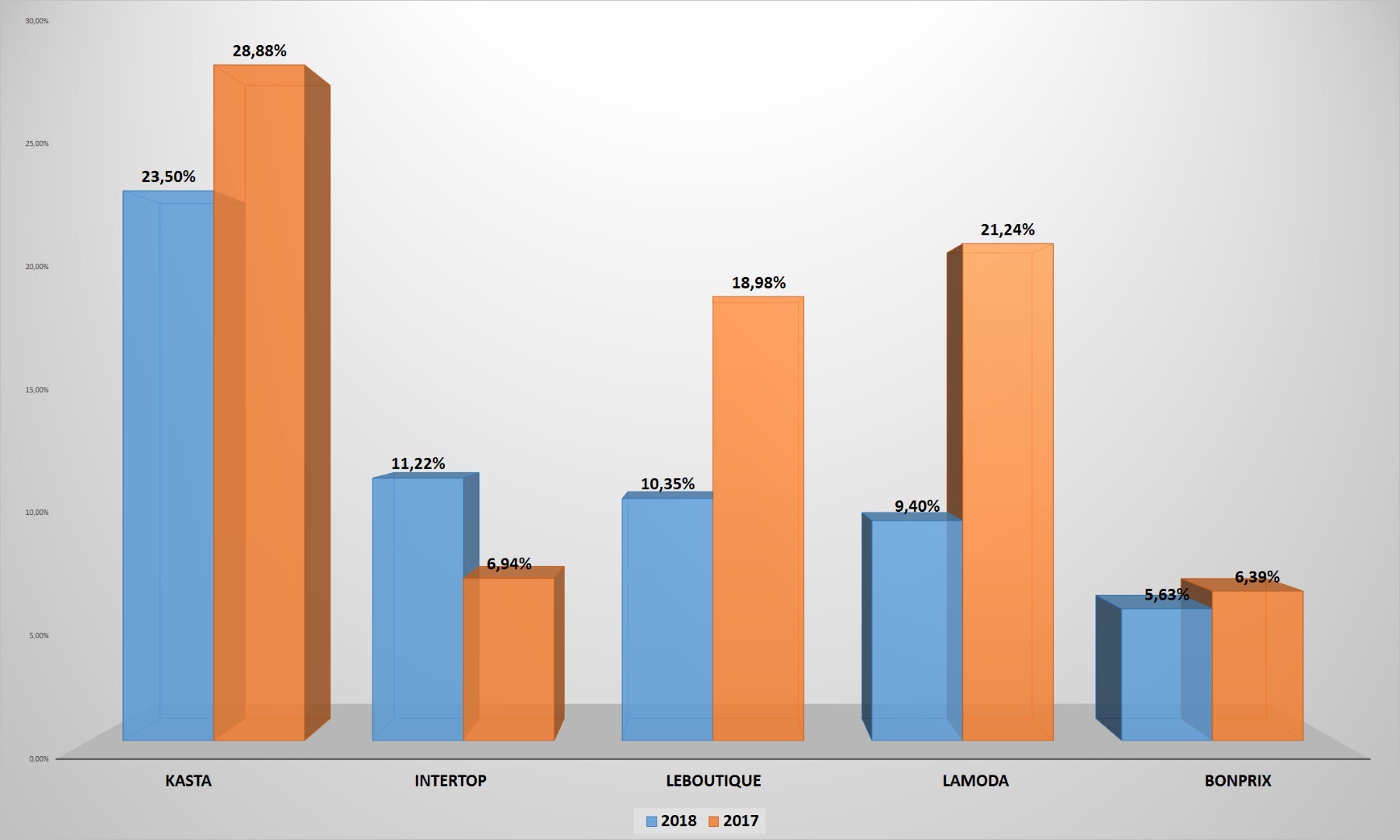

At the same time, only Intertop managed to increase its audience coverage in UAnet, compared to last year – the rest operators lost the user. So the group’s decision to sell on its own sites goods from other companies (de facto, the transition beginning to work in the marketplace-format) turned out to be successful. Last year, Intertop achieved coverage 7%, and in this year it grew by almost half.

This allowed the company to move from fifth to second in audience reaching terms among the top-5. If such growth rates persist, then the segment leader, Kasta, fit to worry about maintaining separation from its competitor in the market.

For all that, this segment’ visitors are distinguished by enviable loyalty to the selected brands. Nearly two-thirds of them visit retailer sites more than once a year. The indicator slightly decreased, but a drop 1% does not mean anything, compared to last year.

The failures’ number is also stably low – within 35%, almost unchanged over the year. The high loyalty, the excellent viewing depth, a small users’ proportion that immediately leave the site it is good prerequisites for high conversion in clothing and footwear online-retailers.

However, fashion-operators operating on the World Wide Web have to make a lot of effort to achieve such indicators. The visits share from search engines is noticeably lower than in the market as a whole, but conversions from e-mail newsletters, paid advertising, and applications are, on the contrary, higher. That is, fashionable companies’ marketers have to be creative in order to attract users. The organic search share has increased, but the cross-link clicks number has decreased, compared to 2017.

YouTube remains the main traffic channel from social chains, as in most other cases. At the same time, the Facebook significant role is noticeable. The most popular social chain in Ukraine abruptly lost ground, compared to last year: in 2017, it provided clicks 65% to fashionable online-retailers sites, and now it has step back to YouTube.

It is surprisingly, the formally prohibited in the country VKontakte and Odnoklassniki provide in total fashion-stores with almost transitions 20% from social chains.

Fashionable online-stores have increased the visits from mobile devices share, contrary to the all-Ukrainian trend: last year it was only 43%, but this year it was 47.3%. But this may be related to the comparison base: the active using by Ukrainians 3G and 4G capabilities could not but affect the mobile traffic amount. Accordingly, the visits number to clothing online-stores’ websites from mobile devices is increasing.

Buyers and shoppers high percentage from 55 to 64 years old draws attention to itselves, in the age context – it is almost a third of all visitors to online-fashion stores. Young people under the age up to 35 seem to prefer other shopping channels – it must be noted by retailers.

Sports goods

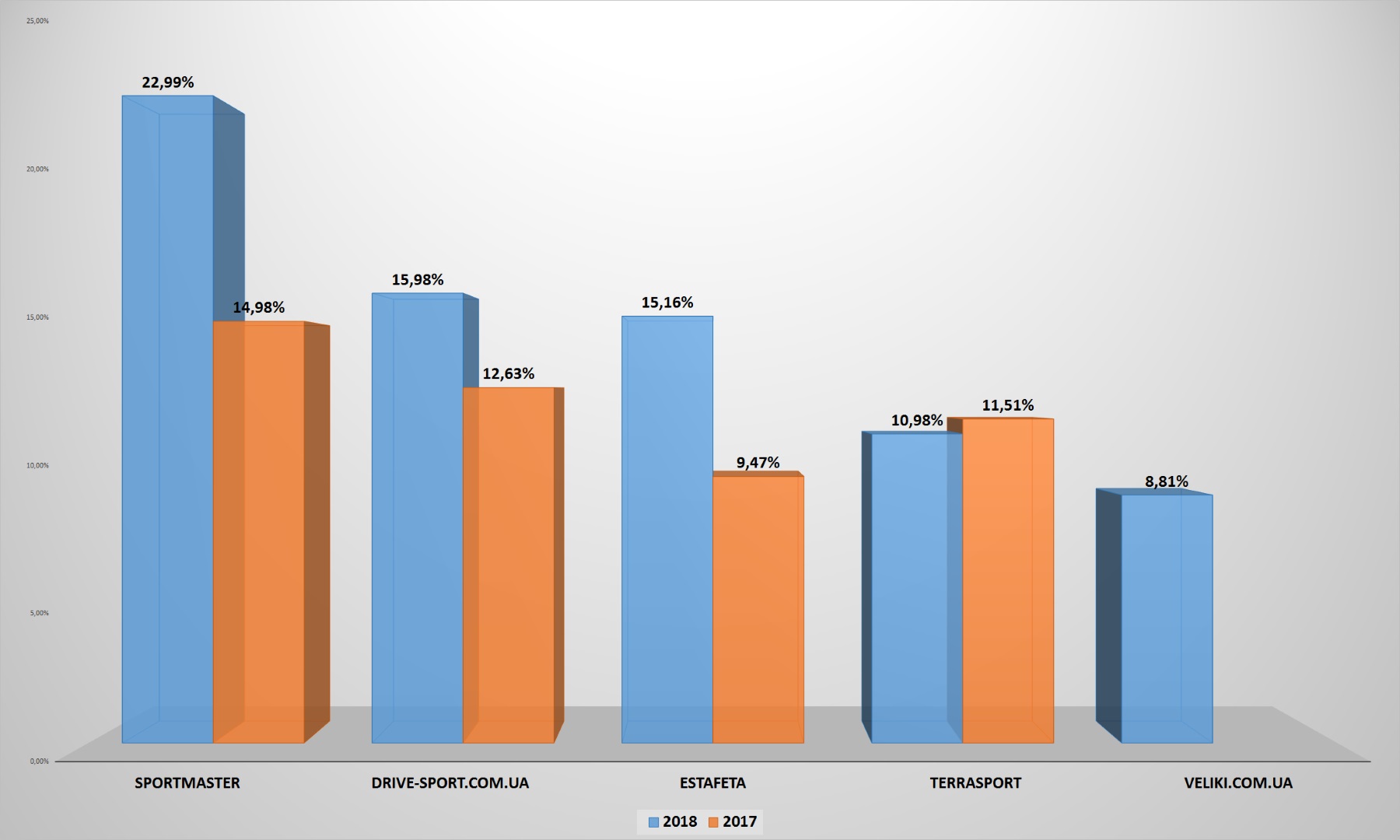

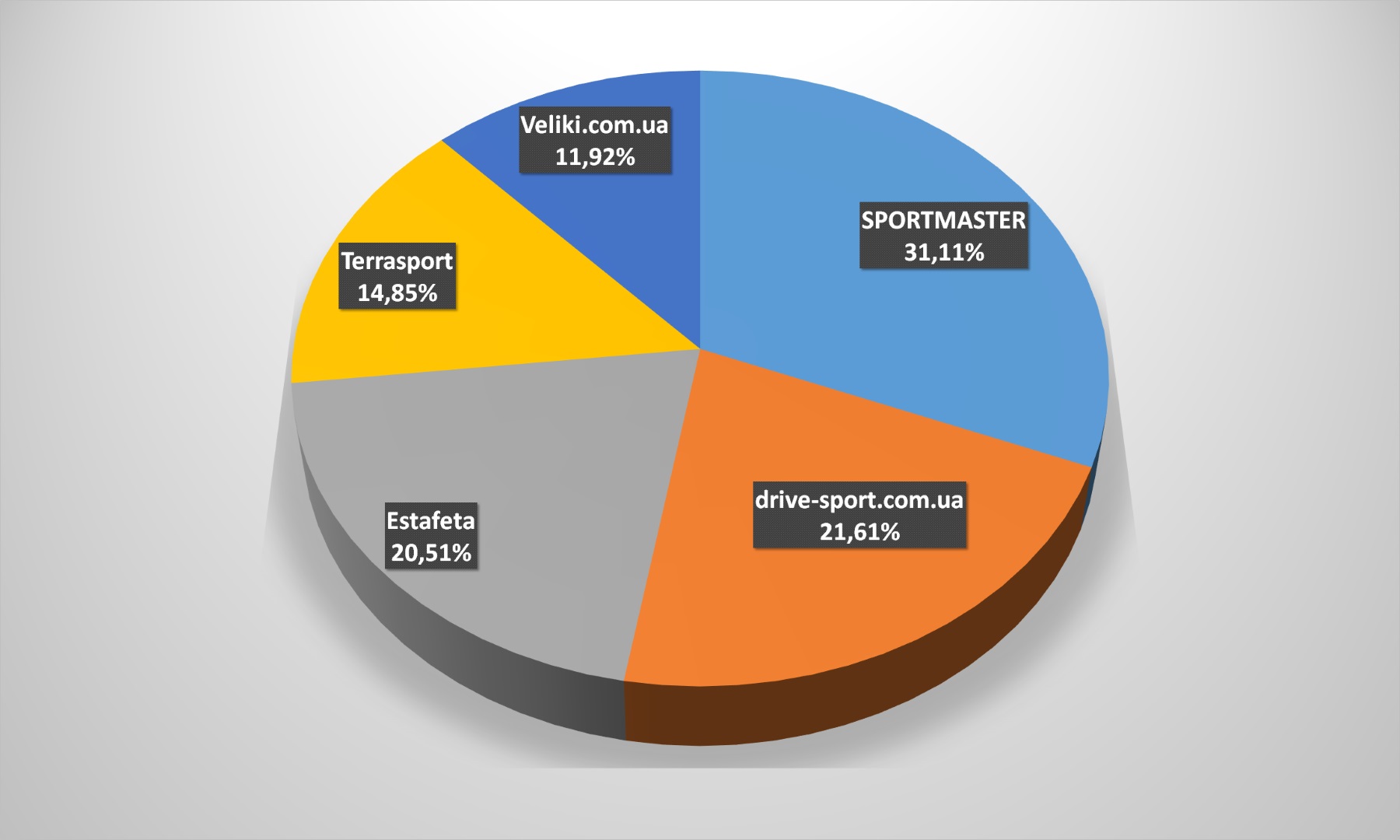

The first thing, what you would pay attention to, is the new player’ emergence in this category. Veliki.com.ua hit in the top-5 most popular sports goods, tourism and active rest sites, instead of the online-shop Bicycle Planet. But at the same time, the leaders noticeably increased the gap, compared to last year. And it is possible that in the near future in this category it will be possible to observe a situation like the online-gadget stores, where Citrus.ua reigns supreme.

However, if we take the audience coverage not in the whole segment, but only among the top-5, then everything does not look so pessimistic: the shares are divided quite evenly. Sportmaster is in the lead, but its gap is not as catastrophic as in some other Ukrainian e-commerce segments.

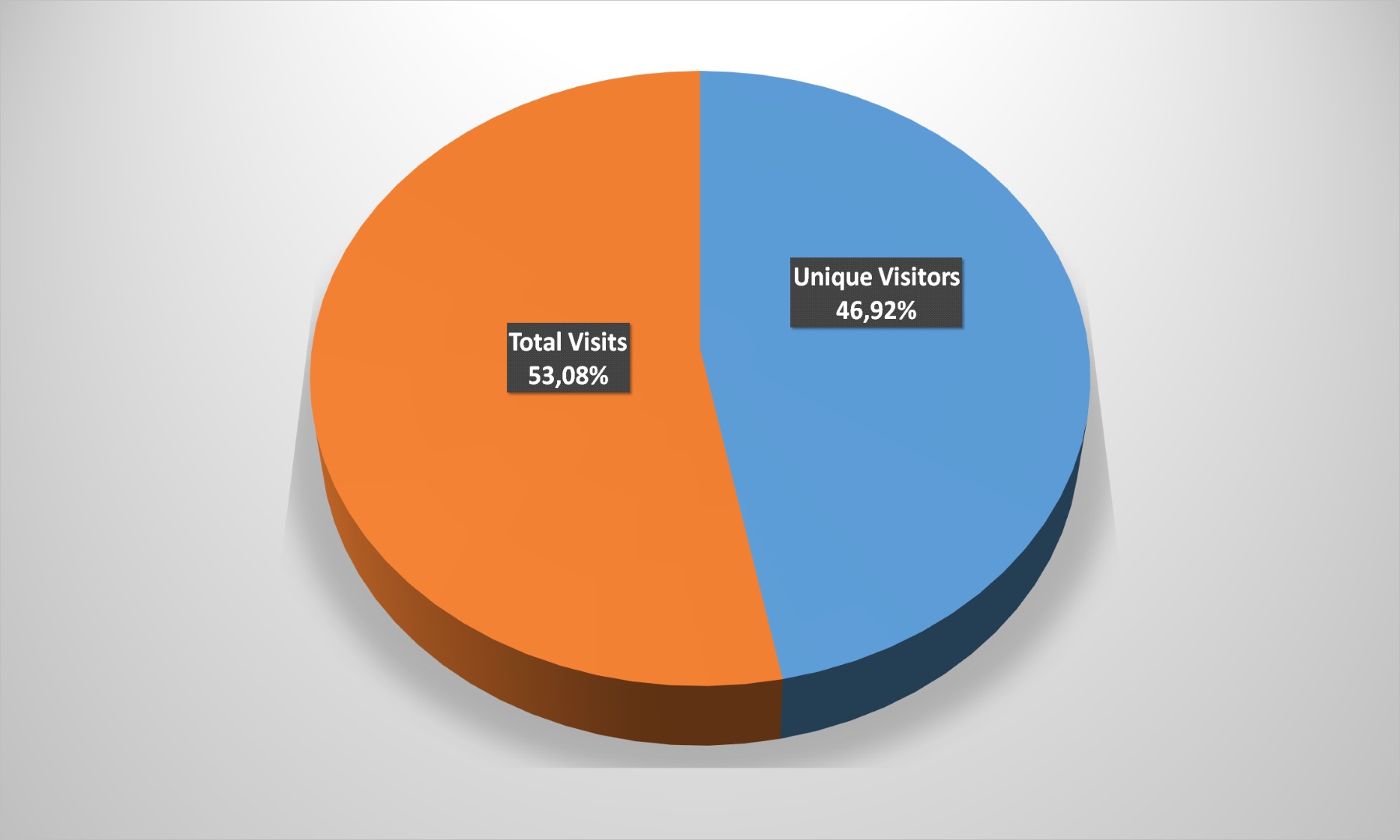

The situation with unique / repetitive visits is no different from the average in Ukraine: it is a little more than a loyal audience, but there are also enough repeat visits.

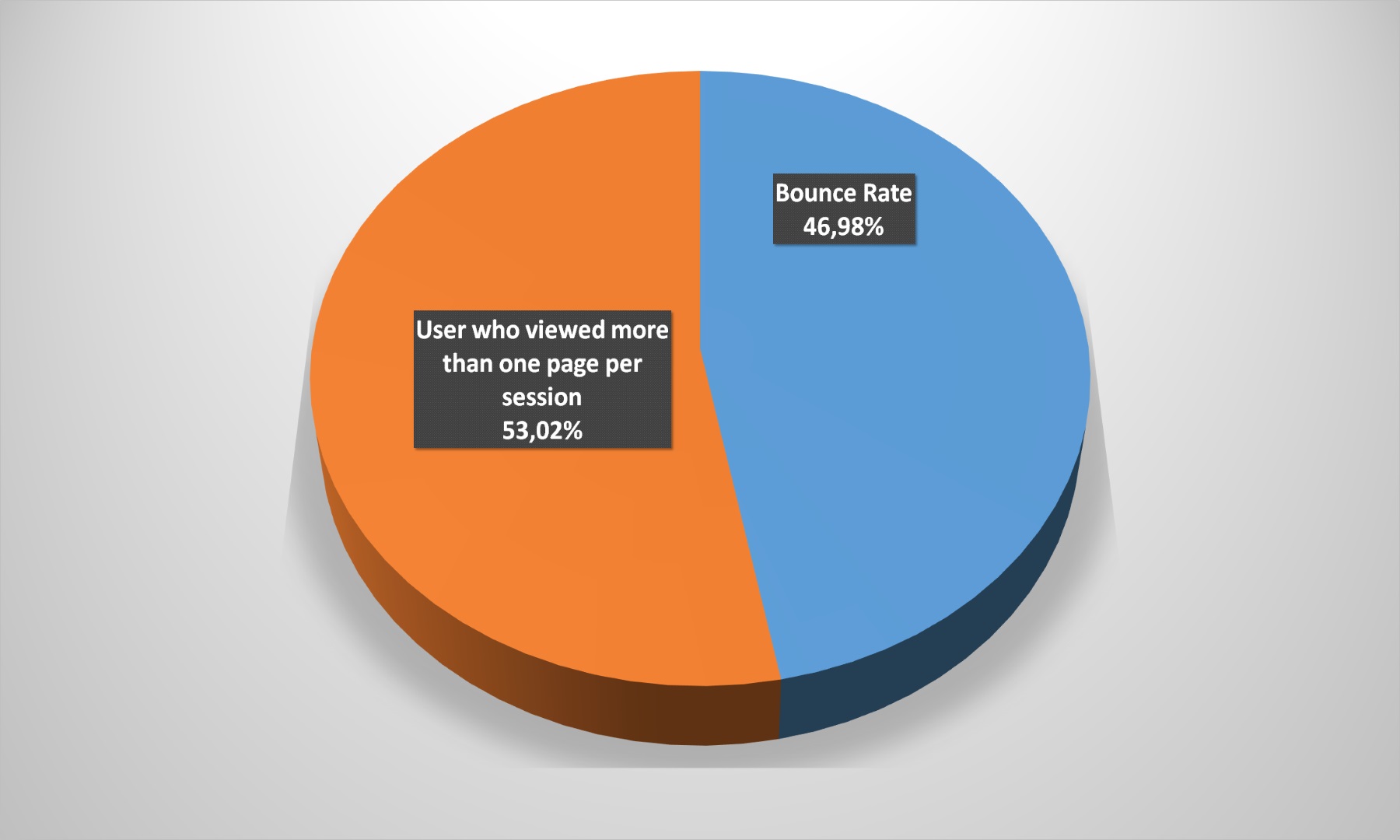

The failures’ number is somewhat larger than in other categories number, but, again, it is nothing critical: all the same, more than half of users continue their way through the online-store, which means: they make a purchase with a certain degree of probability.

The organic search brings almost half of the visits to goods for sports and tourism sellers. That is, users still do not know in most cases where exactly they will buy the selected product, and they are ready to consider all possible options. We also note a fairly visits high proportion from paid advertising and from social chains.

What is striking: the transitions’ number from the Russian social chain VKontakte increased from 14 to 16.5% only in this category, compared to last year. Whether the lock is inefficient, or these online-stores customers will not part with the forbidden social chain. The rest is nothing unusual: YuoTube has put some pressure on Facebook, while other social chains generate a meager transitions amount.

Most users still visit this category’ online-stores from mobile devices, but the “mobile” customers’ share have decreased from 66 to 52%.

Also attention attract the customers age: users 60% – the age from 25 to 45 years, another 25% – up to 55. The youngest and oldest sports are either not engaged, or they are paid for by older or younger relatives.

Jewelry Retail

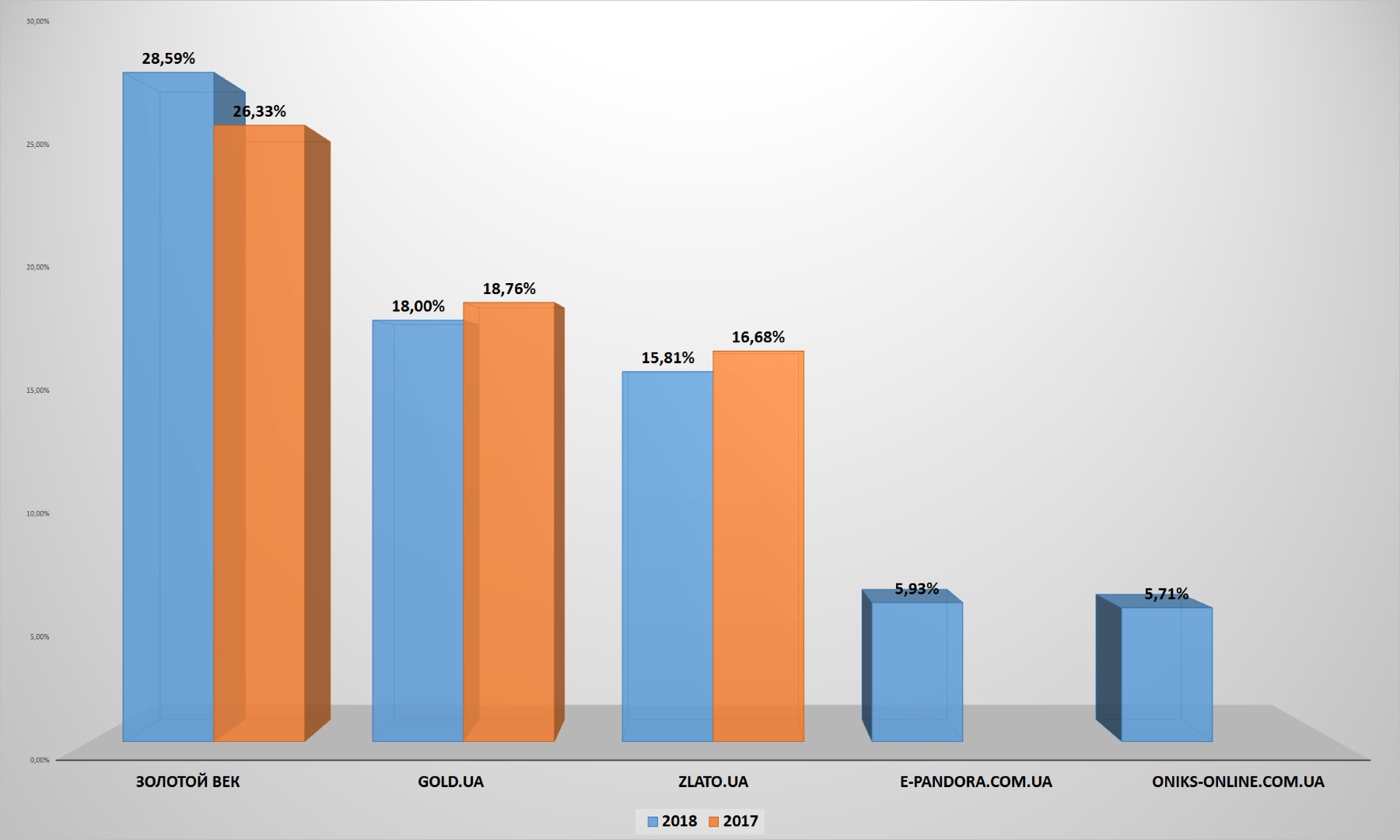

There are the same reshuffles in this domestic e-commerce sub-segment: Srbniy Vіk and 925.ua left the top-5, and e-pandora.com.ua and oniks-online.com.ua included. The leader, Golden Vіk, has increased its lead, as in many other sectors, but gold.ua and zlato.ua have sagged somewhat in the audience reach terms.

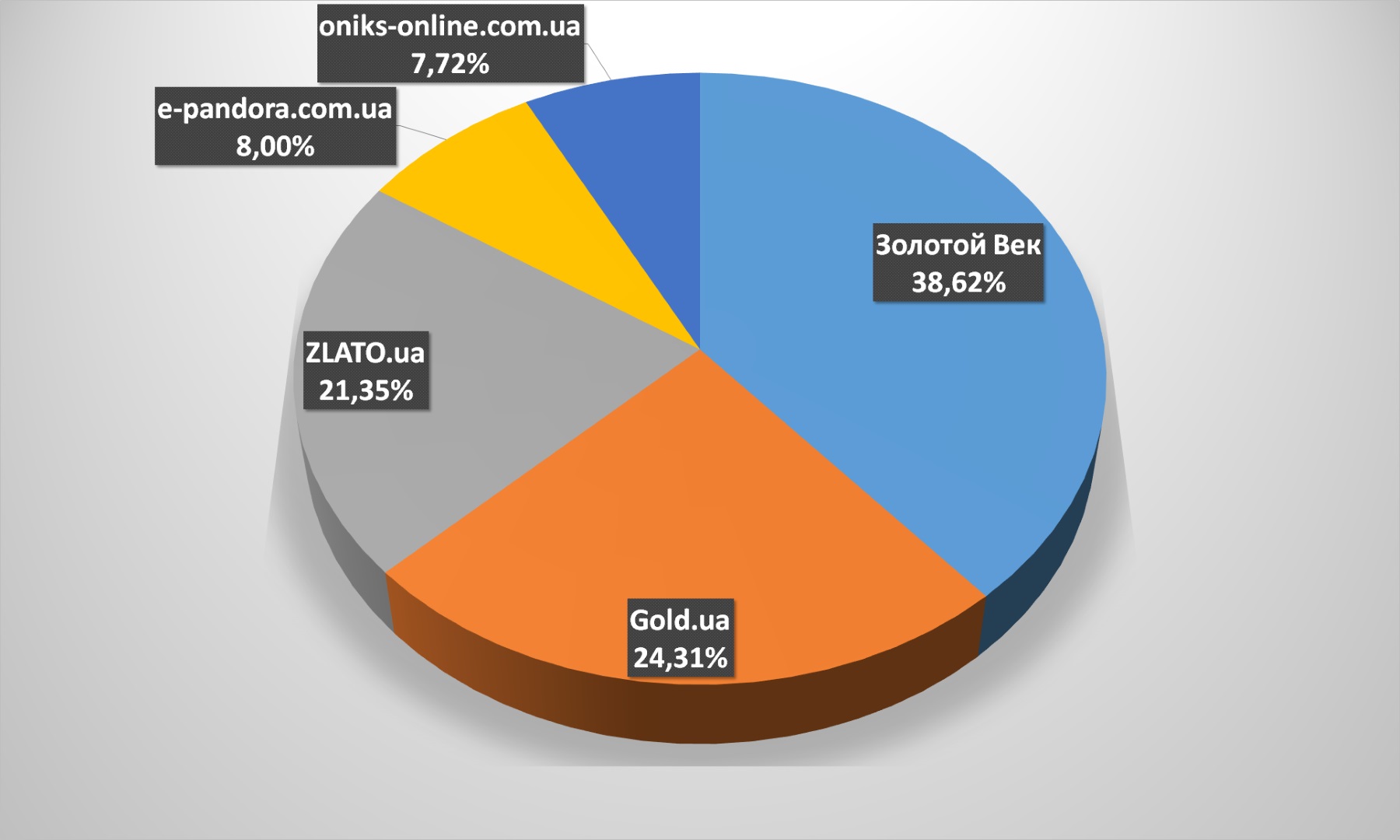

The “Big Three” of online-jewelry retailers in Ukraine continues to confidently hold positions, totally covering almost audience 85% among the first five jewelry and accessories online-stores.

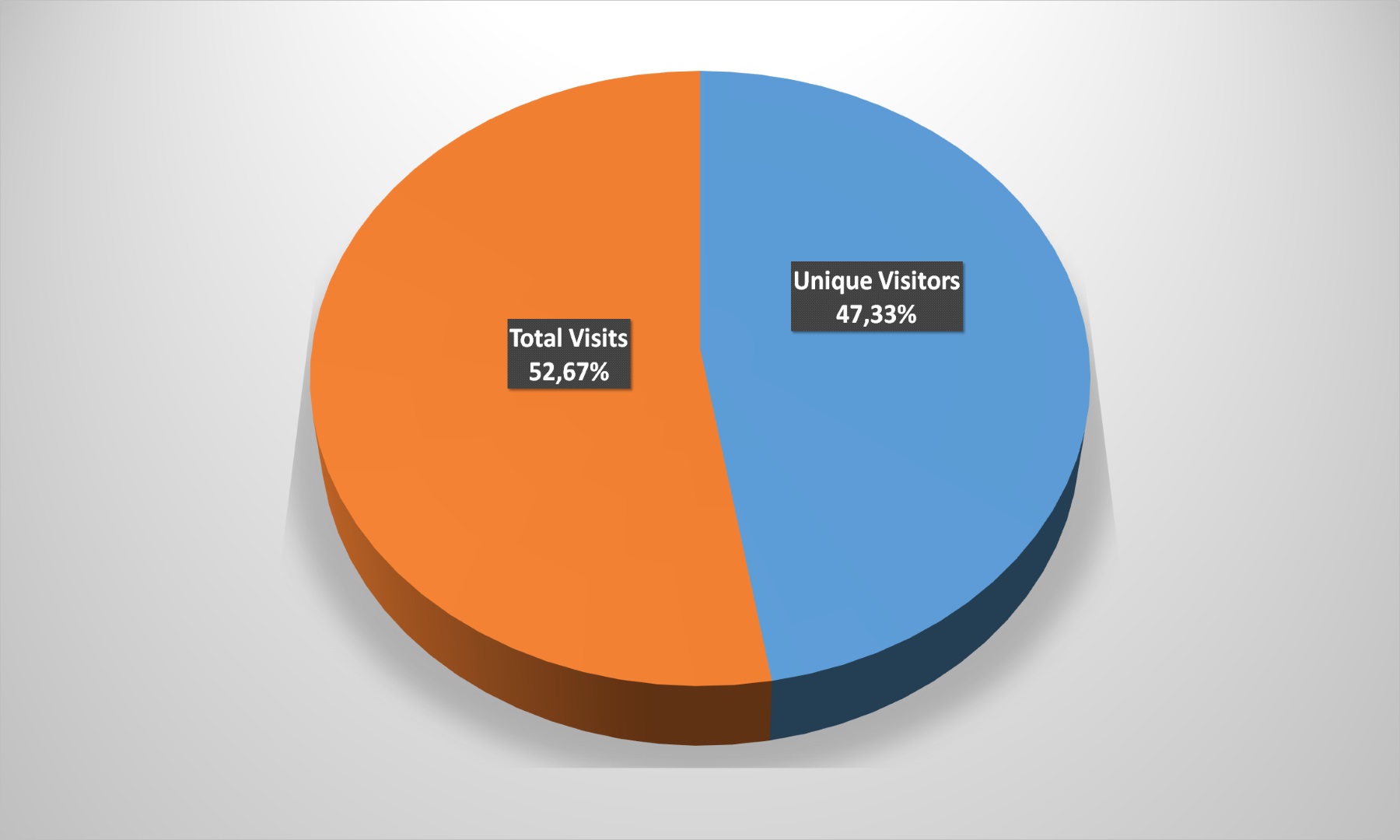

Moreover, more than half of users visit company sites more than once a year. Over the year, the loyal audience grew slightly (slightly more than 1%), but the trend is definitely good.

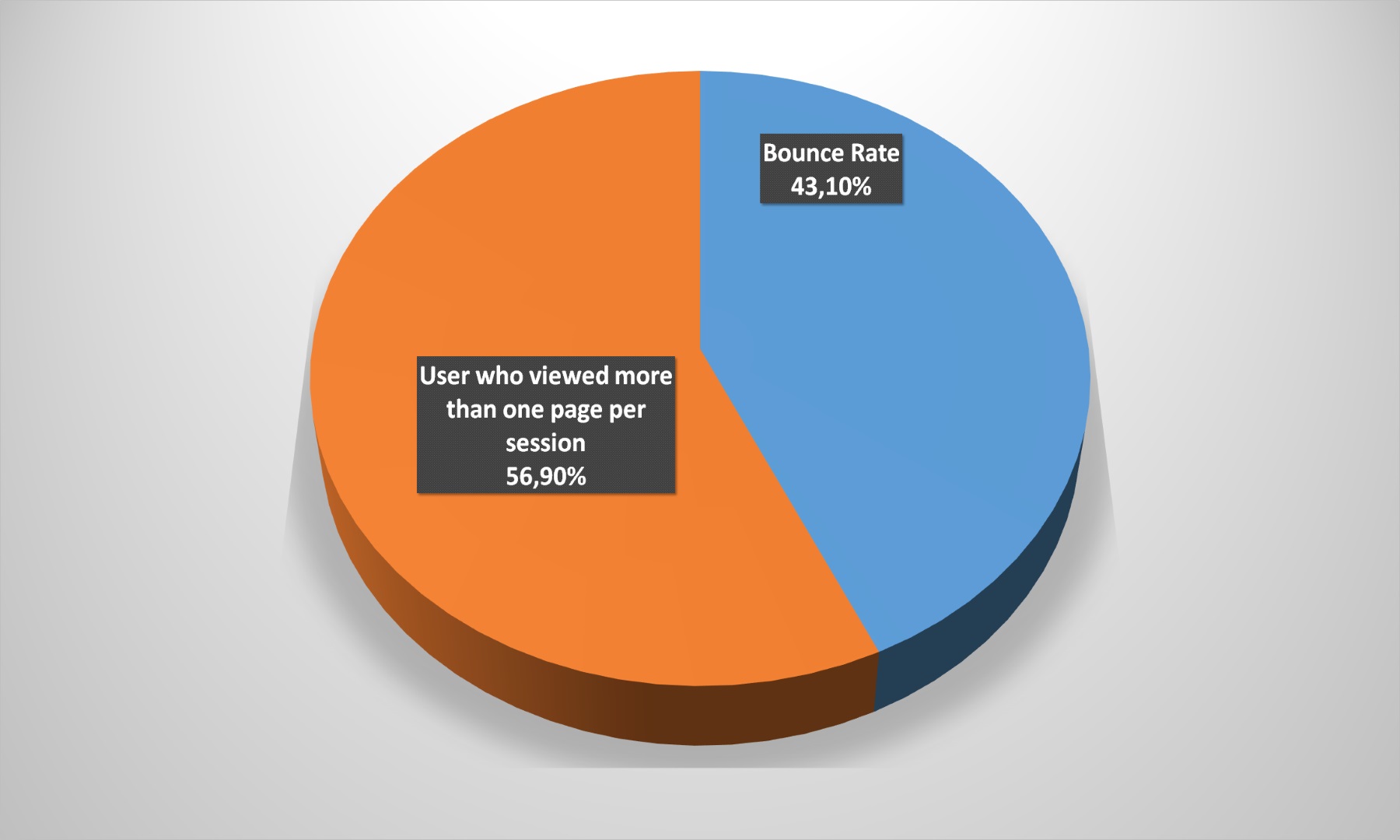

At the same time, the failures number has increased. If only users 31.29% left from the entry page of jewelry retailers’ portals at the last year end, then in 2018 – already 43.1%. On the other hand, the multichannel sales’ development allows to suggest that users chose jewelry by online in this case. But they made a purchase by offline, seeing and touching the product.

Transitions from search engines and from adverts in its are clearly distinguished among entry channels. There are not so many direct calls. Transitions on links have fallen sharply; the social chains’ significance has grown.

Most likely, users are looking for products in google and similar systems, and they not go directly to the retailers sites. SEO and search engine optimization would come first for jewelry market players.

Although social chains provide only 5% of jewelry and accessories online-stores total traffic, it would not be forget about it. Moreover, Facebook is extremely important for jewelry makers, unlike other categories. But on the contrary, YouTube noticeably subsided compared to last year. In 2017, it brought to stores 31% of traffic from social chains, but in this year – only 22.3%. This trend is different from the general Ukrainian.

Also, the users’ share who visits online-jewelry stores from mobile devices has slightly decreased – from 77% to 68%. But it still remains noticeably higher than the market average.

The age group from 25 years to 34 years clearly stands out among users, calling on online-jewelry stores. There are roughly equal customers with age 18-24, 35-44, and 45-54.

Goods for kids

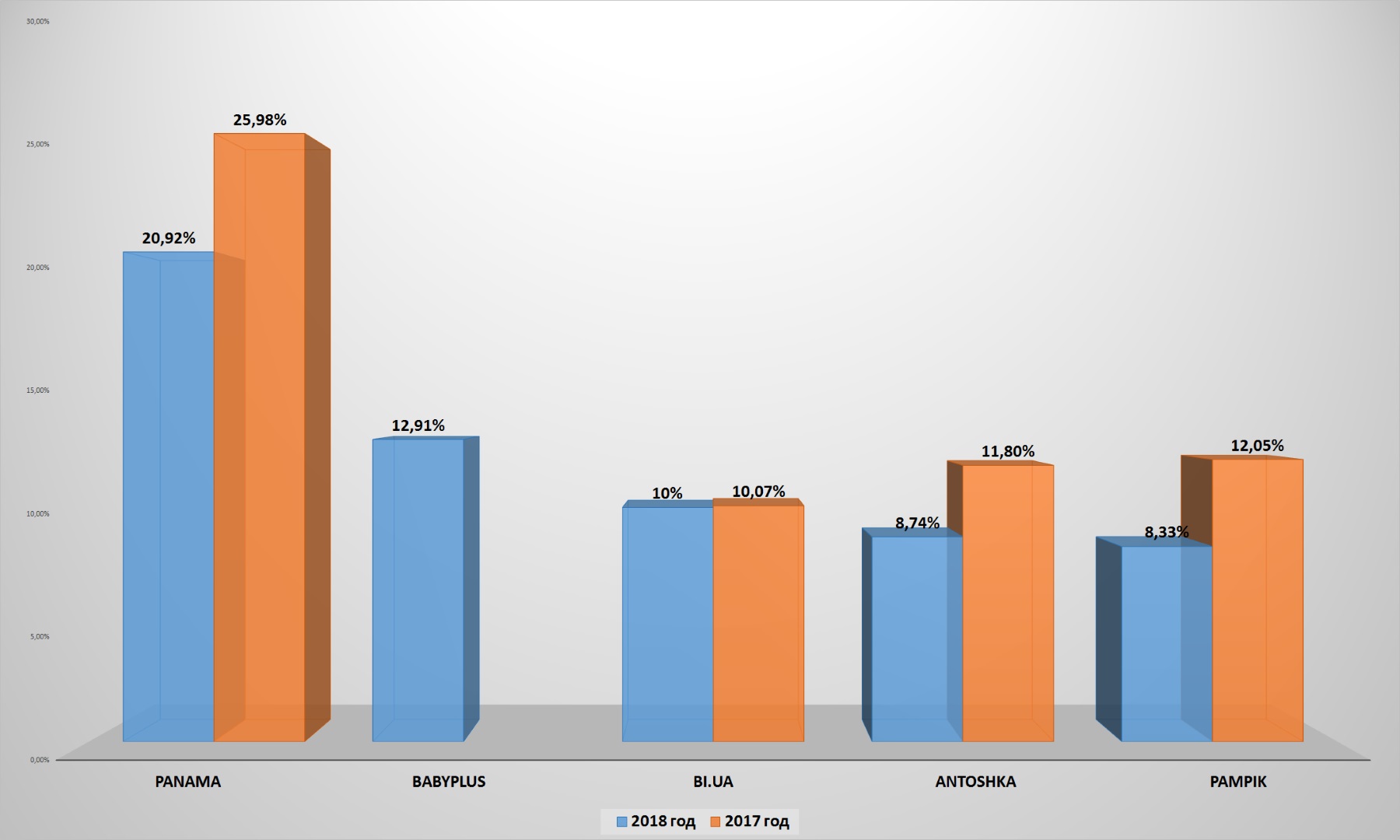

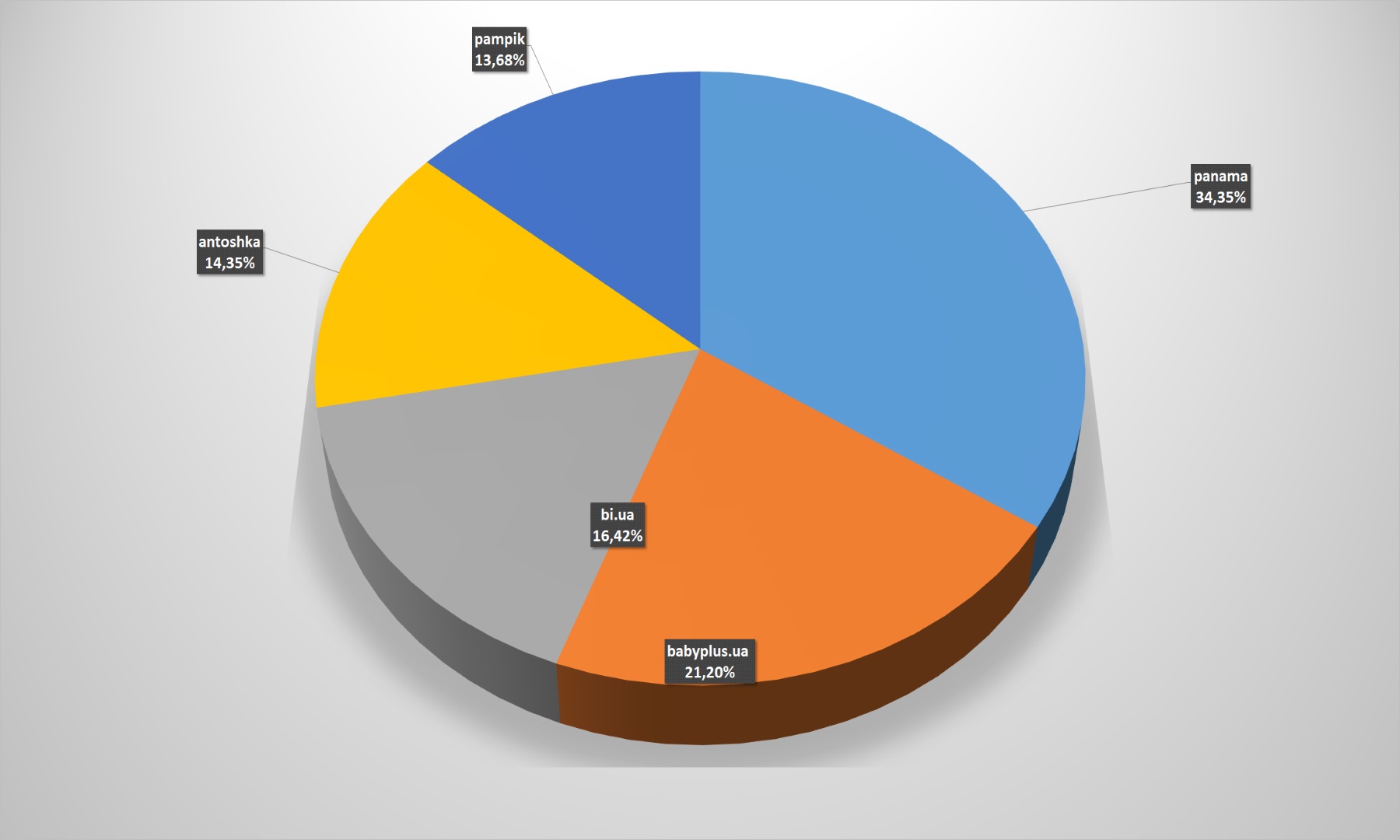

There is a novice in the children products segment. Online-babyplus store took the place toys.com.ua. And it immediately took the solid audience 13% in this direction. The market old-timers – Antoshka, Panama, Pampik, Budinok Іgrashok – just lost its positions. It is possible due to the aggressive babyplus development.

Moreover, the rating novice broke out immediately to second place with an indicator 21.2% among the coverage in the top-5. On the other hand, Antoshka and Budinok Іgrashok are not classic online-stores, but omnichannel retailers. So the World Wide Web is for it only one of the sales channels, and not the fact that it is the most important.

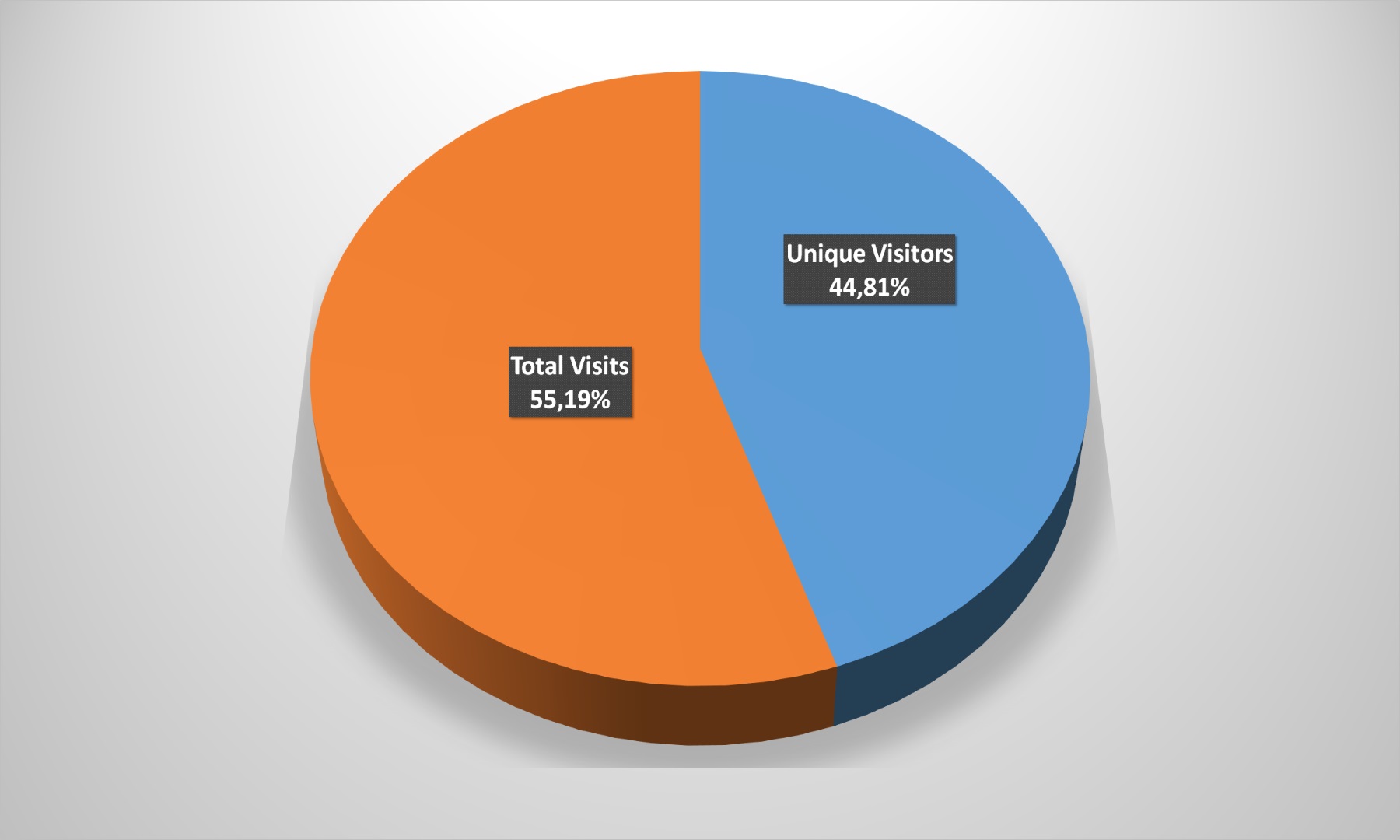

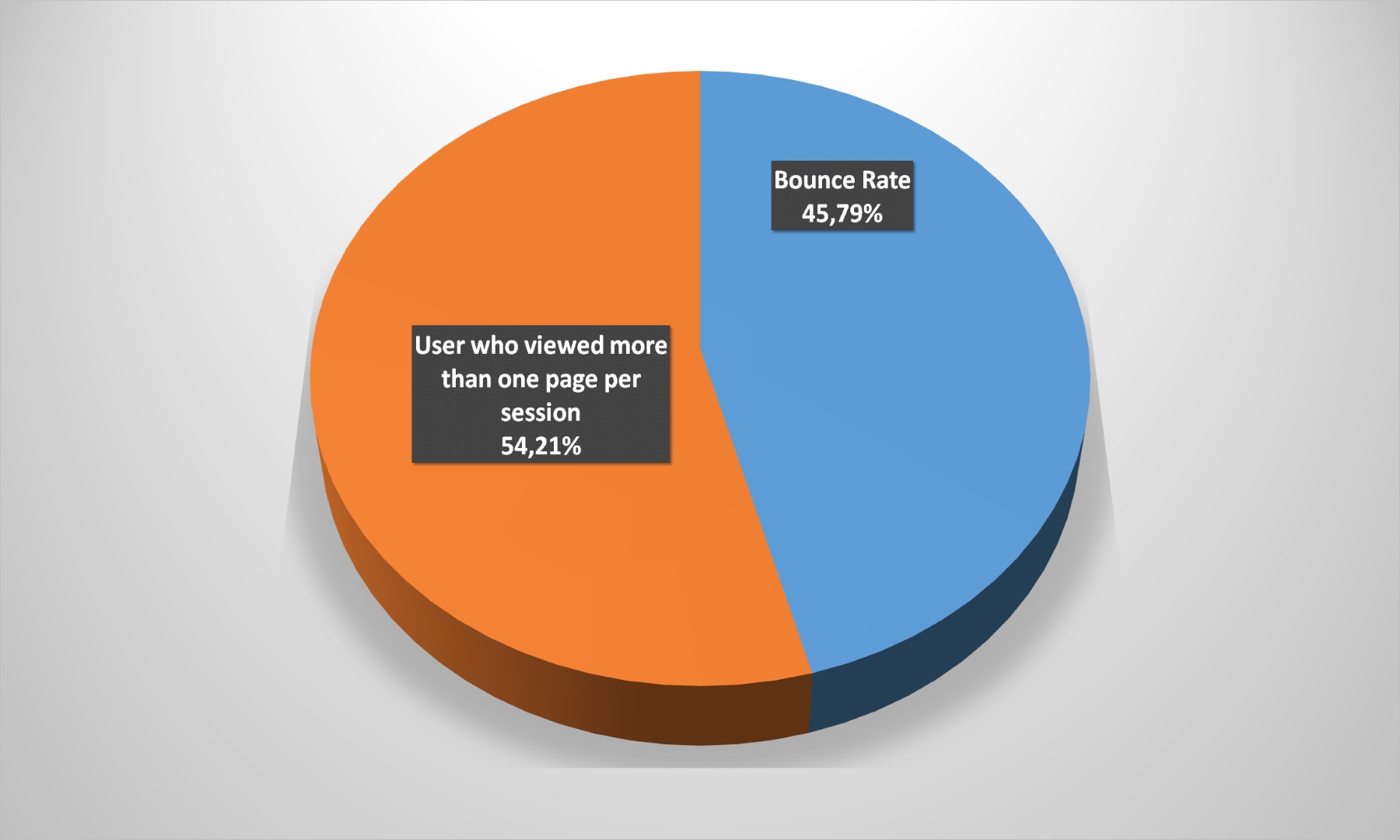

The repeated visits number, and, therefore, the loyal audience meets on average the overall indicators for Ukraine, and it has not changed since last year.

The situation is similar with the refusals’ number – 0.5% of fluctuations per year are insignificant and it can be neglected. It is amazing stability.

If the main channels for customers’ entry to children’s clothing online- stores compare with 2017, the direct visits’ proportion has noticeably increased, and conversions from search engines have also fallen at the same time. That is, it can be said that consumers have already found “their own” store at least in some cases. And now they are looking for goods not just on the Internet, but on the online-retailer specific site.

And YouTube has managed to press Facebook in the products for children category, which previously provided the main transitions share to the online-stores pages from all social chains. Last year, video service generated 36.57% of traffic from social chains, and this year it is already 48%. Obviously, young parents prefer to watch video reviews, rather than looking at photos or reading texts.

The mobile devices users’ share has decreased from 71 to 60% compared to 2017, but it still remains dominant.

This is not surprising, given this goods category main buyers’ age: 86% – from 25 to 45 years! The remaining 14% are either early parents or already grandparents who buy goods to their grandchildren.

Cosmetics and drogerie

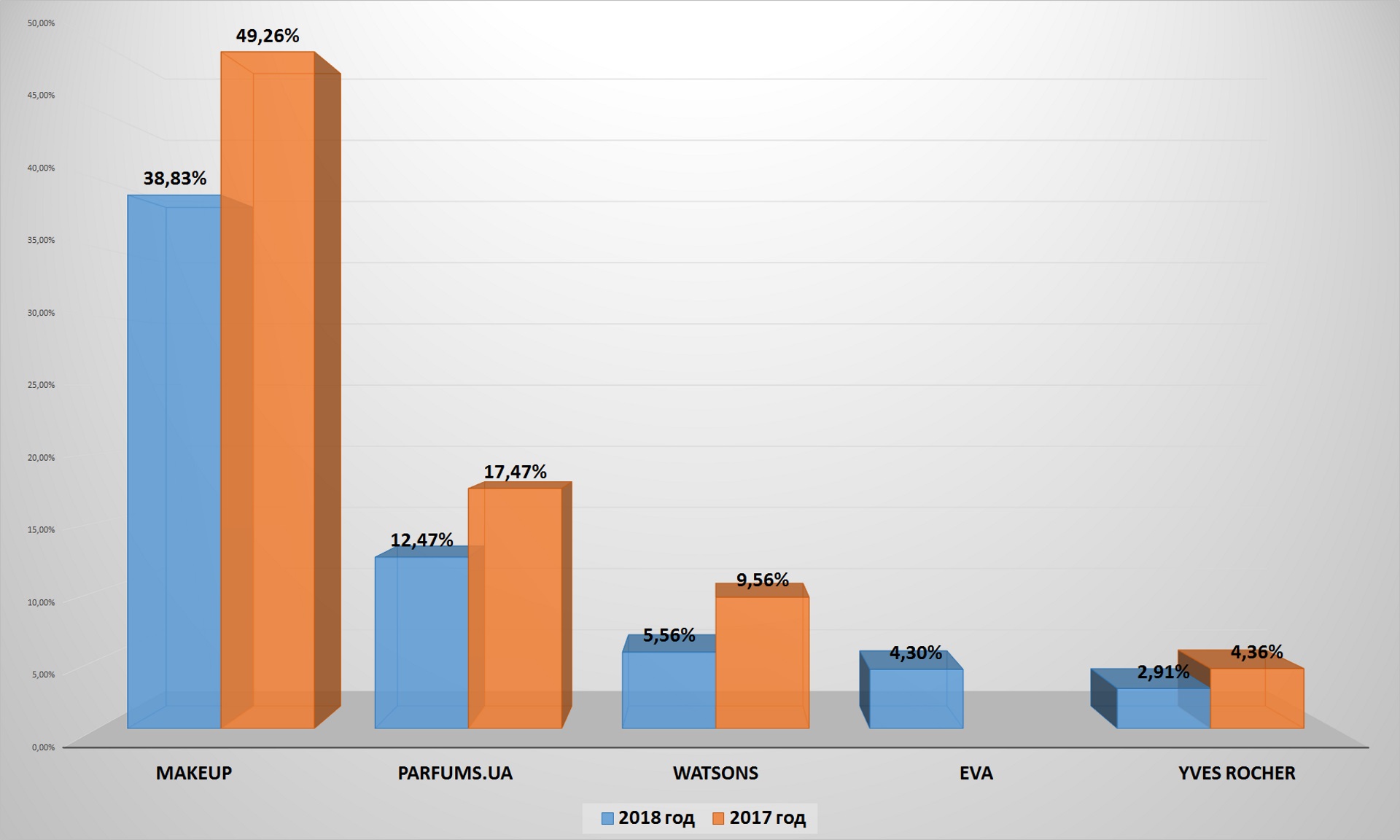

Some changes are in this segment. The largest offline-store for beauty and health EVA began to conquer the Internet. And it immediately achieved coverage 4.3% from the entire active audience in given trend. In respect that the coverage has fallen by all other players in the market, – it is good result.

At the same time, there is a leader among the top-5 who categorically refuses to take positions – makeup.ua. from the Big Five alone covers 61% of audience, and the rest come close to him will be problematically. However, in general, the position and the beauty products retailers’ coverage have not changed – only EVA is in the top-5, instead of letu.ua.

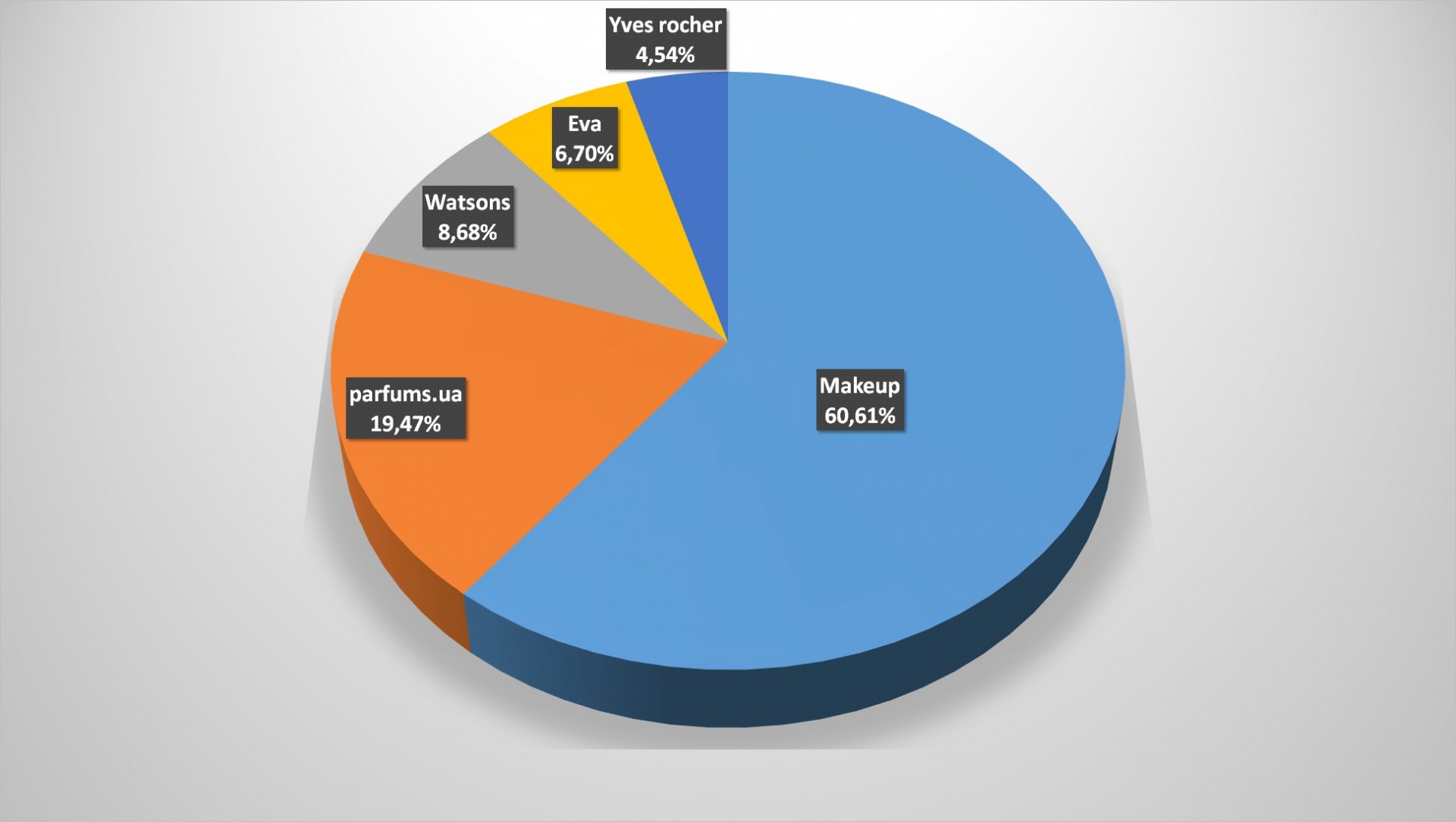

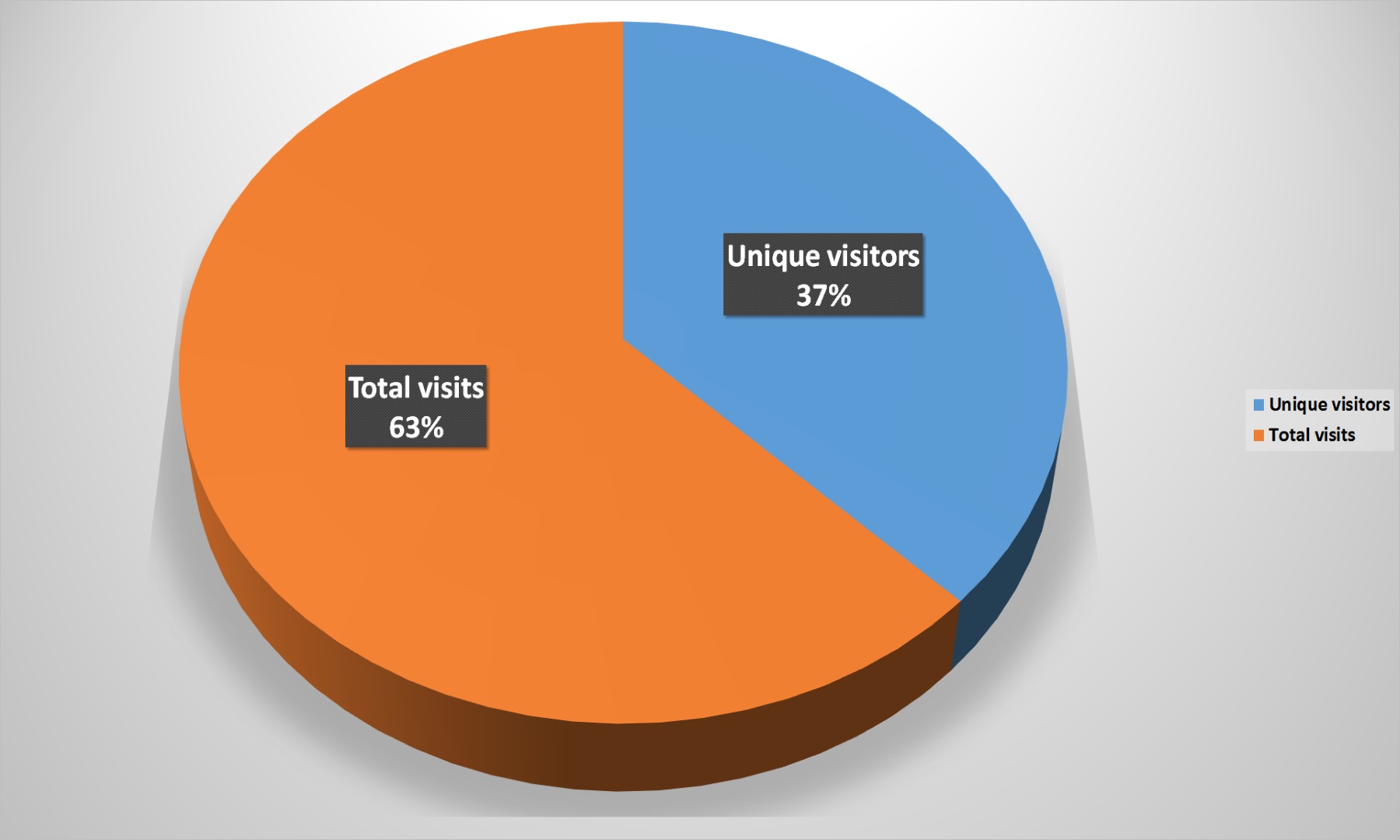

Online-stores drogerie customers’ loyalty is envied by many – 63% of repeated visits, which is significantly higher than the market average. For the year, this indicator has grown slightly (by 1%), but stability is sign of class in this case.

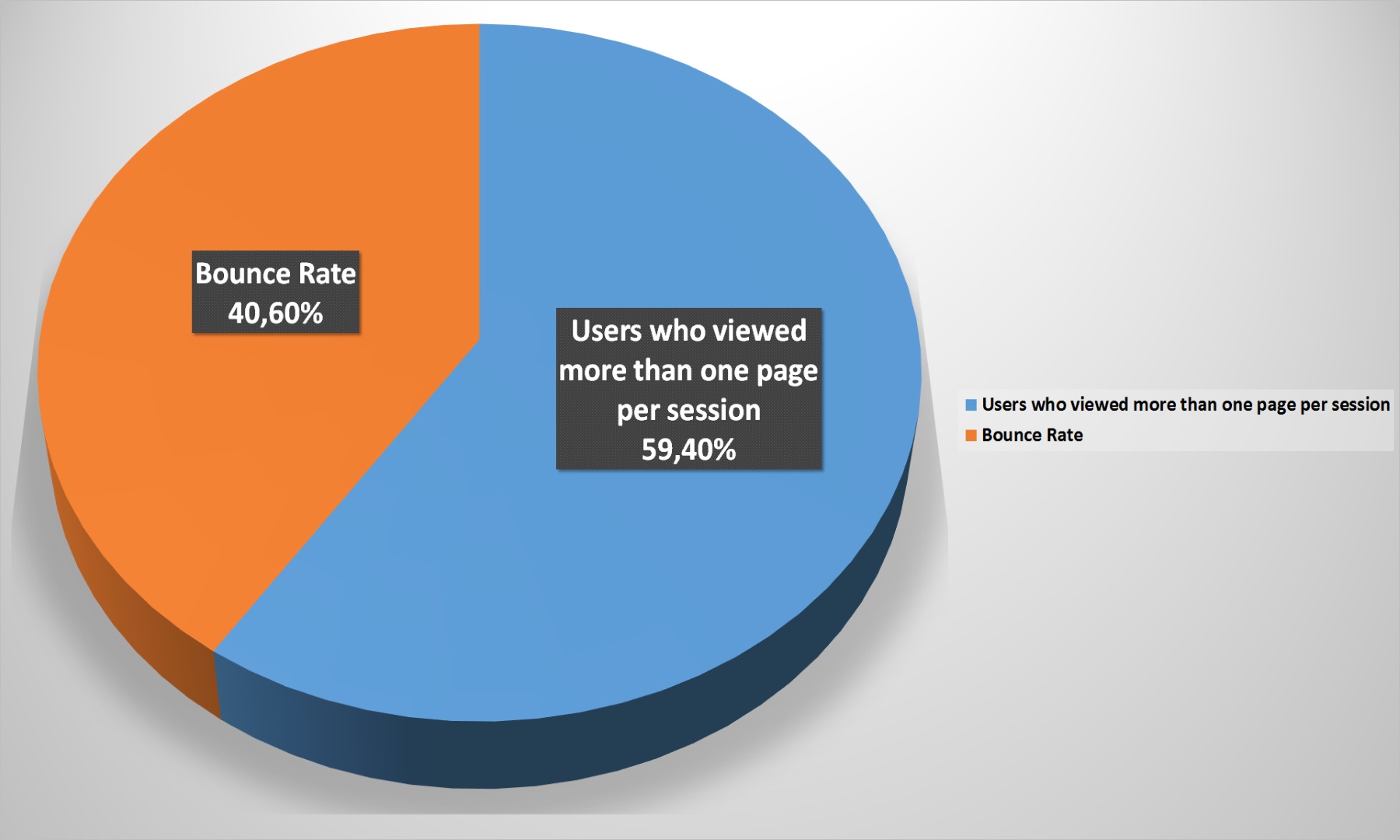

The failures’ number is relatively low – 40.6%. Over the year, it grew by 1.7%, but cosmetics and hygiene products’ sellers still have no cause for concern.

The main entry channels are traditional: organic search and direct hits. In total, it gives traffic 64%. The transitions on links placed on other portals (from 17% to 4%) have fallen sharply, like all Ukrainian online-retailers. This once again proves that the banner advertising and cross-references time is already in the past.

Facebook brings the transitions lion’s share from social chains to online-retailers in the drоgerie segment. This is the most effective tool to attract consumers to the site in its case.

The mobile users’ number has decreased, compared to 2017: 57% versus 71%, but it still prevails. It is curious whether the trend of the m-commerce reducing role will remain, or is it a one-time phenomenon caused by the fact that customers are not satisfied with the convenience and functionality of online-stores mobile versions?

The buyers’ age range of cosmetics and health products online-stores is quite diverse. Virtually all consumers buy in one case or another various products categories by online.

Read also

Respublika Park Leads Kyiv Shopping Malls in Tax Payments