Retail during the war: Turnover of Ukrainian retail chains exceeded UAH 1.1 trillion (infographic)

A study of the Ukrainian retail market has shown that compared to pre-war 2021, retailers have reduced their revenue by almost UAH 300 billion, but remain critical to the country’s economy.

Based on the financial statements of retailers, the Retail Association of Ukraine has conducted another analytical study to determine the turnover of retail chains in the turbulent year of 2022, the most difficult year in the country’s recent history.

It was quite predictable that the companies’ revenues fell significantly, and nothing else could have been expected. The occupation of large areas, looting, shelling of peaceful cities, constant air raid alarms and blackouts have hit retailers hard. Nevertheless, even in the most difficult conditions, retailers managed to adapt and fulfil their mission: to provide consumers with everything they need. And even in the newly liberated cities and villages, shops, distribution points, pharmacies, etc. were opened at the first opportunity.

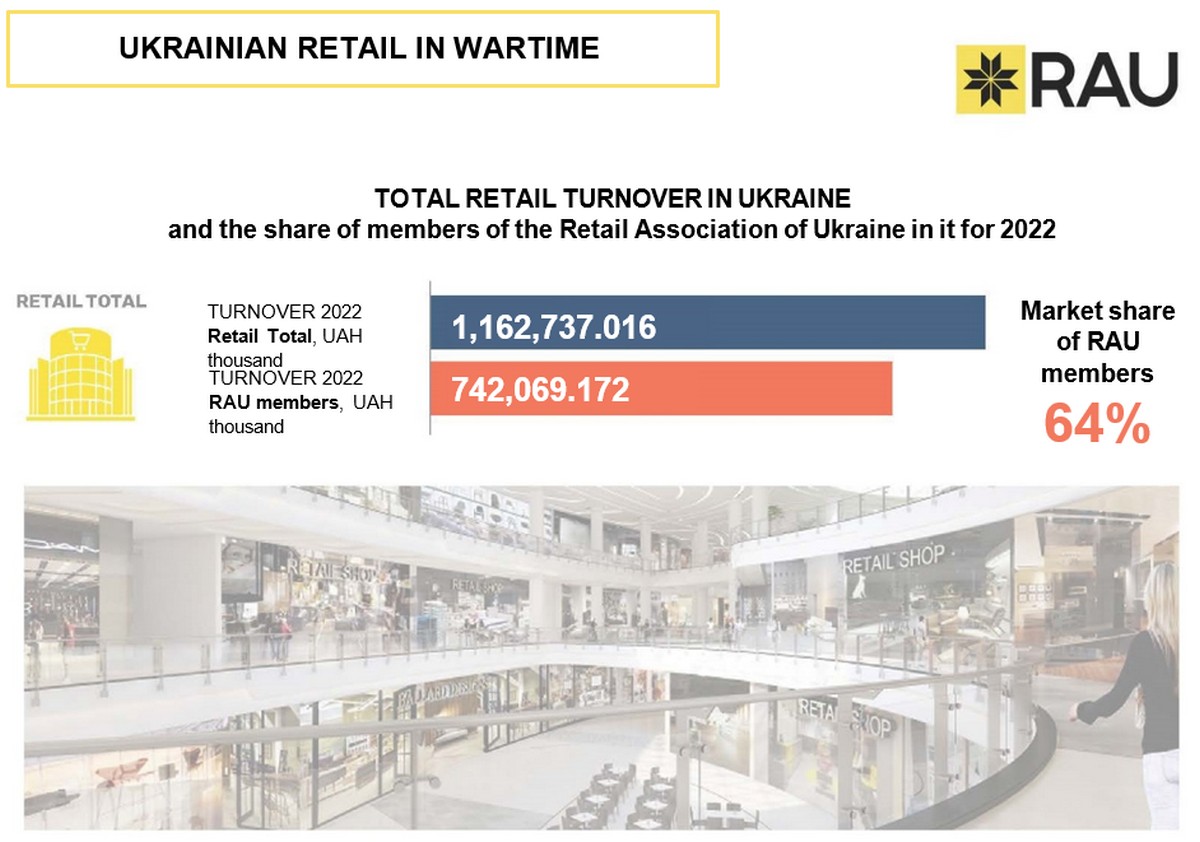

However, pallid statistics show that retailers failed to maintain the same turnover level. While in 2021, retailers’ revenue amounted to UAH 1.44 trillion, last year this figure was UAH 1.16 trillion. And this is without even taking into account inflation, which was 26.6% last year, according to official data, meaning that the actual turnover of retailers fell much more.

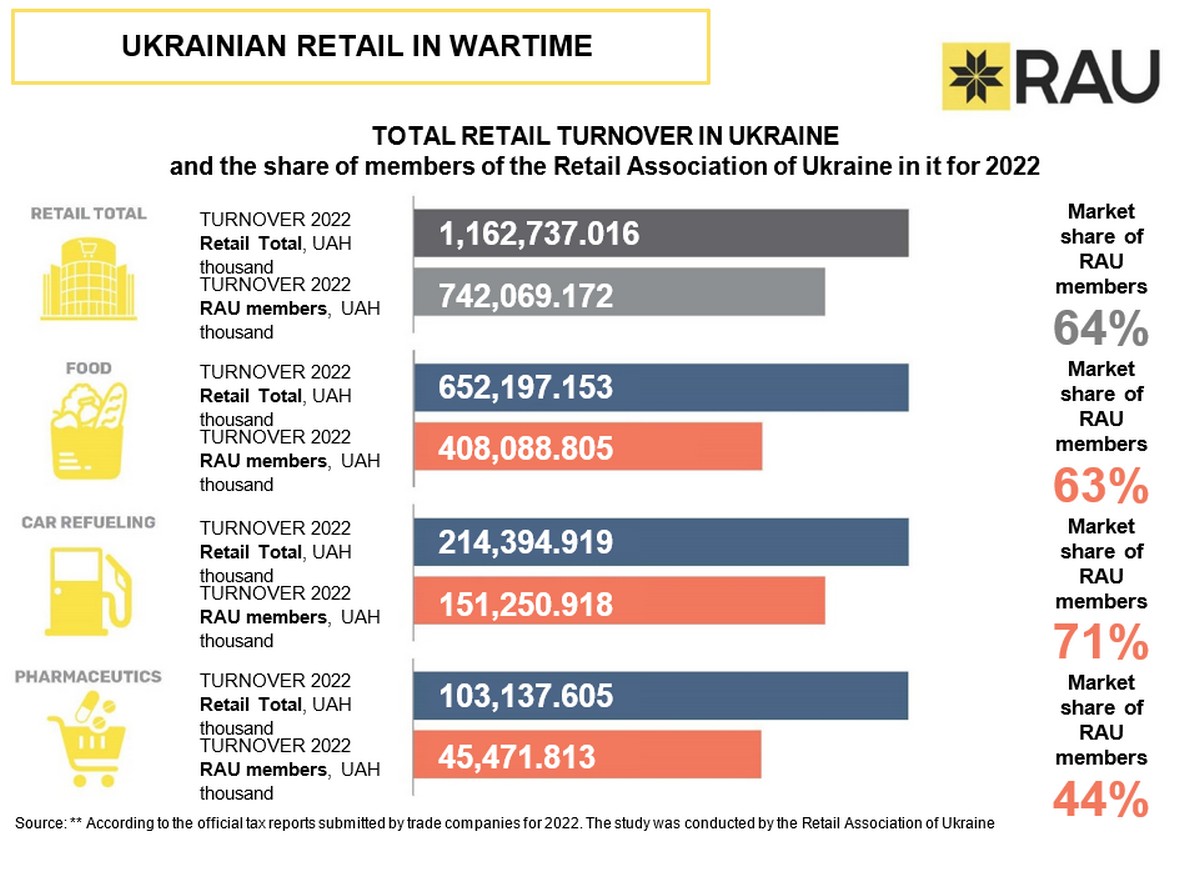

Interestingly, almost two-thirds of the total turnover of retail chains (64%) was provided by member companies of the Retail Association of Ukraine. In absolute terms, their revenue was more than UAH 740 billion, of which almost UAH 150 billion was accounted for by ATB, the leading grocery operator in Ukraine. In general, food retail generated the highest turnover in 2022: while consumers could still refrain from buying clothes and household appliances, they bought food steadily. Silpo was the second largest retailer in Ukraine in terms of turnover with UAH 70 billion in revenue, followed by Fora and Metro Cash&Carry.

The first non-food operator (Rozetka marketplace) finished 2022 in fifth place, but in terms of revenue, it is almost an order of magnitude behind the leader.

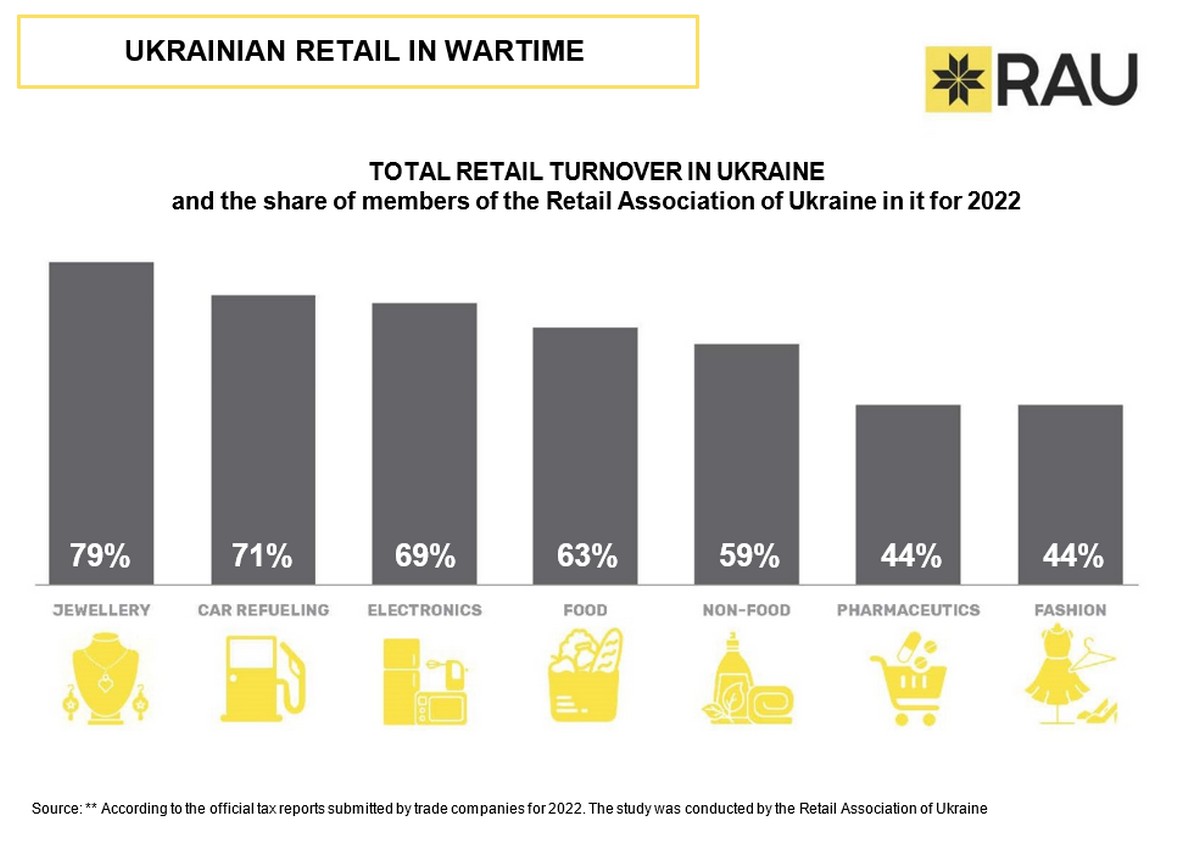

Petrol stations are the second fastest-growing sector in retail. While grocery retailers received a total of UAH 652 billion in revenue, petrol stations earned three times less – UAH 214 billion. However, this segment representatives earned twice as much as pharmacy chains, which made sales worth UAH 103 billion. This is one of the two sectors where RAU members accounted for less than half of the total revenue.

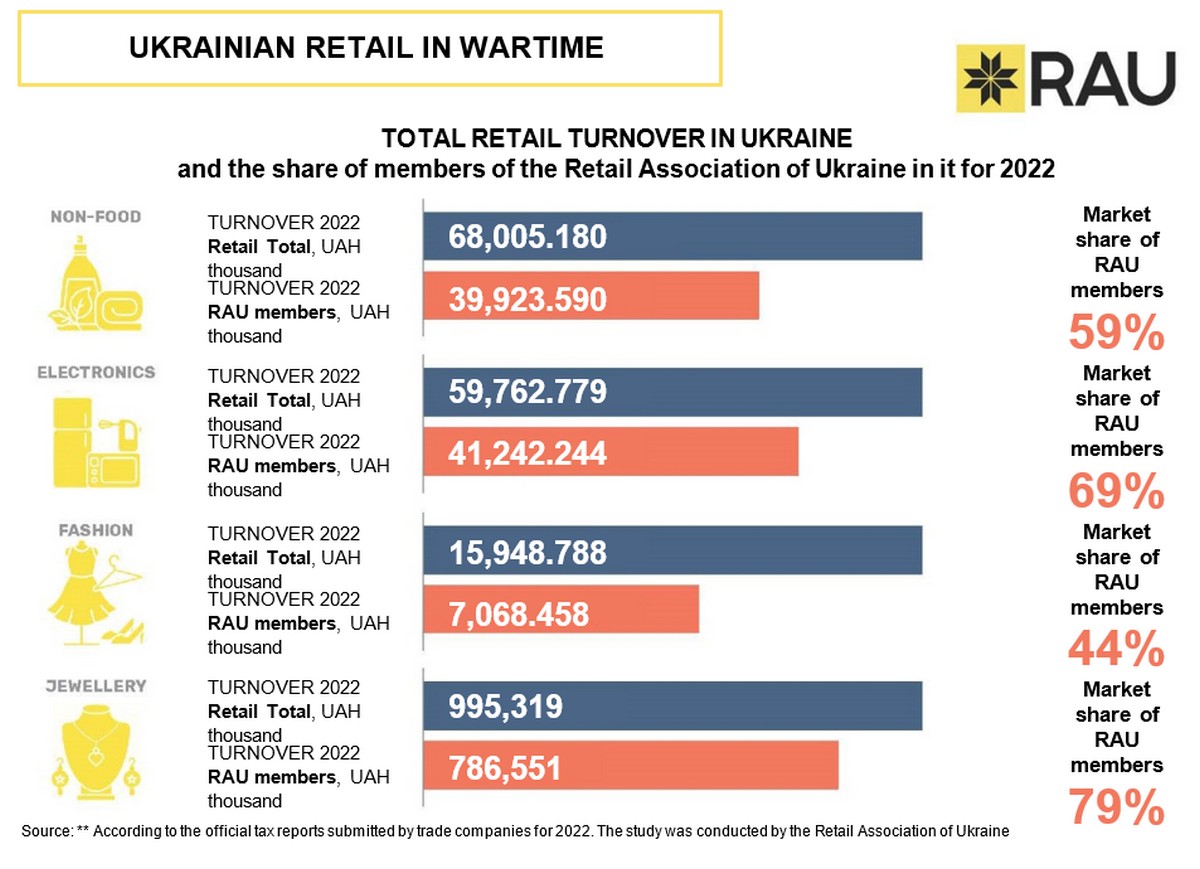

Other retailers face a difficult situation. During the full-scale war, consumers saved on everything, so the companies’ revenues decreased significantly. For example, non-food operators generated UAH 68 billion in sales, hardware, and electronics stores – UAH 59.7 billion, clothing, and footwear chains – UAH 16 billion, and jewellery stores – UAH 995 million.

Besides a drop in effective demand, this is due to the mass migration of Ukrainians abroad: many customers have left the country, and the number of visitors to stores has significantly decreased.

In general, companies that are members of RAU account for a significant share of the total turnover of network players. They are most fully represented in the jewellery sector – 79%. All leading players in this sector are members of the Association: Zolotyi Vik, Ukrzoloto, SOVA, petrol stations, which are members of RAU, account for 71% of the sector’s total revenue, hardware, and electronics stores – 69%, grocery retailers – 63%, etc.

Read also

Suziria Group launches a new pet food production facility in Ukraine and introduces the new CATCH! brand